Do you want to make a profitable crypto trade but don't have enough funds of your own? You can use borrowed funds provided by your exchange or broker.

How does cryptocurrency trading with leverage work? What are the risks when using leverage and what are the advantages of such "credit"? The answers to these and other questions can be found in this review.

If you want to learn even more about ways to make money from digital assets, read the article "Cryptocurrency trading."

Leverage trading crypto

When we talk about leverage in trading, we mean borrowed money, which is used to work with different assets such as stocks, currency pairs, etc. Leverage is also used in cryptocurrency trading.

A kind of credit allows traders to increase their trading opportunities. The fact is that by borrowing money, a trader can increase the volume of the transaction.

In this connection, the volume of the position determines the amount of profit that can be obtained if the trader's forecast comes true. The loan is provided by cryptocurrency exchanges, as well as brokers.

Where do they get the funds for this?

Firstly, exchanges have their capital. It consists of funds received from trading commissions, fees for listing new coins, etc.

By the way, there are also commissions for using leverage in trading.

Secondly, some exchanges offer their clients so-called funding wallets. Users transfer money to those wallets so other traders could loan these funds.

In this case, the size of the credit and the interest rates for using it are set by the trader, who created such a wallet.

Thirdly, individual exchanges pay crypto owners interest for storing coins. As long as the digital coins of the depositors are in the exchange's vault, it lends them to other traders.

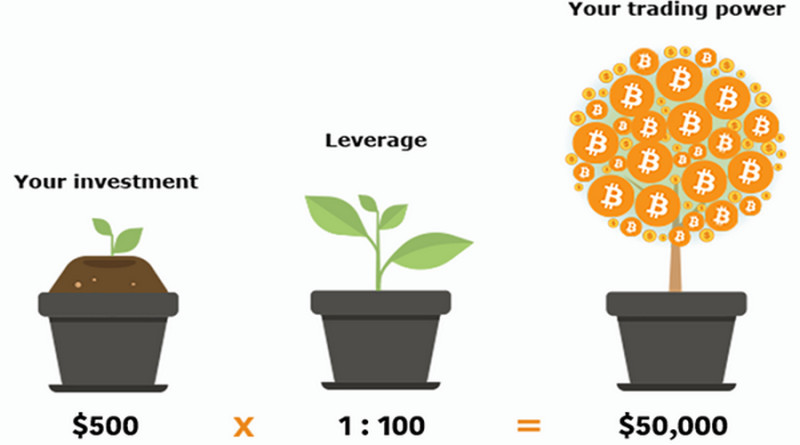

The maximum amount of leverage is different for each marketplace. Some intermediaries can increase a client's deposit by 10 times, and some by 100 times.

However, the average leverage allowed in the case of cryptocurrencies is lower than for other assets. For example, on Forex, it can be even 1:1000, while cryptocurrencies usually do not exceed 1:200.

Most often, crypto exchanges offer clients leverages ranging from 1:2 to 1:100.

Leverage consists of two numbers, which show the ratio between the own money and the borrowed sum. The first number is the trader's own money, and the second one is the amount of transaction with borrowed money.

For example, if a trader's capital is $100, then leverage 1:10 automatically increases that amount to $10,000. $10,000 is the volume of the transaction.

Thus, the main advantage that leverage brings to cryptocurrency trading is the ability to open large positions. Without leverage, they would not be possible as traders' money would not be enough for that.

The larger the transaction volume, the higher the potential income.

In addition, leverage increases the liquidity of crypto assets and makes it possible to diversify the investment portfolio.

For example, a trader has $500 and intends to invest this amount in Etherium as he or she considers it a promising coin.

However, the trader can use only $100 of his own money for that, and borrow the remaining $400 from the exchange, using a 1:5 leverage. Free funds can be used for other purposes. For example, to buy another cryptocurrency.

How leveraged trading crypto works

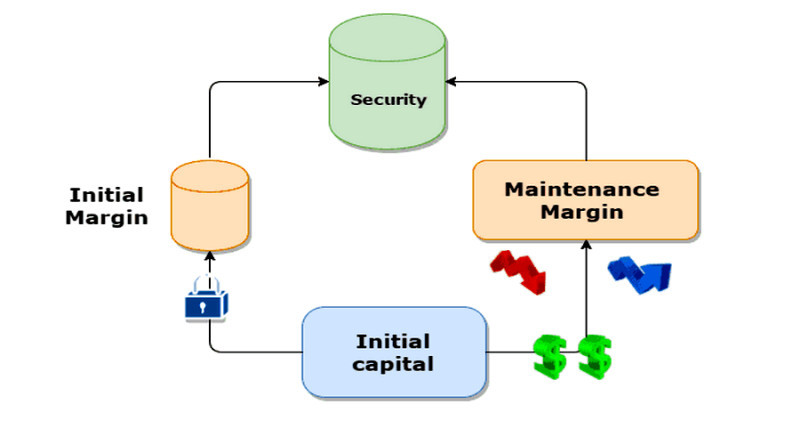

To take advantage of leverage trading crypto, a trader's financial contribution, the so-called initial margin or collateral, is required. That is, trading solely on borrowed funds is not possible.

The amount of necessary equity depends on the transaction volume and the leverage size.

For example, if a user wants to buy 1 BTC (at the time of writing the article, the BTC price is $16,840.30), and the exchange offers leverage of 1:5, the equity must be nearly $3,370. If the leverage is 1:10, the minimum amount will be $1,684.

That said, some crypto exchanges limit the list of assets that can be used as collateral.

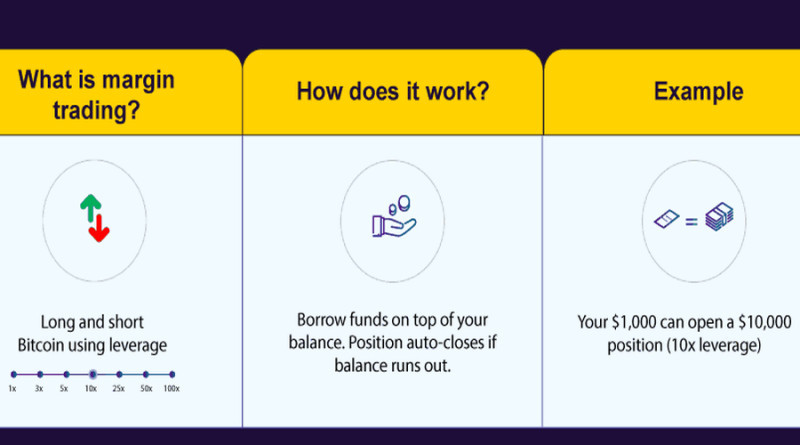

This money can be used for both long and short positions. For example, predicting a rise in the price of crypto in the long run, a trader borrows money to buy coins now and then sells them at a more attractive price.

When it comes to short trades, the trader uses borrowed digital coins and puts them up for sale. Later, when the price of the asset falls, the trader buys it at the minimum value.

When the trade is closed, the trader returns the credit and fixes a profit on his account. Its size depends on how much the price of the cryptocurrency has changed.

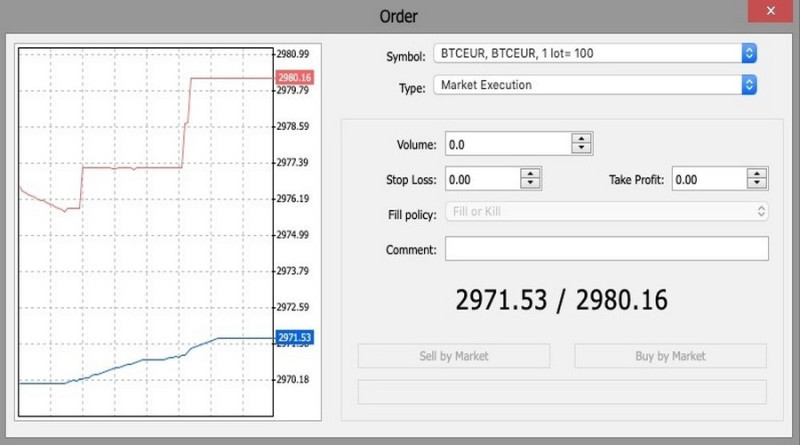

Both market and pending orders can be used. In the first case, we are talking about the immediate purchase or sale of coins at the current market price.

Pending orders are executed when the price reaches a certain price level. That is, the trader decides at what price he wants to buy or sell the digital asset.

Meanwhile, a minimum amount of capital is not all that is required from the trader. When a trade is open, the amount in the player's account must not fall below this bar.

This bar is called the maintenance margin, and its size is specific to each exchange. For example, a certain exchange has set the maintenance margin at 30%.

This percentage is calculated from the amount of the initial margin. For example, if the initial margin was $100, then the maintenance margin in this case will be equal to $30.

When the price of a cryptocurrency moves against the trader's expectations and the amount in the account approaches a critical threshold, the player receives a corresponding notification (Margin Call). This can be an email or push notification.

To keep the position open, the player must fund the account to buy time in case the price moves in the right direction. If the trader does nothing, the exchange automatically liquidates the transaction.

Here is a specific example of a margin transaction. Suppose, the trader has decided to invest in Bitcoin because he believes that its price will rise in the future.

This means that a trader plans to open a long position, buys BTC, and then sells it at a higher price.

The user has $1,000 on his account; he increases his trading opportunities up to $10,000 using leverage 1:10. For this amount, he buys bitcoins.

Imagine that after a while the BTC went up in price by 10%, that is, the player's forecast was correct. In this case, the profit of the trader will be about $1,000.

If he had not used leverage, the profit would have been 10 times lower ($100).

However, cryptocurrencies are unpredictable in terms of value, so even the most accurate forecasts may fail to come true. Let's say that BTC did not rise but fell by 10%.

In this case, a trader would lose $1,000, or the whole equity. If leverage was not used, the loss would be only $100.

These examples do not take into account commissions as their size is different for all exchanges. These additional costs should be considered when planning profits.

At the same time, do not forget about the maintenance margin. So, if in our case it was 30%, the position would have been automatically liquidated at the moment when the funds on the account decreased to $300.

Key takeaways:

- Leverage is a way to increase potential profits, but with it comes increased risks;

- When using large leverage, the risks can be unnecessarily high;

- When deciding to use leverage trading crypto, you need to weigh the pros and cons. Each leveraged trade should be considered and backed up by technical and fundamental justifications.

Pros and cons of leverage

When we talk about trading cryptocurrencies, we mean speculative operations that allow you to earn income from changes in the exchange rate. In contrast to spot trading, in margin trading, one can earn on both growth and decline in the value of assets.

A very popular method of leveraged trading in digital coins is Contracts for Difference (CFDs). They are offered by many brokerage companies, including InstaForex.

These are so-called non-deliverable transactions. A trader does not become the owner of the cryptocurrency but speculates on its value.

He makes "bets" on an increase or decrease in the price, and if the assumptions come true, the trader makes a profit.

Accordingly, leverage can multiply that profit by increasing the purchasing power.

In addition, leverage in trading, including crypto CFDs, has other advantages:

1. Increasing the flexibility of the investment portfolio. By investing less of their funds in cryptocurrency trading, traders can use the remaining money for other purposes.

For example, to trade other assets, pay commissions to a broker (exchange), etc.;

2. Reaching new heights in trading. The more funds are at the disposal of a trader, the higher the trading level;

3. Compliance with the principles of risk management and trading cryptocurrency in strict accordance with the chosen strategy. Increased risks in margin trading force traders to avoid hasty steps and make only well-considered trading decisions;

4. Ability to choose a suitable leverage size and adjust it during trading;

5. Limitation of losses, which is provided due to Margin Call and Stop Out.

Along with all of its advantages, leverage also has disadvantages. We've already talked about the risk of position liquidation when leverage is used.

Among other disadvantages are:

- Additional trading costs. The fact is that exchanges and brokers can charge commissions;

- High risk for novice market participants, especially when it comes to large leverage;

- The need to use only effective and tested strategies. Leverage should not be used in trading experiments and approbation of new tactics;

- The high psychological burden on the trader is connected with the use of borrowed funds when making trades.

How to minimize risks when trading with leverage

Crypto exchanges set the maximum leverage size. For example, on some platforms, it is 1:20, on others, it can be 1:100.

When choosing a leverage size, traders are primarily guided by the amount of money they have. The higher the leverage, the less initial margin is needed.

In this case, the risk of position liquidation (Stop Out) increases.

Thus, small leverage can minimize the risks of trading, because even experienced traders are not immune to mistakes.

When using leverage, it is important to follow the rules of risk management:

1. Stop Loss orders are necessary if the price starts moving against the forecast. The trader fixes the value at which the transaction will be automatically closed, thereby avoiding large financial losses;

2. Take Profit. This order allows you to limit the amount of profit. Probably, beginners may have a logical question: why close a trade if the value of the cryptocurrency is moving according to the forecast and the profit is growing?

The fact is that excessive greed is a player's enemy. Any trend ends sooner or later, and its reversal is not always predictable.

That is why the attempt to earn more money may lead to the loss of the whole deposit;

3. Reasonable approach to determining the amount invested in crypto-trading. It is better to invest only that amount, the loss of which will not greatly affect your financial situation;

4. Correlation of potential reward and risk. Before opening a position with leverage, it is necessary to calculate how much money can be received if the trade is winning, and how much will be lost in case of losses;

5. Control of funds on the deposit. Do not wait for the Margin Call if you see that a trend has formed on the chart, which is contrary to your forecast;

6. Select the size of leverage based on your experience and skills. For example, beginners should not use leverage more than 1:2 or 1:3.

At the same time, it is wrong to think that leverage inevitably leads to losses. On the contrary, learning to use it correctly and objectively assessing your abilities, and leverage can improve trading results.

Choosing platform for margin trading

A few years ago, cryptocurrency trading required traders’ entire amount to make a transaction but now the situation is different. More and more crypto exchanges provide leverage, attracting new clients and increasing their trading volumes.

Some crypto exchanges with margin trading:

- IFXBIT;

- OKX;

- EXMO;

- Binance;

- HUOBI.

Since there are many such exchanges, the question arises: how to choose the most appropriate one? Some characteristics to consider are listed in the table below.

Criteria for choosing an exchange for margin crypto trading

| Feature | Description |

| Account safety | Two-factor authentication is a must. |

| Reputation | A lot of useful information can be found on forums and feedback websites. However, you have to be careful with the reviews as many of them can be written on purpose. |

| Number of clients | The more clients trade on the exchange, the higher the liquidity of assets. |

| Trading platform | The platform should be user-friendly, with easy-to-use navigation, and include all the necessary functions. It is important to pay attention to the list of available indicators for a full-fledged technical analysis. |

| Commissions | Exchanges with minimal commissions are preferable as the trade costs will be smaller. |

| Deposits and withdrawals | Crypto exchange should provide customers with a choice: bank cards, wire transfers, payment systems, etc. The more options, the better. |

| Range of assets | The variety of trading instruments increases the potential for customers. |

| Website | Training materials, analytical reviews, and expert forecasts are significant. |

| Support service | It should be responsive and have multiple channels of communication. |

Traders who are beginning their journey into the world of cryptocurrencies should understand that digital assets can be either basic or derivative. The former are coins themselves, while the latter are futures or CFDs.

By trading cryptocurrencies on spot markets, traders acquire coins, while CFDs are speculative transactions without actually purchasing the assets.

Many brokers offer such contracts for cryptocurrencies. We've already told you that InstaForex is among them.

When choosing a brokerage company for leveraged CFD trading, you can be guided by the same criteria as in the case of cryptocurrency exchanges.

Peculiarities of cryptocurrency trading on the exchange and with a broker:

- Leverage can be used with both, but the CFD limit will usually be higher. In addition, margin trading is offered by almost all brokers. However, not all exchanges lend money;

- On crypto exchanges, it is sometimes difficult to carry out large transactions due to the low level of liquidity, and in the case of CFDs, it is impossible to do so;

- Almost all brokers offer demo accounts. Only some crypto exchanges do;

- Trading costs are slightly different;

- At the exchanges, the list of cryptocurrency assets is usually more extensive;

- Compared to the platforms of crypto exchanges, the platforms offered by brokers are often more advanced. For example, many brokers offer MetaTrader, known for its convenience and simplicity.

Is leverage worth it?

Leverage in cryptocurrency trading can multiply both profits and losses. High volatility and difficulty in predicting future prices are one of the peculiarities of cryptocurrencies.

This means that leverage should be used with more caution when trading cryptocurrencies than when trading stocks or other assets. It is important to assess your trading strengths before using leverage to make trades.

You can use a demo account. You can open positions with virtual money and lose nothing.

At the same time, profits made from successful transactions will also be virtual.

What it takes to gain profits when trading with leverage:

- Training. Without the necessary knowledge and practical skills, cryptocurrency trading will not lead to the expected financial results;

- Understanding the principles of leverage and the risks associated with possible account liquidation;

- Individual approach in choosing the leverage size. It is important to consider two fundamental factors: the trader's experience and the potential of a future transaction.

The more experienced a trader is, the more he or she can afford to leverage. The greater the trader's confidence in the outcome of the trade, the greater the advisability of the use of leverage.

It is important to understand that using leverage is a trader's right, not an obligation when starting margin trading. For example, some trades can only be made with one's own money, and some trades can be made with leverage.

Experienced traders will usually only use leverage when they are confident that a future trade will be successful. Usually, such a decision is made only after careful research and technical and fundamental factors are analyzed.

Conclusions

Thus, leveraged cryptocurrency trading opens up new opportunities in crypto trading. At the same time, it increases the potential risks.

Cryptocurrencies are assets with high volatility, so trading them requires a lot of preparation and a well-built strategy. If leverage is used in trading, the requirements are even stricter.

To avoid substantial financial losses, you can follow these simple rules:

- Do not use very large leverage in trading crypto. This is especially relevant for beginners;

- Before using borrowed funds, it is better to make sure that in the current market situation, it will be justified. Simply put, trading with leverage is worthwhile only when a trade is promising and such a step is necessary.

Recommended:

Crypto Trading Training

Cryptocurrency Arbitrage

Crypto Margin Trading

What is Spot Trading in Crypto

Grid Trading Crypto

Short Term Crypto Trading

Crypto Demo Trading

Back to articles

Back to articles