High volatility is what distinguishes cryptocurrencies from other assets. So, a trader needs to learn how to take advantage of the volatile crypto market.

The grid trading strategy is one of the techniques suitable for volatile markets.

This article explains what grid trading is, how it works, and what are the benefits for traders.

To delve deeper into the world of crypto, read our article Crypto Trading.

What is grid trading crypto?

Cryptocurrencies are known for their high volatility. The price of coins is constantly changing and sometimes going through serious ups and downs.

High volatility increases the risk of losses as such price swings are difficult to predict.

To navigate these price movements, traders use various strategies, and grid trading is one of them. The strategy involves placing buy and sell orders at regular intervals, thus forming a grid, which explains the name of the method.

This turns volatility into a tool to make a profit.

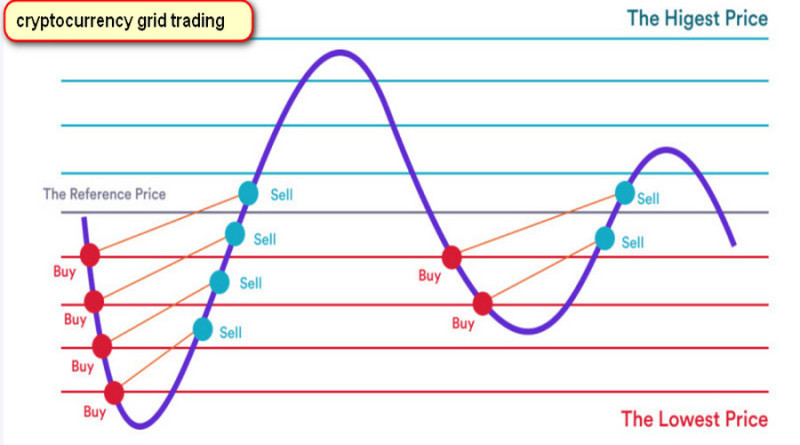

Most of the time, a crypto chart looks like waves or broken lines which play a key role in grid trading.

In this approach, orders should be placed at certain price levels. Importantly, the average buy price must be lower than the average sell price.

Example of grid trading:

Let’s assume a trader sees that Bitcoin is trading at $16,596.30.

The trader wants to buy BTC at $15,596.30 and sell it when the price reaches $17,596.30. These are the levels we were talking about.

After setting the grid limits, a crypto trader can entrust the rest of the work to trading bots. When the price reaches the predetermined level, a bot executes buy or sell orders.

The process continues until all levels are passed.

Grid trading involves setting multiple price levels that eventually form a grid.

These levels are used to place orders.

A trader determines the number of orders according to his/her strategy. The simplest grid setup includes four levels as shown below.

Let's assume that the price of Bitcoin goes down. In this case, buy orders will be triggered at certain intervals when the price touches these levels.

If the price of Bitcoin goes up, sell orders will be triggered one by one. Most of the time, this is done by trading bots.

In grid trading, every buy order corresponds to a sell order set at a higher price. The distance between each price level is typically set to be the same.

Apart from choosing an interval, a trader needs to set the upper and the lower limit of the grid. If the price moves above or below the set limits, buy or sell orders won’t be executed.

This is how the process looks on the chart.

Grid trading is a quantitative strategy that can be used in various markets to capitalize on price volatility.

Key takeaways:

- Crypto grid trading means setting a certain range where buy and sell orders will be executed by a trading bot;

- This method is especially suitable for a range-bound market when no clear trend is observed;

- Apart from bringing profit, this strategy also increases liquidity of assets on a crypto exchange;

- A grid is typically applied to crypto and forex trading as well as other assets.

Grid trading crypto example

As we have mentioned above, a trader sets certain price levels to build a grid. And for this, they need to define a reference price.

In a bullish market, the buying price is increasing, and buy orders are triggered until the price reaches the upper limit. In a bearish market, the selling price is decreasing until it hits the lower limit.

At the moment of writing, Litecoin was trading at $66.92. A trader can set a grid in such a way that sell and buy orders are executed each time when the price moves up or down by $10.

In this case, the first sell order will be triggered when the quote hits $56.92 and the second one will be executed at $46.92. Buy orders are set in a similar way but the execution price is gradually rising.

In other words, an asset is bought or sold at a regular interval, with the average selling price staying higher than the average buying price.

This technique is especially effective in sideways trading when the price is moving in a narrow range for a long period of time.

Multiple orders increase the frequency of trading. This means that the profit from each trade will be smaller than that generated in low-frequency trading.

Grid trading has some obvious advantages:

- Convenience: it is relatively easy to determine levels and set up a grid;

- Efficiency: this strategy has an optimal risk/reward ratio;

- Time-tested: grid trading has been in use for decades and has gained popularity among professional and novice traders;

- Flexibility: grids are suitable for different market environments;

- Automation: trading bots make crypto trading easier.

Bots in grid trading crypto

Bots are special trading programs that follow a certain algorithm in order to facilitate the process of trading.

Parameters for grid trading bots are set up by a trader.

A bot will start its operation as soon as it meets certain pre-set triggers. In grid trading, price levels serve as such triggers.

When the price of an asset reaches a certain target, a bot forms the first buy order. A sell order is placed at the next level above the buy order.

If the price moves up and reaches the sell target, the sell order is executed, and a trader can lock in profits.

Let’s see how a grid bot functions in more detail.

For example, Bitcoin is trading at $16,596.30 per token.

A trader first needs to set up grid limits, for example, at $18,596.30 and $14,596.30.

Then they need to set the number of grid levels which will determine intervals inside the grid. In this example, we will have 8 levels set at a distance of $500.

A trader also enters the amount he wants to use in a trade, for example, $8,000.

The rest of the work is done by a trading bot:

- It calculates the volume of the asset (Bitcoin) and buys it using a market order when the price hits $17,096.30 (plus $500 to the initial market price);

- The pending sell order is set at $17,596.30. As soon as the price breaks above this level, the asset will be sold;

- After that, the bot places an order to buy the asset at $18,096.30;

- Buy and sell orders are formed until grid trading is stopped after passing all the levels, hitting a stop-loss order, or when ordered manually.

Grid trading is especially effective in a sideways movement as pullbacks are necessary for gaining profit. The stronger the fluctuation, the better.

In essence, a trading bot is designed to buy cryptocurrency at a lower price and sell it at a higher price as shown below.

Pros and cons of automated trading

Grid trading can be done manually, but the situation in the cryptocurrency market changes so rapidly that it may be difficult to keep up with these price swings.

This results in missed trading opportunities and profits.

To make trading more effective, traders use bots. To launch the program, they first need to manually set the upper and lower limits of the grid (maximum and minimum prices).

The trader also sets multiple levels within the formed range and chooses the interval. Once all these settings are complete, a bot will start trading.

You can either set the price for the first trade yourself or the bot will use the current market price for this.

As soon as the price touches a certain target level in the grid, a bot will place pending orders to buy or sell an asset.

Crypto grid trading bots are beneficial for the following reasons:

- Time-saving. When the process is automated, traders do not need to constantly monitor changes in the price of a digital asset in order to sell and buy it in a timely manner within the chosen range;

- Elimination of the human factor. Sometimes the price changes so rapidly that placing orders becomes impossible without a bot, especially when it comes to a grid with a large number of levels;

- Facilitation of the trading process. The user does not have to analyze the market situation, apply indicators, and make decisions about entry and exit since the program will take care of all this;

- Quick and easy bot setup. It does not take a lot of time or in-depth knowledge to automate the process of grid trading;

- Optimal risk/reward balance. It ensures stable profits amid low-risk trading;

- Minimum commissions. Bots increase liquidity in the order book of the crypto exchange, so a trader pays a maker fee that is lower than the taker fee;

- Can be applied to different assets. Trading programs can be used for trading cryptocurrencies as well as other markets;

- Ability to adapt to different strategies. You can trade cryptocurrencies using the grid both in short-term and long-term trading strategies, making small or large profits;

- Diversification. Bots can make a profit simultaneously from several cryptocurrencies in the user's investment portfolio;

- Bots take away psychological pressure. After configuring bot parameters, a trader may relax and entrust trade execution to bots;

- Rational decision-making. Robots do not deviate from the given algorithm, they are unaffected by greed, fear, and other emotions that negatively affect the result of trading.

However, automation also has certain disadvantages. For example, some bots only function correctly when the Internet is stable, otherwise, they may glitch.

There are also other disadvantages:

- Quite often, traders need to monitor the program, especially when it comes to new and insufficiently tested bots;

- Sometimes there are security issues since almost all bots operate through the API;

- It is necessary to make settings and control the market situation. This can cause difficulties for novice traders;

- Since the number of orders in the grid is limited, you will have to create a new grid and set its parameters if you want to continue trading;

- Some bots have paid subscriptions which reduces your profit from trading.

Examples of grid trading crypto bots

There are numerous bots that can be used in cryptocurrency grid trading. So, if you decide to automate this process, it won’t be difficult to find a bot.

Let's talk about some bots worth paying attention to.

1. Bitsgap is a platform used by many crypto exchanges. It offers such trading bots as Sbot, which is used during flat trading, and Classic Bitsgap Bot, which works in a bull market.

The settings of the above bots require the installation of Stop Loss and Take Profit orders. Developers offer users several subscription plans with different numbers of bots.

To test the Bitsgap service, you can sign up for a free subscription for seven days;

2. TradeSanta is a cloud bot that has ready-made templates and built-in indicators. Customers can choose one of the three subscription plans.

Each of them has a different cost and number of bots included in the subscription. Advantages of TradeSanta include a simple and clear interface, a demo account, and a mobile application;

3. Coinrule is software with many templates, the list of which is constantly updated. There is a paid and free subscription plan. The first one includes a large number of templates and training materials;

4. BitUniverse is a free grid bot. It has a mobile application and can be used on more than 20 crypto exchanges;

5. Quadency is a program with a free basic set of bots, including a grid one. This option is supported by 35 crypto exchanges.

Many crypto exchanges also have their own grid bots. Among them are KuCoin, Binance, Pionex, Bybit, and so on.

In most cases, they are free for website customers.

Grid bots are suitable for both beginners and experienced traders. They greatly facilitate the trading process and can improve the results of crypto trading.

Grid trading on a crypto exchange

In the first part of our article, we discussed the principles of cryptocurrency grid trading. But how does it work in practice?

Let's describe this process using the example of a crypto exchange. These steps may slightly differ from platform to platform but the overall process will be the same in most cases.

We will use the spot market to demonstrate grid trading. The main feature of the spot market is that trades are executed within a short period of time and with no borrowed money, or leverage, involved.

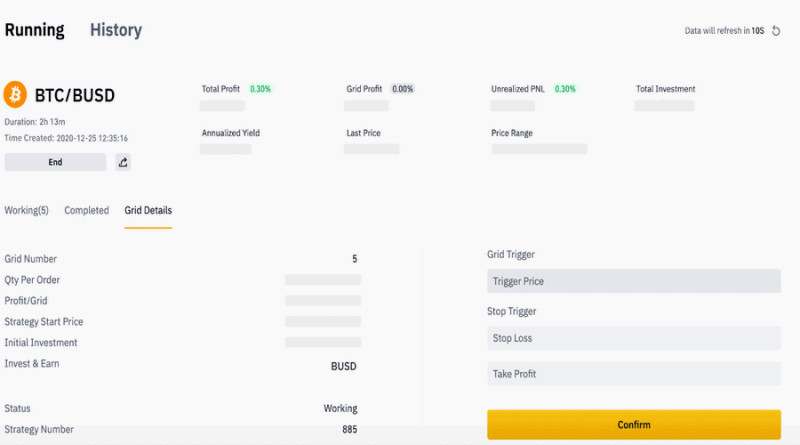

The first thing you need to do is select the grid trading option in the exchange platform menu. Usually it can be found in the list of available strategies.

The next step is to set the grid parameters. Sometimes some of them are already installed, so you can either change them or leave them as they are.

Let’s consider a scenario when you need to set all parameters manually.

First, you need to find a tab in the spot trading menu for creating strategies. After that, the system will automatically redirect you to the Settings tab.

You will need to set the following parameters:

1. Trading pair (for example, BTC/USD);

2. The time frame for the grid strategy (for example, a day, a week, and so on);

3. The amount you are going to invest in cryptocurrency;

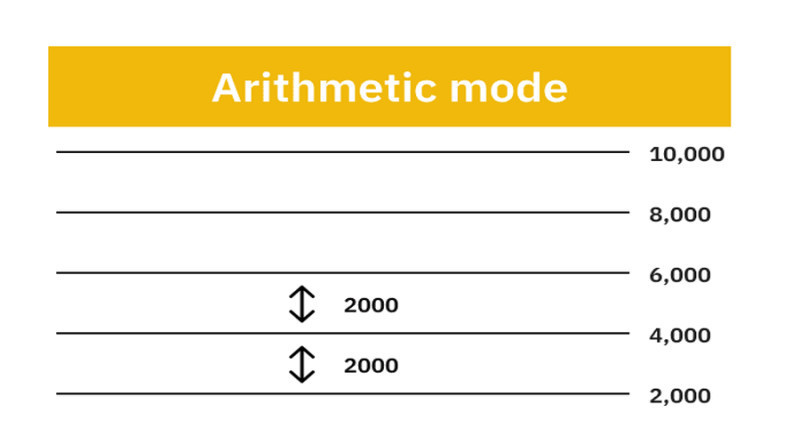

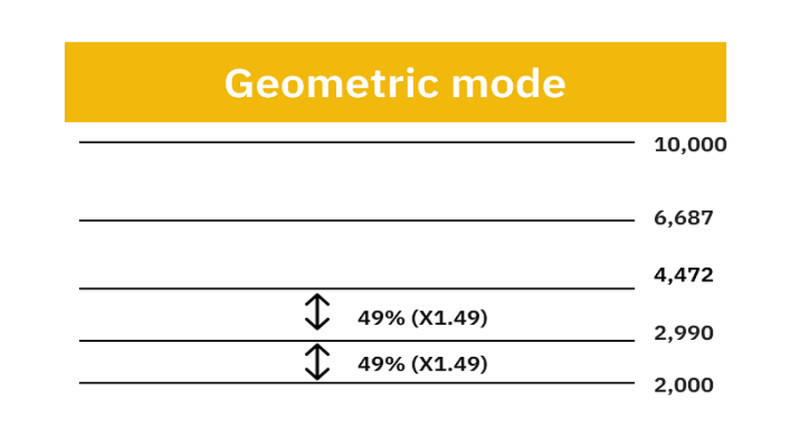

4. Grid mode: it can be geometric or arithmetic. In the first case, the difference between price levels is the same, in the second - the distance is calculated as a percentage;

5. Lower and upper grid limits. Trades will not be executed outside the set range between the maximum and minimum price;

6. The number of levels in the grid, which determines the potential profit from each trade and the frequency of trading;

7. Stop Loss and Take Profit. The stop-loss order should be set below the minimum and the current price, while the take-profit order should be placed above the maximum and the current market value;

8. Trigger price. If you don’t set it manually, the bot will buy a certain amount of coins automatically at the market value.

The platform displays the list of open and executed orders, information about them, as well as the grid parameters.

To launch a grid strategy, a trader needs to have enough money in his/her wallet.

A trader can always interrupt the trading process without waiting for the execution of orders at all levels.

In this case, all orders will be canceled, and the profit will be calculated at the current market value. Users can also cancel individual pending orders.

These features make grid trading more flexible.

Important aspects

Grid trading is quite popular among crypto traders as it allows them to benefit from the main feature of the crypto market - its volatility.

In grid trading, the invested amount is divided into smaller parts which reduces the risks compared to regular trading. A profit from each executed order is small but it adds up into a bigger amount thanks to a large number of trades.

A return in the grid trading strategy can sometimes exceed 100%.

But to have such a result, you need to keep in mind some aspects that we have listed below.

1. Importantly, the chosen asset should be trading with pullbacks. This condition makes it possible to buy or sell an asset at a set interval. If the price is moving strictly within a trend, a trader can face losses;

2. Grid trading requires traders to have certain skills, especially if orders are placed manually.;

3. For novice players, it is better to choose well-known crypto assets that are leading in terms of market capitalization and are characterized by high liquidity. For example, it can be Bitcoin, Ethereum, Litecoin, and so on;

4. The right grid parameters are the most important condition for a successful grid strategy. The wider the range between the high and low, the lower the risks and the greater the level of diversification;

5. If the grid contains a large number of order execution levels, the trading frequency will be higher than with a smaller number. Bots can cope with high speed but traders are not always able to keep up;

6. The number of levels affects the amount of potential profit from each order. The fewer of them, the more profit at each level;

Usually when the number of levels is set, the system automatically calculates the estimated profit for each order. If the profit is around 0.8%, the grid is probably very small, 5% is too large, and 3% is the optimal value.

Also, make sure that the profit per order covers trading commissions set by the crypto exchange. Otherwise, trading makes no sense.

Tips for beginners

For those who have just started to trade crypto, the grid strategy may seem to be too complicated. You need to have some skills and knowledge to set up the grid correctly.

First of all, it is important to recognize the trend (bearish, bullish, or sideways) and define whether grid trading will be appropriate here.

As was discussed above, the best condition for grid trading is a sideways trend.

Once you have set the upper and lower limits of the grid, beyond which no orders will be executed, you need to choose the right number of levels. If you trade without bots, it is better to set a small grid so that the trading frequency is not too high.

Another factor to consider is the amount of money you are going to use for crypto trading. Don’t invest all your funds as there is always a risk of losing all your capital.

Ideally, you should invest an amount that you are ready to lose in case something goes wrong.

You should be especially careful when it comes to using leverage. This option is available if you trade futures. However, leverage trading should be used only when trading with your own funds brings profit.

At the very beginning, leverage should be low.

More tips:

- Practice your trading skills and knowledge on a demo account first. This is a safe way to try your hand at trading without risking your deposit;

- Try the Copy Trading service to learn grid trading. This way, you will see grid parameters used by professional traders and will learn the logic behind the process;

- Do not rush to gain the maximum profit at the very beginning. First, invest a small amount and then add more to it while improving your trading skills;

- Take advantage of trading bots. Automation of the trading process will help you grasp the essence of grid trading and make it more efficient;

- Keep in mind that you won’t be able to change the parameters of the grid once the process is launched. So, before proceeding with the strategy, make sure that all the parameters are set correctly;

- Do not turn trading into gambling. If you have a losing trade, don’t try to win back losses right away. Sometimes, it is necessary to slow down and wait.

Conclusion

Grid trading crypto is one of the strategies for trading crypto with an optimal risk/reward ratio. In a nutshell, it means placing sell and buy orders above and below the current market price at certain regular intervals.

The distance between the price levels is pre-set. The upper and lower limits of the grid keep the trading process within a predetermined range. Eventually, a trader gets a profit from buying lower and selling higher.

If there are many levels in the grid, the profit will be small as the frequency of trades will be high. By contrast, fewer levels mean larger profits, and the frequency of trading is lower in this case.

It is up to you which strategy to choose. Just make sure your crypto asset is volatile enough and is trading with pullbacks.

Grid trading is most of the time an automated process. Some traders prefer to do everything manually but the majority of them rely on bots.

Automated trading saves time and effort but at the same time, it allows traders to develop their trading skills as they still need to set grid parameters themselves.

Some major downsides of automated trading are:

- No guarantee. Even the most popular trading bot cannot guarantee that the grid strategy will meet your financial goals;

- Some bots have paid subscriptions which increases your trading costs.

Recommended:

Crypto Trading Training

Cryptocurrency Arbitrage

Crypto Margin Trading

What is Spot Trading in Crypto

Leverage Trading Crypto

Short Term Crypto Trading

Crypto Demo Trading

Back to articles

Back to articles