It is hard to imagine successful trading of any asset, including cryptocurrencies, without a well-thought-out strategy. You may be able to make single successful trades, but it will be very difficult to achieve success in the long run.

It is about different trading strategies that we will talk about in this article. Short-term cryptocurrency trading will be the focus, as its features, advantages and disadvantages, and other nuances.

To learn more about where to start crypto trading, what cryptocurrencies there are besides bitcoin, and much more, you can read the article "Cryptocurrency trading".

Traders by temperament type

The psychological aspect plays a very important role in trading. People, first and foremost, have emotions, fears, and worries. They experience stress and other factors that may affect their trading results.

Perhaps the main emotions that drive people in trading are fear and greed. On the one hand, there is a desire to close transactions as quickly as possible because of the fear of losing money. On the other hand, there is a desire to earn as much as possible because of greed.

However, these are all common traits, which are to some extent inherent to all people. Nevertheless, there are also those innate characteristics and aspects of behavior that together determine a person.

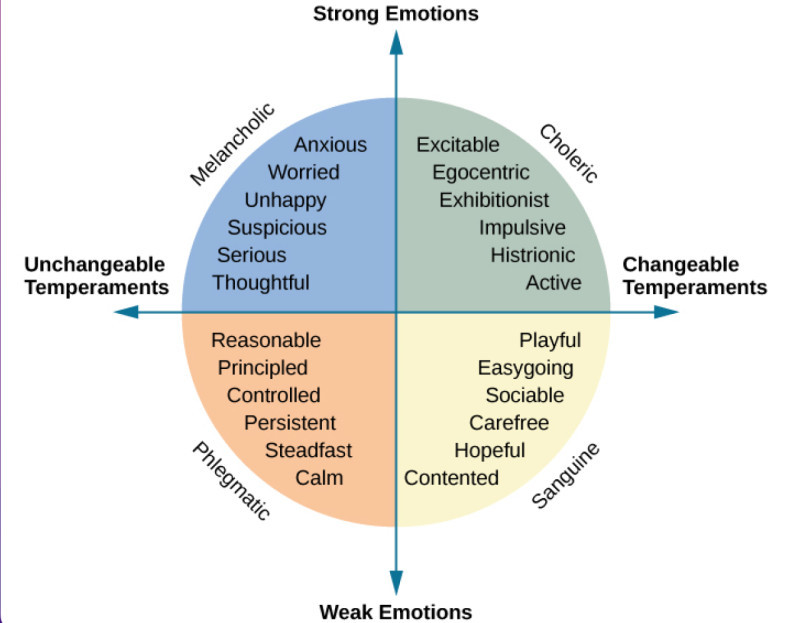

A temperament type has a significant impact on the trading style, exposure to risk, and other aspects of trading. Therefore, you should determine your type before choosing a trading strategy.

There are four basic types of temperament:

- The choleric is characterized by a high reaction rate, short temper, and strong expression of emotions. Such people persistently pursue their goals, have good concentration, and are very energetic. They have an explosive nature and are very emotional and impulsive. They often find it difficult to control their emotions and excitement.

- Sanguine is the most optimistic type, active, and easy to communicate. These people have a high work capacity, do not feel fatigued, quickly engrossed in something new. Despite the emotionality, they are less influenced by their emotions than the choleric.

- Melancholics are overly sensitive, vulnerable, and prone to pessimism. Such people are often shy and unsure of themselves, have low concentration, and do not participate in disputes. They tend to think for a long time. It is difficult for them to try something new and cope with stress.

- The phlegmatic is characterized by high performance and concentration. However, they are often slow and have problems with motivation and the ability to make quick decisions. At the same time, such people have high emotional control and stress tolerance.

Notably, pure temperaments are very rare. However, there is a certain dominant type and some traits of other types in each of us.

Short-term crypto trading styles

Now let's look at different trading styles and distinguish types of traders depending on the preferred style. We can distinguish the three largest groups, which are subdivided into smaller ones:

1. Short-term crypto trading, which includes:

- scalping;

- day trading;

2. Mid-term, which often also includes swing trading;

3. Long-term trading or investing.

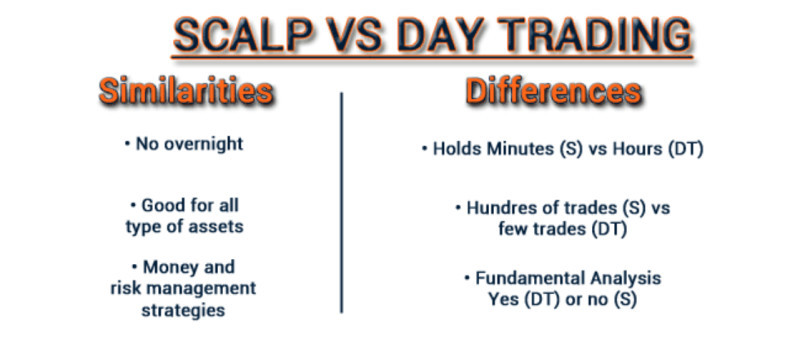

Scalpers are traders who prefer to make a large number of trades of small volume. Such transactions are made over several seconds or minutes.

Even the slightest price change matter to scalpers because they can earn money on them. That is why they choose lower time frames for analysis and trading.

Intraday traders are the second group of users who prefer the short-term style. Their main trading principle is to close all open positions within one trading day.

Day traders can make about ten trades lasting from a few minutes to a few hours during the day. A characteristic feature of this style is careful risk control.

Due to the high volatility of cryptocurrencies, i.e. frequent changes in their value, these assets are very well suited for short-term trading.

The category of swing traders includes those who do not trade all the time, but only during periods of strong market movement. At times when the market is moving sideways, that is, does not make pronounced fluctuations, they refrain from making trades.

Position traders can keep their trades open from several hours to several weeks. They use higher time frames (H1 and higher) for analysis and trading. Such a trading style easily allows you to combine trading with your main occupation and earn extra income.

Traders who prefer a medium-term style can keep positions open from several days to several months. This type of trading can also be combined with your job.

Investors stick to a buy-and-hold strategy. They buy assets, often stocks, and hold them in their portfolio for a long time, usually several years or even dozens of years.

You can invest in any asset, including cryptocurrencies. Despite their high volatility, they have a high potential yield, which is much higher than the yield of even the top stocks.

Which temperament fits which style

Now let's try to figure out what style of trading is more suitable for what type of temperament. This connection must be taken into account because it is the innate characteristics and abilities that can both help and hinder traders in reaching their goals.

Choleric traders often choose scalping. They are attracted to this style by the opportunity to trade actively. They easily cope with losses and failures, though not always willing to analyze and find out the reasons.

However, it would be better for them to combine intraday with swing trading. On the one hand, they could get their excitement from short-term trades. On the other hand, they have an opportunity to recoup the losses during the most active hours in the market.

Sanguine traders have a good chance to succeed in both intraday and medium-term trading. They are also, like the choleric, active, but more balanced and better control their emotions.

Their lack of patience and assiduity can make it difficult for them to hold positions open for long periods. At the same time, sanguine people have no problem mastering swing trading.

Melancholic traders are not suitable for active trading styles due to the high level of stress and intensity of trading, which they find difficult to cope with. For them, investing for one year or more is the best solution.

Since they find it hard to cope with stress and losses, they can get disappointed in trading after the first failures and give up trading.

Phlegmatic traders usually enjoy position trading, medium-term trading, and investing. They can conduct a thorough analysis, but can not make quick decisions.

Phlegmatic people adhere to the chosen strategy and calmly tolerate failure. They are patient and calm enough to keep positions open for long periods.

Features of cryptocurrencies

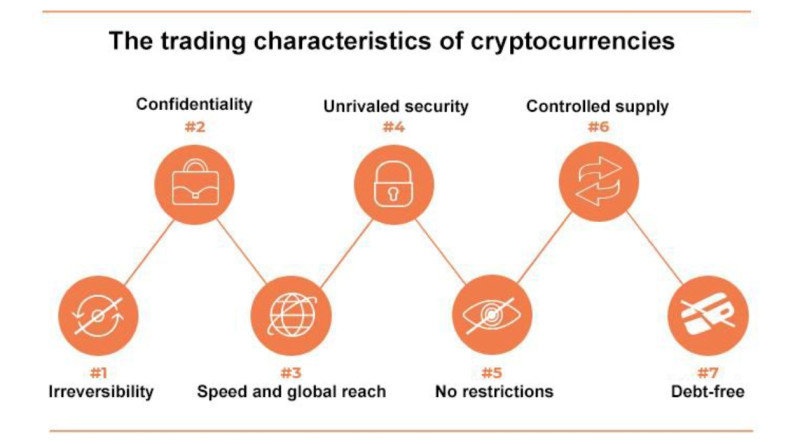

Crypto does not exist in tangible form, it is a completely digital currency. On the one hand, it is money for which you can buy something. On the other hand, you cannot cash it, you can only make payments on the Internet.

Cryptocurrencies are not affected by inflation. In addition, it is a fully decentralized asset, there are several exchanges where it is traded but there is no central regulation.

Crypto transactions cannot be traced nor can they be undone. The security system and protection are at a very high level, so it is considered safer to store or use crypto than other currencies in banks or other accounts.

However, the main feature of crypto is its high volatility. The value of the asset can change by 10-30% in a single day both upwards and downwards.

In addition, cryptocurrencies have high liquidity. This means that they are in high demand and they are easy to sell at any time.

The two properties of cryptocurrencies are key to using digital coins in short-term strategies. Traders can make good money on frequent value fluctuations, which attracts them to the cryptocurrency market.

However, some people prefer to invest in cryptocurrencies. That is, they buy and hold them until the asset reaches the desired price.

Experienced investors do not recommend investing all funds in digital coins. They should constitute only a certain percentage of the investor's portfolio as a diversification tool.

In addition, it is not recommended to invest all funds in only one cryptocurrency. It is better to assemble a certain set, consisting of 4-8 different coins. In this case, the portfolio can be more conservative and include instruments with a lower level of risk or more aggressive with high risks.

Short-term crypto trading

What is short-term crypto trading? Let's take a closer look at this section. The two main varieties of short-term trading are scalping and day trading.

Let's start with scalping. As we said before, it involves constantly tracking any changes in value and making a large number of trades. The duration of one transaction may be several seconds.

Scalping is based on technical analysis because it can predict in which direction the price will move. However, this strategy requires thorough preparation.

Since decisions have to be made very quickly, almost instantly, it is necessary to analyze the asset in advance. This will allow you to understand the direction in which the market is moving and find the right points to open a position.

This type of trading is not recommended for beginners as they do not have enough experience in market analysis.

The main feature of day trading is that all trades are opened and closed within one day. In the case of cryptocurrencies, trading can be done around the clock because cryptocurrency exchanges do not have fixed opening hours like other types of exchanges.

Therefore, intraday trades are executed within a single day. However, the main feature is the constant monitoring of open positions and market situations.

As well as in scalping, intraday transactions are made based on technical analysis. There are much fewer trades about ten per day. Nevertheless, a fast reaction to changing situations is also required.

For a trader who uses short-term strategies, it is very important to know what factors affect changes in the value of the traded cryptocurrencies. These factors must be constantly monitored and taken into account when making transactions.

Pros and cons of short-term crypto trading

Like any style of trading, short-term trading has its advantages and disadvantages that users need to consider. Let's consider them in more detail in this section.

So, the advantages of short-term crypto trading include:

- The ability to make a fairly large profit quickly. This is because the value of cryptocurrencies, unlike other assets, can change dramatically over even a short time. In comparison, the value of other assets can change by about 1% in one day, while cryptocurrencies can double their value in that period;

- The cryptocurrency market is constantly expanding. New digital coins keep appearing, so traders have more and more opportunities to make money on newly appearing coins;

•High trading volumes. This is important because it allows each trader to quickly find a seller or a buyer to make a trade.

Among the disadvantages of short-term crypto trading are the following:

- High volatility. This is both a pro and a con of crypto. On the one hand, large fluctuations in the value provide opportunities to get profits. On the other hand, they can bring large losses;

- Requires a lot of time for analysis. You need to know all the nuances of technical analysis and conduct it constantly so that you are ready to enter or exit the market at any time. The trades are made quickly but the preparation for their implementation can take a long time;

- You need a lot of money for investments. To trade in the cryptocurrency market, it is necessary to have rather large sums of money, exceeding $1,000. Beginners rarely obtain such large sums.

Rules of short-term crypto trading

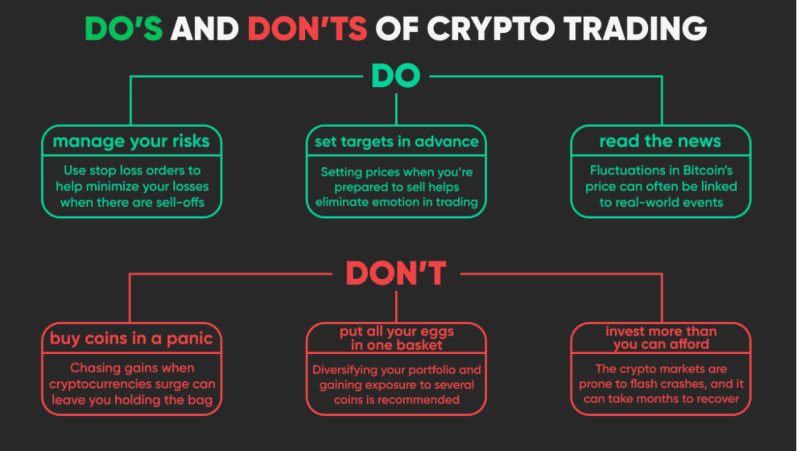

The cryptocurrency market attracts many traders. However, beginners who do not have enough experience and knowledge can very quickly lose the entire deposit and be disappointed in trading.

To avoid disappointment, it is better to adhere to these rules. We have tried to collect them all in one place:

- Get training. Even if you have traded other assets than crypto, you should first learn what it is and only then start trading. Cryptocurrencies have their own peculiarities and you need to take them into account when trading or investing in these assets.

- When choosing specific digital coins for trading, pay attention to trading volumes and market capitalization. Thus, you can find assets that are not in high demand, respectively, their value will not rise quickly. However, some of them can show good potential in the future and you can earn from an increase in their price later.

- Remember, there is no perfect time to open a position. You should constantly analyze and start trading before the market changes its trend. Use technical analysis to predict the future movement of a currency rate. It is also necessary to take into account the fact that exchange rates can be artificially influenced, so the crowd's opinion may not always reflect reality.

- You should not wait for the high or low prices. As we have mentioned many times before, the value of cryptocurrencies can change within minutes. Therefore, do not try to maximize your profits right away, it is better to increase them little by little.

- Follow the rules of risk management. This is especially important when dealing with digital assets. The temptation to place a big stake and win the big score at once is very great. As a rule, it is not recommended to use more than 3-5% of your total deposit per trade. Of course, this threshold is different for every trader, but beginners should follow this rule.

- Try to develop your trading strategy and stick to it, no matter what. Having a trading algorithm does not guarantee that all trades will be profitable. However, it will eventually lead to a positive result in your account.

- Determine your type of temperament and match it with those trading styles that are more suited to you. Your trading style should be tailored to your personality and inclinations. Otherwise, you will always have to fight with yourself.

Conclusions

In this article, we looked at the key concepts, features, advantages, and disadvantages of short-term cryptocurrency trading. Since crypto has distinctive features from all other assets, they need to be taken into account when trading this asset.

The main feature of digital coins is their high volatility. This is both an advantage and a disadvantage of this asset. It allows earning on the rapid growth of the price, and it is possible to lose your money.

Every trader needs to find their trading style, and it is equally important that the style is not just to their liking but also fits their temperament type. Each type of temperament has its own innate characteristics, which can give an advantage in a particular style of trading.

For example, short-term crypto trading suits the active types: choleric or sanguine and does not suit the melancholic. When it comes to short-term trading, it is important to concentrate more, to be able to control your emotions, as well as to make decisions quickly.

In this case, scalping, one of the types of short-term trading, is not only suitable for people with a certain temperament but also with sufficient experience in trading. This style is not recommended for beginners.

Day trading is a more relaxed type of short-term trading, however, it also requires a lot of preparation and time. Therefore, technical analysis plays an important role here.

Recommended:

Crypto Trading Training

Cryptocurrency Arbitrage

Crypto Margin Trading

What is Spot Trading in Crypto

Leverage Trading Crypto

Grid Trading Crypto

Crypto Demo Trading

Back to articles

Back to articles