Cryptocurrencies are rather attractive assets for many traders nowadays. However, even experienced traders acknowledge that entering the market without any knowledge base is quite risky.

That is why proper preparation is quite important. Trading on a demo account is just the right way of doing it. This is what this review is about.

Want to learn more about cryptocurrencies and how to profit from them? Then read our article about Crypto trading.

Where to start

Those who decided to start trading cryptocurrencies need to be aware of a few important issues. First of all, trading in any financial markets, including the cryptocurrency market, is quite risky.

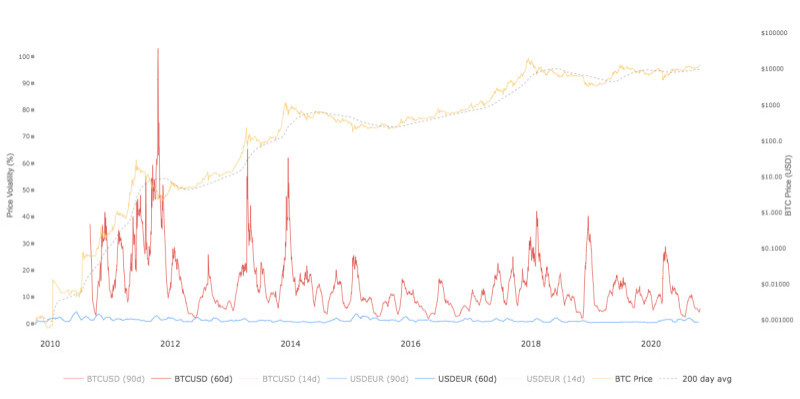

Cryptocurrencies are highly volatile trading instruments. It means that their value tends to fluctuate frequently. Such instruments are not suitable for long-term strategies.

However, these frequent fluctuations can provide opportunities for short-term and medium-term profits. To achieve this, it is important to adhere to money management rules and avoid placing trades of large volumes.

Before you start trading, you need to take a few simple steps. We describe these steps in more detail in this and the following sections.

The first thing to do is to choose a trading platform. When selecting a cryptocurrency exchange, it is necessary to check its reliability. You need to find out if it suffered any hacker attacks, how long it has been operating, and what kind of reviews it has online.

After choosing an exchange, you need to register on it. The registration process is quite simple and similar to the procedure on any other website. However, reliable cryptocurrency exchanges provide limited access to their services after registration.

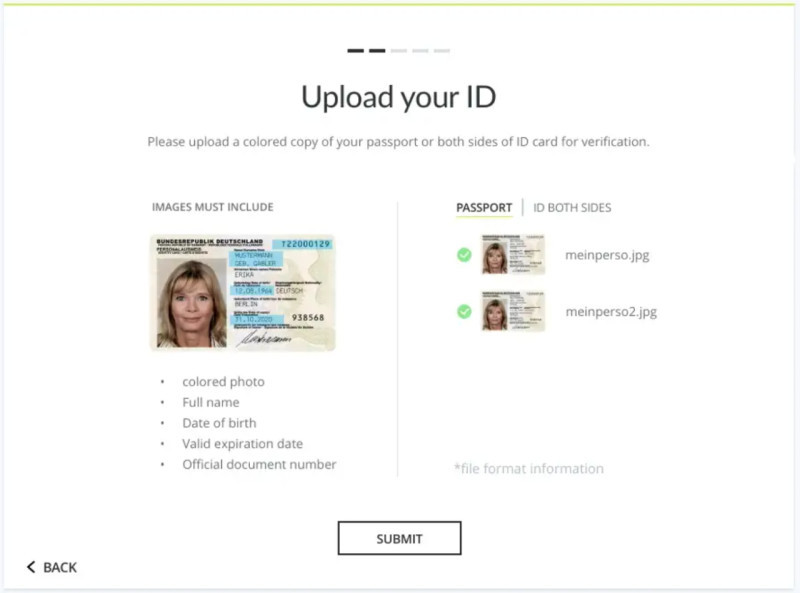

In order to fully utilize all the features of crypto trading platforms, it is necessary to go through the verification process, or KYC (Know Your Customer). This procedure allows the exchange to verify the user identity.

To verify an account, users need to confirm their identity and residential address by providing an appropriate document, such as a passport or residence permit, as well as utility bills as proof of address.

Learning crypto demo trading

The next important step is education. No one enters a new field fully prepared. Even if a trader has previously worked with other assets, cryptocurrencies have certain characteristics that need to be factored in.

Newcomers who have never traded before should approach the learning process even more responsibly. Currently, there are numerous opportunities for learning, including online and offline courses, seminars, workshops, lectures, articles, and books about trading.

Each user can choose the most convenient way to learn. Moreover, many trading platforms and brokerage firms offer free education to their clients after opening a trading account.

Successful trading requires understanding the basic principles of how the market works, knowing the basics of technical and fundamental analysis, as well as the factors that can affect an asset price.

However, it can be difficult for beginner traders to decide where to start. Even if they simply search for "cryptocurrency trading education," the search engine will return numerous courses and strategies that promise instant large profits.

Often, such courses don't even explain the essence of their strategies, just providing a specific algorithm that a trader should follow to achieve success. However, without understanding the cause-and-effect relationships, successful trading is impossible.

That is why it would be more wise of a trader to acquire some theoretical knowledge, gain practical experience, and eventually develop their own trading strategy.

Of course, this path is longer and requires self-discipline compared to simply following someone else's strategies. However, this approach is more reliable, as it provides the knowledge and skills that can be used under any market conditions, not just in a specific situation.

Trading strategies

Undoubtedly, there is no single strategy that would suit everyone. Ideally, each trader should develop their own system that best meets their needs and character traits.

Some users trade cryptocurrencies for the long term, but not everyone has the nerves and patience to hold open positions for a long time when an asset undergoes numerous price fluctuations.

There is no universal trading algorithm, but there are some basic rules that everyone who starts trading cryptocurrencies should follow.

1. Due to the fact that crypto is a rather volatile asset, it is quite easy to lose money when trading it. Therefore, it is necessary to use only those funds that you can afford to lose.

In addition, it is not worth investing all your free funds only in crypto. It is essential to diversify your portfolio and use various types of assets for investing and trading. Experienced users recommend allocating no more than 6% of the portfolio to cryptocurrencies.

2. You need to try not to react to daily cryptocurrency fluctuations and make hasty decisions. If a trader invests in an asset they believe has potential, they should not immediately close the trade if the price has dropped during a trading day. It is necessary to evaluate the asset in the long-term perspective.

3. It is essential to pay attention to the way different cryptocurrencies are interconnected. For example, when the value of Bitcoin starts to increase, all other coins may soon follow suit. Similarly, when the price of Bitcoin starts to fall, other cryptocurrencies may also begin to depreciate.

4. If possible, use market orders. When setting a Stop Loss level, you don't have to worry about the decrease in asset value. As soon as the price reaches the specified level, the trade will automatically get closed.

Another option is automated trading, i.e., using trading robots. However, traders need to be cautious about them, and their work must be constantly monitored. As market conditions change, robots continue to operate according to the built-in algorithm, which needs to be adjusted from time to time.

5. To make timely trading decisions, one should always keep tabs on the latest economic and financial news. That is why it is really important to monitor the key global events.

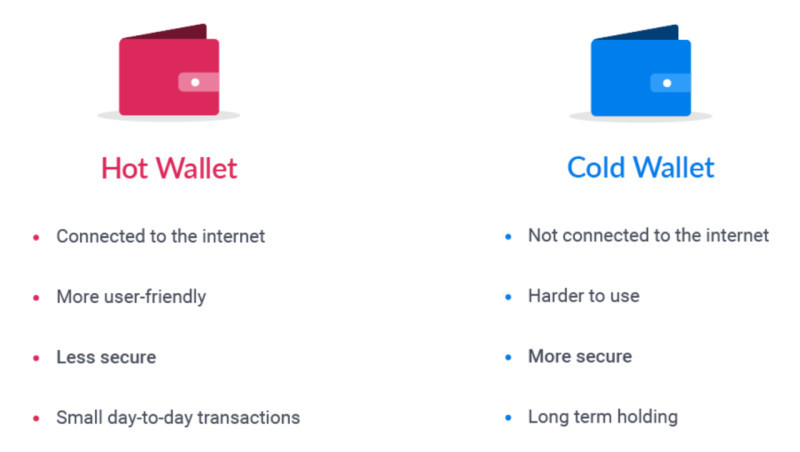

Crypto wallets

Storage is another important aspect when it comes to buying crypto. There is a great variety of wallets, each of them having advantages and disadvantages. Here we provide a more detailed description of wallet types.

1. A paper wallet is considered one of the simplest and most reliable ways to store cryptocurrency. With the help of special services, an offline wallet can be created.

This is its main advantage, as it makes this wallet immune to hacker attacks. However, paper itself can be vulnerable to many factors: water, sunlight, fire, and so on. Therefore, it is advisable to store paper wallets in a safe.

2. A hardware wallet is a separate device used to store cryptocurrency. Like a paper wallet, it is not connected to the internet but offers better protection from physical damage.

The main disadvantage of such devices is their high cost, which can reach up to several hundred dollars. Additionally, the loss or theft of a hardware wallet would result in losing your crypto.

3. A mobile or desktop wallet is considered one of the most convenient but least secure ways to store digital assets. Its advantage is the ease of use, specifically the ability to access coins through an app.

This makes it easier for traders who need quick access to cryptocurrency for trading operations. However, these wallets are connected to the internet, making them vulnerable to hacker attacks.

It is worth noting that when a user buys cryptocurrency on an exchange, it is stored directly in the service's storage, not in the buyer's account. Therefore, in case of the exchange's bankruptcy or hacking, the user risks losing all their coins.

In this regard, it is recommended to withdraw purchased coins to your own wallets. Which wallet to choose depends on the trader's goals and objectives. If these are long-term investments, it is safer to store them in paper or hardware wallets, while mobile wallets are more convenient for regular trading.

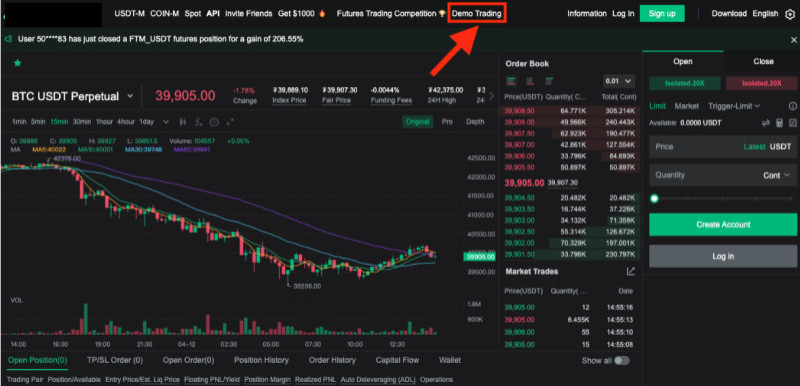

Crypto demo trading

Another important step in crypto trading is trading on a demo account. This is an excellent opportunity to apply theoretical knowledge in practice.

The advantage of demo accounts is that there is no risk of losing real money, as trading is conducted with virtual funds. This is a simulation of real deals that can be made with crypto.

However, one should take trading on a demo account seriously. It is necessary to make the most of this opportunity, allow mistakes, and find ways to deal with any difficult situation.

For beginners, this is a great opportunity to learn the basics of working with an exchange in practice, learn how to perform operations, place orders of various types, and so on.

At the same time, demo accounts are often used by experienced traders as well. They use such opportunities when there is a need to test a new strategy.

There are also some risks associated with using demo accounts. Some users get caught up in their success, and when they achieve certain results in trading on a demo account, they feel they have already understood everything about real trading.

Next, they move on to a real account and start making quite risky trades or using excessively large amounts for a single transaction. It is essential to always stick to the money management rules.

Some users also try to withdraw funds earned on a demo account. However, this is not possible, as no real money is used in such trading. You cannot deposit or withdraw funds from a demo account.

Pros and Cons of demo accounts

Though demo accounts seem to be quite an attractive tool, there are also certain disadvantages. Firstly, let us describe the advantages:

- An opportunity to determine whether cryptocurrency trading is suitable for a particular trader. A demo account allows you to understand how easy or difficult it is, and whether it is worth trading at all.

- The possibility of practical application of theoretical knowledge obtained during training. Demo accounts provide a unique opportunity to trade based on historical quotes, which is as close to real trading conditions as possible.

- Possibility to study and apply in practice different order types. Every trader should understand that besides market orders there are pending and protective orders. If traders can use them properly, they have certain advantages in trading.

- A demo account enables a trader to develop and test their own trading strategy. It's a good opportunity for a beginner to create a trading algorithm for the first time. For experienced users, demo accounts serve to test new tactics before using them on a real account.

And here are some disadvantages:

- The psychological aspects are not factored in. When trading on a demo account, a trader experiences no stress. When successful trades are made, there is no joy, and when unsuccessful ones, there is no dissapointment. The psychological aspect is always included in real trading and it greatly influences trader's behavior.

- Demo accounts raise risk tolerance. If a user has been trading on a demo account for a long time, he or she gets used to risk-free environment. Many traders continue to trade quite aggressively when switching to a real account, which can lead to a rapid loss of funds.

- On demo accounts, users don't have to follow a certain trading strategy. This aspect is quite important in real trading. An effecient trading algorithm always includes both psychological aspects and money management rules.

How to register a demo account?

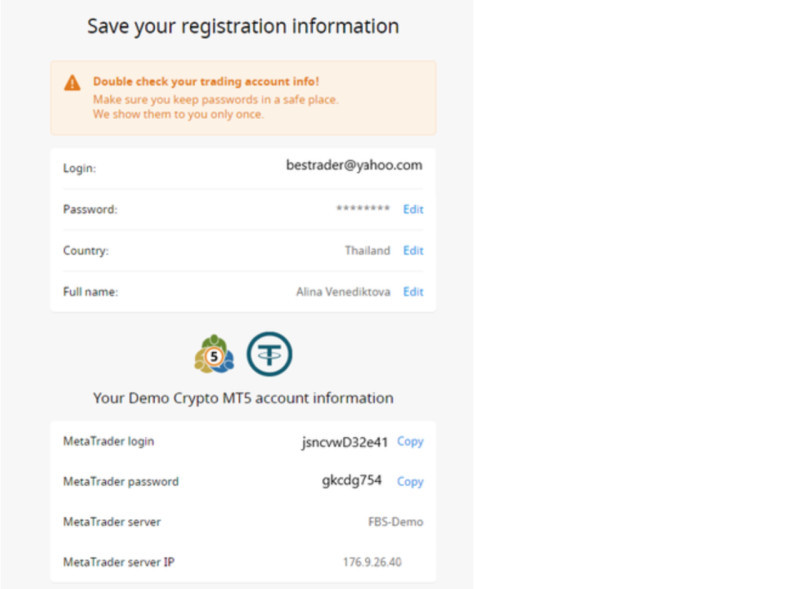

Almost all popular brokers offer its clients demo accounts. In some cases, such accounts can be created without registration.

Demo accounts are usually provided for free. After registering a demo account, a user can select the amount of virtual funds that will be used in trading.

Some traders prefer not to disclose their personal data when registering a demo account. In such a situation, they enter fictitious first and last name and other information. As already mentioned, some platforms allow access to demo accounts without registration.

After registration, a user gets access to a personal area where they can use all the functions of a trading terminal. They can go to the "Trading" section and start practicing.

In this section, traders can choose any assets to trade, including the most popular cryptocurrencies.

It is possible to register virtual accounts with several brokers at once. In this way, it is easier to decide what broker is more comfortable to work with and whose terms are the most suitable.

The only important thing to keep in mind when trading on a demo account is that all orders are executed almost instantly, unlike on live accounts. Transactions in the real market conditions take longer to execute.

This aspect should be factored in when you switch from a demo account to a real one. Otherwise, you can lose real money due to improper time management.

How to use a demo account?

As soon as users log in to their personal profile, they see many different tabs. Let us explain what functions each of them performs, using the MetaTrader platform as an example.

We have already mentioned the Trading tab where users can select trading instruments and directly carry out the trading process. We describe the trading process in more detail below.

The Copy tab offers users to copy trades of other traders. The user subscribes to one or more successful traders, and their trades are automatically copied in their account.

Such a method is especially attractive for beginners, because they can start earning without much knowledge or experience. On the other hand, such an option can be used as training. Followers don't just copy trades, they can also track the managing trader's actions and try to grasp the essence of their strategy.

In the Analytics section, you can find the most relevant information regarding trading. This section includes analytical materials, trading signals, news from the world of finance and other useful materials.

Using the Finance tab you can perform various operations in your account. Specifically, you can deposit and withdraw funds from your account.

The Training section allows you to find training materials that can help you study the trading process. You can use these material not only before you start trading, but also in the process.

The MetaTrader tab makes it possible to manage various accounts, including opening and using demo accounts.

Finally, the Partners section is designed to create your own affiliate network. You can refer your friends and become a partner, receiving a passive income in a form of commissions from the activity of traders referred by you.

Crypto exchanges providing crypto demo trading

Some crypto exchanges do not provide their clients with an opportunity of using a demo account. However, most popular exchanges have this option. In this paragraph, we expand into these options.

- Binance Futures is known for its large trading volumes and the large number of trading instruments available. To use a demo account, users need to open a separate account. However, the login and password can be the same as on the live account. Demo accounts have a large amount of virtual funds for training. The initial virtual deposit is as much as 100,000 USDT. This crypto exchange has advanced functionality, including adjustment of the leverage and other options.

- Bybit is a crypto exchange providing access to trading crypto futures such as BTCUSD, ETHUSD, and other. To register, a users needs to enter their email and password. Also, it is required to confirm registration with a code received via email. The demo account functionality matches the one of a live account.

- Currency.com is one of the largest crypto exchanges in the CIS. It has a large daily trading volume and a large number of trading instruments. This exchange also enables its clients to invest cryptocurrencies in stocks, raw materials, and other assets. For virtual trading, users are provided with 1 bitcoin. The demo balance can be increased or decreased at the request of a client.

- Nominex is a relatively young exchange. It gives users an opportunity to create accounts without KYC, make a deposit with a bank card ,and provides other options. Also has a large knowledge base with educational materials is available for traders. A virtual balance of 10,000 USDT is initially provided for trading. You can switch to a demo account if you already have an account on this exchange.

How to choose a crypto platform

When choosing a platform for crypto trading, including demo trading, one should pay attention to the following criteria:

- reliability;

- available markets;

- the amount of virtual funds a trader can use on a demo account;

- the period of time during a demo account remains active;

- access to various functions of a trading platform;

- availability of various analytical tools;

- automation.

Here we describe the above criteria in more detail. So, when choosing a trading platform, the primary factor is reliability. An exchange can be considered reliable only if it is regulated and licensed. Besides, it should have a vast experience in the industry. Only in this case you can be sure that you are not dealing with scammers.

Some exchanges don't provide the opportunity to trade in different markets. There are platforms that specialize in certain trading instruments and, as a result, provide access to the relevant markets. If you are interested in the possibility of trading cryptocurrencies, you need to choose an exchange that provides such an opportunity.

Regarding the amount of funds on a demo account, two factors are important. On the one hand, this is the virtual amount that is provided by the exchange for trading. On the other hand, a trader needs to set clear goals regarding how much they can have on a real account and proceed from this when making trades on a demo.

The allowed lifetime of a demo account is also important. Some platforms limit the time of using demo accounts, for example, by 30 days. However, this time may not be enough for some users. Therefore, for a thorough study of trading platforms and their functionality, it is better to choose unlimited demo accounts.

Another important factor is the convenience of using a trading platform. Users need to assess how intuitive the user interface is, make sure there is a mobile app, and check other options.

Without the correct use of analytical tools, successful trading is not possible. Every trader should know how to read charts and apply technical indicators and chart patterns to determine the future price behavior and place trading orders.

The availability of trading advisors is also an advantage. However, such options should be applied with caution, as their uncontrolled use can bring losses instead of profit.

What coins to trade

After choosing a trading platform and exploring its features, traders need to take the next important step, i.e. select what asset they will trade or invest in. Here are some criteria that should be taken into account:

- Despite the fact that cryptocurrencies emerged not so long ago, some of them have become widely known while others are not that popular. Bitcoin and Ethereum are among the most famous and popular coins. However, there are younger and, accordingly, more promising crypto assets.

- The wide popularity of a particular coin among users ensures a high level of liquidity. This is important because there is always demand for highly liquid assets, meaning they can be quickly sold at any time if necessary.

- Availability of cryptocurrencies on various trading platforms. Since crypto trading is not regulated, the supply and demand ratio forms the final value of a particular coin. It depends on the total number of users on a specific exchange, their activity, and other factors. Therefore, the price of the same asset on different platforms can vary significantly.

- Undervaluation is the criterion that is directly related to the first point. New assets constantly appear on the market, but not all of them can ultimately be profitable. Low initial value is either for new assets or those in a state of rollback. In both cases, an asset can turn out to be profitable.

- One or more instruments. This choice depends on the specific trading strategy. When using medium-term or long-term algorithms, it is possible to trade with several instruments at once. However, in the case of short-term trading and especially scalping, it can be difficult to monitor price changes even for a single asset.

When to switch to a real account?

As we have already mentioned, modern trading platforms allow the same user to open multiple accounts of different types. Therefore, it is necessary to be extremely attentive.

This is especially true for traders who use different accounts. For example, when testing a new strategy, you need to switch from a real account to a demo one.

Subsequently, you need to switch back to your real account to continue trading in the usual mode. Otherwise, even when making successful trades, you will not be able to make real profits.

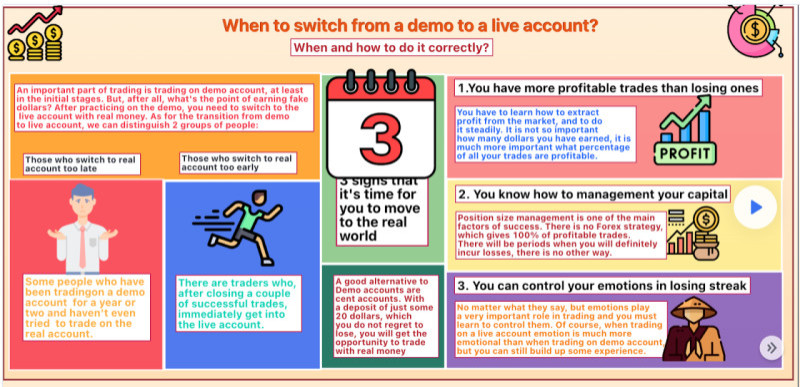

So when is it time for a beginner to switch from trading on a demo account to a real one? This is a rather complicated question, and there is no definitive answer, nor are there any specific timeframes.

This moment should be determined by each person individually. The decision should be based on inner feelings and self-confidence.

Another indicator of your readiness to switch from a demo to a real account is the fact of receiving a stable profit for at least two weeks.

After that, you can try to trade on a real account and get real income. However, you should not get upset and worry if the level of income on a real account at first turns out to be lower than on a demo one. It all depends on the specifics of the exchanges operation in real time.

You need to continue following your strategy, and the result will not be long in coming.

Principles of using a demo account

So, how can you get the most out of trading on a demo account? There are several key principles that you should follow when working on this type of account. We have gathered the main ones in this section:

- Use a demo account to the fullest: explore all the functionality of the trading platform that you plan to use. It is important to learn where the tabs and buttons are located, but it is also crucial to understand how trades are made and what settings can be applied to them.

- Select the instruments you are going to trade. If it is cryptocurrencies, you need to choose one or several coins that you will trade or invest in. It is important to find out when a particular asset is traded and what factors can influence its price change.

- Learn to cope with stress and rein in your emotions. We mentioned that there are no real emotions on a demo account, but you need to be prepared for the fact that after switching to a real account, the emotional aspect will come to the fore. Fear, greed, the influence of other emotions and stress can often hinder a trader in achieving success.

- Learn to set the right leverage. On the one hand, leverage increases potential profits. However, it increases potential losses. You need to find the optimal value that won't cause too much harm to your deposit.

- Learn to manage risks. The money management rules have already been mentioned in this article and in many other sources. There are certain recommendations regarding what percentage of the total deposit can be used for one trade. However, this largely depends on your personal preferences. For someone, a permissible level of risk may be a loss of 5% of the deposit, while others can afford to lose 20%.

- Use a demo account to develop and test trading strategies. This rule applies to everyone: both beginners and experienced traders. Novice traders can use a demo account to create their own trading systems, while professionals usually test new ideas on demo accounts.

- Choose a trading style that suits you. Using a demo account allows you to get a general idea of how the market works. In addition, you can understand what style better suits your personality type and temperament: short-term trading, medium-term trading, or investing.

Trading vs. Investing

Any beginning trader usually faces this dilemma. Your personal traits and temperament should tell you whether to trade or invest.

In general, there are the following types of traders:

- Scalpers execute a large number of short, small-volume trades during a single trading day.

- Day traders make fewer trades, but do not leave positions open for longer than one day.

- Swing traders may hold positions open for a period of several days to several weeks.

- Position traders keep positions open for several months and even years.

- Investors gradually form positions, making partial purchases and sales.

Some users cannot stay glued to a monitor for hours, tracking every price change. They are calm and patient and can leave trades open for an extended period of time.

For such users, medium-term and long-term strategies or investing are definitely more suitable styles. When using these strategies, a trader won't see immediate results in the account, but the potential profit is much larger.

More active and impatient users who want to see immediate results would prefer short-term strategies. For them, it is important to control what is happening here and now, as tomorrow brings uncertainty and unpredictability.

Position traders gradually build their positions, moving to higher price levels. Also, they gradually get rid of some positions, selling them in parts.

Why trade cryptocurrencies?

Currently, the cryptocurrency market is quite popular and it has a direct impact on other markets. In general, trading cryptocurrencies and other assets has a lot in common, so users do not need to take any additional training.

The most important factors characterizing cryptocurrencies as assets for intraday or short-term trading are high liquidity and volatility.

In addition to the aforementioned liquidity and volatility, there are several other factors that attract increasingly more users to crypto exchanges. Some of these factors are the opportunity for quick profits, low deposit requirements, minimal costs, and other reasons.

However, many experts still do not take digital coins seriously, considering trading them more of a gamble than real trading or investing.

Despite that, an increasing number of people are adding crypto to their portfolios, as the temptation to quickly earn on the wide price fluctuations is quite great. For comparison, the average return on assets in the stock market is about 10% per year, while Bitcoin can offer ROI as high as 230%.

At the same time, it is important to understand that trading crypto can be quite challenging, as this market has some peculiarities. It differs from other markets, such as the stock market, for example.

Securities sold on the stock market are backed by collateral. In the case of stocks, this represents a share of ownership in the company, while bonds are debt securities backed by the borrower's assets.

Cryptocurrencies have no collateral, so their value is determined based on an agreement between the buyer and seller. This is why they are highly volatile assets.

Stocks are classified into blue chips, second-tier, and third-tier securities. The potential return on securities and associated risks depend on the stock type.

In the case of crypto, it is quite difficult to establish any classification. The two most popular cryptocurrencies are Bitcoin and Ethereum. There are also altcoins that are less popular, so many users hesitate to invest their funds in them.

Another factor is the complexity of analyzing digital coins. This type of analysis has certain peculiarities compared to conventional assets.

Conclusion

In this article, we have described the key stages in preparing for trading or investing in digital coins. First and foremost, this involves undergoing training that provides basic knowledge about crypto and the principles of how the market works.

It is also important to selecting a trading platform, that is, an exchange for purchasing cryptocurrencies. After a user buys crypto, they need to store it in a special wallet that can be either hardware or software, depending on the user's goals.

Trading on a demo account is another crucial step that should not be skipped. Trading cryptocurrency on a demo account is a simulation of a real account, allowing you to perform all the same actions without risking real money.

Opening a demo account is quite simple, and its benefits are hard to overestimate. It allows you to thoroughly study the trading platform and its functionality, find out what types of orders there are, learn how to use leverage, and much more.

At the same time, demo accounts have some disadvantages. Specifically, they don't factor in a psychological aspect. Besides, demo traders cannot withdraw earned funds. Moreover, demo accounts create an increased tolerance for risk.

It is always up to a trader to decide when to switch from a demo account to a live one. This moment is determined by the readiness and confidence of the user in their own abilities. Another criterion is the fact of achieving stable profits on a demo account for two weeks.

In any case, it is necessary to make the most of this opportunity. However, it is important not to get carried away and not to treat it as a game, but rather as one of the stages of learning.

Recommended:

Crypto Trading Training

Cryptocurrency Arbitrage

Crypto Margin Trading

What is Spot Trading in Crypto

Leverage Trading Crypto

Grid Trading Crypto

Short-Term Crypto Trading

Back to articles

Back to articles