Sometimes one can hear that everything new is well-forgotten old. This statement is also true for some systems of trading activity in the forex market.

For example, the Sniper Forex strategy by Pavel Dmitriev is based on support and resistance levels.

What is the essence of this trading technique, what are its advantages, and what do other users say about the Sniper strategy? The answers to these and other questions are in our article.

If you want to learn about other forex trading systems, you can read the article “Forex strategies.”

Understanding Sniper Forex strategy

The "Sniper" is a trading strategy based on the principles of technical analysis. To be more precise, it embodies support and resistance levels, from which trading is conducted.

By and large, the usual tools are used in the implementation of this strategy. Frankly, there are a lot of them and they have different names, so, they can seem quite new and complicated at first.

However, if we look into this strategy in more detail and learn how to apply it, it will become clear that its author has not made any discoveries. Although discussions on this subject have been going on for many years.

The creator of the Sniper strategy is trader Pavel Dmitriev who has been testing various strategies and learning the subtleties of trading for about 10 years. In his research, he lost thousands of dollars but he created a strategy, the effectiveness of which fully met his expectations.

At the same time, many professionals note the similarity of "Sniper" with the trading system "Meat" developed by Peter Bainov.

Dmitriev's methodology brought him fame, "Sniper" began to spread in social networks and was used by quite a large number of traders. A guide to using this strategy initially cost between $500 and $2,000, although many free instructions can now be found in the public domain.

Interest in the strategy was also shown by bucket shops and educational organizations, which sold the technique to their clients. That way they not only made a profit but also contributed to the popularity of the new strategy.

What is the essence of this strategy? First, a trader opens new positions considering the key levels, and second, the period of transactions is limited to one day.

Trading usually starts in the morning. By this time, there is a sideways trend on the chart, which is formed due to a decrease in volatility during the nighttime.

During the night the price moves within a narrow range, while staying within its upper and lower boundaries. When the price breaks through the range in the morning, a trade can be opened.

At this time, the European session begins, which is accompanied by an increase in volatility and liquidity. There is even a separate strategy called London Breakout, which involves opening positions in the direction of the candlesticks.

The Sniper strategy involves several options for using key levels:

- Opening positions when the price chart crosses the upper or lower boundary of the range;

- Execution of transactions on the price reversal when the boundary is reached;

- Adding orders when the price rebounds from or break through the key zone.

During the day new signals for entry may appear, so if a trader misses one of them, nothing bad will happen. The author has not imposed restrictions on the number of trades and recommended keeping the open position as long as the price changes in the direction necessary for the trader within a day.

Thus, a position can be closed in three ways:

- by triggering a take profit order;

- by triggering a stop-loss order when the price is moving against the trader's expectations;

- manually when the trend ends or its reversal begins.

A trader should determine the trend based on personal judgment. If the chart shows a lot of bullish candlesticks (white or green), the price and the lows edge up and an uptrend develops.

On the other hand, if red or black candlesticks prevail on the chart, and the highs decrease, the trend is bearish or downward.

To reduce the psychological burden on the user, Dmitriev has developed the Safe method, which we will talk about later. It helps to minimize trading risks and is used not only in Sniper, although it was created exactly for this strategy from the beginning.

Dmitriev has completely abandoned the use of indicators. In his opinion, the efficiency of their use is sometimes quite questionable and therefore they should not be used in trading.

Disadvantages of indicators:

- Many are lagging, which negatively affects the result;

- Some options need constant optimization;

- Most are unable to react to force majeure on time;

- If several indicators are used simultaneously, they can give different signals.

That is why Dmitriev can be called a follower of the Price Action method, which does not use indicators. According to this theory, the price of assets changes solely based on the psychology of buyers and sellers.

At the same time, Sniper is completely different from Price Action in some details. When implementing this strategy, lower time frames are used and the profit from each transaction is small. To some extent, it can be called a scalping strategy.

Initially, it was applied to the GBP/USD pair. Later, the testing covered other currency pairs as well. It showed that Sniper can be used on any asset, as long as the pair has high volatility.

The basic principles of Sniper:

- The European and US sessions are used;

- Trading is based on the trend, its direction is determined visually, in the direction of the breakdown of the night flat. Indicators are not used for drawing the trend lines;

- The volume of the transaction can be any, the main thing is that it corresponds to the rules of risk management;

- Several time frames are used in trading: lower ones for entering and higher ones for fixing the levels. In the first case, it may be M1, M5 or M15, in the second - H1, H4, D1;

- Two charts are used in the work, it follows from the previous paragraph;

- It is necessary to choose a currency pair with high volatility;

- Transactions are made within one trading session without any swaps. The above method belongs to the intraday strategies;

- The entrance is not carried out during periods of important economic news;

- Trading is done only during the trend movement;

- The strategy is based on support and resistance levels, you can trade on a breakthrough as well as on a rebound. Unlike the classic strategies, there are several key zones, and they are used simultaneously;

- Each level has its name and represents not a line, but a zone on the chart of the currency pair;

- The same momentum can be used for multiple trades within a day;

- The target profit in forex trading is about 50 pips a day if at least three trades are made.

Thus, Dmitriev's system implements the theory of Dow, according to which the market is characterized by three stages, which replace each other. They are flat, momentum, and reversal.

Terms and definitions of Sniper Forex strategy

Support and resistance levels play a key role in this trading system. However, they have other names in Sniper.

In addition to these levels, other terms are used during the implementation of this tactic, the knowledge and understanding of which is necessary. Let us focus on them in more detail.

1. Total impulse levels, the construction of which is often based on the hourly time frame, though sometimes H4 and D1 time frames may be used. In this case, we are talking about classical support and resistance, and the more times the price touches them, the more considerable the zone;

2. The impulse level is a micro flat on lower time frames, that is, we are talking about the zone of price correction when the value settles. The role of this range is not so significant, as the momentum level most often only confirms or refutes signals to open a position, and momentums are local.

Why use different levels fixed on different charts? To answer this question, let us give an example.

Imagine that a trader sees that the price of a currency pair has approached the momentum zone on the M5 chart. Later, it can either break through it or rebound from it.

This is why the trader needs to switch to a higher time frame. It is necessary to look at the direction of the last candlestick, where the trend is directed;

3. The level of a sharp change in trend. This is the area in which the previous trend has reversed. This can be signaled by a candlestick with a long wick on the higher time frame, the wick is located according to the main trend, and the body is against it;

4. A consolidation zone is a flat channel, which can be observed most often in the morning, from the end of the US session to the beginning of the European session. We are talking about the extremums of the Asian and Pacific sessions, the range of price fluctuations on the M5 in this case does not exceed 20 points, and the duration of the flat is at least 20 candlesticks;

5. The bank level is the closing price of the daily candlestick, formed during the previous day at midnight GMT. It is believed that this value is set by the banks, that is, big players. When the next session is completed, the previous value of BL is removed, because later it does not play an important role.

According to Dmitriev, this indicator reflects the marks of value, on which whales, including banks, conduct speculative operations. Such value is the most profitable for them, which is why the value of a currency pair usually demonstrates a strong leap next to the BL;

6. Flat is an impassable zone, the range between the swing support and resistance levels;

7. Safe is Pavel Dmitriev's unique solution, which allows you to reduce trading risks. Its essence is that each trade is closed in parts, so you can fix profits step by step.

When the price has passed a certain distance (at least 15 pips) to a take profit order, half of the position is closed, after which a stop loss order is moved to a breakeven point. It is better to place two orders while investing no more than 10% of the deposit.

Forex Sniper strategy

The strategy is multi-level, which is why it may seem complicated at first glance. To make it easier to understand, we will tell you about the necessary steps in more detail.

Some levels, which we described above, are fixed in advance. Usually, it is better to start this a few hours before the opening of the European session.

Traders usually do the following:

- Fixation of a flat (consolidation zone), formed during the Asian trading session, for this purpose extremums - lows and highs are connected. If the height of the formed corridor does not exceed 20 points (at four-digit quotes), it is better to plan the entrance into the market;

- Determining the BL. As we have already mentioned, the candlestick formed at 00:00 GMT is used for this purpose;

- Forming of a total impulse level. To do this, open the hourly chart (H4 and M30 are also used) and fix support and resistance levels;

- Transferring the TIL to the chart. Acceptable time frames are from M1 to M15.

All other levels (impulse and sharp trend change) are formed in trading. They are fixed on the chart during the trading session.

Entry is made when the price of the asset breaks through or bounces from at least two significant levels. Another signal to open a position is when the price moves out of the consolidation zone and breaks through an impulse level on the chart.

The direction of the trade should be consistent with the breakout.

We have already talked about how the Safe is used when closing a position. It can be applied in two ways, but in both cases, the distance from the entry point to a stop loss and take profit orders is the same.

- When the price moves according to the forecast and covers about half of the distance to a take-profit order, 50% of the lot is closed, and the stop loss order is moved to the entry point. Thus, a trader takes profits, and even if the price sharply changes, the second part of the transaction will be moved to a breakeven point;

- Two positions are opened simultaneously, they have the same stop loss, and two different take profit orders. The first transaction is closed earlier (the take profit order is placed at the distance of a stop loss order from the entry point), and the second transaction is closed later (quite often a take profit order exceeds the stop loss by three times).

Thus, during the implementation of the Sniper strategy, the first trade is opened after the first impulse. When this happens, the user should make sure that the trend is moving in the right direction.

Secondly, when opening the first position the distance from the entry point to stop loss and take profit orders should be the same about 15 pips each. According to the system's author, the closing price or the extremums of the previous day, support, and resistance levels on higher time frames can be used to determine them.

If the market situation is favorable, the profit is fixed when half of the trade is closed, and a stop loss order is moved to a breakeven point.

Third, trade should be paused if important economic news is released. They can cause both growth and fall of the price, hence - triggering a stop loss order.

Example of performed trade

Imagine that you are trading the EUR/USD pair. For example, the trade can be made on October 3.

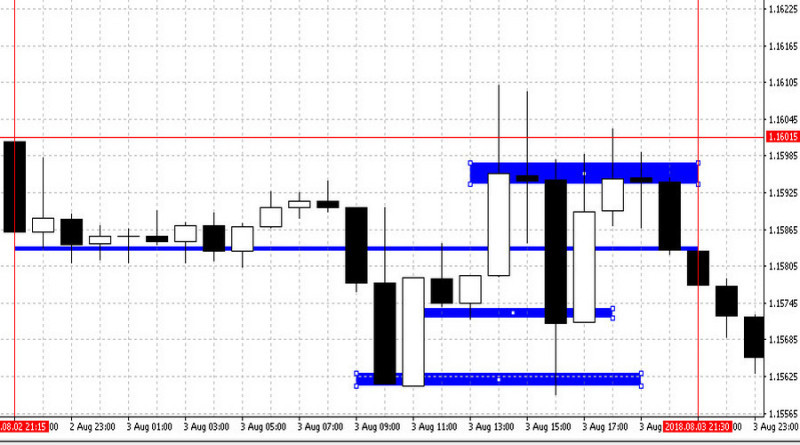

On the chart below, we can see that a TIL was formed on it approximately at 7:00 p.m. Notably, the H1 chart was used in this case.

On the same indicator, the value of the currency pair is fixed IS. The applied time frame is M5.

As previously reported, in both cases, the range of time frames may vary. At about 8 p.m., a falling candle with a high body broke through both zones.

At the low point of this candle, a trader forms two limit orders to sell the asset. This corresponds to the basic concept of the Sniper.

Further price movement on the chart shows that both the first and second orders are triggered on the next candlestick.

As for the closing. The first order was closed after about 30 minutes due to the triggering of the take profit order. We already told you about the Safe rule in this article.

The second order is closed by the trader, it happens almost at midnight. At this moment, the new support indicator has already formed on the chart, and the order was closed before its retest.

Notably, both stop-loss orders were fixed above the IL. Since the price was moving in the expected direction, the loss limiters did not work, and the profit received as a result of the transaction was the highest possible.

How to draw levels easier

Although the Sniper Forex strategy does not involve the use of indicators, some algorithms help to implement it. For example, the indicator of the same name builds levels by itself, as well as indicates the direction of entry with arrows.

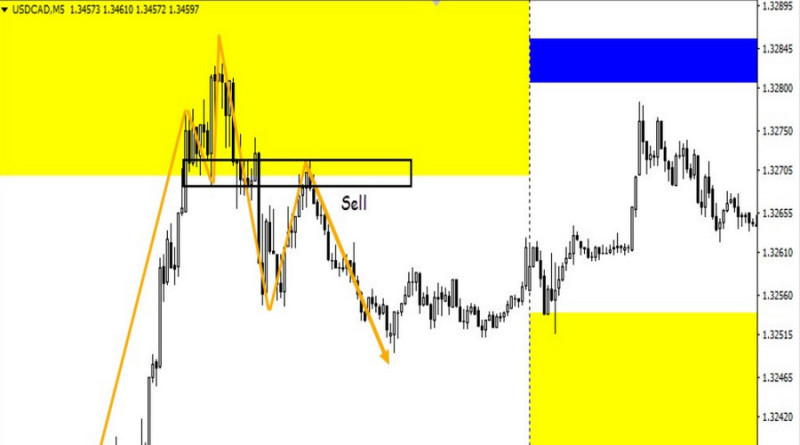

Let's start with the key zones. There are three zones in the indicator's functionality, and each has a different color on the chart.

Blue is the resistance area, fixed based on the previous day’s highs. Red determines the support level. It is plotted using the previous day’s lows.

There is also a yellow color, which indicates the continuation of the trend.

Notably, the Sniper indicator only facilitates the trader's work. A trader still has to follow the Dmitriev patterns during trading and use the zones created by the indicator only as a reference.

In other words, if the indicator shows an arrow or the price breaks the level drawn by it, the trader should not immediately open a position. It is only a hint, a reason for additional checking, and not an action guide.

For example, it is better to keep control of the price relative to the yellow zone when trading. If the price moves above the yellow zone, it is more likely to grow, if the price goes below it, it is likely to go down.

Testing the boundaries of the zone gives an entry point.

In the screenshot below, you can see that the price has formed the letter M - a Price Action reversal pattern. At the point where the retest of the lower boundary of the yellow zone occurred, selling is possible.

The signals of the Sniper indicator are not redrawn. The indicator forms new levels every day. You can use this algorithm absolutely for free.

Feedback on Sniper strategy

As a rule, each trading system has its admirers and critics. Quite often the confrontation between the former and the latter can be traced to popular reviews and forums dedicated to Forex trading.

As for the Sniper strategy, user reviews about this tactic are almost unanimous. Most commentators believe that it does not guarantee profits but almost all of them acknowledge the effectiveness of this system.

Why are there relatively few cardinally opposite opinions about this trading system? The fact is that Dmitriev's method is based on levels and trend trading, and the reliability of these tools is unquestionable.

Here are excerpts from some of the reviews.

- Peter: "At first, I traded Forex with the help of indicators, then I switched to wave analysis, combined different approaches, but my profit was steadily falling. The Sniper system was my last hope, and it justified my efforts and time invested in training";

- Alexander: "When I started, I increased my deposit by 15% per month; now, after a year of trading with Sniper, my monthly profit is about 30%. This is the best result for all five years of my trading on Forex";

- Anna: "I used different strategies before, but with time they all lost their effectiveness. With Sniper it is different. During three years this method has not failed me even once, although it did not bring huge profit";

- Victor: "In one month of trading my $300 turned into $410, which is very good for me as a beginner. I am lucky that my friend has been trading with this strategy for a long time and has taught me to trade using it;

- Pavel: "Almost a year of training and error correction. As a result, my monthly profit is about 25%, the drawdown is not more than 5%. My profit is not very big, but taking into account that I do not spend more than three hours a day on trading, I am satisfied with the result".

While the effectiveness of the strategy is generally evaluated positively, Dmitriev's personality is very ambiguous. Some commentators consider him to be not quite a conscientious trader who appropriated all the well-known tools of technical analysis, others doubt that behind this name there is a real person.

Pros and cons of Sniper strategy

The Sniper strategy involves trading based on price levels, and this trading option is used when trading different assets and in different markets. Based on this, one of the main advantages of Sniper is versatility.

In addition to this, there are other advantages:

1. Relevance, which does not decrease over time. This is not characteristic of all trading systems;

2. Efficiency. More advanced strategies are used for determining the sniper zones. Due to this, the method justifies traders' expectations in financial terms;

3. Relative simplicity. Traders do not need to apply indicators to the chart, keep track of their signals, use advisors, etc. Sniper is an independent strategy, which includes the functionality of several trading tactics.

That said, there are quite frequent mentions of the advisor with the same name on the Internet. But before you start using it, it is worth learning about its essence.

The fact is that it is a very specific Expert Advisor. The most difficult and routine work - the construction of levels, will still have to be done by a trader.

The Expert Advisor will only open trades and trigger protective orders, using the Safe rule. Thus, the Sniper strategy does not assume complete automation;

4. Flexibility. Dmitriev's tactics can be used both as an independent method and as an auxiliary one;

5. Existence of clear and understandable trading rules. A trader does not have to experiment, because the algorithm is already set up and does not need to be corrected;

6. Availability. Sniper does not require large funds to start trading, so the strategy can be used by traders with different financial capabilities.

Disadvantages of the trading Sniper strategy:

1. Difficulty for beginners in the market. Beginners will need experience and time to understand all the terminology of the trading system and learn to apply the methodology in practice.

It is better to master classical trading from support and resistance to start with, and then move to Sniper. You can use a demo account for training. For example, you can do it with InstaForex.

2. Large psychological load on a trader. Even a minor error in the construction of zones can lead to undesirable consequences, so the trader is often nervous and worried;

3. Subjectivity in the determination of some zones;

4. Inadmissibility of experiments: even a small deviation from the rules may lead to undesirable financial consequences;

5. Ambiguity. You can find many Sniper strategies on the Internet, the content of which is different. There are two potential reasons here.

The first is that unscrupulous educational providers sell similar products under this name. The second reason arises from the fact that the description of the zones in the classic version is rather vague, so it is interpreted differently.

What critics say about Sniper

In our review, we already told you that the implementation of the Sniper strategy begins with certain zones. First of all, we are talking about the consolidation zone and the bank level.

It is the BL that becomes the subject of discussion among many professional traders. Thus, Dmitriev believes that the previous day's closing price is the most preferred price for big players or banks.

There is no doubt that this indicator can be used as a potential turning point. That is, if during the day the value of the currency broke through the closing price, it indicates a change in trend.

Even before Dmitriev, professional trader Larry Williams covered this question in his works.

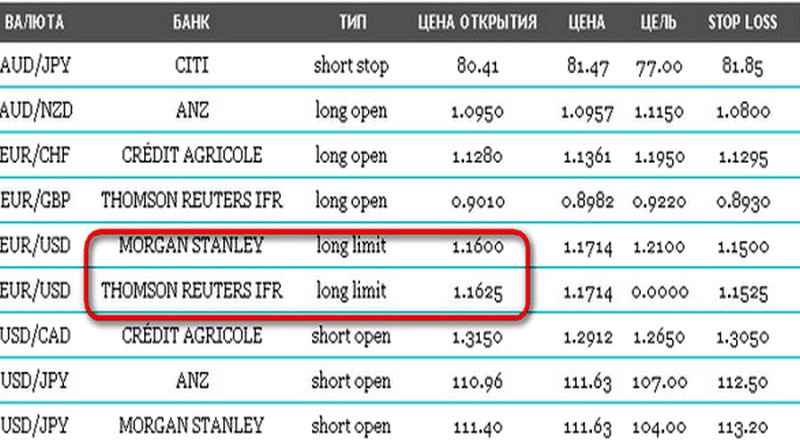

Whether the closing price is desirable for banks is a big question. Some critics support their arguments with lists with orders of the largest banks that are published every day.

Based on these documents, we can conclude that banks are not always tied to the specified indicator.

Here's an example. On August 24, 2018, the closing price for the EUR/USD pair was 1.1620.

According to Dmitriev, this rate is the bank rate and should be used by banks the next day, that is, on August 27 (the 25th and 26th were days off). However, this did not happen.

As can be seen in the screenshot, none of the banks presented used the closing price.

There is no disagreement with the consolidation zone. It always occurs during the Asian sessions.

At this time, the US and European market participants have a rest, and the market shows low trading volumes, liquidity, and volatility. All this does not allow the price to form a trend, and it moves sideways between support and resistance.

The impulses (IL and TIL) raise questions. We will explain why.

Talking about the TIL, Pavel Dmitriev draws attention to the fact that it is a zone, not a line. However, critics believe that it is a line.

They even provide an argument in their favor: the author himself says that the price should touch and bounce from TIL. However, the bounces are possible from the line, not from the zone.

When it comes to the TIL, zones are indeed implied. We have already talked about a flat in the Dow theory, which confirms this fact.

The last thing I would like to mention is the level of a sharp trend change. This is the name coined by Pavel Dmitriev for the pin-bar pattern, which is a rather popular pattern of the Price Action system.

Thus, many of the Sniper tools can hardly be called new. In most cases, they were developed and tested long before Dmitriev created his methods.

Some critics are sure that behind the name of Pavel Dmitriev, there is just an advertising project that brings a lot of money to its creators. Users think the developers just renamed well-known tools of technical analysis and managed to present them as know-how.

At the same time, the critics agree that Safe is unique. Such an approach to risk reduction meets the requirements of money management and reduces the psychological burden on the trader, associated with the fear of financial losses.

How to get Sniper strategy guide

"Sniper" is the first version of the strategy of the same name. To date, the trading system has several updated versions popular among forex traders.

Although the basic principles of the strategy have remained the same, some important points have changed. For example, if you compare the first and third versions of the methodology, the latter is more aggressive.

In the first version, it was recommended to finish trading actions 30 minutes before the important news release, while in the third version, this period has been reduced to several minutes.

The requirements for the closing of trade have also changed. The third version allows increasing the deposit, but the Safe rule has been kept.

There is no BL and other zones have replaced it. This is just a small part of the changes that have occurred in the Sniper tactic for all the time of its existence.

There are at least five such versions. One of the most revolutionary appeared in 2018 and is called Sniper X which we will talk about below.

To use any of the versions of the strategy, you need to take a training course.

This can be done in the following ways:

1. To buy a training course. Such an option is offered by some brokers as well as educational resources related to Forex. The main advantage of this option is that the user can study at any convenient time.

The disadvantages are as follows: the courses are usually paid and their effectiveness can be assessed only after all the lessons are completed. Simply put, you cannot understand how useful classes are in advance;

2. Take part in webinars. Such a form of education is mostly used by brokerage companies;

3. Watch video lessons on YouTube or other platforms. Some successful and experienced traders release such educational content;

4. Find and download information from open sources on the Internet. Traders who want to learn Sniper do not have to visit libraries or search for necessary literature in bookstores.

All the necessary information about this technique can be found on the Internet. Usually, it is free of charge.

We have already mentioned that there are many strategies with the same name but considerably different from Dmitriev's methodology. For example, some variants are supplemented with indicators (Parabolic SAR, Moving Average), while others have other requirements for position openings.

Sniper X updates

The Sniper strategy is constantly being modified. The developers explain the need to modernize the original version by the demands of time, while the critics believe that it is just a marketing move.

It is thanks to updates, in their opinion, Dmitriev's method not only does not lose relevance but also finds new users.

Currently, the most popular version of the system is X. It differs from the original, that is, the classic version, in the following features:

1. It includes not only intraday trading but also medium and long-term trading. This makes the trading system even more universal;

2. The method has an algorithm for defining correction zones of currency values;

3. The four basic levels are replaced by the levels of imbalance: global and local. All trading activity is based on them;

4. There is one more new term "cascade entry point." The updated strategy implies making a series of trades when the trend is strong.

For comparison, the initial version recommended trading on the breakout of the first two zones, formed after the pullbacks at the beginning of the trend;

5. Trading requires less time than with the original version of Sniper;

6. To build a flat zone, three points (extremums) are enough, at the connection of which the letter V or its inverted variant will be formed. The piercing of the upper or lower boundary of the specified corridor can be regarded as a signal to open a position.

Thus, Sniper X is a global and systematic update of Pavel Dmitriev's strategy. At the same time, the original version has not disappeared and is used by many market participants.

Trading recommendations

Pavel Dmitriev's trading system is attractive first of all to scalpers who aim to make small trades of profit during the day. The amount of profit depends not only on the number of signals received when implementing this strategy but also on how correctly the trader reads and uses them.

Tips for implementing the Sniper strategy:

- When a bullish trend is observed on the chart, trades are opened exclusively on a rebound from support or a break of resistance;

- If the trend is bearish, the trader should enter the market when there is a rebound from support or when the opposite support is pierced;

- It is better to open the first trade in the morning, so as not to miss trading opportunities. Most often, the best time to start is two to three hours after the start of the European session;

- The last trade should be closed in the evening. There are no limits on the number of trades during the day;

- Compulsory to use the Safe rule. It is a guarantee that even in case of an unfavorable situation a trader will lose less than half of the deposit;

- New orders should not be formed during periods of important economic news publication. Transactions that have already been opened earlier are recommended to be moved to a breakeven point;

- All levels provided by Sniper should be updated daily, that is, every morning before the start of the session;

- For convenience, each trading day on the chart can be separated from the previous day with vertical lines;

- Traders who are just getting acquainted with the Sniper strategy should not trade a large number of assets simultaneously. It is better to trade no more than two;

- If the width of the consolidation zone exceeds 20 points, likely, the price will not have the potential for a strong trend. In this case, it is better to refrain from entering the market.

One of the rules of money management states that the risk per trade should not exceed 2-3% of the deposit. During the implementation of the Sniper strategy, as we have already mentioned, this figure reaches 10%.

The fact is that this trading system involves boosting the deposit, so its implementation allows such losses. If the results of the trading day turned out to be that the trader has lost 10% of the deposit, it is better to put the trade on pause for at least two days.

During this time, it is necessary to work on mistakes and re-examine the basics of the realized strategy. Such a financial result may be a consequence of the wrong interpretation of the terms or the wrong construction of the key levels.

Conclusions

Thus, the Sniper Forex strategy is effective. It allows you to get an average of about 7 signals per day. The more trades you make, the greater your profits will be.

The effectiveness of Sniper depends not so much on the tools included in the methodology, as on the trader's ability to use them correctly. In this case, the rules of the strategy are not subject to adjustment. A trader should follow strictly according to Pavel Dmitriev.

Indicators are not used in trading, so the strategy belongs to the Price Action one. The key role in trading belongs to the levels, to which the creator has given new names and made the process of their construction more advanced.

At first glance, the Spinner method is much more complicated than other trading tactics. This is because it contains many rules and new terms not always unambiguous interpretations of both the former and the latter.

It is not a good idea to start using this strategy without prior training. First, you need to gain theoretical knowledge and practical trading skills using support and resistance levels. Secondly, you need to master the basics of Sniper.

A demo account is the best way to test Sniper. You can open such an account with InstaForex in just a few clicks.

You may also like:

Support and resistance trading strategy

Back to articles

Back to articles