Under certain market conditions, each new trade may be a losing one. The result of this is obvious: disappointed traders exit the market.

However, there are some methods that enable traders to benefit from losses. One of such methods is the Martingale strategy Forex.

In this article, we explain how this strategy appeared, how it works, and advantages it provides.

You can learn about other trading strategies in our article about Forex strategies.

Some background information

The Martingale history runs back to the 18th centure. At that time, it was used in gambling. The strategy was developed by French mathematician Paul Pierre Levy.

His method implied that gamblers were supposed to raise stakes in losing games until their bets increased. That is, the key point of that method was to get profits following a series of unsuccessful bets.

For example, a roulette player bet $5 but lost. In this case, they don't need to stop the game, but make a new bigger bet of $10.

According to the Martingale strategy Forex, a player should continue increasing bets until one of them wins. Given that bets increase exponentially, the resulting winnings may offset all previous losses and even provide the player with a profit.

If a player decides to continue the game following a winning bet, they should start with a small stake again and increase it in case of a failure.

Why one of the bets should turn up to be winning at some point? The answer to this question lies in the probability theory.

In casino, bets can be placed either on red or on black. So, the probability of winning in both cases is 50%.

That is, according to the probability theory, if a player placed a bet on black but it didn't win, sooner or later the opposite will occur. In other words, if you ignore the financial losses and always bet on black, that sector will eventually come up for sure.

However, this approach is not ideal and has rightfully attracted criticism. Here are the main drawbacks:

1. Some casinos set the maximum and minimum allowable bet sizes. This innovation was introduced after players using the Martingale strategy began winning en masse.

The new casino policy eliminated this possibility. This means that after a series of unsuccessful bets, the player will not be able to increase them at a certain point, thus ending up with nothing.

2. Winning odds aren't always a neat 50/50 split, which means that even recouping your initial deposit might be a long shot. For instance, roulette has more than just red and black outcomes – there's also zero (sometimes double or triple), so the likelihood of success is actually less than 50%.

3. In most cases, players merely manage to recoup their investments, with no profit at all or quite modest profits if any.

4. A player may simply run out of money before they can fully implement the Martingale strategy. After all, there's no telling how long a losing streak might last.

In a Monte Carlo casino, a record was once set when the roulette wheel landed on black 27 times in a row. Such occurrences can happen not only in casinos but also in trading.

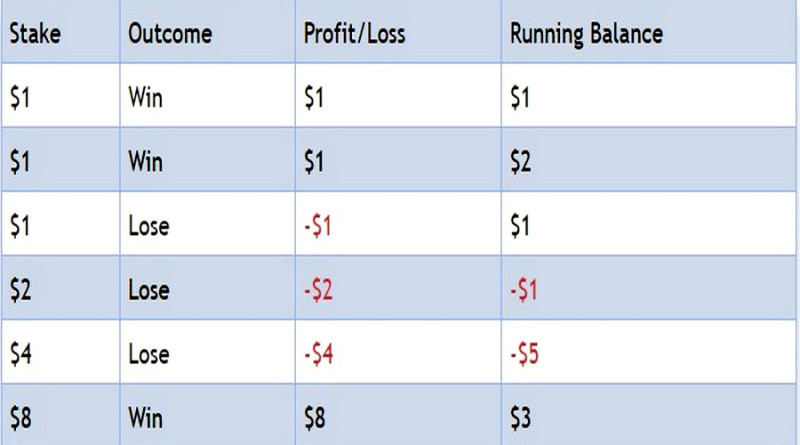

Let's illustrate with a simple example. Suppose a trader invested $1 in their first trade, but it ended in a loss.

In the second trade, they'd have to invest $2, $16 for the fifth, $512 for the tenth, and so on.

Over time, this strategy has been modified and refined. For instance, some players suggested increasing bets by a factor of three instead of two.

Additionally, players could opt not to revert to the initial bet and start subsequent betting series with a more substantial sum. While this alternative might yield higher earnings, losses could be more significant in case of failure.

The use of Martingale in trading

The exact moment when the Martingale method migrated to the realm of financial market trading remains uncertain. However, it has garnered both supporters and detractors in this sphere.

The main argument in favor is that implementing the strategy doesn't require the in-depth analysis of market conditions. However, this is not entirely true, but we will explain it later.

The biggest drawback is the difficulty, or sometimes even impossibility, of adhering to the fundamental rules of risk management.

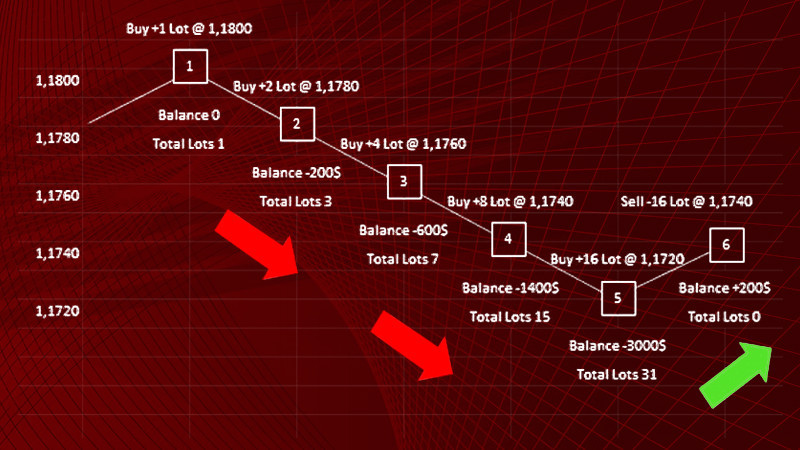

The essence of the method remains unchanged, with the same algorithm from gambling games at its core. A schematic example of the technique's application in trading can be seen in the table.

The main difference from gambling is that in trading, one needs to increase the trade volume in lots rather than in monetary value. In other words, buy and sell orders are used instead of bets.

Additionally, it is the amount of profit or losses that matters in forex trading. In gambling, a bet either wins or loses.

Here is a specific example. Suppose a trader intends to trade the EUR/USD currency pair. Its rate was 1.0869 at the time of writing.

Let's assume the minimum position volume is 0.01 lots, which we will use. In this case, the point value will be $0.1.

The trader believes that the euro will appreciate relative to the US Dollar. Therefore, they count 30 points upward from the current value and set a Take Profit at that level.

The trader plans to earn a profit of $3. To determine a stop loss level, they need to measure 30 points downward from the current price (observing the rule of equal distances to a stop loss and take profit).

However, the price drops, failing to meet the trader's expectations. The trade closes at the stop loss level, and the trader incurs a loss of $3.

According to the Martingale strategy Forex, a new position should be opened following that failure, and if it wins, it would offset the incurred loss.

There are two ways to solve this issue. For instance, one could simply double the trade volume to 0.02 lots. In this case, the point value would also double.

It means that if the asset appreciates, the profit will be greater than with a position of 0.01 lot, allowing the loss to be covered more quickly.

If the trade is profitable, a gain of $6 can be achieved (assuming a 30-point distance to Take Profit remains). Accounting for the previous $3 loss, the net profit would be $3.

Another way is to raise a take profit to 40 pips, for example. However, this option does not always prove to be effecient. Besides, traders can shift a take profit if the price starts moving in the favorable direction.

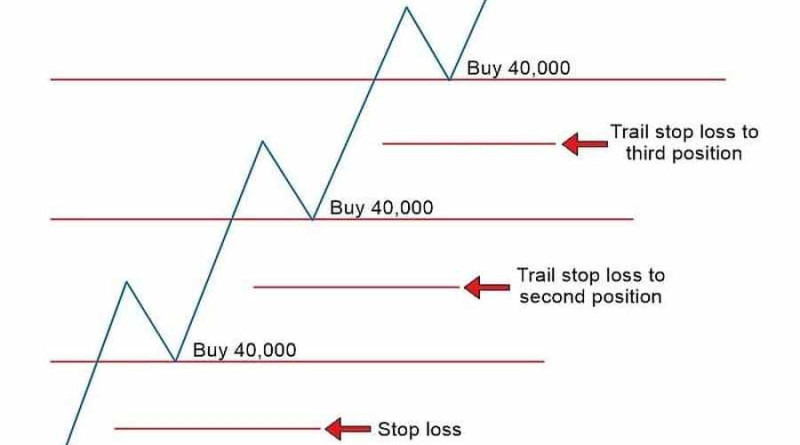

Importantly, every trade, following a losing one, should be placed in the same direction. For example, a trader goes long amid an upward trend, but then price starts correcting gains, resulting in a loss for the trader.

The direction of the next trade should coincide with the trend direction. The basic idea is that the price cannot move in one direction all the time.

It should be noted, however, that a strong sustainable trend is the exceptional conditions when the Martingale strategy does not work.

The guide to implementing the Martingale strategy:

- Choose a trading asset, such as a currency pair. To achieve the best results, the asset should be highly liquid.

- Study the economic calendar to rule out the possibility of macroeconomic statistics being published.

- Determine the price movement direction of the chosen asset.

- Identify the best entry point using indicators, key levels, or chart patterns.

- Determine the trade volume, which depends on the deposit size.

- Open a position based on the current price dynamics.

- Set Stop Loss and Take Profit levels at equal distances from the entry point, for example, 10 points up and down. If the price moves as predicted, you can shift the Take Profit level to increase profits.

- If the trade results in a loss, you need to open another trade of the double volume. If it becomes profitable, you need to re-enter the market with the initial (minimum) volume.

So, implementing the Martingale strategy in the forex market involves finding the optimal balance between Stop Loss, Take Profit, and increasing the position volume. It is not possible to raise the Take Profit all the time, so traders need to increase the trade volume.

Key Takeaways:

- The Martingale method is justified if a trader understands how it works and uses it in combination with technical and fundamental analysis.

- Financial losses are inherent in this strategy. It's essential to understand that there's always the risk of losing.

- Trades typically don't carry over to the next day, making this method more suitable for intraday traders. However, scalpers rarely use it.

- The trade volume doesn't necessarily need to be doubled. In the forex market, multipliers of 1.3 and 1.6 are often used.

Who is the Martingale method suitable for?

Traders have different opinions about this strategy. Some see it solely as a way to drain their deposit, while others view it as a quick means to increase it.

Often, traders draw these conclusions after testing the Martingale method in practice. This approach has helped some traders make money, while others have lost money due to it.

The strategy is reasonable in the following cases:

- If a user trades not so much for profit but for enjoyment. Yielding to the thrill, some traders don't mind incurring losses and aim to recover, finding satisfaction in the process.

- When a trader has enough experience to find a balance between potential risk and profit. Expert advisors are often used to implement this method.

- If a trader's primary goal is to boost their deposit quickly. The method allows increasing the account balance faster than using conservative approaches.

It can be concluded that the Martingale method is not suitable for beginners in the market. Without the necessary skills to implement risk management principles, they won't be able to profit from the Martingale method.

Also, the Martingale method is not suitable for long-term traders who panic after any loss. As practice shows, there are more losing trades in Martingale than profitable ones, and one should be prepared for this.

There is no way to make this methodology entirely safe. When opening another position, the user must understand that its outcome is always unpredictable.

How to reduce risks when employing the Martingale method

The effectiveness and riskiness of any trading tactic depend not only on its content but also on the trader implementing it. Although the Martingale strategy involves following a clear algorithm, there are nuances that can negatively affect the outcome of trading activities.

Here are some recommendations to avoid these pitfalls:

1. Refrain from using the Martingale strategy Forex during the release of significant economic news. In such situations, a strong and prolonged trend may form. Consequently, a series of losing trades could be too long, and there may not be enough funds in the account to reach a profitable transaction.

2. As a safeguard, it's advisable to use additional tools such as fundamental factors, key price levels, chart patterns, and so on. In other words, the Martingale approach should be considered as part of a complex trading strategy, rather than the sole trading tool.

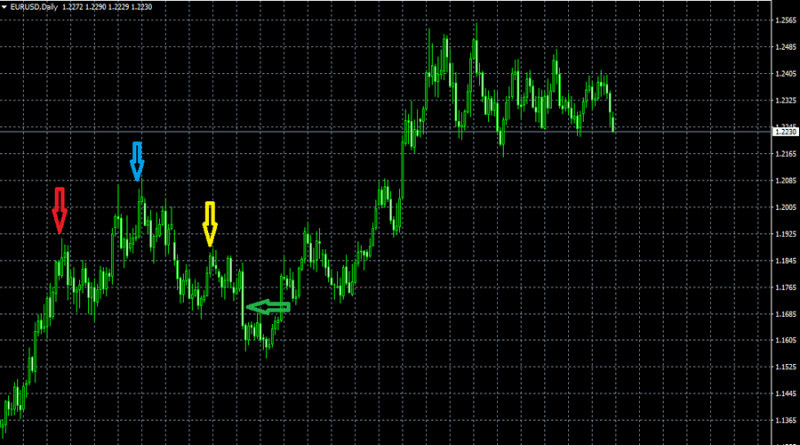

The screenshot demonstrates the Head and Shoulders pattern, which is often used in conjunction with the Martingale method. Its inverted variant is also quite popular among traders.

3. It's better to choose currency pairs with high volatility and liquidity for trading (for example, GBP/USD). Besides, the Martingale strategy is rather effective when trading cryptocurrencies.

In the USD/JPY chart, you can see that the pair's value occasionally moves in one direction for an extended period, which is not ideal for implementing the strategy.

4. The first trade should have the smallest possible volume, such as the point price multiplied by two. It increases the chances of having enough funds in the account to execute the strategy.

5. It is recommended to risk no more than 1-2% of the deposit amount in one trade. This is the main rule of risk management, but it's often overlooked in the Martingale strategy.

6. Avoid opening positions without setting a Stop Loss beforehand, as losses can be huge. A Take Profit is also recommended, but it can be adjusted during trading to increase profits.

7. Don't use timeframes shorter than M30. On very short periods, price trends can be unpredictable.

8. Keep your emotions in check in all situations. Don't attempt to make up for losses when doubting about a pronounced trend or reversal.

In such cases, it's better to accept the loss of a small sum rather than double the bets, thus risking losing even more.

9. Before you start using the Martingale strategy on a real account, it would be wise to test the strategy on a demo account. This allows traders to understand how many losing trades a single series may contain and how much money they need to invest to achieve profits.

Registering a demo account with InstaForex takes just a few minutes.

Pros and Cons of the Martingale Strategy Forex

No trading method guarantees perfect results. Each approach has upsides and downsides, and the key is to evaluate and consider them in your trading activities.

Advantages of the Martingale strategy are:

- There's no need for an in-depth market analysis. The method can be profitable even without extra trading tools.

- The trader's actions are straightforward. Just determine the trade volume, open a trade, and wait. If it results in a loss, double the volume; if profitable, return to the initial volume or pause trading.

- Profit will eventually come, as long as the deposit can handle a series of losses. If not, the position may be stopped out.

However, the strategy has more drawbacks. It's important to note that trading in the currency market and gambling are not the same.

In roulette, there is either black or red. In Forex, an asset's price can't move in the same direction forever. A pullback or reversal will happen eventually, opening up profit opportunities.

So, it's wrong to assume that the Martingale strategy is always a losing one.

Disadvantages of the strategy:

- Traders need a large amount of money in their account. Even though the first order is minimal, losses require increasing the number of lots.

- Traders should calculate position volumes and the needed deposit size for a series of trades. Even a large sum of money can run out if there are too many consecutive losses.

- The strategy puts significant psychological pressure on the trader. Opening the first few positions is easy and confident, but when losses eat up 50% of the deposit, anxiety and fear increase, causing some traders to leave the market to avoid further losses.

- Predicting how many positions will be profitable or losing is difficult, in some cases it is even impossible. Traders should either accept these risks or abandon this trading strategy.

- If pullbacks or reversals don't happen for a long time, the trader's losses grow rapidly. A long and strong trend is dangerous for implementing the strategy.

- With a long series of losing trades, following risk management rules becomes almost impossible.

Similar strategies

The method describe here has several variations. They are based on the same principle: each subsequent bet is increased.

However, the conditions of increasing bets vary. In some cases, the volume is not doubled.

Specifically, there is the anti-Martingale strategy that implies that not losing, but profitable trades should be increased.

In case of a winning deal, a trader should place a new one in the same direction but of a larger volume. As a rule, the increase is two-fold, but in forex trading a 1.5-fold increase is more common.

If the larger position does not meet the trader's expectations, they should place another trade of the initial volume.

This strategy is often called pyramiding because its working principle visually resembles a pyramid.

The biggest challenge in implementing the anti-Martingale system is determining the point at which a series of successful trades should be ended. For example, it should be done before the correction starts.

If a trader ends the series of winning trades too late, they risk losing all profits. If a new large order becomes unprofitable, it will nullify the income gained from previous trades.

To avoid such a scenario, it is recommended to use signals of technical analysis indicators. It is not advisable to increase the volume for too long.

In the currency market, a series is usually limited to four trades.

Another option is going against the trend. In this case, a doubled trade is made in the opposite direction following a losing trade.

For example, if a buy order resulted in a loss, you should open a short position, and vice versa.

As with the classic Martingale system, it's best not to use these strategies during the release of macroeconomic data. So, it's a good idea to constantly monitor the economic calendar.

Using trading advisors

Some trading robots used in currency trading operate on the Martingale principle. At the time of writing, there were several dozen such advisors, one of the most famous being Ilan, which is easily installed in MetaTrader and has several versions.

Since Ilan is based on a series of positions with a predetermined increment and a proportionally increasing volume, it belongs to the grid category.

How trading advisors work:

- Trade volume is increased gradually. For example, a coefficient of 1.1 is applied first, then 1.2, and so on (these coefficients are set by the user).

- Robots act based on technical indicator data, making them quite effective. For example, RSI and Ozymandias algorithms are used to find optimal entry points.

- Profits are fixed and withdrawn at predetermined intervals.

Despite robots handling the trading process, trader involvement is still necessary. There are situations where it's better to close a position manually rather than watch the dynamics until a stop loss is triggered or the trade gets stopped out.

You can test an advisor's performance on a demo or cent account. This will allow you to assess its effectiveness with zero or minimal risks.

Advisors work correctly only when the connection is stable. To avoid negative consequences during disruptions, it is recommended to use a VPS server while trading.

In addition to Ilan, other advisors operate on the Martingale principle, such as Autoprofit, Forex SetkaTrader, and more.

Conclusion

The Martingale strategy Forex has been and remains one of the most debated topics. Some traders believe that making a profit with this method is highly questionable. Even if there is any profit, it is much likely to be small.

On the other hand, Martingale supporters believe this approach is excellent for quickly increasing a deposit. Additionally, you don't need to be an analyst to use the Martingale strategy. Understanding its algorithm and choosing the right initial bet volume is enough.

Both sides have one thing in common: they agree that this method isn't suitable for market beginners. It requires testing on a demo account first.

You may also like:

Support and resistance trading strategy

Back to articles

Back to articles