Despite a rich variety of brands and types of cars, BMW is considered a manufacturer of luxury vehicles. The brand is recognized worldwide as a successful and promising company. However, it does not mean that you cannot become part of such a successful corporation. All you need is to invest in its shares. We will tell you how to do it right and as gainfully as possible in this article.

About BMW AG

BMW AG (Bayerische Motoren Werke AG) is a German manufacturer of vehicles, motorcycles, and bicycles. It is mainly focused on the production of luxury cars. The company has many research centers and factories across the world. BMW AG headquarters are in Munich, Bavaria, Germany.

The company was founded in 1916 and was registered as a legal entity in July 1917. A hundred years ago, it specialized in the production of aircraft engines. With time, the company shifted to the production of vehicles. Today, the automaker is the owner of 3 large brands - BMW, Rolls-Royce, Mini. It is the world’s best-selling luxury car brand.

BMW shares

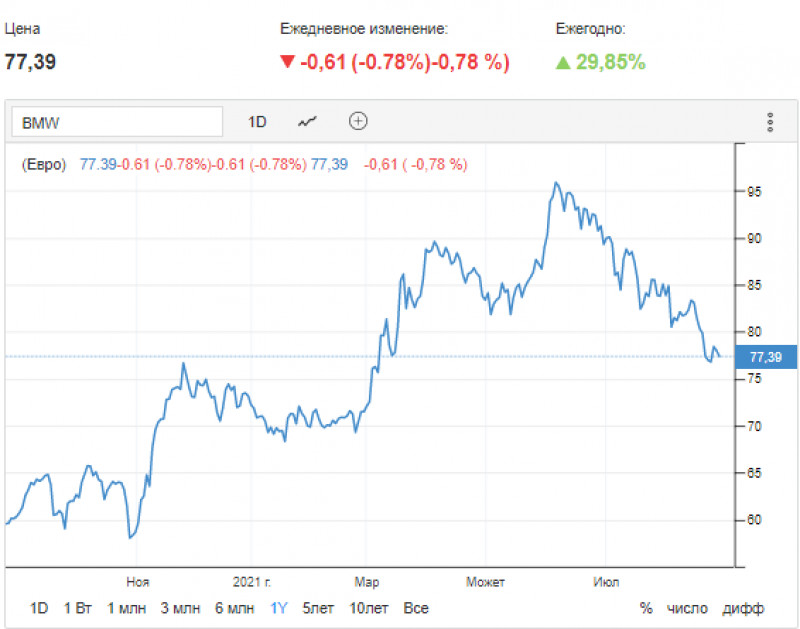

BMW AG shares are traded under the ticker #BMWG on the Frankfurt, Hamburg, Berlin, Swiss, Munich, London, and many other stock exchanges.

The German automaker has a large number of shareholders. At the same time, a significant amount of shares are owned by several individuals and institutional investors.

BMW shares are a constituent of many stock indices, including the Euro Stoxx 50, DAX, STOXX Europe Large 200 EUR Price, MSCI Pan Euro, and others.

This makes BMW shares attractive to funds that invest in European assets.

Today, BMW AG’s market capitalization is €302,214,053,888.

The company pays dividends to its shareholders annually in May. The automaker's yearly dividends reach 3-6%. Each payment to shareholders sparks interest among investors from all over the world. At the same time, each new announcement about the imminent payment of dividends boosts the price of BMW shares and makes them an attractive investment instrument.

In addition to BMW shares, investors can buy/sell American depositary receipts (ADRs). They are a kind of derivative assets based on the company's traditional securities. On the stock exchange, ADRs are traded under the ticker #BMWYY. When trading this instrument, traders should remember that 3 BMW ADRs are equal to 1 traditional share of the manufacturer.

Investing in BMW shares

Anyone can invest in BMW shares. All you need is to register an account with an intermediary company (broker). The price of one share is €77.39.

You can track changes in the share price of BMW AG in the DAX index online on the InstaForex website.

Subsidiaries

BMW subsidiaries make a significant contribution to the manufacturer’s overall profit. Thus, the strong financial performance of the subsidiaries often boosts the value of the automaker's shares in the stock markets.

In addition, they help the company establish business processes in different countries. BMW AG has assembly plants in Germany, China, Thailand, the United States, South Africa, Russia, etc. Here is the list of the automaker’s 5 subsidiaries.

- Rolls-Royce Motor Cars Ltd., a British subsidiary of BMW, dominates the market of luxury car brands, according to analysts.

- BMW M GmbH, is a German subsidiary of BMW AG that manufactures high-performance cars.

- Mini, a British brand owned by BMW, manufactures small cars popular in megacities.

- BMW i, a German sub-brand of BMW, designs and manufactures plug-in electric vehicles.

- BMW Brilliance Automotive is a joint venture between BMW and a large Chinese automaker. BMW Brilliance Automotive is mainly focused on the Asian market.

Summary

Bayerische Motoren Werke AG is a popular and profitable brand. The company maintains a strong presence in the market of premium car brands. BMW AG is constantly developing and expanding the areas of its activity. It is now focused on the production of electric and plug-in hybrid electric cars. Despite the coronavirus crisis, the automaker continues to establish new subsidiaries worldwide.

BMW AG shares remain an attractive asset for investment and trading in the stock markets. The company pays around 4% in dividends to shareholders (3.4% in 2020). Notably, the global market environment has little impact on BMW shares.

Back to articles

Back to articles