Forex trading is a process that can run round the clock five days a week. For a human, it may be a rather challenging task to keep a clear mind for that long. Fatigue and emotional strain may cause failures and mistakes.

To solve this problem, traders use special software: expert advisors. They are unbiased, unemotional, and cannot be pressured upon.

Experts advisors are perfect tools for simplifying the trading process. They perform all these monotonous, time-consuming, and small tasks that matter so much in overall success.

A real-life example can demonstrate the role of expert advisors in trading. Suppose you need to get to the 25th floor of a building, and you have two options: either to go by stairs or to use a lift. In the first case, the ascend will take a lot of your time and strength. Probably, you will have to take rest at some point of your journey. And there is no guarantee that you will reach your destination at all.

By using a lift, you will get to the necesasy floor in a few minutes. At the same time, you will remain full of strength. Expert advisors perform a function similar to a lift. They are used to perform hard and time-consuming tasks that are not of a major importance, though.

Forex Eas Trading Advisors: What are they and how do they work?

Trading advisors, as they are commonly known, are specialized software programs written in the language of a platform used for trading. These programs operate based on a predefined algorithm and are designed to carry out specific tasks.

Forex trading advisors are classified in a range from simple to complex. Small-scale programs are designed to carry out standard tasks, such as opening/closing orders based on generated signals, managing pending orders, calculating trade position volumes, and other tasks.

More advanced versions of these advisors offer functionality approaching that of neural networks and artificial intelligence. In other words, their operations are broader and deeper. This is referred to as algorithmic trading in professional language.

Such automated advisors are capable of carrying out advanced operations based on imput data. In addition, they can self-learn from the preset parameters and the results of their own operations.

| Forex expert advisors are automated programs that monitor the market and, upon detecting specific trading opportunities, either send a corresponding signal to the trader or take action independently. |

According to experienced forex traders, these assistants do not always oprate accurately. There have been cases when the signals they generate were utterly unpredictable. For this reason, one must be very cautious when using them.

Despite this, they can serve as excellent support for trading at times when a trader is unable to manage it completely independently.

The operation of any advisor is based on an algorithm that requires adherence to a set of rules. These rules may vary for each individual case.

The key function of expert advisors is to reduce the emotional component of trading, ideally eliminating it altogether. In addition, they perform well when it comes to making decisions appropriate to specific conditions. That is, they rely not on emotions, but on precise statistical data.

There is a vast array of advisors available today. Some of them are already integrated into a trading platform, and it's enough to activate them. Others can be found on the internet and installed manually. Doing this does not require too much effort or any specialized knowledge.

All trading advisors fall into several categories depending on the market trading strategy:

1. News trading advisors.

Their algorithm is based on the selection and analysis of major news events capable of driving significant price dynamics. Most often, this happens during periods when key macroeconomic statistics from global markets are released.

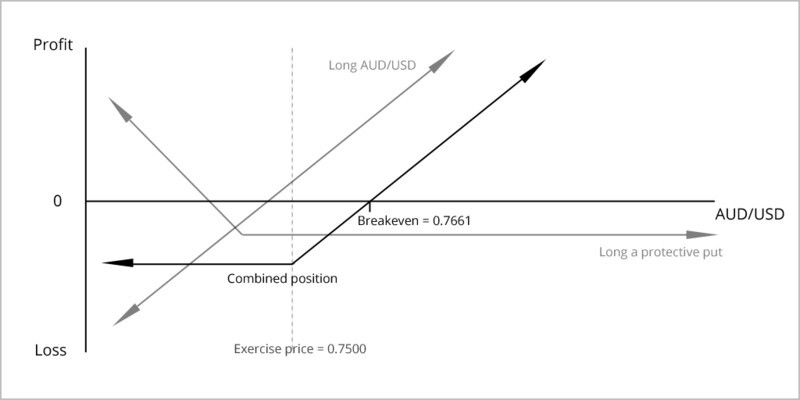

2. Hedging advisors.

Their algorithm is designed to work with several trading positions simultaneously, often two. An essential condition here is that the orders are in opposite directions. These advisors aim to minimize losses in one direction and maximize profits in the other.

3. Scalping advisors

Their primary task is to provide traders with small profits. In other words, they are geared towards endlessly opening and closing trades, but there is no goal of maximizing revenue. It is the total number, not the quality of orders that matters. Sometimes, their number can reach 500 per day.

4. Breakout advisors

These advisors close orders as soon as a pre-determined support or resistance level set by the trader is breached.

Regardless of the function performed by advisors, they can be combined and applied to different trading strategies. Moreover, they often complement each other and refine signals. As a result, a trader can have a more complete and accurate picture.

Advisors that not only signal but fully control the trading account hold special significance. Their main task is to monitor the current balance of the investor's account to reduce the risk of significant losses. They decide what portion of the budget can be used and what part should be kept as insurance. Most often, such programs risk no more than 2% of the account.

The specifics of using several advisors simultaneously:

- Most trading terminals permit the concurrent use of several advisors. However, one must remember that some advisors may not be compatible with each other. Moreover, they can give conflicting signals, which can negatively impact a trader's performance.

- Another important point regarding the simultaneous use of advisors is that they may attempt to interfere with each other's open trades. This technical peculiarity is something that experienced programmers are constantly working to resolve, but a full solution has not yet been achieved.

- There are also restrictions from a trading platform itself. It's not always possible to connect multiple advisors, as an error may occur if they simultaneously request a connection to the server. This error is called "Trading flow is busy" and usually arises due to an excessive number of indicators.

Expert advisors significantly simplify a trader's work, adding structure, clarity, and logic. This becomes apparent when comparing two trading methods: manual trading versus automated trading.

Manual trading vs Automated trading

| Manual trading | Automated trading |

| When a certain market tendency is defined, a trader adds necessary tools to a chart manually in order to receive signals. | When a certain market tendency is defined, an expert advisor gets activated to track signals automatically. |

| Traders need to monitor charts and define entry and exit points on their own. | Charts are monitored by expert advisors. At the right moment, it sends a signal, releasing traders from the need to constantly monitor charts. |

| If a trader has several charts at the same time, they need to stick to the risk management, as well as recalculate it if the transaction turns out to be unprofitable. | An expert advisor is capable of monitoring several charts simultaneously, and adjust the risk management when necessary. |

| Trading can be an extra job, so one need to combine it with the main job. In some cases, investors just cannot react timely to market changes. | A trader can occasionally check the platform and the operation of an expert advisor without interrupting the main job. |

| A trader needs a plan in case a good entry or exit point is missed, and for those cases when there is no Internet. | The settings allow traders to switch an adviser to fully automatic mode, which will allow it to work even when the device is turned off. |

So, expert advisors for the Forex market in some moments are indispensable assistants that you can rely on. However, for full-fledged and confident trading on live accounts, preliminary testing on a demo version is required. This will make the probability of errors and incorrect work much lower. In addition, it will allow traders to get used to the advisor and its signals.

The best means multifunctional: main types of trading advisors

All Forex market advisors can be classified into several categories. None of them individually can encompass all the necessary functions. Still, some traders believe that the best expert advisors do exist. Before discussing these, it's essential to understand the different types available.

Based on their functional features, advisors are divided into:

- Fully automatic advisors. They can perform all tasks on behalf of a trader, as long as they are accurately set up.

- Semi-automatic advisors. Their job is to generate tips. They won't take any action by themselves, but rather indicate what actions should be taken at any given moment.

- Script advisors. This is a somewhat limited assistant. It's not suitable for market monitoring. Its function is to perform specific actions at the right time, after which it deactivates itself.

Depending on the trading method, advisors fall into the following categories:

1. Trend advisors.

They are only effecient fo as long as there is any definite trend in the market, i.e. when the market is falling or rising.

2. Multicurrency advisors.

These are designed to be used when trading a wide range of different currencies and pairs.

3. Scalping advisors

Their primary feature is high productivity. In other words, they open and close a large number of orders in a short time for the purpose of making a profit.

4. Complex or combined advisors.

They can be adapted for any trading strategies, acting as universal assistants.

5. Neural Network advisors

These have a complex internal action algorithm. They can learn on their own. Customizing these indicators takes longer due to their intricate structure.

6. Grid advisors

These advisors are designed to place a grid of pending orders. When these orders get activates, a trader either gets profits rapidly or accumulates losses.

7. Indicator-based advisors

These allow you to determine the entry/exit point for a trade quite accurately based on the analysis of one or more indicators simultaneously.

8. Non-indicator advisors

Their algorithm incorporates a specific theory of technical analysis. For example, wave theory or volume analysis theory. They successfully analyze charts and candlestick patterns.

9. Signal (Informational) advisors.

Their primary task is to analyze the market and provide recommendations to a trader. The final decision rests with the trader, not the program.

10. Auxiliary advisors.

They help traders set take profit and stop loss orders correctly. They can suggest the timing of candlestick formation and similar aspects.

Depending on the trading methods used, advisors can be divided into the following categories:

- Technical analysis trading. These advisors assist in charting, attaching necessary tools, setting levels, and preparing for market movement tracking.

- Fundamental analysis trading. These advisors are designed to gather essential statistical information needed for analyzing price changes. The obtained information is presented as instructions that traders can follow, although they are optional and advisory in nature.

- Wave analysis trading. These advisors calculate wave lengths, label charts, and set up tools that provide signals for price movements in different directions. The settings allow for the incorporation of an algorithm demonstrating the end of one wave and the beginning of another in the market.

- Graphic analysis and candlestick pattern trading. This program recognizes and signals various price formations that serve as the foundation for making final decisions regarding trading strategies. The settings enable the identification of specific areas based on predetermined mathematical parameters.

- Martingale method trading. This advisor is useful for calculating entry points and managing risk. It also allows for automatic order cancellation when the loss amount exceeds a predetermined value.

- Trading with the use of other forecasting methods. Trading advisors can be widely applied in various strategies, such as volume trading, arbitrage strategies, and similar approaches. They provide either reference information for traders to consider or form the basis for a comprehensive trading strategy.

Forex advisors are available in various forms on the internet, and they differ in quality from one another. For convenience, they are usually categorized and made available for download.

Almost every trading instrument can be considered a suitable advisor for Forex eas trading. However, it is important to remember one crucial rule: it should perfectly suit the specific trading situation. Otherwise, the results may disappoint the trader.

Therefore, each market participant has the right to choose the best assistant for their work based on their chosen trading strategy and personal preferences.

Profit is what really matters: technical tools help in getting it

Efficiency of a technical tool is the most important criterion. At the same time, profit is the measure of efficiency.

So, the key quesiton that traders should ask themselves is what profitable Forex advisors there are. Though it is almost impossible to define the best programs for automated trading, we can at least provide a list of the most popular ones.

Profitable advisors for MT4 and MT5 platforms:

- Itic Software

It works based on data analysis, which is used to generate signals for action, such as buying or selling. It is a versatile assistant that can be used with different trading strategies. It contains unique algorithms and is constantly tested by professionals. It has a high level of trust.

- Armor

There are two versions available. The first version actively works when the trend changes to the opposite direction, based on averaging values. The second version combines hedging, grid, and martingale strategies. Both versions double the order volume when it is in a loss.

- Combo

This advisor has earned a high level of trust among traders. It is based on an extraordinary algorithm that includes four different strategies. These strategies can work together or separately. Over its long history, many versions of Combo have been released.

- Forex Gump

This advisor combines trend filters, price action, and news filtering. It has three different risk settings: high, medium, and low. This makes it more reliable and potentially profitable.

- Miner EA V3.0

This advisor can be combined with trend-following strategies. Its results are based on the analysis of a wide range of indicators. It has performed well on most currency pairs.

Important note! Regardless of how well an advisor is suited for trading, it cannot guarantee profitability. While it is possible to increase gains through their use, it is also possible to experience significant losses.

How to find a trading assistant: several available options

Trading advisors for the Forex market can be obtained from various sources. There are several options for getting specialized software.

The most effective method in terms of improving trading quality is self-development. Only in this case can a trader be fully confident in the performance and functional features of the advisor.

Almost every experienced user knows how to create an advisor for MT4 . It is not necessary to be a programmer for that.

Based on accessibility, expert advisors can be divided into the following categories:

1. Free advisors

They can be built into trading terminals or available for download on the internet.

2. Paid advisors

There is a wide variety of paid advisors available on the internet. Some of them can be quite expensive. Often, these are well-performing assistants that can significantly increase a trader's profits.

3. Self-created advisors in the trading platform's language

Writing an expert advisor requires minimal programming skills are required, that can be easily learned through practice during the advisor's development. At the same time, writing, testing, and optimizing an advisor require a considerable amount of time. The final result is unpredictable, but it allows for creating an indicator according to specific requirements.

4. Custom-made advisors by a programmer

In this case, individual requests and approaches determine the cost of the program.

There are two ways to install a trading assistant. Firstly, investors can use a pre-built program included in the trading platform, which only requires activation in the corresponding menu section.

Secondly, they can apply a third-party program downloaded from the internet or created by a programmer or themselves. Activating such a program requires a little more effort.

Important note! After downloading, always make sure that the script has the .ex4 or .mq4 extension. This indicates that it is an advisor.

Step-by-step guide on setting up an expert advisor on MetaTrader:

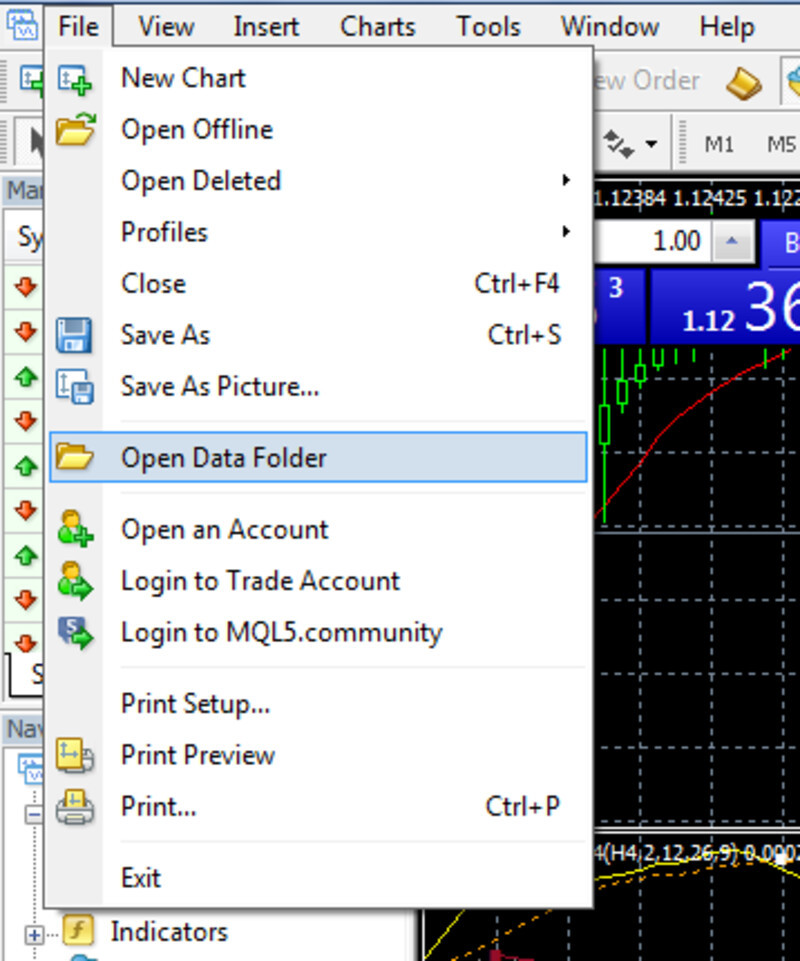

- Download the zipped file onto the device where your trading terminal is installed. Unzip the file once downloaded.

- Launch the platform and click 'File' in the menu.

- Navigate to the 'Open Data Folder' tab. Choose the MQL section. Within it, you'll need to locate the 'Indicators' folder.

4. Copy the previously downloaded file (in .ex4 or .mq4 format) into this folder.

5. Close all tabs and restart the trading platform.

6. Once you've logged back in, look for the 'Service' option in the menu. Click on it and proceed to 'Settings'.

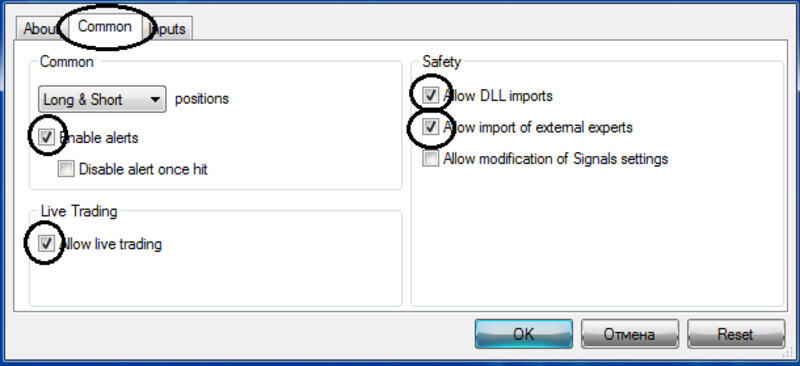

7. After accessing the settings menu, open the 'Advisors' tab. Dive into it and carry out a few simple steps:

- Tick "Allow live trading"

- Tick "Allow DLL imports".

8. Click 'OK' and then restart the platform once again.

9. Log back in and open the currency chart you're interested in. This is where you'll need to install the downloaded program.

10. In the top menu, select the 'Insert' section. Go to the 'Indicator' tab and click on 'Custom'.

11. A list of all previously installed tools will appear. Find the one you need and click on it.

12. A window will pop up, and it needs to be filled out. It displays the main parameters for setting up the advisor. These are essential for effective and convenient operation. For instance, you can customize visibility level, colors, and more.

13. After making changes and clicking 'OK', the added advisor will instantly appear on the chart.

If you need to edit a program that has already been installed, navigate through the following path: Menu → Navigator window → Advisors → Modify.

To avoid many potential errors in the actions of the installed advisor, it's recommended to carefully pre-configure it. Also, it's advisable to test its operation over a substantial period of time. At the same time, it is quite important to select a timeframe properly.

The key assistant in routine work

The primary purpose of Forex eas advisors was initially to relieve traders from monotonous mechanical tasks. These tasks tend to overwhelm the trader, leading to distraction and fatigue.

Hence, constant tracking of indicators, observation and analysis, signal detection, as well as closing/opening trades, setting take-profits and stop-losses - all these operations can be delegated to specialized software. Since then, the creation expert advisors based on indicators has become the most popular activity not just for programmers, but also for experienced traders.

Technological progress has led to the enhancement of these tools' capabilities. Yet, their original function remains the same, and it is indeed the fundamental purpose of any indicator-based trading advisors.

The central task of such assistants is to analyze the market situation based on predefined parameters. This allows them to generate a signal, which is then relayed to a trader.

Characteristics of indicator advisors:

- They are less profitable compared to martingale and grid-based advisors, but at the same time, they are less risky.

- The underlying algorithm is based on technical analysis, which is superior to simple mathematical calculations.

- They have a high degree of reliability, especially in the long term.

The advisors based on indicators solely are practically no longer used today. They are gradually being replaced by combined programs that perform several functions.

You can create an indicator assistant yourself. This task is relatively straightforward and doesn't require any particularly specialized skills or knowledge.

The internet is abundant with programming templates that can be used to build your own advisor based on an indicator.

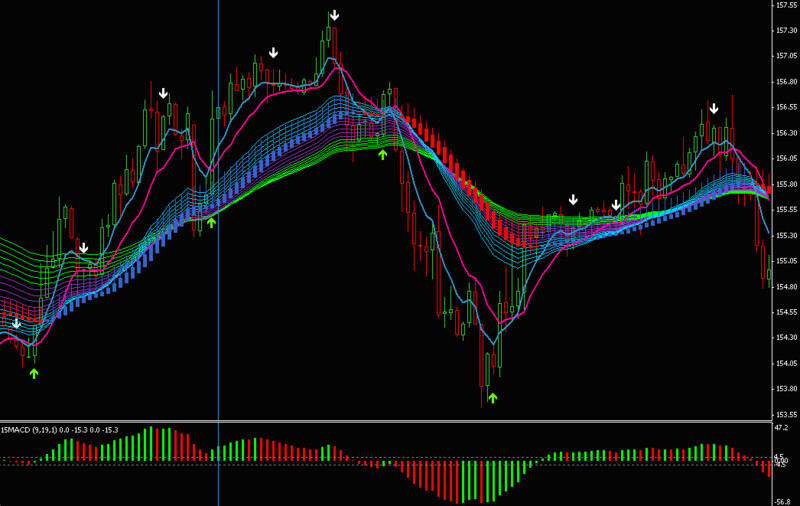

Follow the arrows: a user-friendly and efficient tool

Many traders agree that arrow indicators hold the top spot when it comes to basic trading aids. Their popularity stems from their simplistic yet effective algorithm. Using arrow indicator advisors is one of the simplest and most straightforward ways to gain trading insights.

The core function of this program is to provide clear signals at the right time for buying or selling. These signals are visually represented as arrows on a chart.

An upward arrow indicates a buy signal, while a downward one signals a sell. This feature makes the tool intuitive and easy to use, which is crucial for efficient trading.

In the traditional version of this tool, arrows are color-coded: red and green, representing short and long positions respectively. However, these can be customized in the settings to suit individual preferences, making the tool easier to comprehend.

Some advisors of this type are equipped with alerts that can be adjusted as well.

Key features of arrow indicators:

- They are user-friendly for trading on Forex.

- They offer clear, visual trading recommendations.

- They provide rapid responses.

- They carry out in-depth analysis of signals on behalf of a trader.

There are two types of arrow advisors:

• Simple: These generate signals based on a simple algorithm.

• Composite: These include multiple simple indicators. Their interaction works as follows: one generates a signal, which is then filtered through others, resulting in a more detailed recommendation.

Important! All arrow indicators may look similar, but the way they receive and process signals can vary significantly. This depends on the underlying methodology used.

The MetaTrader4 platform allows you to combine multiple arrow tools. This has a positive impact on trading quality.

In addition to the Forex market, arrow indicators are often used in other trading sectors.

The Best Advisors for Scalping

A vast array of technical indicators for the Forex market exists today, ranging from simple to more complex software versions.

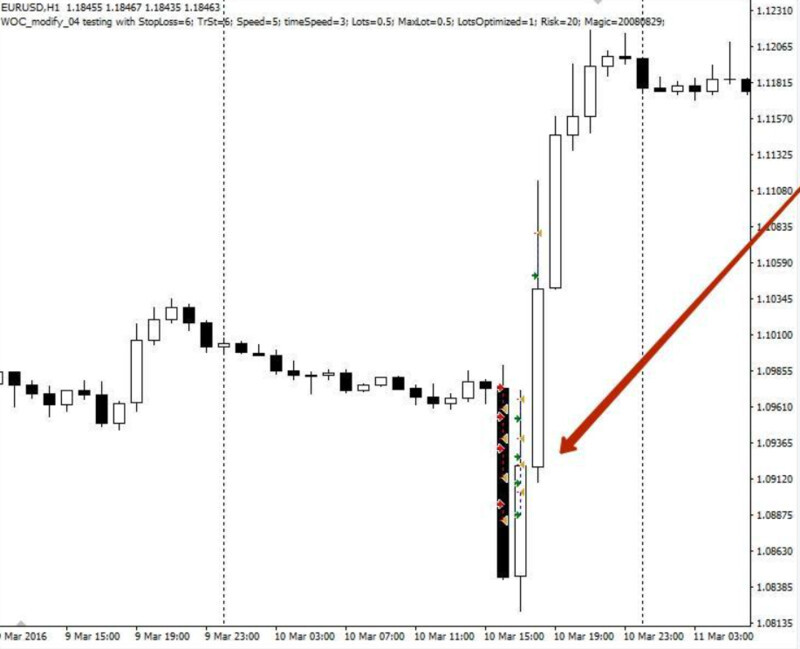

However, some have gained particular favor among traders. One such tool is the WOC advisor. This tool is a trading robot designed around the scalping strategy.

The primary function of this software is to accurately identify entry and exit points for trades. It has demonstrated impressive results in markets with high volatility levels, earning it a reputation among traders as one of the most reliable tools.

Its profitability rate is moderate, ranging from 30 to 50%, and it has a low drawdown, not exceeding 1.5%.

The main trading principle of this tool is based on continuous analysis of candlestick charts, specifically, bullish and bearish trends. Following this analysis, it generates a signal to open a short-term trade in the direction of the trend.

The advisor makes five trades per day at the most, trading independently without interference of a trader. Its daily profits are not big, though in a large time span, such as several months, its performance is more impressive.

The WOC trading algorithm cannot open multiple orders simultaneously. Instead, trades are executed one after the other. This could be a drawback as it may not compensate for potential losses.

The advisor has gained huge popularity, so that a plenty of copies can be found online, which may vary significantly in quality compared to the original version. There are both free and relatively expensive versions of the software available.

The results in test mode were extremely promising. Out of 22 open orders, 20 closed with subsequent profits. However, this does not guarantee that the same performance will be replicated on a live account.

The tool requires meticulous and precise configuration. Its effectiveness will directly depend on how well it is set up.

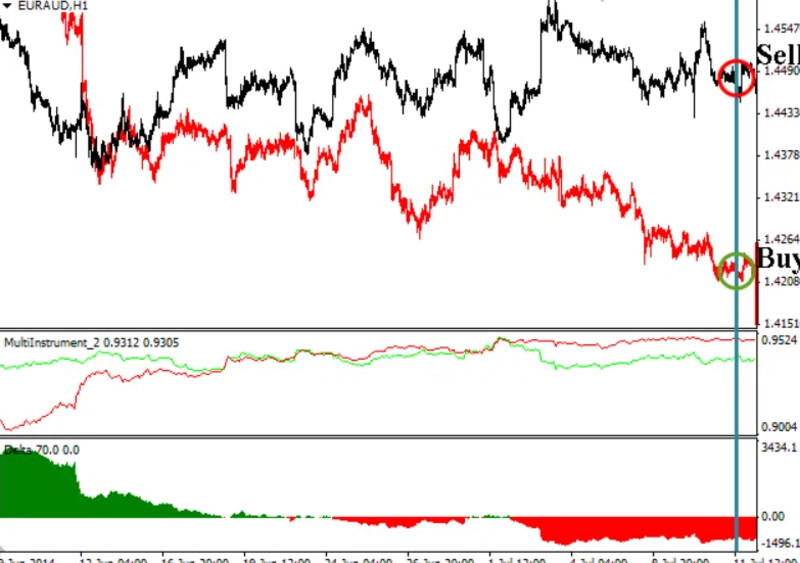

Pairs trading: an advisor will guide you on what to do

Currently, the majority of strategies commonly used by traders in the Forex market are automated. This means that the main part of the work is delegated to specialized programs.

There is a technical assistant for practically every trading area. The Pair Trading Advisor often operates based on this principle. Furthermore, this strategy is considered one of the most profitable, which is why the number of programs for it is constantly increasing.

The pairs trading is based on the correlations that arise between certain currencies in the market. The interdependence can be either unidirectional or multidirectional.

For example, the New Zealand dollar and its Australian counterpart move synchronously, meaning they are affected equally by market changes. At the same time, the Canadian dollar usually moves in the opposite direction to oil.

Pairs trading is built on this principle. Correlations can be strong or weak, and sometimes they are easily detectable, while other times they are hidden.

Investors who apply this strategy are well aware of all its intricacies and nuances. Therefore, they often simplify their work by using special programs - advisors for pairs trading.

There are both free and paid software options available. It is also possible to develop and create an advisor independently, ensuring that it meets all the necessary trading requirements.

When it comes to the most popular pair trading tools, two programs should be mentioned:

- Grand Master

A robotic assistant that includes two advisors. They operate independently of each other, and the principle of averaging results forms the basis of their activity.

- Spreader 4

It independently calculates the direction and quantity of trades to open. This is done in a way that either quickly accumulates positive spreads or reduces potential losses. Its operation is based solely on historical data. Typically, the analysis is done using the last 60 bars.

Regardless of what pairs trading advisor used, it is important to periodically readjust it and carefully monitor its actions.

Pros and cons of using Forex advisors: traders' reviews

The practical application of specialized programs to assist in Forex trading allows us to identify both positive and negative aspects.

These aspects are not always clearly visible, and often situations arise where it becomes difficult or even impossible to rectify something.

It would be helpful to read about Forex expert advisors reviews that can be found in large numbers on the internet. Traders are always ready to share positive or negative impressions of using indicators, so that others can avoid unnecessary mistakes.

In general, all recommendations and peculiarities of using these programs can be categorized into two groups: the pros and cons of using specialized software.

There are certainly more pros than cons. However, one should not forget about the latter, as they can impact the trading results.

| Pros | Cons | |

| 1 | There is no emotional component of trading and the human factor: there is no fear, panic, nervousness, greed, excessive carelessness, false hopes. The desire to win back immediately in case of losses is completely excluded. | Unexpected losses may occur under changed market conditions, so advisors should be adjusted occasionally. |

| 2 | Accuracy of actions provided by the specified algorithm. Random errors, which a trader may make due to carelessness, are excluded. For example, opening an order for 2 lots instead of 0.2. | The embedded algorithm remains unchanged even if each subsequent trade is closed with a loss. The program will continue to open losing orders until either the settings are changed or it is manually stopped. This carries the risk of losing the entire deposit. |

| 3 | Flexibility of technical parameters. A trader can always adjust the program settings if necessary. This allows for more precise adaptation of an advisor to the market at any time. | It does not recognize finer settings. For example, it is completely insensitive to market panic, which can lead to erroneous actions. This drawback can be overcome by training an advisor, but not everyone can do it. |

| 4 | Immediate execution of specified operations. No human possesses such instant reaction. An expert advisor is extremely sensitive to any market changes, giving it an advantage in operation. The trader needs time for reflection where the advisor makes decisions promptly. | Paid programs do not guarantee profits in the future. |

| 5 | No slips or errors due to inattentiveness when working with multiple assets or indicators simultaneously. | Testing on a demo account can greatly differ from real-life performance. |

| 6 | The ability to control a large number of trades simultaneously. In some cases, the number of trades can reach several thousand. | Difficulties in adapting to fundamental analysis. It cannot accurately perceive and convey crowd psychology. Analysis without numbers and precise data is impossible. |

| 7 | Round-the-clock operation without breaks on weekends and holidays. The installed program will function until the trader decides to discontinue it. | Advisors have no intuition, though it leads traders to success in some situations. |

| 8 | Advisors can save investors from the need to add additional objects on charts to identify trend changes. The program will analyze everything itself and provide signals at the right time. | Timely monitoring of an advisor is necessary to ensure it stays on the correct course of operation. |

| 9 | Under certain conditions, the advisor will continue to work even without an internet connection or access to the trading terminal. | Without VPS hosting, advisors will not be able to continue functioning with the computer turned off and no internet access. |

| 10 | There is no need to learn all the intricacies of manual trading. Even all the nuances of market analysis can be delegated to an advisor that will perform all the actions. | Statistically, sooner or later, all advisors start draining deposits. The cost or complexity of the program does not matter in this case. It occurs due to market dynamics. The crucial thing is to catch the moment of failure and adjust the indicator's operation or disable it completely. |

Despite the above-mentioned advantages and drawbacks of using expert advisors, they are quite popular with traders. However, it is important to remember that merely downloading and installing a trading software is not enough to achieve success.

Even the most trusted, tried-and-true advisors start failing sooner or later. That is why it is crucially important to closely study its technical features and settings.

One should not rely on a trading robot completely. A trader should be the one who controls the process. Opinions of experienced traders can be of help.

Conclusion

Before deciding to use any trading software, it's crucial to carefully consider your choice. It's especially important to understand how the tool will function in the future.

Forex eas advisors are automatic tools that have their pros and cons. The main advantages are linked to the fact that these assistants lack emotions and don't have working time restrictions.

However, one should not expect that their profit will skyrocket immediately after installing and activating an expert advisor. Traders need to get accustomed to its work and carefully configure it.

When choosing a program, it's best to carefully read user reviews. Sometimes a free advisor does an excellent job. And sometimes, even a paid one performs poorly, so it does not worth its money.

Nevertheless, understanding how an advisor will work before it gets installed on a trading platform is virtually impossible. Therefore, the only correct approach to choosing is personal experience.

Conducting preliminary testing on a demo account is also helpful. This step is often neglected by traders who rely solely on their experience. Such an approach may lead to mistakes, sometimes significant, that could have been easily avoided.

After proper preparation, an advisor can significantly simplify a trader's work and make their trading more efficient.

It is also essential to wisely choose a robotic assistant for the tasks that need to be accomplished. This is another common mistake made by traders. The type of advisor play a very important role, sometimes even decisive.

It is important to remember that no program can fully replace a human, especially considering that the final decision always lies with the trader.

An advisor is not a magic wand that will do everything for its owner. It is just a tool that needs to be used wisely to increase potential profits.

Back to articles

Back to articles