What associations with the word Mastercard do common consumers have nowadays? For instance, they use a credit card to buy a fresh croissant near the Eiffel Tower, or they pay with it for the entrance ticket to the half-ruined Roman Colosseum.

In common sense, Masterсard is a functional payment card that can be used in any spot on the globe. However, when we pay with the card, we do not even think that this small plastic rectangle is a product of the giant corporation. It serves 210 countries, provides users with a choice of 150 currencies, has 22,000 financial institutions around the world, and, apparently, is going to develop further.

In this article, we will expand our knowledge about Mastercard as not only a means of payment but see it from a different angle. We will learn whether Mastercard stocks are lucrative assets, what dividends investors can get, and what fundamentals the corporation can boast of at the moment.

A few words about the company and its products

Mastercard Inc. was established by several Californian banks in the 60-es of the twentieth century. At that time, this association was called the Interbank Card Association, and the MasterСard name appeared only in 1979. The banks provided its clients with specially issued securities that could be used as cash in local stores. From that day on, the Interbank Card Association began to develop successfully.

As soon as at the beginning of 1980, the Mastercard payment system took one of the leading positions in the world. By the end of that year, it issued 55 million credit cards.

Today, the corporation’s prime activities are processing electronic payments on the Internet and payments between acquiring banks and issuing banks. Mastercard is headquartered in Harrison, New York. The company employs over 20,000 people.

By the way, the famous slogan “There are some things money can't buy. For everything else there's Mastercard” has slightly changed. Now the company offers not only the classic Mastercard “for everything else”, but also two of its leading products - Maestro and Cirrus.

Here are the features of these products:

- Everyone has heard of the Mastercard payment card. It provides instant access to funds at millions of locations around the world.

- The second most important product of the company is Maestro. Holders of this card can make purchases and withdraw cash in local currency 24/7 from almost anywhere in the world.

- Finally, there is Cirrus. It is a global international ATM network operating in many countries around the world.

Masterсard stocks

Nowadays, Mastercard Inc. stocks are some of the most popular investment products in the US stock market. Investors are confident in the sustainable growth of the company's securities and stable dividends from investments. The company's profitability indicator is balancing at the level of 37-42%, while the growth indicator of Mastercard stocks increased more than 12 times over the past decade.

Mastercard stocks are traded on the New York Stock Exchange under the symbol #MA. Currently, the market capitalization of Mastercard Inc. is €302,214,053,888.

The corporation pays quarterly dividends amounting to up to 30% of profits. As a rule, they are paid on the 8th-10th of February, May, August, and November. The average dividend yield is around 0.5%.

MasterCard stocks are quite popular on the stock market today. The company's stock price is tracked by global indices such as the S&P 500, the Dow Jones Large-Cap, the NYSE Composite, and many others.

Who can buy Mastercard shares, how to do it, and what is the price?

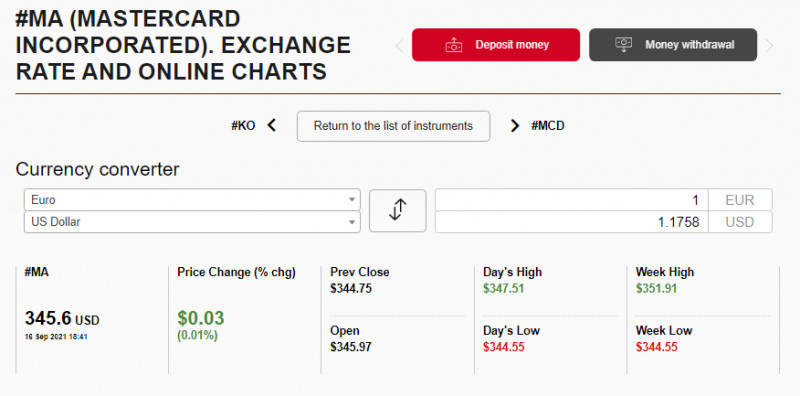

Anyone can buy stocks of the international corporation. All you need to do is to register with a broker that has access to the NYSE stock exchange. You can do this on the InstaForex website. At the moment of writing, the stock price was $345.6.

You can track the MasterCard quotes and monitor its charts online on the InstaForex website. Here is what an online chart showing price changes for a certain period looks like

10 facts about Mastercard an investor should know

- Mastercard Inc. makes the world's top 20 companies in terms of market capitalization.

- About 11% of the company's stocks belong to insiders, and institutional holders own over 75% of stocks.

- Much of Mastercard's business is based on partnerships with governments, banks, and other large businesses.

- When a user makes an ordinary purchase using a Mastercard, as many as 5 participants are involved in this operation: Mastercard Inc. itself, the cardholder (the buyer), the issuing bank (the buyer's bank), the seller, and the acquiring bank (the seller's bank). At the same time, MasterCard is responsible for processing the payment, while both banks pay the commission for domestic and international transactions.

- Mastercard's revenue is spread across 4 leading areas.

- The most common and frequently used currencies in the Mastercard system are the US dollar, the euro, and the Brazilian real.

- The company has developed QkR, a modern mobile payment application intended for ordering food and services via a smartphone.

- Mastercard is a regular sponsor of sports and charity events such as the UEFA Champions League, the Canadian Hockey League Memorial Cup, and Formula 1.

- The corporation's subsidiaries are located all over the world. The most famous of them are in Singapore and Belgium. Today, Mastercard Inc. is trying to expand its presence in countries where electronic payments are not popular. They are such countries as India and some African states.

- The share of the United States in the total net profit of the corporation accounts for over 30%.

To sum up

Today, Mastercard Inc. is quite an attractive company for investments. In addition to high liquidity, it has sufficient volatility during news releases and publications of reports. Moreover, the corporation's revenues rise steadily and are used to pay dividends. Mastercard is notable for its great stability and low sensitivity to market fluctuations. The company's products are diversified, due to which there has been no protracted decline in its shares.

Back to articles

Back to articles