Who earns more on Forex: a trader or a robot? Traders have knowledge and intuition, but they cannot be attentive and unbiased around the clock. Forex Expert Advisors, on the other hand, are not distracted by the human factor and fatigue, but they do not have a trader's intuition, which often turns out to be a decisive factor in profitable trades.

This means that trading robots have become a great tool for the trader. Provided that traders take responsibility for the final result of the trade and show intuition, which is often more important than algorithms.

We have explained how these programs work in the article "Forex Eas." Today we will talk about the most profitable Forex Expert Advisors and how they can help in trading.

Understanding Forex Expert Advisors

Each trading strategy has an algorithm. The work of trading advisors is based on these algorithms. It is set by the developer, and all that depends on the trader is to competently manage the actions of the robot. If we are talking about a fully automated robot, it is possible to get completely away from transactions: automated programs analyze the market 24 hours a day and can make investment decisions without your participation, even when you are asleep.

What does a Forex robot do?

- Analyzes market data and makes decisions to open/close positions.

- Processes large amounts of information and executes trades in a matter of seconds.

- Works continuously without a break for rest or sleep, which allows it to monitor the market day and night.

The programmer, who has created a mechanical trading system, has put in his work a certain strategy that uses certain indicators. However, any advisor needs regular human attention. At least this concerns program updates, as well as the revision of algorithms.

Since there are hundreds of automated programs in the market today, it is very easy to get confused or even cheated. That's why we have selected profitable Forex Expert Advisors, which will help you avoid possible risks and rash conclusions about market movements. Now let's see how robots work.

How robots work

When a robot receives data about the current market situation, it analyzes it and then decides on a trade. The robot can make a recommendation about when to enter the market, when to exit the market, or even make a trade automatically (the fully automated system mentioned above). At the same time, not all market conditions are suitable for working with programs. Robots can give signals to open positions when there are no suitable conditions for trading, which can lead to a loss of money.

Thus, the trading algorithm can help traders to stay in the market even when they are away from their PC, as well as make transactions automatically. At the same time, the factor of intuition and conscious decision-making is left to traders.

Who invented robots in trading

The idea of using trading automation technology has been around for a long time. Programmers were the first to use trading software.

In the early 2000s, developers began to explore the possibilities of automated trading. At that time, Forex was just starting to take off, and many people saw great potential in this new way of investing. However, manual trading required a lot of time and effort, so many began looking for ways to automate the process.

The first bots for Forex trading appeared in the late 1990s, but they were rather simple and had few features. Over time, developers began to create more complex technologies based on market analysis, regularities, statistics, and mathematical algorithms. This made it possible to create more and more precise robots.

Modern robot algorithms help traders to automate all nuances of trading, including market analysis, determination of entry and exit points, and risk management. In addition, some programs have artificial intelligence, learning from their trading experience.

Thus, the idea of using trading scripts or robots was born thanks to developers who were looking for ways to automate trading.

What are the advantages and disadvantages of trading with automatic programs today? Let's see below.

Pros and cons of trading robots

| Pros | Cons |

Accuracy A trader is not able to monitor the market situation as quickly and impartially. Whether it is technical or fundamental analysis, in any case, the algorithm will cope with this task much better. | Technical understanding required Creating or setting up a trading advisor requires knowledge of programming and technical market analysis. |

24/7 support for traders Robots help traders trade even when they sleep: they monitor signals 24/7, keeping track of the market all the time. Thus, they save time and also help to minimize losses related to the human factor - emotions, negativity, haste, or panic. | Updates Robots need to be updated regularly to maintain their effectiveness. |

Objectivity Since the trading rules are set in advance, the trading assistant is more objective than a human. It also allows the trader to spend less time analyzing the market and more time on other tasks. | Risks Trading programs do not guarantee profits and can incur losses like any other trading strategy. |

System of timely notifications Robots inform by e-mail, SMS, and ICQ in case of unforeseen situations. At the same time, the settings of the trading robot are updated. | Limited flexibility Robots work strictly within the given rules, which may limit the trader's ability to adapt to changing market conditions. |

Easy to use Automated systems are easy to manage thanks to their intuitive interface, and their variety allows you to tailor your investment strategy to your individual needs. | No guaranteed return Spending money on a robot (assuming you choose paid programs, which are more reliable) and testing does not guarantee a profit. |

Thus, a Forex trading advisor is a useful tool. It can help traders to automate their trading operations and reduce errors due to the human factor. At the same time, its use does not guarantee profits. It requires careful market analysis, determination of rules, and constant updating.

Forex robot types

Robots can be classified according to various criteria. Some programs are already built into the trading platform. You just need to activate them. Others can be found on the Internet and installed on the terminal.

A separate category is made up of custom Expert Advisors, which are robots that a trader can order from a programmer based on his or her trading strategy. The first option is custom programmers. This option can be one of the most budget-friendly. The second option is to turn to specialized trading websites that act as intermediaries between clients and performers.

IMPORTANT Almost every trading robot can be found in the public domain. However, this does not guarantee its correct functioning. Be careful: download free and paid programs only from official websites! |

Depending on the strategy, bots can be divided into several types:

• Trend robots work only when the market is moving in a clear direction, opening transactions strictly in the direction of the dominant trend. Their purpose is to keep their hand on the pulse of strong price movements when macroeconomic statistics of world markets are released. These robots are useful only on trend lines when the market movement oscillates.

• Flat robots work during market consolidation when the value moves within a certain corridor or channel. Trades are opened when one level is touched and closed when the opposite level is reached.

Other types of trading robots:

• Indicator programs.

They are used for market analysis, forecasting price movements based on oscillators, trend indicators, and other technical indicators.

• Scalpers.

They are used for fast trading in short time intervals, allowing them to make small profits with low risk. Their goal is to make a lot of trades in a short period.

• Martingale.

They work to increase lots with negative trades, thus increasing the amount of profit.

• Signal algorithms (informational).

Programs analyze the situation and give recommendations to the trader. The trader decides whether to take them into account.

• Expert advisors for hedging.

This category includes any robot that trades two positions opened in opposite directions, thus reducing the loss on one and increasing the profit on the other.

• Neural algorithms.

The most complex robot programs are capable of self-learning in the process of trading.

• Advisors based on the theory of Elliott waves.

The principle on which this robot works is based on Ralph Elliott's theory of technical analysis.

It is important to understand that each type of bot has its advantages and disadvantages. Use them with caution and adapt them to your trading vision and strategy.

How to trade using robots

Key rules that will help you start trading with algorithms:

1. Find a suitable program for your trading strategy: through forex forums, specialized stores, or from your broker. You need to understand what tools the robot uses, how it opens/closes trades, and how it manages risk.

2. Install the robot on your trading platform. Every platform has its installation system. You need to follow the instructions that come with the program.

3. Define your trading goals and risks.

You need to define your goals and risks before you start trading with the Expert Advisor. Work out your trading plan, set your profit and loss targets, and determine the size of your position.

4. Set your program parameters. Each advisor has its settings, which you can change to suit your trading objectives. In some of the settings, you can adjust position volume, time allowed to trade, and take profit.

5. Run the program in demo mode. Before you start trading with real money, you need to test the advisor in demo mode. It will help you to learn how the bot works in real-time and then determine the efficiency of its work.

6. Start trading with real money. If the test shows good results, you can start trading with real money. Do not forget about the risks involved in trading. Only bet money that you can afford to lose.

7. Stay informed.

Pay attention to news that may affect your investment. This will help you make informed decisions about when it is best to enter and exit trades.

Risks taken by traders

Using robots can also pose certain risks that traders should be aware of.

Customization risk

There is a risk of setting up EAs incorrectly, which can lead to large losses. Some traders may not have enough knowledge to configure them, which can lead to them not working properly. Programs may be configured to trade with too much or too little risk, which can lead to losses that traders cannot afford.

Connection loss risk

Internet connection problems can lead to situations where robots are unable to function properly and/or make timely decisions. This can lead to losses. Traders must ensure that they have a reliable Internet connection that will not be interrupted.

Software errors

Advisors can be prone to errors, either due to poor software quality or incompatibility with other programs included in the trader's system. In these cases, advisors may not work properly, which can lead to large losses.

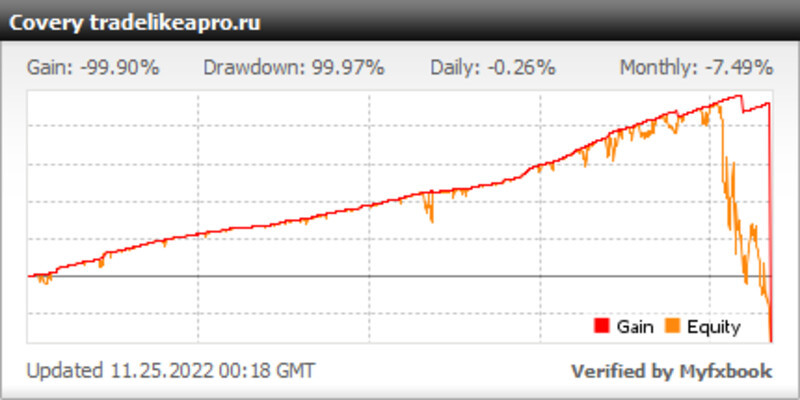

Fraud risk

There is a risk of fraud with some Forex bots. These scripts can be created by unscrupulous traders who try to deceive other market participants by offering high profits without participation. Be careful: study the history and reviews of the programs to make sure they are reliable.

Risk of becoming dependent on expert advisors

Some traders may become dependent on the help of the program, relying entirely on it to make decisions. This can lead to missing out on potential profits, as robots are non-living algorithms and cannot make 100% correct decisions. Traders must constantly study the market to take more informed risks.

Using Profitable Forex advisors can increase the chances of success if they are properly configured and installed. However, it is always worth remembering that trading is a risky business, and no single algorithm can guarantee success.

How to choose trading advisor

Choosing a trading algorithm depends on your trading goals. Here are some tips on what to look for when choosing a trading advisor:

1. The reputation of the developer:

Read about the company that developed the trading advisor and read reviews from other traders about their work. Pay attention to their level of professionalism and service.

2. Testing:

Before buying a trading bot, learn about its performance by studying its tests and performance reports. This will give you an idea of how it performs on different currency pairs, time frames, and market conditions.

3. Support:

Make sure that the developer has good customer support that can help you with any problems that may arise.

4. Fit your needs:

Choose the trading robot that best suits your trading style and risk management. Check if it meets your stop loss/take profit criteria.

5. Get recommendations from other traders:

Talk to other traders who have used the advisor you are interested in. Ask them which robot they use and why. This can help you make a more informed choice.

6. Ask the seller for a test version of the program; for example, test it with Wealth-Lab. Compare your results with the backtest provided by the seller.

7. Choose open-source programs. They can be modified (or you can ask the programmers to correct them, for example, in MQL5).

8. Download robots with narrow specialization. There are no universal Forex trading programs, but there is a chance that the program with a narrow specialization is actually "limited" to work in certain market conditions.

Do not forget that no advisor provides 100% profitability of trading; you should always have a clear risk management plan and a disciplined trading strategy.

Top 5 profitable forex expert advisors for trading with small deposits

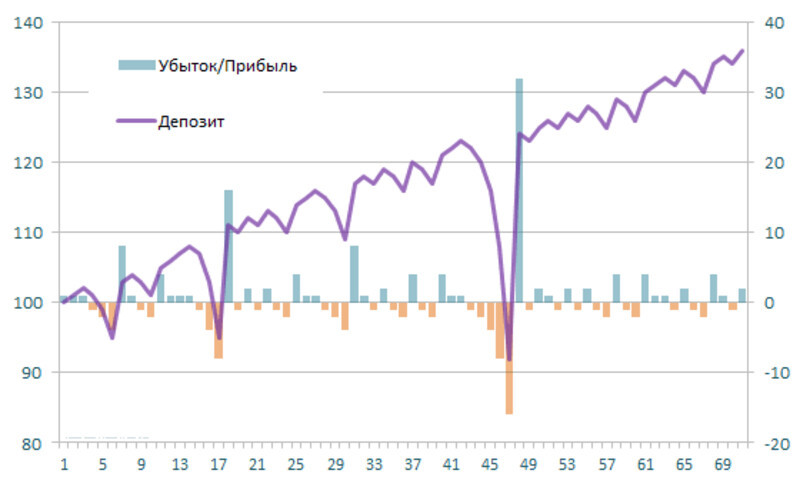

We do not recommend beginners use robots that double or average trade orders. This is too risky a strategy, as the level of risk depends on the reliability of the trading strategy, as well as compliance with the rules of capital management.

The rating of automated programs for small deposits can vary depending on the strategies used, the size of the deposit, and other factors. Here is a list of the most reliable expert advisors for small deposits (from $100 to $1,000):

1. WallStreet Forex Robot 2.0 Evolution has shown a stable profit for a long time. It can work on a fixed and variable lot. Uses the technology "Broker Spy Module", which allows the advisor to analyze the work of the broker and adjust to changing trading conditions. The developers promise that by using the optimal settings, this bot will be able to bring up to 40% per month.

2. Forex Diamond combines various strategies such as scalping, intraday, and medium-term trading, i.e., both trend-following and counter-trend strategies. It allows you to achieve high profitability with moderate risk. Very precise. It offers a high speed of transaction execution, and its trading parameters change dynamically when market conditions change.

3. FXStabilizer works both during the trend and the flat. It combines scalping and reverse trend trading strategies. It has high profits and low risks. It has several operating modes, which allows the user to choose a mode that suits the situation. The robot also has adjustable parameters: choice of currency pairs, risk, and a maximum number of open trades.

4. Forex Fury uses the scalping strategy, allowing you to make small profits on short market movements. It has a high accuracy of market entries/exits, which allows it to achieve high profitability if it is set up correctly. Multicurrency robots work with any broker but require a minimum spread, so it is better to work on an ECN account. It performs up to 10 trades per day and is easy to set up. Forex Fury promises about 10% profitability per month.

5. FXSecret Immortal uses an unconventional approach to trading that allows you to optimize returns and reduce risk. It shows record-high returns on small and medium deposits. It is an automatic system; you just need to follow the provided components to set it up. The bot will analyze the detected objects and entry opportunities. If it finds them, it can manage positions on your behalf.

It is important to remember that even effective advisors do not guarantee success and can lead to losses, so traders should always monitor their trades and use risk management strategies. Beginners should learn trading with the help of assistants with minimum deposits.

Free profitable Forex advisors

Let's find out how free Expert Advisors work, although we shouldn't expect huge profits. Even paid EAs that were released a few months ago require testing and cannot guarantee 100% success in trading.

Let's consider the nuances of trading with free robots:

- As a rule, high-quality and profitable Forex advisors are released in paid versions because the development of such programs requires time and resources.

- Often traders themselves have to experiment with different parameters of the advisor to achieve profitability.

- There are not so many effective free advisors; they can only work with a limited set of trading tools. For example, a Forex expert advisor will not be able to trade Apple shares.

Any robot, even the best, does not guarantee 100% success. In addition, some free EAs may contain bugs or malicious code, so use them at your own risk.

So, let's look at the top 5 free bots:

1. FX Charger uses three different strategies to enter the market. This allows it to be flexible and adapt to different market conditions. It trades on multiple currency pairs. FX Charger can draw on an archive of many years of historical data and use it to analyze past trends and predict future movements. It promises returns of 30% to 50% per month.

2. WallStreet Forex Robot is based on a price pattern strategy. It trades the EUR/USD and GBP/USD pairs. It promises a return of about 20% per month. Trading with this expert advisor is not intensive. Even on small timeframes, the number of open trades per year will not be as high as it may seem.

3. Forex Steam uses a scalping strategy based on the principle of scalping with a higher degree of filtering of trading signals. It trades EUR/USD. It promises monthly profitability of about 10%.

4. Forex Gump uses trend strategies based on the use of indicators. It promises a monthly return of about 30%. One of the advantages of Forex Gump is its relatively high signal accuracy. In addition, it has several strategies and settings that allow you to adapt it to different market conditions. Forex Gump can also work with any broker, which makes it quite versatile.

5. MACD pattern is based on the MACD indicator. It determines the moments of entry into the transaction and controls the risks. The program also has a pending orders function. MACD Sample can work with any currency pair and time frame. The number of erroneous trades is minimal due to the use of indicators and filters.

These robots can be good tools for novice traders who want to make a profit without the expense of buying paid robots. But don't just believe any promise of high returns and use any bot without proper verification and analysis.

Top 6 paid programs that generate profit

The essence of paid trading programs is that they allow you to significantly reduce the risks for the trader and increase the profitability of trading. Below are the top 6 profitable paid trading advisors for Forex:

1. Forex Megadroid is an algorithm with artificial intelligence technology. It is capable of analyzing market data and making decisions about buying/selling currencies at the most favorable price.

2. Forex Flex EA is a program bound to different time frames and currencies. It uses 12 different strategies and has high profitability and low risk. It allows traders to adapt their trading robot to any market conditions.

3. Forex Fury is a mechanical trading system based on technical and fundamental analysis. It can analyze market data and make decisions about buying/selling currencies.

4. Forex Hacked uses multi-currency trading technology. It has a high accuracy of market prediction and flexible settings.

5. WallStreet Forex Robot is based on wave analysis and price resistance. It has high market prediction accuracy and flexible settings. The maximum drawdown of the deposit for one currency pair can reach 20%, but the bot is multicurrency, which means that the drawdown on one pair is offset by profits on the other.

All the above programs and algorithms are highly efficient and can be excellent tools for automated trading in the forex market. Before starting work, it is necessary to thoroughly study the characteristics, features, and history of each robot and perform tests on historical data to avoid unexpected losses.

Conclusion

This article introduced the history of Forex Expert Advisors, the principles of such trading systems, types, disadvantages, and advantages of trading with assistants. We also reviewed the most popular profitable trading advisors that have earned the trust of traders. Choose your trading strategy, your appetite for profit, and try to put the control in the hands of robots.

However, the choice of an Expert Advisor should be made in a balanced way based on the size of the deposit, considering the risks, as well as other precautions, such as testing the chosen robot on a demo account, getting feedback from traders, adapting the robot to your trading strategy. Of course, you can use automated trading strategies, but remember that fundamental news can contribute to significant changes in the market.

Trading programs help not only beginners but also experienced traders. You can analyze the market without emotions. Since most trading mistakes are made because of the human factor, a robot helps to eliminate its influence.

Let automated Forex assistants help you trade effectively. Make the final decision about trades and rely on your experience and strategy.

You may also like:

Back to articles

Back to articles