Traders with different levels of skill and experience in trading will, sooner or later, resort to the help of expert advisors. It should be noted, however, that in order for trading bots to work effectively, a trader should control them.

Each Expert Advisor is based on a specific trading strategy, which the bot strictly follows regardless of what happens in the market. Sometimes, it is better to reconfigure or disable the trading bot and trade manually.

This article will tell you about some varieties of trading robots and the peculiarities of trading with their use. You can learn more about Expert Advisors and their main pros and cons from the article "Forex eas".

Understanding trading algorithms

A trading algorithm includes a certain set of rules that a trader should adhere to when opening and closing positions. These rules relate to analyzing the market, finding entry points, setting protective levels, risk- and money management.

There are several different classifications of trading strategies, we will consider the main ones. So, depending on the time frames, strategies are subdivided into:

1. Short-term algorithms imply the conclusion of several short transactions in small time intervals. In this category, several subcategories can be distinguished:

- pipsing - trades are opened for the shortest possible time (2-5 minutes) to get a small profit, the M1-M5 time frames are used;

- scalping includes short-living trades that can be kept open for up to 10-20 minutes, the M5-M15 time frames are used;

- intraday trading implies making trades within one trading day without transferring open positions overnight, the M15-H4 time frames are used;

2. Medium-term trading assumes that trades remain open for several days or even several weeks. It is better to use the H4-D1 time frames. This strategy is also called swing trading;

3. Long-term strategies, or position trading, involves opening trades for several weeks to several months, the D1-MN time frames are used.

Depending on the method of opening a trade, trading strategies are the following:

- Trend strategies are based on the postulate that "the trend is your friend" and consist of strictly following the current trend of value movement. Trades are opened in the direction of the dominant trend;

- Counter-trends involve opening trades against the current trend in the hope of making a profit during periods when most other traders are closing their positions;

- Flat trading assumes trading within the corridor in which the value of the asset moves when there are no wide fluctuations in the market.

The technical characteristics of trading algorithms are the following:

- Manual - all trading operations from the analysis to the moment of closing the transaction are carried out by a trader independently and manually;

- Automatic trading involves the use of computer programs for market analysis and selection of entry points, as well as the execution of transactions in automatic mode.

How to create trading strategy

Without any strategy or comprehensive approach, you can trade in the forex market or other markets for years. However, such an approach is more like a casino - you go lucky or go bankrupt. Meanwhile, trading is not a game of luck, it should involve a strategy and trading results.

It is necessary to realize that having a trading strategy does not mean that all trades will necessarily close in the "plus". However, clear adherence to the rules minimizes decision-making under the influence of emotions and stress, which ultimately has a positive effect on the balance of the trading account.

It is for this reason that experienced traders recommend using trading strategies. You can start with ready-made algorithms, but later you need to develop your own system.

On the web, you can find a large number of trading strategies. There are simpler ones, which are suitable for beginners, and very complex ones, which can only be used by professionals.

However, any ready-made algorithm will have to be customized and its settings will have to be changed. You can even go further and develop your own strategy on the basis of a ready-made system. You can even combine several algorithms if needed.

It is important to take into account the individual characteristics of a particular user: type of temperament and character. For example, a calm and slow person will not be suitable for scalping, but a more active user will find it difficult to trade in the long term.

The main elements of any trading strategy are:

- Rules concerning market analysis;

- Principles of selecting assets for trading and timeframes;

- Conditions for finding points for opening trades;

- Principles of holding positions and closing trades;

- Settings regarding risk management;

- Principles of working on mistakes.

What is Expert Advisor?

After creating a competent, working trading strategy, you can start testing it. First, to confirm its effectiveness, any algorithm is run through a special program - a strategy tester.

This is not the only step that should be taken before trading on a live account using a particular algorithm. This is trading on a demo account - a step that is not recommended to be skipped neither by beginners nor by experienced users.

When all the steps of testing a trading algorithm have been passed, you can try trading on a live account. If the strategy on a real account behaves properly and the trader gets the desired profit, you can move to the next level and automate your trading system.

It is possible to automate only a part of the operations, and it is possible to make trading fully automated. There are two main types of trading bots for this purpose: semi-automatic and fully automatic.

Semi-automatic bots are also called expert advisors. They perform a full analysis of the current market situation and look for the most suitable points for opening positions.

After a suitable moment to enter a trade is detected by the Expert Advisor, it signals the trader. However, the decision to directly enter a position is left to a person.

Fully automatic bots, in addition to analyzing the market, make trades on their own. That is, they fully carry out trading on behalf of the user.

The second option seems very attractive, but it should be understood that a computer program cannot react flexibly to any sudden and drastic changes. The bot will continue to trade even if it will only bring losses.

Therefore, experienced users recommend monitoring the work of bots and making adjustments to their operations if necessary. So far, the ability to see the full picture, including fundamental analysis, as well as to apply experience and intuition is available only to humans.

Expert Advisors based on Martingale strategy

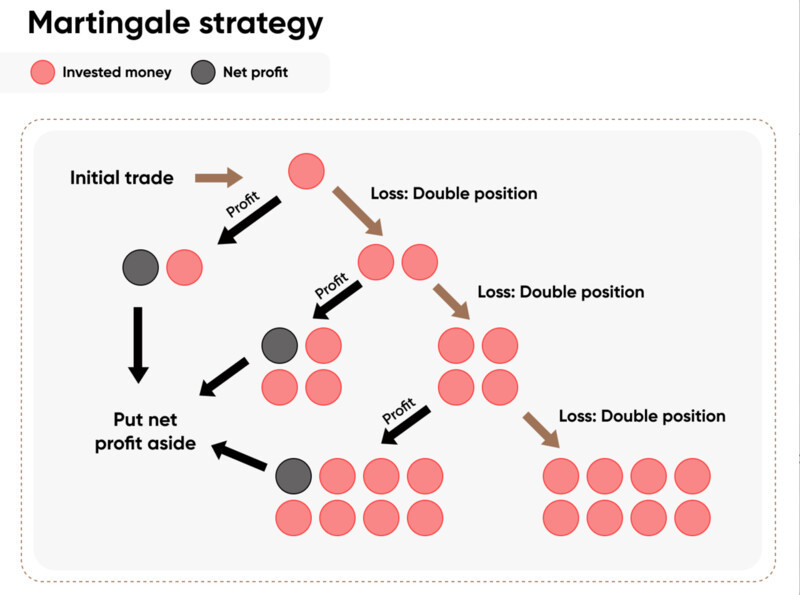

Before we find out what a WOC adviser is, let's understand one popular algorithm that is used in the creation of many trading bots. This is a strategy based on the Martingale method.

Initially, this methodology was developed for gambling. However, it was soon adapted for trading on stock markets, Forex, and others. Currently, a huge number of expert advisors are created on the basis of this strategy.

The main essence of this strategy is as follows. When a trade is closed with a loss, the next trade is opened in the opposite direction and with a double lot.

This is done in order to use the potential profit from the next trade to cover the losses on the previous position. With each subsequent "loss" the next position is increased. However, it is impossible to increase the position size indefinitely, otherwise, you can lose all your money.

During the existence of this strategy, various modifications of it have appeared. For example, some users do not double positions, but open them of the same size or increase them only 1.5 or 1.3 times. In another variant, trades are opened not in the opposite direction, but in the same direction.

At the same time in the network, you can find quite contradictory reviews about this trading system. Some users like this system very much. Others believe that its use in the long term can only bring losses.

An important point when using this strategy and Expert Advisors based on it is a constant analysis of the market, including fundamental analysis. It is not recommended to use this algorithm during the release of important news and statistical data, as it can lead to significant losses.

It is also necessary to choose the right assets for trading - they should have low volatility. For successful trading, it is necessary to correctly determine the initial bet size, set protective orders, and be able to exit the chain of losing trades in time.

WOC Expert Advisor

The key feature of Martingale trading is the trader's confidence that the market will sooner or later go in the right direction. That is why users continue to bet against the current trend, which can eventually lead to the loss of the deposit.

There is another kind of trading system - these are so-called "anti-martingales". They are completely opposite to the strategy based on Martingale.

The key feature of this algorithm is the accumulation of trades closed in plus. That is, if the previous trade was profitable, the next one is opened in the same direction, but with an even larger volume.

If the position turns out to be unprofitable, the next position is opened with the same volume, without increase. Thanks to this, the trader does not risk a large part of the deposit.

Nevertheless, it cannot be said that this strategy is completely risk-free. If the second or the third transaction, which is opened with a large volume, will go into a loss, it can overlap the profit from the previous transaction, which closed with a plus.

Besides, the cyclicality is an important point. It means that the building up of position volumes does not occur indefinitely. After reaching four times the volume, as a rule, traders end the cycle and return to the original one.

There are other variants of strategies without Martingale. For example, many Expert Advisors are based on trading on signals from technical indicators. As a rule, some combination of two or more indicators is used.

Understanding WOC Adviser

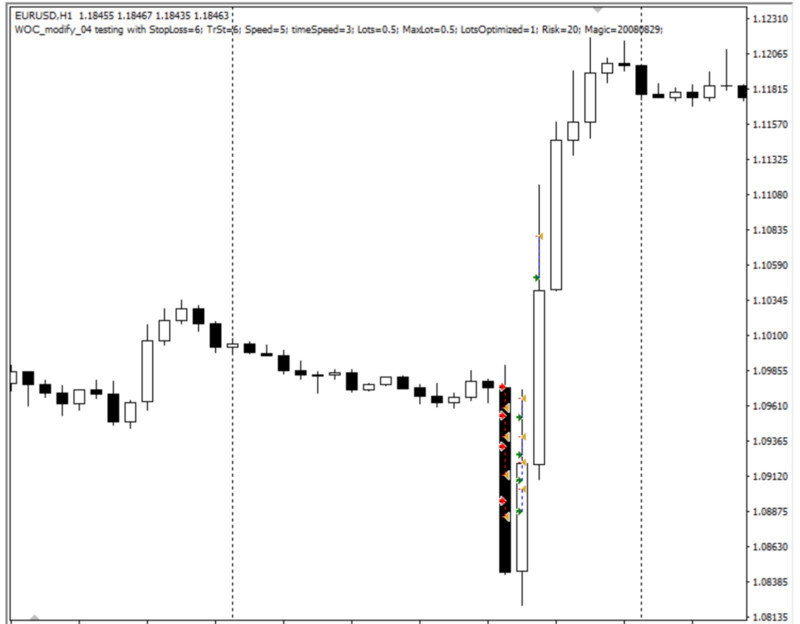

As we have already mentioned, not all trading bots work according to the Martingale strategy. The WOC Expert Advisor is just a good representative of the programs that do not use Martingale.

Moreover, this Expert Advisor promises very low drawdowns of up to 0.4%, and quite high profitability, up to 100% per year. What is the secret of its work? Let's analyze it.

The principle of the program is quite simple. The chart designed for the work of the advisor finds periods of strong fluctuations and opens positions in the direction of a sharp jump in value.

At the same time, a Stop Loss order is set a few pips lower to protect the position from heavy losses in case of a reversal. The SL order is moved as the price moves until it finally reverses.

Thanks to this methodology, the loss is not so significant even if the price starts moving in the opposite direction immediately after opening a position.

This bot works according to the scalping strategy, transactions often last no longer than two minutes. Therefore, for the correct functioning of the Expert Advisor, it is important to consider a number of technical conditions, which we will discuss later.

WOC has built-in settings, there is no need to change them. It is designed for use with the EUR/USD, USD/JPY, and GBP/USD currency pairs on the H1 time frame. The initial investment amount starts from $100.

The work of this Expert Advisor with other instruments may not be as effective as with the above-mentioned pairs. Therefore, it is not recommended to use it with other pairs due to the wider spread.

Numerous tests of this bot confirm its efficiency and stability with low drawdowns and quite high returns.

Technical conditions for WOC adviser

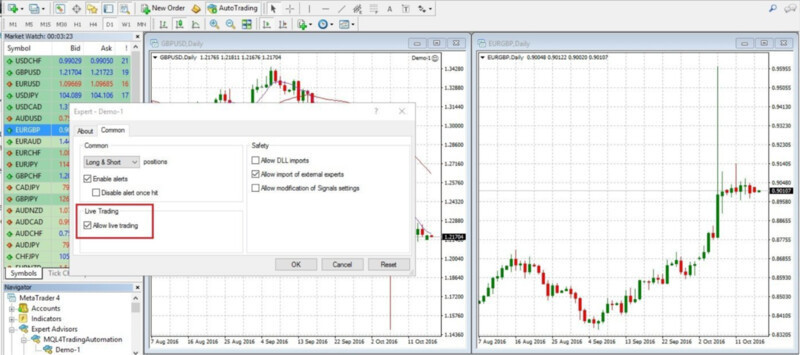

This Expert Advisor is not included in the standard set of programs of most trading platforms and is not pre-installed. Therefore, it can be downloaded and then added to the Experts folder.

Due to the standardized settings, the user does not need to configure the program before using it. Therefore, it is only necessary to test it in the Strategy Tester and on a demo account before using it on a live account.

An important element of the reliable operation of a particular bot is the clear and smooth operation of the broker and trading platform. When choosing a broker, you should pay attention to the speed of order execution, slippage, and spread.

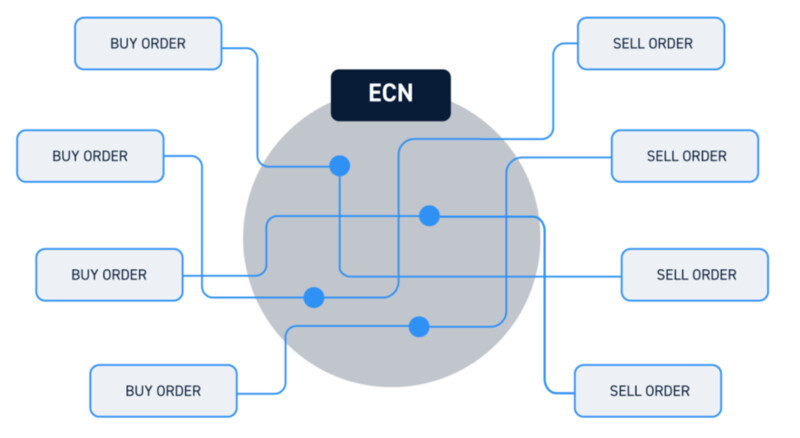

In addition, it is better to use ECN accounts for the correct operation of the WOC Advisor than a live account. ECN is a trading system that allows the user to enter the market with a minimum number of intermediaries.

When trading on a live account, the broker selects a counterparty at the trader's request based on the available orders. In the case of ECN, this process is automatic and the system itself selects the most suitable counterparty from the entire database.

This approach increases the speed of order execution and reduces costs for trading participants. By selecting the best offer available in the market at that moment, the size of the commission is reduced. Since this trading advisor uses the scalping strategy, the continuity of its work is an important condition. For the most efficient work of the bot, it is recommended to use a VPS server.

No one is immune to technical failures of equipment, sudden power cuts, or Internet disconnections. In a normal situation, all these events will lead to a loss on the transaction.

This can be avoided by using a virtual private server, which is a trader's remote workstation. This server can host trading platforms and other tools that can be accessed from anywhere in the world at any time.

Forex Expert Advisors

The WOC Expert Advisor is not the only free program for Forex trading. Let's consider the main features of trading advisors and the points you should pay attention to when choosing a bot.

The main advantages of computer programs over a human are the ability to trade around the clock, without breaks for rest and meals, lack of exposure to the influence of emotions and stress, and fast execution of orders.

There are many programs for algorithmic trading. Each bot is based on a certain algorithm, i.e. a set of rules according to which the bot makes transactions.

We have already talked about the fact that strategies can be quite different, hence the huge number of trading bots available for download and use. You should always remember and take into account that before using any advisor you should first understand the principles of its work, and study the instructions and recommendations.

It is ignorance of the specifics of the work of expert advisors often leads to negative reviews of the network about their ineffective work and loss of the deposit. In addition, traders often start using bots for trading other assets or on other time frames without changing the settings.

Notably, both paid and free programs can become outdated and less effective over time. To prevent this, you should constantly monitor the work of the Expert Advisor and make adjustments if necessary.

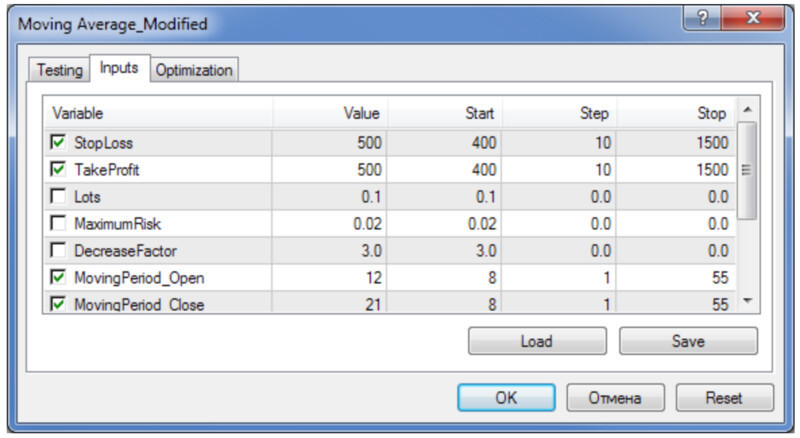

In particular, every bot needs to be optimized. This is done by changing the set of settings that were originally entered into the algorithm of its work. Difficulties may arise only if the settings of the Expert Advisor do not directly affect its work.

Best Expert Advisors for beginners

Using automated trading programs seems to be a very tempting idea, especially for novice traders. They do not have enough experience to make a qualitative analysis of the market and make decisions about the moment to enter a position.

However, as we have already mentioned, in order to trade effectively with Expert Advisor, it is necessary to have a clear understanding of its strategy and basic principles.

In addition, it is necessary to constantly monitor the Expert Advisor's work. If there are sudden and strong changes in the market, the program cannot react to them, so it continues to trade as usual. In this case, the user has to make adjustments.

That is why experienced users recommend not to use fully automatic programs that make transactions independently on behalf of the trader. It is better to leave the analysis of the market to the advisor and make the final decision on the transaction.

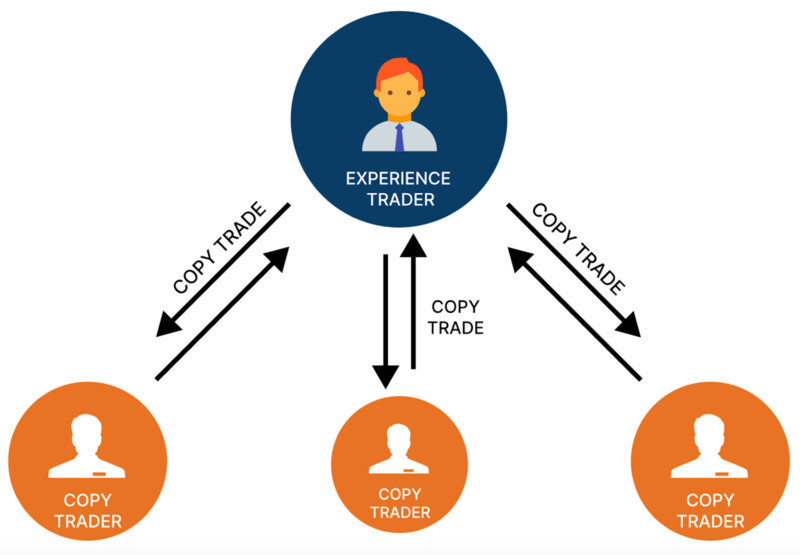

For beginners, there is another interesting option - copy trading. This is actually automatic trading as well since the user does not make any transactions.

A trader can subscribe to one or more experienced and successful traders and all their trades are automatically duplicated. This allows you to receive income without doing anything. However, if the trader who copied the trades suffers a loss, the trader who copied the trades suffers the same loss.

In addition to generating income, copy trading can also be used for educational purposes. A beginner can follow the trades of an experienced trader and learn the basics of trading different assets.

Some traders subscribe to several traders at the same time in order to diversify their portfolios and minimize risks. Since each trader has his own strategy and trading rules, his preferences regarding the choice of assets to trade.

Conclusion

In this article, we have become acquainted with various trading algorithms, which are the basis for the work of expert advisors. It is very important for the user to understand the essence of the program, the rules by which the bot analyzes the market and makes transactions.

Many Expert Advisors are based on the Martingale strategy. Its essence is that after a failed transaction, the next position is opened by doubling the volume in the opposite direction.

This is done in order to cover the losses of the previous trade with the next profitable one. However, not every subsequent trade turns out to be profitable, so losses may continue to increase.

An alternative to such bots is the WOC Adviser - a program that is not based on the principles of Martingale. This bot makes transactions during sharp jumps in the direction of movement of the value of the asset.

This Expert Advisor allows you to minimize drawdowns and earn high profits. When trading, you need to follow the program's settings regarding time frames, selection of assets, etc.

You may also like:

Back to articles

Back to articles