Many traders, regardless of their experience level, tend to delegate some of their routine tasks to expert advisors, aka trading robots. Such a practice seems attractive, as it enables traders to save loads of time and spend it on more pleasant activities.

However, there are quite a lot of reviews on the Internet blaming Forex expert advisors reviews for non-satisfactory results, resulting in losses. But is it really a trading robot that should be blamed? Read on to delve into this issue.

In fact, algorithmic trading can be effecient and successful if you study its basic principles. For this purpose, read our article about Forex eas.

How trading advisors work

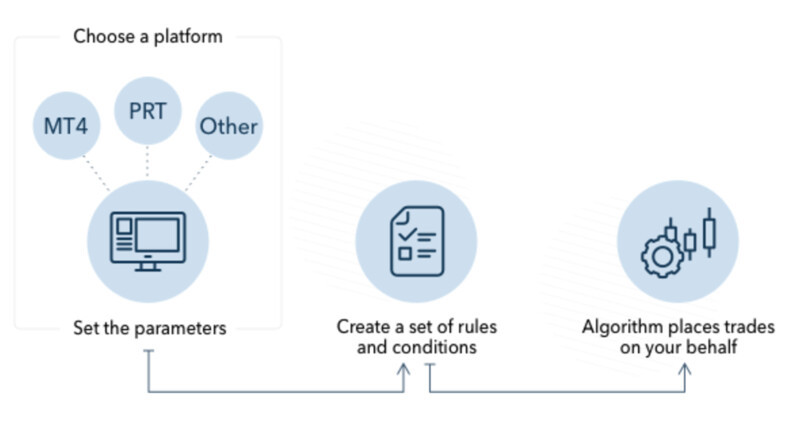

For a start, let's clarify the fundamental concepts: what is an advisor and how does it operate? Before assessing the credibility of online reviews concerning trading robots, it is crucial to have a clear grasp of what they can actually do.

An advisor, also known as a trading robot, is a computer program embedded with a specific algorithm. They function according to predefined rules and can operate continuously without breaks for rest or sustenance.

This is one of the primary advantages of computer programs. Additionally, a significant characteristic that sets them apart from humans is their immunity to emotions and stress, eliminating impulsive decision-making driven by greed or fear.

Trading bots can be either semi-automatic, commonly referred to as advisors, or fully automatic, commonly called robots.

Advisors conduct a thorough market analysis and identify potentially successful entry points. Subsequently, they provide signals to a user, but the ultimate decision to open a trade or not lies with the trader.

In addition to analysis, robots can also open and close positions. They make independent decisions based on input data and predefined parameters.

This may seem highly convenient; however, it is important not to forget that a program can only follow a specific set of instructions. It cannot perceive the complete picture or react to changing market conditions.

Therefore, experienced traders prefer not to leave trading bots unattended for extended periods. It is necessary to continuously monitor their performance and adjust settings when needed.

Types of Advisors

In addition to the previously mentioned classification based on the autonomy level of trading advisors, there are several other categories that bots can be grouped into. Depending on the primary strategy embedded in the program's algorithm, they can be classified as follows:

- Trend-following advisors. These advisors exclusively operate in markets characterized by clear and directional movements. They open trades strictly in alignment with the prevailing trend.

- Range-bound advisors. These advisors function during periods of market consolidation when prices move within a specific range or channel. Trades are initiated when a predefined level is reached, and they are closed when the opposite level is achieved.

Furthermore, advisors can be categorized based on specific trading tactics they employ:

1. News trading advisors: These advisors utilize the release of important news and other events that can have a significant impact on price fluctuations.

2. Martingale-based advisors. The principle underlying the operation of advisors using the Martingale strategy is as follows: after closing an unsuccessful position, the bot opens the next trade with double the volume, typically in the opposite direction. This is done to compensate for the loss incurred in the previous trade.

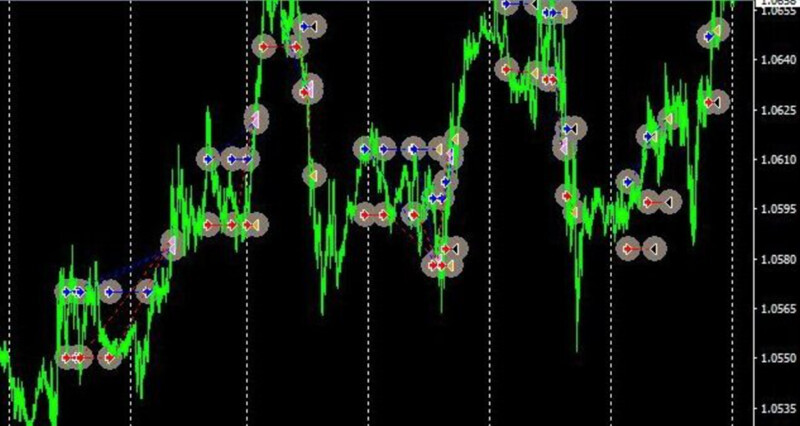

3. Scalping robots. These programs open a large number of trades with small profits, often executing up to 400-500 such trades per day. Trading bots can also engage in high-frequency trading, where trades are executed within fractions of a second, which is practically impossible for a human.

And here are some other types of trading bots:

• Hedging bots. This category of programs simultaneously opens two positions in opposite directions, aiming to reduce the loss from one trade by increasing the profit from the other.

• Breakout trading bot. This program opens trades when the price chart crosses user-defined support and resistance lines.

Forex Advisor Reviews

So, what are the most common reviews found online regarding various trading advisors? Some reviews are positive, highlighting effective performance and successful trades performed by bots.

However, a more frequent opinion is that Forex expert advisors reviews are useless, fail to deliver desired profits, or even result in a complete loss of the account. In this section and the following ones, let's delve into whether these claims hold true.

Users' main complaints can be grouped into several categories:

- Bots make mistakes.

- Bots cause heavy losses.

- Bots fail to generate profits.

It's important to understand that computer programs are developed by humans. Errors can occur during the coding process, leading to incorrect functionality of the advisors.

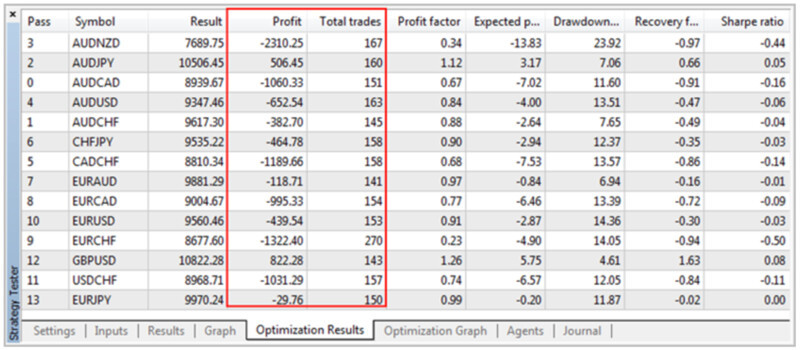

People make mistakes, and it's an even greater mistake or negligence to use an advisor on a live account without conducting proper testing. It's advisable to start with a thorough evaluation on a demo account at the very least.

Furthermore, it's crucial to recognize that all programs are designed for specific trading strategies. This means they already incorporate predefined trading parameters such as assets, timeframes, and more.

If a trader simply starts using an advisor without adjusting it to their requirements, over time, they can indeed expect to experience losses. Each robot needs to be properly configured before a trader starts working with it.

Nevertheless, many users are convinced that the problem lies not with the advisors themselves but with those who ineptly utilize them. There is some truth to this as well, since before employing an advisor, it should be thoroughly studied and tested.

How to select an expert advisor

Quite often, users express their dissatisfaction online when it comes to using Forex advisors. The majority of reviews revolve around the advisors not functioning properly.

In reality, there is a wide range of automated trading programs available. Many of them can be downloaded for free, while others are paid. However, the main driving force behind them is advertising that promises incredible profits in a short period of time.

Users often fall for these promises and download advisors without considering whether they are actually suitable for their needs. But they risk to end up losing their money. They can avoid this by approaching the selection of an advisor with careful consideration.

We have compiled the essential criteria that should be taken into account when searching for a trading bot on the Internet. So, what aspects should you pay attention to when choosing an advisor for trading?

- The most important criterion is that an advisor should suit the trading strategy employed by a trader. In such a case, the trader will have a clear understanding of the software algorithm, so they will have no difficulty in adjusting its settings.

- The money and risk management strategies employed by an advisor should suit the trader's strategy. The higher the bot profitability, the higher the risks. So, if a trader intends to get big profits, they should be ready to incur hefty losses in case of a losing trade.

- An expert advisor should work independently of any brokerage company. If a trading robot can operate only with some particular broker, it means that the provider of this bot profits from referring clients to that broker but not from profitable trades by the bot.

- There should be detailed guidelines from the bot developers.

- There should be contact with the seller/provider of the bot. Ideally, developers should sell their product on their own in order to provide the detailed information first-hand. In addition, if the seller has nothing to hide, they will gladly answer all questions and provide any necessary information.

- Expert advisors should be first tested on a demo account. Before a trader starts using a bot on a real account, they should make sure that the bot is really efficient.

Free trading advisors

Many users, especially those new to algorithmic trading, want to save money in the early stages. And few are willing to invest a large amount of money right away in something that is new, unknown, and unclear.

That's why they download free programs that promise high profits in a short period of time. However, it doesn't always turn out exactly as advertised.

There are free advisors that are already built into trading platforms. Consequently, users gain access to them simultaneously when downloading and starting to use the trading platform.

In such cases, one can expect these programs to work more or less steadily and reliably. Although it should be understood that free programs are mostly universal and may not be as profitable as paid options.

As a rule, these are time-tested advisors that won't cause significant losses for beginners. They are based on minimal risk, but the profitability is also not very high.

At the same time, free bots that are widely available online are often demo versions or pirated copies of paid programs. That's why they can produce poor results or work incorrectly.

Furthermore, advisors can become outdated if they don't undergo timely upgrades, so even a previously successful bot may provide poorer results over time. This problem primarily applies to free programs.

Therefore, it is important to carefully study ratings and read user reviews before downloading and using a particular robot. It is crucial to pay attention specifically to reviews about the bot's performance on real accounts, rather than on demo or strategy tester accounts.

How to pick the most optimal advisor

To avoid disappointments when using trading advisors, it is important to know how to choose them. With a wide variety of offerings available on the internet, it can be challenging to find the right one.

Furthermore, one key aspect of ready-made computer programs is that they are standardized. In other words, they do not take into account the unique trading strategy of each individual user.

Therefore, to use them successfully, it is necessary to study the algorithm of the advisor's operation and the strategy it is based on. Additionally, a trader may need to adjust the settings depending on the assets being traded.

If a user is not willing to delve into the specifics of the advisor operation and is unfamiliar with its settings, it is possible that the bot may turn out to be ineffective and generate losses instead of profits.

However, since most users, especially beginners, are not familiar with the intricacies of using bots, misunderstandings and dissatisfaction among traders arise when the program fails to deliver the desired results.

In reality, a robot can work quite successfully if used correctly. It just requires some effort to understand its peculiarities, test it thoroughly, and only then begin using it on a real account.

Still, even this is not the ideal way to use trading advisors. The best outcome in trading can be achieved with a robot that is specifically designed for the particular trading strategy of an individual user.

There are two main approaches to obtaining such a program: either creating it independently or outsourcing its development to third-party providers. We will discuss this further in the next section.

Where to get a reliable advisor

Ideally, Forex trading advisors with only positive reviews are the ones created by the traders themselves. After all, in such cases, all the nuances of the user's trading strategy, preferences, and wishes are taken into account.

Modern trading platforms allow users to independently create customized technical indicators, scripts, and trading advisors.

Technical indicators enable market analysis but are not intended for trading. Advisors, on the other hand, can not only analyze but also make decisions on opening trades. Scripts are used for performing one-time operations.

Moreover, platforms provide ready-made templates that can be used when creating custom bots. Trading platform also offer detailed instructions and educational materials that can help users attempt to develop their own advisors.

However, not all traders possess programming skills, even at the basic level. Therefore, many of them have to turn to external organizations or individual developers.

During this process, some misunderstandings can arise between the client and the developer, as they see the same things from different perspectives. Traders view everything from a trading standpoint, while programmers approach it from a development standpoint.

Nevertheless, they need to communicate and understand each other in order to achieve a good result. To facilitate the interaction, the user needs to provide a technical specification from the start.

This document should include all the crucial points that the developer needs to consider when creating the advisor. Additionally, it is essential for the trader to have a clear understanding of the fundamentals of their trading strategy, which will be incorporated into the bot's functionality.

How to order the development of an advisor

If a trader decides to order the development of a trading bot, there are several options available on where and how to do it. The first option is individual programmers. This option can be one of the most budget-friendly choices.

It is possible to find novice developers who may agree to do it for free or for a symbolic fee to gain experience. However, there is a risk of receiving a program of subpar quality, which can be caused by the developer's lack of experience.

Additionally, one may encounter scammers who disappear after receiving full or partial payment. Tracking down such programmers is very difficult, as they know how to cover their tracks well, so there are virtually no chances of recovering the funds.

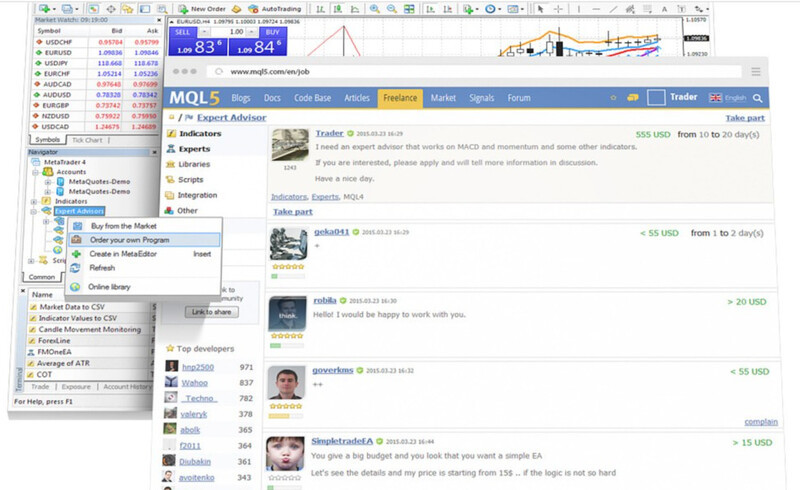

The second option is to approach specialized trader websites that act as intermediaries between clients and developers. Trading platforms themselves often have relevant sections for this purpose.

Such websites or platforms act as guarantors of the reliability of both parties in fulfilling their obligations. They also serve as arbitrators in case of disputes.

The third option is to use the services of hosting providers. Besides providing hosting services, these organizations also engage in software development.

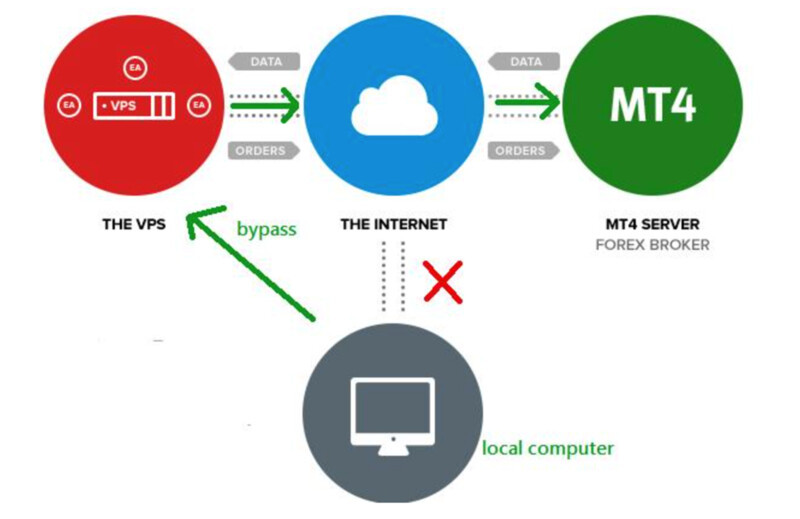

In addition to renting a VPS server, which is necessary for automated trading in any case, users can also receive an additional bonus in the form of a trading advisor.

It is important to note that such programs are often cheaper than ones ordered on specialized websites. However, this is not their only advantage. Other benefits include:

- A user can control all processes.

- The ability to adjust the advisor's operation.

- Stable and high-speed internet connection, ensuring uninterrupted bot performance.

- Access to the server from any device and from anywhere in the world.

Rules and tips for working with trading bots

We have already discussed at length that the satisfaction with the operation of forex advisors and the reviews of their performance largely depend on the accuracy of the bot selection and its subsequent use.

We have compiled the main guidelines for working with trading advisors in one section that can ensure successful and efficient trading.

1. Don't fall for advertising and empty promises. Free advisors often turn out to be unlicensed copies of paid programs or some demonstration version that lacks full functionality.

2. Before using any advisor on a real account, regardless of whether it's paid or free, test it on a demo account.

3. Almost all bots are created for specific markets and trading with specific assets, which should be taken into account. Therefore, it's always necessary to test the robot before using it and adjust its settings if needed.

4. Always study the guidelines and recommendations for trading bots. They are written by authors who have extensive experience with the program and know its peculiarities.

5. Study the principles of the advisor operation. It's important to understand how it works, what tactics are embedded in its trading strategies, and what its pros and cons are.

6. For uninterrupted bot operation, it is advisable to use VPS server services. Though it is a paid service, it will protect your account from losses in the event of sudden power outages or internet disconnections.

7. Additionally, companies that provide VPS also offer services for developing and providing trading advisors.

8. Ideally, if you have sufficient knowledge and skills, try developing a trading robot yourself. In that case, you will be confident that all the nuances of your trading strategy will be taken into account and reflected in the advisor's operation.

9. When working with a robot, try to withdraw profits as frequently as possible. No matter how reliable the advisor is, it can eventually experience a malfunction and result in losses. If you avoid keeping a large sum in the account, you will be protected from significant losses.

Conclusion

In this article, we have examined the principles of operation and the main types of trading advisors. User dissatisfaction with bot performance can be caused by a number of reasons.

The negative reviews from traders are usually related to those Forex exper advisors reviews that do not function correctly, fail to generate desired profits, or cause hefty losses. However, the problem does not always lie solely with the programs.

In fact, users themselves make a number of mistakes when using trading advisors. In most cases, they just don't understand how the program works and what trading strategy it is based on.

Each advisor is developed according to a specific trading algorithm, which includes certain trading rules. Besides, assets for trading, time frames, and other parameters should be factored in.

Traders need to reconfigure a trading bot before using it in different markets. Additionally, regular updates are necessary for proper functioning since the market is constantly changing, and programs can become outdated.

The ideal trading robots is the one that is specifically designed for a user's specific trading strategy. This can be done independently or by outsourcing development to third-party providers.

In any case, to avoid disappointment, it is essential to thoroughly study the principles of the advisor's operation, guidelines and recommendations for using it, and to test its performance on a demo account.

You may also like:

Back to articles

Back to articles