Creating expert advisor is not an easy task. Some traders do it themselves while others hire experts to help them create a trading robot.

Yet, a programmer is not a trader: they may not know some peculiarities of trading which may cause misunderstandings. We will talk about the issues that you may encounter later on.

Find out more about expert advisors, their functions, types, and all pros and cons in our article about Forex eas.

What are trading indicators?

First, let’s discuss what trading indicators are. Indicators help obtain information from the chart about the current market situation and possible developments. Indicators are mathematical computations based on specific data such as the asset price, trading volumes, etc.

Analysis carried out with the help of indicators is called technical, or mathematical, analysis. Every indicator is based on a certain mathematical pattern and a calculation formula.

Initially, these calculations were done manually but with computer advancement, they became automated, making the process of analysis much easier.

Each indicator has a certain function. Some of them spot and predict price movements while others look for potential reversal points.

Depending on their functions, indicators are divided into three main categories:

- Trend indicators are designed to identify the current trend and its potential reversal. This is a lagging indicator that helps evaluate the overall state of the market.

- Oscillators are leading indicators, meaning that they give signals before the potential price movement starts. They help predict the future price and are especially handy when there is no clear trend or when a new trend is forming.

- Volume indicators show the number of assets traded over a given period of time. This tool is usually used in addition to other indicators to confirm or filter out other signals.

One indicator is not enough to display a real situation in the market. Some indicators are lagging behind while others are moving ahead of the actual market conditions.

How indicators work

Every trading algorithm consists of three basic steps:

- Conducting market analysis which implies determining of the existing trend, possible reversal scenarios and so on;

- Looking for best entry points;

- Opening a sell or buy trade depending on market analysis.

Technical indicators should be used in the first two stages. The final stage of opening a trade is done by a trader or a trading robot. Indicators are not meant to open a trade.

Future success largely depends on how thoroughly you have analyzed the market. It is essential to figure out whether you are dealing with a trending market or a flat market.

To do this, different types of indicators are used. For example, lagging indicators confirm a stable and clear trend while leading indicators predict a new trend that is about to emerge.

They also help identify key levels, entry points, and levels for setting stop-loss orders.

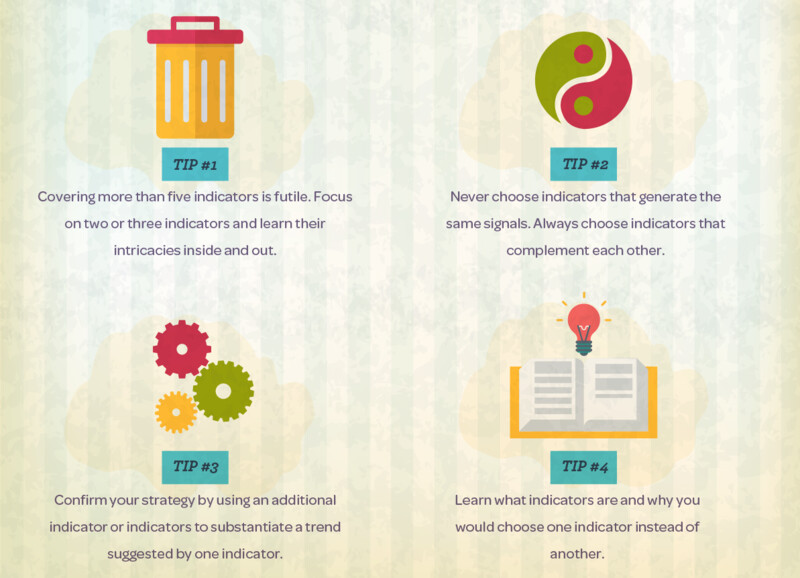

An indicator taken on its own can not provide a full picture of the market. Therefore, they should be used in combination with other indicators of different types.

For example, trend indicators should be used together with oscillators as the latter help filter out false signals generated by the first ones.

Volume indicators are commonly used in combination with other indicators and chart patterns to confirm the formation of a certain graphical model.

How indicators and EAs are related

Before creating an indicator-based trading advisor, you need to understand what indicators and EAs have in common and what their main differences are.

Their key similarity lies in the fact that both are some kind of computer programs based on a particular algorithm.

The main function of an indicator is to analyze current market conditions, while the main task of an creating expert advisor is to find the best entry points and even to open trades if programmed.

In fact, indicators and advisers complement each other. Above, we have listed three steps necessary to open a trade.

The first two steps are done with the help of an indicator, while the third step can be automated through the use of a trading robot.

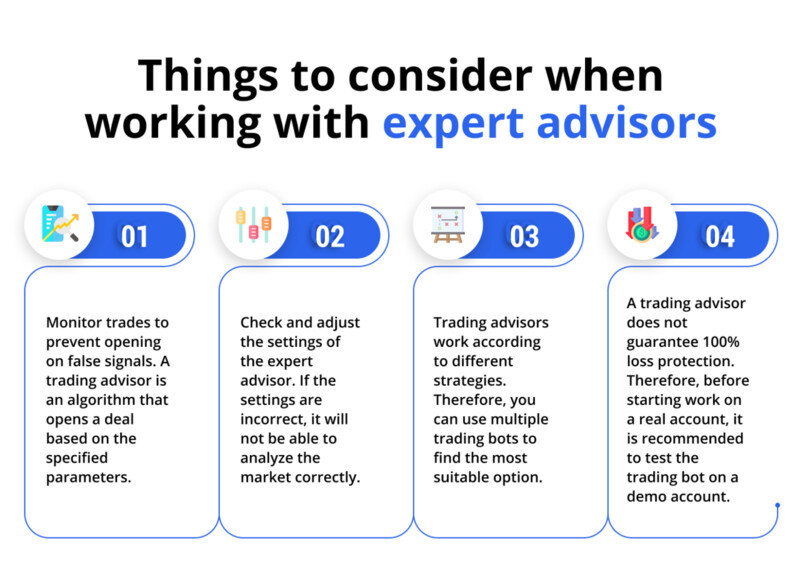

Notably, modern expert advisors can also conduct market analysis on their own thanks to the in-built functions of technical indicators.

As a rule, creating expert advisors are created for a specific trading strategy and apply a set of functions that are necessary for the effective running of the algorithm.

Different trading systems are developed in line with different trading preferences. Accordingly, a trader first needs to develop their own trading rules and put them together in a system.

Then, these rules are incorporated into the algorithm of the expert advisor, enabling it to trade the way a trader wants. However, trading bots are not flexible and can not adjust their strategy on the spot if market conditions change.

Creating EA based on indicators

Many traders find the idea of automated trading appealing as it saves a lot of time. Indeed, special trading programs can act on behalf of a trader in several or even all stages of the trading process.

Where can you find an effective creating expert advisor that will be based on a tailor-made strategy?

Beginners often fall for online ads and download free or paid trading robots. Their creators promise huge profits, minimal costs, and successful trades.

But is it really so? None of the existing robots can be viewed as a tool suitable for everyone. A particular expert advisor can not be perfect for every trader as it is created to meet individual trading needs.

So, the “one size fits all” principle does not apply here. Similarly, you don’t treat your illness by asking other people how they did it. That’s what doctors are for. They will prescribe a medicine based on your individual symptoms.

Likewise, trading algorithms should be customized in accordance with the needs of a particular user. Only then will they be effective for a trader.

How to create an Expert Advisor

So how do you get an expert advisor that fits you best? Experienced traders prefer to create their own trading robots based on their preferences and trading strategies.

You can either write a trading algorithm yourself or ask an expert to do this. Creating expert advisor on your own has some advantages. First of all, you don’t need any third parties to be involved, meaning that there will be no misunderstandings.

Yet, this option requires you to have some coding skills which is not for everyone. At the same time, modern trading platforms make this task so much easier.

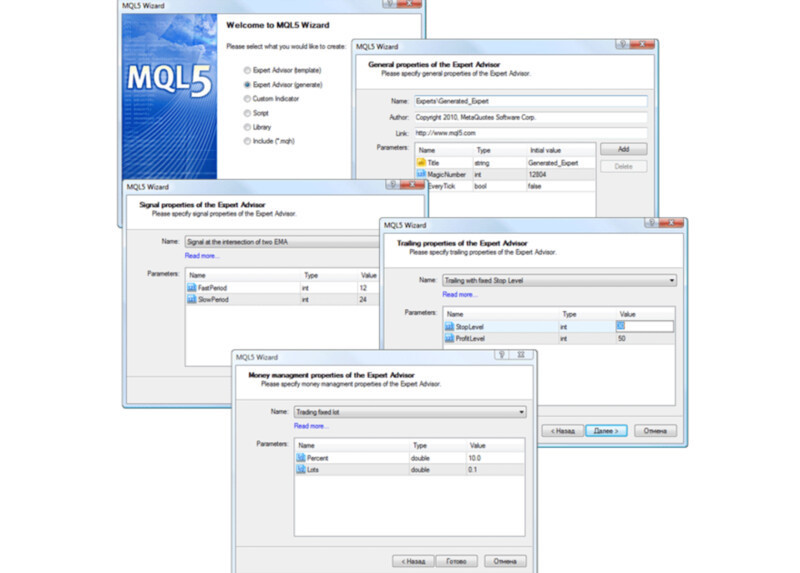

For example, MetaTrader 5 offers its users various ways to create custom indicators or trading robots. The platform has its programming language called MetaQuotes Language 5.

This programming language is believed to be very similar to С++. Besides, the platform features MetaEditor which allows traders to write and edit various trading programs.

MetaEditor allows users to create programs even without deep knowledge of coding. It has an in-built helper with ready-made templates and algorithms that can be configured with the required parameters.

The helper generates the code based on the set parameters. It also gives some tips and helps navigate the codes of trading programs.

MetaEditor also contains learning materials devoted to MQL5 programming. Besides, in its library, you will find all the necessary information regarding code writing and editing.

How to order a customized EA

Creating an indicator on your own may seem to be a challenging task. This is when professional EA developers come to the rescue as they can write an indicator-based trading robot for a certain fee.

Can you get a customized expert advisor for free? Actually, you can. Beginner developers can do it for you at a low price or even for free.

However, in this case, the development process may take much longer than expected. Besides, there is a risk of getting a code with errors since a programmer may not be experienced enough to work with trading algorithms.

If a trader chooses to order an EA from professionals, he/she must be ready to pay for this. Yet, paying more doesn’t always guarantee you a higher quality.

Follow these steps to order a trading robot:

- First, you need to develop a trading strategy or at least have clear-cut requirements for it, including market analysis methods, principles of defining entry points, and conditions for opening and closing trades. Don’t forget about money management;

- Prepare a detailed specification for a developer and set out all the principles and requirements of your strategy;

- Clarify all the details with the developer to make the task clear;

- After you make an advance payment, the developer will start working on your order;

- Usually, you will first get a demo version that you may test and check whether it meets your requirements;

- If you are happy with the product, you pay the rest of the sum and get the full version of the program and the initial code;

- Some developers offer post-sale support, meaning that you can ask for help if something is wrong with the expert advisor.

How to find a good EA developer

Where do you find a programmer who will write a high-quality trading robot?

One way is to look for them online but this can be risky as you may fall for a scam and be left without money and an EA. There are more risks associated with third-party developers:

- A programmer can simply steal your idea if he sees its commercial potential. However, these risks are low since developers usually have no expertise in trading;

- Some users may not have programming skills so they won’t be able to check how well the code is written. The existing coding errors will be revealed only in the process of EA’s operation.

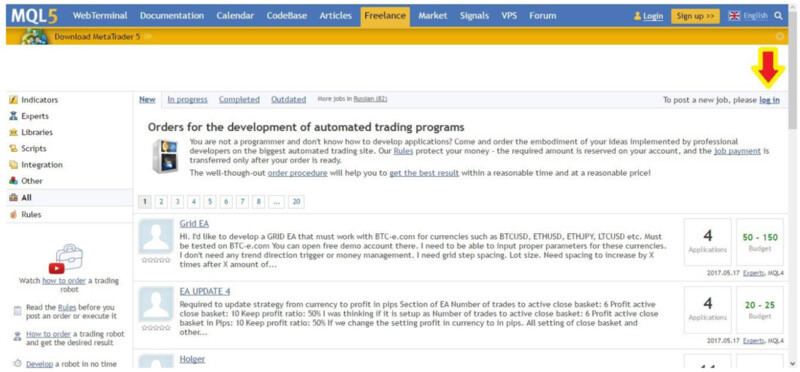

To avoid all the above-mentioned risks, contact only trusted developers. For example, the MetaTrader trading platform has a Freelance section where customers and contractors meet.

The advantage of finding a programmer on such websites is that the trading platform guarantees an honest deal. In addition, in disputable situations, the trading platform acts as an arbiter.

What should you consider when looking for a developer? You need to pay attention to several important factors:

- the total number of disputes and the share of disputes resolved in favor of the customer. If there are more than 10% of disputes and 50% of them are resolved in favor of the customer, then it is better not to contact such a contractor;

- the speed of the developer's response;

- rating and reviews about this developer from other users.

Pros and cons of EAs

We have talked a lot about how trading advisors make things easier for traders. However, they have not only positive but also negative sides. Let's look at them in more detail.

Here are some advantages of trading bots:

- High operation speed. Computer programs have much higher calculation speed compared to a human which enables them to get instant results;

- No emotions. Trading robots have no stress or panic. They are never tired and don’t need to have breaks. They can even operate around the clock if needed which is their biggest advantage;

- They save your time. Trading advisors take up most of the routine work, allowing a trader to devote their time to more complex tasks such as streamlining a trading strategy, testing new trading instruments, and so on;

- Flexible settings. You can change the settings of your EA every time market conditions change. Besides, trading bots can be adjusted to a particular trading instrument.

Expert advisors have some disadvantages as well:

- They are unable to conduct fundamental analysis. Trading robots can not assess the influence of economic, political, or financial news or corporate earnings reports on the price dynamic of an asset. Only a human can do this;

- Possible failures in rapidly changing conditions. A program follows an algorithm that is based on certain market conditions. In the case of unexpected changes, an expert advisor may not be able to adapt to them;

- It is really hard to create an effective trading bot. If you want a program that factors in all the nuances of trading and brings profit, you need to take this task very seriously. At the same time, neither you nor a professional developer can guarantee there will be no mistakes;

- Constant updates. All computer programs including expert advisors tend to become outdated. Strategies and trading approaches are constantly changing. So, traders need to update existing robots or buy new ones.

Automated vs manual trading

No matter how effective trading advisors are, they still have a number of limitations that developers are not yet able to overcome. Computer programs lack the flexibility of a human mind which is also required in trading.

That is why experienced traders do not rely fully on bots but rather use them together with manual trading. This means that some functions of market analysis and preparation for opening a trade are delegated to a trading robot while the rest is done by a trader.

Trading robots have no intuition and can not adjust to a changing environment. Therefore, a trader needs to be tuned in to the trading process by conducting fundamental analysis and adjusting the expert advisor in accordance with incoming data.

Many professional traders prefer to use trading bots that are partially automated. They can quickly perform technical analysis based on the given parameters and generate signals when a good entry opportunity appears.

Yet, the decision to open a trade is made solely by a trader who sees the full picture. If they consider the signal reliable, they open a trade. Otherwise, they keep waiting for the next trading signal.

For successful trading with an EA, you need to be involved in the trading process although correct code writing and development is also important. The involvement means reconfiguring the robot from time to time, monitoring news and market events, and relying on your experience and intuition.

Final thoughts

Now you have gained an insight into how to create and use expert advisors - trading programs running on special algorithms that analyze the market.

As a rule, a trading robot is based on several technical indicators of different types that are meant to complement each other and confirm or filter out emerging signals.

Usually, trend indicators that are lagging by nature and oscillators that are leading indicators are used in combination with each other. Also, volume indicators are applied to confirm signals.

When considering trading automation, a trader needs to decide whether they want to get a ready-made robot or whether they can build it themselves.

Ready-made creating expert advisors can be purchased or downloaded for free but there is no guarantee that they will meet your needs. To be really effective, a trading bot should be customized to the user’s needs.

That is why many traders create robots themselves using special programs or editors or order them from professional developers.

To avoid misunderstandings and scams, use only trusted sources to find a programmer. Also, check customer reviews as well as the number of disputes and other factors.

You may also like:

Back to articles

Back to articles