Every trader has a couple of stories about situations when he or she faced a serious dilemma while trading. Perhaps, one of the most common dilemmas will be about support and resistance levels retest.

You can learn more about other ways of building levels in the article Trading Levels.

Most traders face this situation. At the same time, even professional traders sometimes fail to use it to gain guaranteed profits. For newcomers in trading, the level retest can be quite confusing.

However, even though deciding on a situation with a level breakdown is always up to a trader, today we will consider several rules that will help you decide whether you should trade during a level breakout or wait for its retest.

Understanding level retest

Let's start with the concept of level testing before we dive into the topic of level retest. Surprisingly, some traders do not distinguish between these two concepts, although the difference between them is considerable.

Thus, a level test in trading is understood as a reversal of the asset price from a certain level on the trading chart. With the help of the test, the market confirms that the tested level continues to work. Thus, if the price of an asset tested the support, traders would see a confirmation that the level fulfills its functions.

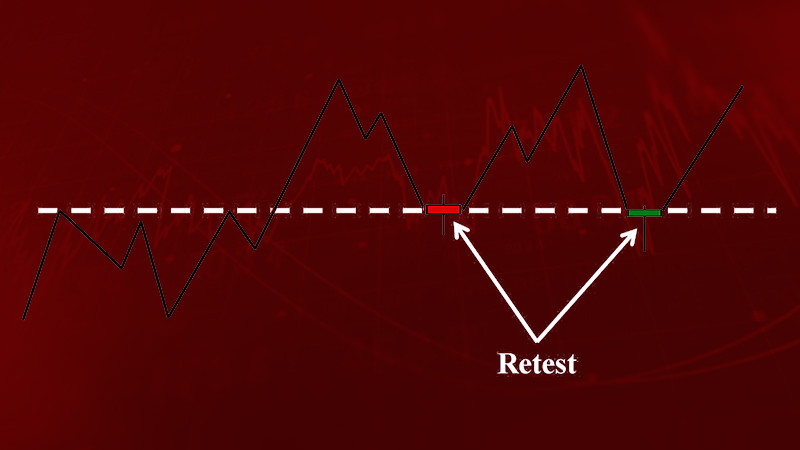

Hence, the concept of level retest is when the price of an asset retests a key support or resistance level several times. Thus, the price breaks through the trend line and returns below or above it.

It is not only about the secondary breakthrough of the level. Quotes often return to the key points three or even more times. At the same time, each of these price touches is considered a favorable opportunity to enter the market.

How a level retest is formed on a trading chart:

- The price breaks through the support or resistance line

- The price moves with the trend for some time

- The price reverses

- The price moves toward the previously broken level

- The price touches this line, followed by a reversal

- The price begins to move in line with the trend again.

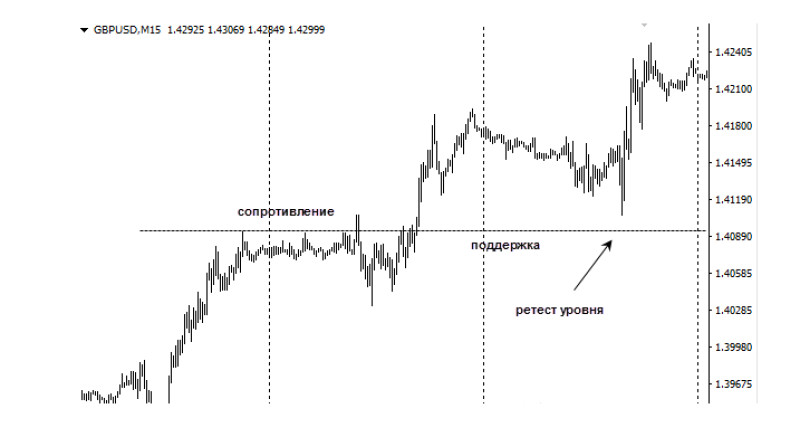

For example, let’s look at the pound/dollar chart. After holding at the level of 1.4090, the price broke through this level and moved upward. On the next day, a retest appeared on the chart.

Why does it happen? The whole point is that a retest is a kind of market reset that is necessary to restore the ever-changing balance between sellers and buyers. It is at key points that their interaction changes dramatically.

Every time traders buy or sell an asset, they expect the market to move in a certain direction. However, for the market to move in the desired direction, it needs a new set of positions opened by sellers or buyers.

* Support and resistance levels are horizontal lines drawn at price lows or highs. It is one of the basic concepts of the forex market. Without support and resistance levels, it is impossible to determine a retest on a trading chart.

How to build key levels?

First, you can use the Fibonacci lines*. Second, use indicators. However, it is important to remember that when choosing indicators, you run the risk of encountering lags*.

To determine the key levels, many market players have developed a way of using a kind of psychological marker next to the round values of quotes. Others choose pivot points*, which allow traders to take into account the range of prices of the previous day.

Finally, the trader's own experience can be a valuable help in determining the key points. It sounds vague and uncertain, but this option is considered the most reliable by professional traders. The fact is that many traders, thanks to many years of experimenting with trading strategies and working out mistakes, learn to find important levels accurately.

So, you managed to identify the level, then the price approached it, what now? There are two possible scenarios: a pullback or a breakout. In this article, we will dwell on the second scenario.

In the case of a breakout, traders face a question: should they wait for the best time to enter the market or should they start trading on the breakout?

Experienced traders are divided into two opposing groups. Some of them call to waste no time, to act aggressively, and to enter the market right on the breakout, while others say that one should be patient and wait for the retest. So which approach to choose?

You will not find a direct answer to this question in any professional trader's textbook or any video on YouTube, and, unfortunately, you will not hear it even in a conversation with a practicing trader. The point is that everyone has to decide for themselves whether they are willing to rush into battle and take all the risks, or whether they prefer the tactics of a beast lurking in the thicket, waiting for the price to fall back behind the breakout line.

* Fibonacci lines are the basic graphical levels of support and resistance. Using these correction and expansion levels, traders can analyze any asset and predict the future trend.

* Signals from most economic indicators are based on past price data. Such lags negatively affect both the amount of profit earned by the trader and the overall success of the transaction.

* Pivot points are turning points in the market, i.e. the central and adjacent levels, where the price changes its direction.

Common mistakes when trading with retests

Although a retest is fairly predictable. It occurs about 80% of the time. However, it is not as simple as it seems. It happens that traders miscalculate important levels while waiting for the retest of the key zone.

Let's try to study in detail the mistakes made by traders who are sure that the retest will occur. The point is that 80% is far from 100%.

That is, in 20% of the cases there is a probability that the retest breakout will not happen. Quite often, traders forget this and trade without setting stop-loss orders*, or set them too far away. Such unreasonable confidence in the correctness of their actions leads to losing trades. It looks especially tragic when in the process of trading a significant amount of investment is used by a trader.

* A stop-loss order is a type of protection order that a trader places to automatically close a trade. A stop-loss order helps to limit potential losses.

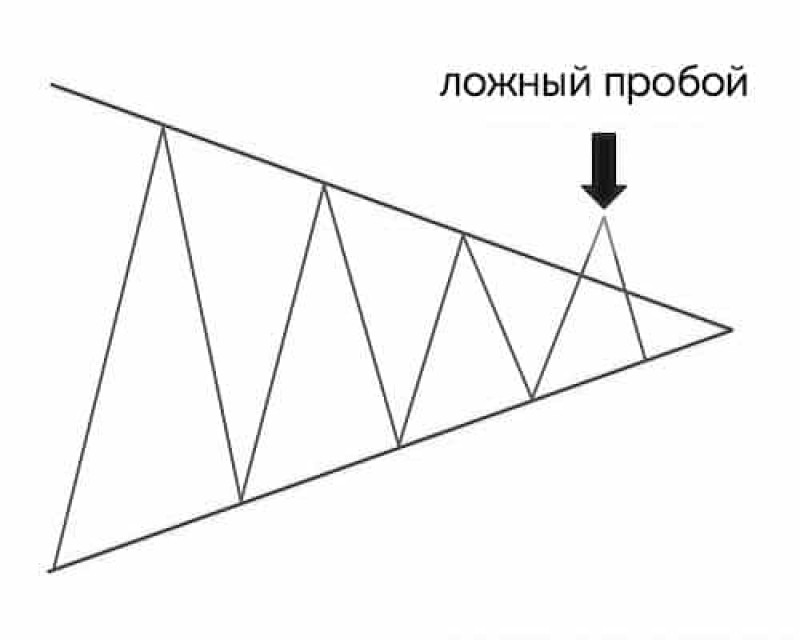

False breakouts

Another extremely unpleasant event in the process of waiting for a retest can be a false breakout. This term in the market refers to the phenomenon of price exit beyond the key level, which creates the effect of its breakdown. In this case, a false breakout is inevitably accompanied by the return of prices to the range, as a result of which they move in the direction opposite to the breakout.

In trading, false breakdowns are often used as trading signals by their participants. Their strength can be determined in the process of fixing on higher timeframes.

False breakouts appear after big market players enter the market. They create attractive conditions that force most traders to buy or sell an asset. In such a situation, big players build up their positions by collecting stop-losses of market participants. The market sharks then buy a financial asset at a cheap price. Due to the resulting price reversal, traders who opened in the direction of the breakdown are forced to fix losing orders. This, in turn, reinforces the counter-movement, which continues permanently under the pressure of fear from traders who have already managed to open positions.

Taking all this into account, we can conclude that a real breakout assumes that the price crosses the key level and fixes above or below it. Everything else is a false breakout. Unfortunately, it is quite difficult to predict a false breakout. First of all, this is because the price of an asset takes into account literally all factors. Thus, the release of important news or unforeseen events in the world can dramatically change the situation in the market.

Psychological aspects of trading with retests

We have studied in detail the dangerous market trap called "false breakout" that awaits traders who are just beginning to use level retests in trading. Now let's imagine a situation when everything is going according to plan, the market is not deceiving us and we are already calculating the amount of profit we are going to make thanks to the retest.

However, we should not be in a hurry. In the process of trading based on a retest, a trader can face a lot of unforeseen circumstances.

For example, the retest can last quite a long time after the initial breakout. In this case, market experts follow the movement of the asset simultaneously on the lower and higher time frames*. Sometimes, we can see the re-breakout on the lower time frame, while on the higher time frame, we can see a consolidation.

For example, if you prefer long-term trading, you need may wait for the re-breakout, dragging on for several weeks. Moreover, it may never appear on the chart.

The opposite situation is a fast retest, which happens so sharply and quickly that the market may simply not notice it. Most often it happens against the background of important world news.

Considering all the above, it is important to understand that the level retest is a process that is impossible to plan. It works according to its own rules and not according to the trader's scenario. There is no guarantee of a successful trade and profit.

This means that by choosing a trading strategy based on waiting for the retest, you can miss an entry point. This strategy can be as well thought out as possible and contain detailed instructions for action, but the market will still have the last word.

All of this is important to consider when answering the question: should you trade immediately on a breakdown or wait for a retest?

By the way, the trading style you have developed can be a clue to answer this question. Trading based on waiting for a retest depends largely on the trader's personality, character, and goals in trading.

That is, a strategy that one trader chooses may be completely unprofitable for another. It is important not only to find a trading strategy that works but also to make sure that it fits your personality type and trading style.

How do all these psychological aspects relate to trading based on waiting for a retest of a key level? Quite simply!

For some traders, the main goal of trading is to seize every opportunity without wasting a second. They act according to the principle: "Do not retreat, but advance". Such players enter the market immediately after the breakdown. This is a more aggressive style of trading, which involves additional risks.

However, the size of the potential profit is more than attractive because breakdowns are excellent trading opportunities. Breakouts often trigger new price movements and trends, allowing traders to enter a potential new trend at its very beginning.

In addition, true breakouts tend to occur when there is strong price momentum and traders are trying to maximize their profits from rapid price movements.

More cautious traders choose the strategy of patiently waiting for the retest. Only after waiting for the price to break through an important level again, they decide to enter the market.

It is important to note that even such a well-considered behavior of a trader does not guarantee him infinite profits and the absence of losses. After all, while waiting (sometimes for a very long time), many attractive trading opportunities are missed. This is the price of waiting for retests. However, once you have decided to follow this strategy, it is important not to act impulsively and to remain as calm and confident as possible.

The choice of trading style is therefore a personal decision that a trader makes based on previous trading experience, personal characteristics, and goals. Whether you choose to trade a breakout or wait for a retest, a reasonable risk/reward ratio should remain the main guideline.

* A timeframe is a time interval used to group quotes in the process of building price chart elements of a trading asset.

Pros and cons of level retest strategy

Traditionally, trading by waiting for the retest is considered a guarantee of low risk for the trader. Firstly, such a strategy allows you to accurately determine if the breakout is real before opening a trade. Second, it provides low stop orders placed near important support and resistance levels.

Thirdly, it is a fairly simple indicator-free strategy that traders can use as a reliable signal to enter a trade. The ability to trade pending orders can also be considered as an additional bonus.

Another important advantage of trading with retests is the absolute lack of restrictions on the choice of trading instruments. You can use this strategy for any asset, in any market, and within any timeframe. In addition, it works independently, as well as in combination with other trading strategies.

Traders who have studied the principle of retest trading well, often set a short stop-loss order, which in turn allows them to further reduce risks and protect themselves from making losing trades.

Moreover, the strategy provides an opportunity to enter a trade at very attractive prices.

However, there are risks associated with this strategy. Often the retest strategy leads to a significant loss of potential profit because the price does not always return to the broken level. Such a problem occurs in the market during a strong trend movement when the breakout is so strong that the price immediately goes in the direction of the trend. In this case, traders are deprived of the opportunity to open a trade.

Another disadvantage of this strategy is that it rarely sends signals. In addition, if you decide to trade with the help of the level retest strategy, you can often face the problem of lack of a clear signal to exit the transaction. That is why professional traders recommend supplementing the strategy with several indicators.

Great myth about retest strategy

There is still a strong belief among traders that the more often an asset price tests a key level, the stronger it becomes. This is not true. Surely, multiple tests of the same level indicate that it is quite significant. However, this is no guarantee that the level will hold quotes indefinitely. This is where the psychology of market participants comes into play.

Let's start looking at the situation from the support level. If the quotes of an asset are constantly trying to break through it, it means that the position of the sellers is constantly strengthening, their attack on the market is getting stronger and stronger, which means that sooner or later the sellers will get the upper hand.

Usually, the support can hold the price for a long time, as it is profitable for large sellers to keep the price high until the orders are not filled. In this way, they keep the price from falling and form a support.

At a certain moment, the orders will be executed, the interest of the big market players will be closed and they will step aside. Immediately after that, the price will begin to fall steadily and the support level will be broken. The situation will be similar to resistance.

In conclusion, resistance and support levels are certainly important price benchmarks that help traders choose the most successful moment to enter a trade. Therefore, trading strategies based on them can be called effective. Meanwhile, there is also a risk behind it.

The market is organized in such a way that sooner or later its quotes will overcome any key segment. This means that every next attempt to break through will weaken the support and resistance levels. Therefore, they should not be used as a magic pill for all problems, but only as temporary trading benchmarks. At the same time, it is important not to forget to place reasonable stop orders and take into account the strength of the level.

Conclusion

The level retest strategy is fairly common in trading, and many market players have learned to use it to gain profits. The main rule for those who have decided to use the principle of retesting is not to rush to open a trade. It is important to correctly assess the market, identify its state, and try to predict further steps of traders and their possible emotional reactions. Only after this, you can open a trade.

If you are not a supporter of a psychological approach to trading, you can use technical indicators to determine further market behavior, which will help you to determine what will happen next: a sharp end of the global trend or its continuation.

The most common of these tools are considered to be trend indicators, chart patterns, and candlestick combinations.

Remember, no matter what trading style you choose, the risk/reward ratio should always be the key factor in deciding whether or not to wait for a retest.

Back to articles

Back to articles