It is hardly possible to become a successful trader without some prior background. Trading course in financial markets is not a lottery or a casino game, so you shouldn’t count on luck.

In order to engage in trading and earn real income from it, you need to go through several stages. One of the most important stages is training. There are various options for learning to trade, and we will talk about them in more detail in this article.

You can learn more about the very concept of trading, its key features, all stages of a trader’s career, and specifics of selecting a broker and trading platform in the article What is a Trader.

Trading course

There is a well-known formula in the service sector, which consists of three components: price-quality-speed. So, two components from this formula exclude the third.

For example, if you need it quickly and efficiently, it will be expensive. If you need cheap and high quality, it will be slow. And if you want it quickly and cheaply, then most likely it will be of poor quality.

This formula can be also applied to trading education. If you choose the path of high-quality but cheap training (looking ahead, it can be completely free of charge), then the process will be quite long.

If you choose a shortcut, but without compromising the quality of training, you will have to pay for it, and perhaps a lot. If you try to learn quickly and cheaply, you can most likely say about the loss of the quality.

Now, let’s look in more detail at why you can’t learn to trade both quickly and cheaply. It is especially true if we consider trading a profession, the main occupation, and the main way to earn money.

As in every profession, you need to spend a lot of time to understand all the intricacies. There is an opinion that to become a professional in any field, you need to spend at least 10,000 hours of study on it.

10,000 hours is a lot of time, but you will hardly be able to achieve mastery in trading the financial markets in less time. Moreover, in some cases it may take even longer than the indicated time.

This involves not only gaining theoretical knowledge but also gaining practical experience. Without these two components, successful trading is simply impossible.

Learning trading

Before you start trading, you need to complete several mandatory steps. One of the first is learning, and there are quite a lot of options for exactly how you can learn.

Moreover, there are options that can be completely free or for a minor fee. However, basically, they involve independent learning which will require a considerable amount of time and effort from a person.

1. If the user does not have enough free funds, you can try self-education. Today you can find a mine of information on any topic on the Internet, including trading.

A large number of articles are freely available. The main disadvantage of this strategy is that anyone can post information online, so you may encounter incompetent authors and receive unreliable information.

Thus, a person may receive information that will not correspond to reality and learn to trade incorrectly or conduct incorrect analysis. As a result, the lack of knowledge will lead to a quick loss of your deposit.

2. Books are a more reliable source of knowledge. Their authors are well-known experienced traders who have come a long way in this matter and who really have something to share with beginners.

The information in books will definitely be reliable. The only nuance that you need to pay attention to is the language and the manner of presenting the material. For beginners, information should be presented in the simplest and most understandable way.

Paid training

So, if a potential trader still has some savings that they are willing to spend on training. There are also some options on a paid basis.

1. One way is to purchase paid courses, lectures, and webinars. They are organized by successful traders, some even create their own trading schools.

Among the wide variety of such courses, it can be quite difficult to choose “the right one”. Many authors allow you to take the first free lesson, which will help you understand whether this option is right for you or if you need to look for something else.

2. When choosing a trading course intermediary, you need to check whether the brokerage company provides training opportunities. Many brokers offer training for free if the user opens a live account.

Often on the broker’s website, you can find not only educational articles and videos, but also other information necessary for a trader. These can be online market quotes, analytical articles, trading schedules, and much more.

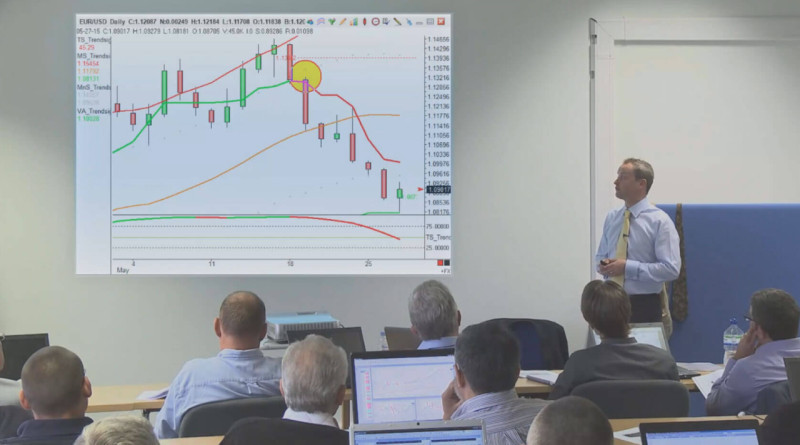

3. You can also consider an option such as personal mentoring or workshops. All courses and lectures are held in a group format and may not provide answers to exactly the questions that interest each individual user.

In the case of individual tutorials, a person receives exactly the information and assistance that is needed. This type of training can be used after you have acquired the basics and a good theoretical background for trading.

Types of training

Various training courses and lectures on trading can be classified according to several parameters. In addition to the fact that you can divide trading training into free or paid, as mentioned above, there are other options.

So, depending on the initial level of knowledge, they distinguish:

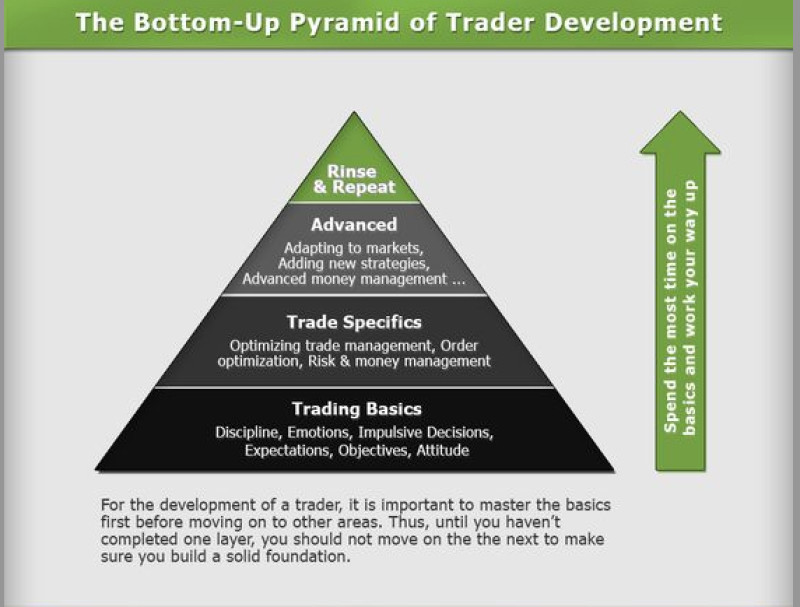

1. The basic course is required for those who are starting to learn trading in financial markets for the first time and do not have any knowledge in this area. At this stage, users learn the most important concepts, study trading tools, and receive other information.

2. The advanced course is the next stage, which includes a more thorough immersion in the topic of trading. As a rule, such courses are conducted in small groups. The main topics include the psychology of trading, the operation of financial markets, and consolidating skills and abilities.

3. Professional training is suitable for those who want to make trading their job and main source of income. The result of this stage should be the development and fine-tuning of your own trading system.

Depending on the lesson format, we can define:

1. Online learning is the most popular form nowadays. You can receive information anytime and anywhere. Oftentimes, when you purchase courses or webinars, they are available for some time to watch or listen to as recorded.

2. Offline training. Some people require the opportunity for personal direct contact, so training in a traditional format is more suitable for them. This method is considered the most effective as attending face-to-face classes disciplines the person.

Depending on the number of students:

1. Personal training is most effective because it is completely customized to what a specific person needs. A trainee is assigned a personal coach who can advise and help in resolving any issues. On the other hand, it has a much higher cost than group classes.

2. Group training also has its advantages, such as the opportunity to collectively discuss issues, receive additional ideas from other participants, and lower cost compared to personal training. However, with this format, less attention is paid to each individual student.

Stages of becoming trader

If a person is determined to become a trader, he/she will have to go through several stages.

The first stage is training which can take from several weeks to several months, depending on the chosen method. This stage ends when the user has gained a good theoretical basis, practical skills, and has already opened an account with the chosen broker.

A trader does not have to cooperate with the same broker in the future. You can compare offers from different companies and choose the most suitable conditions for each period of your activity. However, the first mediator will forever remain in your memory as the first teacher.

The second stage, which we have already touched upon, is the selection of a brokerage company. Selecting an intermediary is a process that can extend throughout a trader's career. Their needs and preferences change, and along with them, the requirements for the broker.

Apart from choosing a broker, at the second stage, you should also select the assets that will be traded. This is an important point since different brokers may offer different conditions and charge different commissions for particular instruments.

The third stage is making the first steps in real trading, which can last for several months and sometimes several years. This stage can be called a “trial period” since it will show whether trading is suitable for a particular person and whether he/she can cope with this.

It is during this stage that the trader should develop their own strategy. Initially, you can use ready-made algorithms from the Internet, but later you need to develop your own strategy and strictly follow it while trading.

This stage can be considered completed when a trader ensures a stable growth of a deposit and drawdowns do not exceed 5%. In order to better track changes in your trading balance, it is better to keep records of transactions and periodically analyze the results obtained.

The fourth stage is improvement. This stage can last indefinitely. You can constantly enhance your trading strategy, look for options for automation and performing some tasks with trading bots.

At this stage, trading should bring the user not only the desired income, but also satisfaction from the trading process itself. If you can achieve this state, you may affirm that you have mastered trading.

How to become professional trader

In order for trading in financial markets to become the main occupation and profession, training must be at the most in-depth level. The main thing is not to perceive this activity as a game or a lottery. You should not rely only on luck.

Firstly, you should know and remember is that trading is a job like any other. Thus, to achieve a good result, you will need to spend a full day on this work. Trading course in between your day job will not make you a professional.

Secondly, planning plays an important role in professional trading. It is necessary to have a clearly elaborated trading plan, daily work planning, and sources of information.

Thirdly, what distinguishes a professional from a beginner is tight control over emotions. The main enemies of any trader are fear and greed. Fear of losing money leads to moving or removing Stop Loss orders. Greed prevents you from closing trades on time in the hope of making more profits.

Fourthly, every professional knows how to manage risks. Experienced traders know how many trades they can open in a certain period of time and how much to bet on one trade. A good reward-to-risk ratio is considered to be 3 to 1.

In addition, a professional always trades only with his own money. Pros never take out loans to trade, do not trade with their last money, and do not use too much leverage.

Fifthly, experienced traders are well versed in market analysis and can carry it out on their own using various tools. Only novice traders rely on ready-made analytical reviews.

In addition, the pros are constantly improving because they know that financial markets are a dynamic industry in which changes pop up constantly. You need to constantly upgrade your skills by attending lectures, seminars, and communicating with other traders.

What does training consist of?

Training in any profession and any business consists of two main components: the theoretical aspect plus practical skills. Without mastering the first, it is impossible to move on to the second.

Therefore, let's start with what is included in the theoretical block of knowledge in trading in financial markets.

1. Basic knowledge of the key concepts in trading. The user needs to master all the terms that are used in this area in order to easily read and understand analytical reviews and other important information.

2. Studying the features of various trading instruments. There are a huge variety of them: currency pairs, stocks, cryptocurrencies, bonds, stock indices, precious metals, as well as derivatives.

3. Skills in working with the trading platform, which includes setting up the visual component, using calculations, using analysis tools and other terminal capabilities.

4. Risk management techniques include searching for the most successful entry points into a position and closing transactions, determining the lot volume per one transaction, the ability to recognize a potentially profitable transaction from an unprofitable one, and so on.

5. Market analysis skills include various techniques: fundamental, technical, graphical, and their various combinations. Technical analysis is based on indicator readings. Fundamental analysis is based on news and its impact on the price of an asset. Graphical analysis is based on readings from the chart itself.

The practical part of the training means the actual managing transactions. It is best to start doing this on a demo account. This is what we will talk about in the next section.

Training on demo account

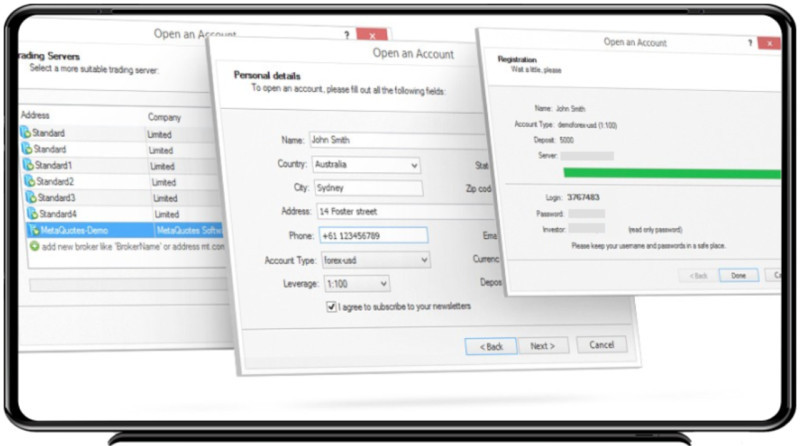

A demo account is practically no different from a real one. Therefore, trading training on a demo account is very close to real trading, with the only difference being that the user does not lose real money.

Otherwise, a complete feeling of real trading is created since the trading platform and managing transactions on a demo account look exactly the same as on a live account.

When opening a demo account, a certain amount of virtual funds is automatically credited to the user’s account, which can be used for trading. All quotes and other trading tools are available.

Trading using a demo account gives you the opportunity to gain the most valuable thing: practical experience. If you skip this stage and start making mistakes on a live account and losing real money, you can become disillusioned with trading and give up this activity completely.

Therefore, it is better to start trading on a demo account. This will allow you to test the selected or created trading strategy, as well as the operation of automated programs.

Plus, you can study and check all the conditions that a particular broker offers. Besides, it is possible even to open accounts with different firms and compare their conditions to understand what suits a particular user best.

The only trap is the psychological aspect. There is no correct perception of risks because a person understands that he will not lose anything. It is very important that this feeling does not transfer to trading course on a live account.

In addition, the execution of orders may differ slightly on a demo account from a real one despite the fact that the account settings are the same. However, as a rule, account data is hosted on different company servers.

How to open and use demo account

The opportunity to open a demo account is provided by most brokerage companies. Moreover, it is provided completely free of charge to both new and existing clients.

When opening a demo account, the user does not have to go through the registration and verification process as with a live account. Therefore, if a person is concerned about the safety of personal data, he/she can enter a fictitious first and last name, as well as contacts.

There are two options for opening a demo account: on the website of the trading platform itself or on the broker’s website. While trading on a demo account, you can at the same time test the work of the brokerage company’s support service and other trading conditions of the company.

You need to start trading on a demo account by trying to open and close positions. Learn to determine in which direction the price is moving and what impact this may have on the result of the transaction.

However, simply opening and closing positions is not trading. For successful trading, you need a trading strategy that includes a set of rules for entering and exiting a position, setting protective orders, and so on.

First, you will need to select a ready-made trading algorithm, which can be easily found on the Internet. The main thing is to understand its essence and grasp the basic principles of operation.

Subsequently, you need to try to develop your own trading strategy, which will be more consistent with all the individual characteristics of the trader.

How long you should practice on a demo account is a question that is quite difficult to give a straightforward answer to. What matters is to pay attention not to time, but to trading results.

When a trader manages to trade consistently on a demo account, this is a signal that he can switch to a live account. Trading smoothly means not just opening and closing transactions, but also gradually increasing your balance.

Advantages of trading on demo account

Using a demo account is one of the important stages in the trading process. Learning is easier when you try everything out in practice. However, this type of trading has not only advantages but also disadvantages.

The positive features of a demo account include:

• An opportunity to hone and test your theoretical knowledge and skills in practice. This is especially important for those who are starting to trade for the first time and have no idea how this process works.

- No risk of losing money. Since trading is carried out with virtual money, the user does not risk anything and can afford to try different trading strategies and make mistakes without worrying about lost money.

• Training in the basics of money management. When trading on a demo account, a trader learns to correctly distribute his/her capital, that is, determine how much to trade, how much to bet on one trade, and so on.

• Emotional control. It is very important for a trader to learn to manage his/her emotions when making transactions. It is necessary to get rid of overly emotional reactions to both profitable and unprofitable transactions.

- Training to work on a trading platform. While trading on a demo account, you can study all the aspects and specifics of the trading platform so that you can easily find all the necessary tools without wasting precious seconds on this while making real transactions.

• Ability to test new algorithms and advisors. This option is used even by experienced traders when they are developing a new strategy or launching a trading bot. Before launching a strategy or bot on a live account, it is better to test it on a demo version.

Disadvantages of using demo account

We have already noted the main advantages of using demo accounts in trading. Now let's look at the disadvantages of demo accounts. Among the negative aspects of training accounts are the following:

• Limitation on validity period and amounts. Most brokers limit the time you can use a demo account, as well as the amount of funds on it. This account cannot be replenished or withdrawn with earned funds since they are virtual.

• Trading on a live account has some differences. It often turns out that orders are executed more slowly on live accounts, so slippage may occur. Therefore, when trading on a live account, the speculator may get lost if he finds himself in such a situation.

• Using too much leverage. On a demo account, you can make transactions with a high leverage, but on a live account, this may result in the loss of your entire deposit. Thus, incorrect habits in the use of borrowed funds are formed.

• Risk tolerance. Since demo trading does not lead to real losses, traders try to make riskier trades. Subsequently, they transfer such strategies to their live account, which leads to losses of real money.

- Tighter spreads. In order to attract clients, brokerage companies can specifically set a lower commission when trading on demo. However, after switching to a live account with the same broker, the trader may face higher commissions.

• Emotional reactions. No matter how traders learn to manage their emotions when making trades on a demo account, they will learn the most significant lessons precisely at the moment when they lose or earn their first real money. This experience cannot be replaced by any simulations or demo accounts.

Another opinion

In this article, we talked a lot about the different ways and stages of learning to trade. However, there is an opinion that training does not actually work.

Let's take a closer look at the preconditions for this opinion. For a start, training itself is necessary for every newcomer in any field, and trading is no exception.

Recently, education, various courses, and training have become a business. You can often come across advertisements on the Internet, offering some wonderful course or training that will allow you to make a profit immediately.

Given that trading is becoming increasingly popular, more and more people want to learn how to trade. Thanks to advertising, it seems to them that it is really very simple: you can take one course and trade successfully.

But in reality this is not the case, and any savvy trader will confirm this. For this reason, many novice traders come to the market, confident in themselves, but very quickly lose their deposit and also begin to think that trading is not suitable for them.

You need to understand that in financial markets, theory is only part of the training. At the same time, the other part, larger and more important, is practical experience, developing trading skills in a practical way.

Therefore, even with a lot of theoretical knowledge, taking several courses or reading dozens of books, a person cannot become a successful trader. However, this does not negate the fact that you still need to study and comprehend the basics of trading.

An intermediate link between theory and practice is getting to know successful traders and reading their biographies. You can study trading strategies of experienced traders, how they open and close positions and other details.

Tips for beginners

Starting any new activity is not easy, and trading course is no exception. But there are some tips and rules that will help you quickly master a new activity. We have tried to collect such tips for you in this section.

1. Decide on your goals and capabilities. If you can afford expensive training and want to get the most in a short time, choose top traders and buy their courses, learn from those who openly show their results in trading.

2. If you cannot afford paid training, study the theory yourself. However, remember that you need to be able to filter information. It is better to study trading from books than from articles by dubious authors on the Internet.

3. There is no need to rush between different trading instruments. At first, it is better to choose one asset and thoroughly study all the nuances of trading. Then, it will be easier for you to adapt and adjust your trading algorithm to other instruments.

4. Don’t stay too long on a demo account. Training on a demo account is important, but using it for too long dulls the fear of losing money (after all, they are not real) and develops risk tolerance.

5. At first, you won’t be able to develop your own strategy, so you can use other people’s algorithms. However, you should not blindly follow someone else’s strategy without trying to understand its essence. You need to try to understand what the strategy is based on.

6. Do not use too much leverage for trading. Until you have sufficient experience, this can only lead to a complete loss of your deposit and losses. Don't try to earn everything at once.

7. Never trade with your last money or borrowed funds. You can only use free money for trading that you can afford to lose in case of failure.

8. Be prepared for losses. Even if you do everything right, the market can sometimes work against you, resulting in a losing trade. You need to gain experience from any transactions.

9. To improve your results, we recommend keeping a journal of transactions and periodically analyzing your performance. This will help you identify the weaknesses in your strategy and improve it.

Conclusion

In this article, we examined in detail one of the most important steps on the path to practising trading, i.e. training. It can be exercised in different forms: independently or under the supervision of a broker or coach, paid or free, in person or in absentia.

Each person chooses the most convenient training option for themselves. First, you need to obtain a theoretical basis, which includes key concepts in trading, methods and tools for market analysis, working with a trading platform, etc.

However, theoretical training is only part of it. The more important and voluminous part is practice. Practical training begins with a demo account. This is the easiest and most reliable way to understand what trading looks like from the inside.

It is important not to skip this stage, but also not to “stay too long” on a demo account. You need to switch to a live account as soon as you begin to trade consistently and gradually increase the deposit on the demo account.

Only practice will allow a beginner to become a real professional. It is believed that in order to master any activity, you need to devote at least 10,000 hours to it. This is a long time, but it does not work any other way.

You may also like:

Back to articles

Back to articles