Many people believe being a trader salary is a nice job. At that, they imagine a trader to be someone with a laptop who is lying on a tropical beach and drinking cocktails.

In reality, the ordinary life of a professional trader is far from that perception. Those who choose trading as their main source of income cannot enjoy such a trouble-free leisure. On the contrary, they need to invest much time and effort to achieve their goals.

If you want to find out more about traders' occupation, learn ins and outs of trading and how to progress in this sphere, read our article about What is a trader.

What does a trader salary earn?

The earning potential of a trader can vary widely, based on numerous factors. Here's a closer look:

- Expertise and Skills. A trader's knowledge and experience can directly influence their profitability. The more seasoned the trader, the higher the potential returns.

- Initial Capital. Starting with just $1 won't set you up for substantial returns. Conversely, large investments can lead to losses if not managed wisely.

- Market of Choice. Certain markets, like Forex, are characterized by high volatility, providing more opportunities to capitalize on price fluctuations.

- Asset Selection. Analogous to market choice, earnings can also depend on the assets a trader opts for, especially those prone to significant price variations.

- Trading Strategy. The choice between scalping, intraday, mid-term, or long-term trading can have different profit potentials.

- Trade Volume. Depending on their trading style, a trader might execute a few trades weekly or monthly, or dozens within a single day.

- Trading as a Primary Profession. While some, especially beginners, might view trading as a side gig, it's unlikely to provide a primary income in such cases.

- Brokerage Fees. Brokers charge for each transaction. The more frequent the trades and the heftier the commission, the thinner the slice of profit left for the trader.

The blueprint to successful trading

Drawing from the prior discussion, one can conclude that to profit from financial market trading, a sequence of crucial steps needs to be undertaken. Here's a more detailed look.

- Asset Selection. Nowadays, traders have a plethora of assets at their disposal. Beginners are often advised to opt for highly liquid instruments, such as the major currency pairs.

- Brokerage Firm Choice. There are several criteria to consider when picking a broker, including its regulatory standing, deposit and commission structures, available trading instruments, and specific trading conditions for various assets.

- Developing a Trading Strategy. This might be the most challenging phase, often stretching over years. Beginners tend to start with strategies found online. However, a self-crafted strategy often yields the best results.

- Demo Account Trading. A crucial learning phase where traders gain practical experience without risking real capital. Moreover, even experienced traders employ demo accounts to test their strategies.

- Mastering Trading Psychology. Emotions play a vital role in financial trading. Being able to control one's feelings and make calculated decisions is pivotal for trading success.

- Adherence to Risk and Money Management Principles. These should be integral to one's trading strategy. It's essential to determine and stick to a risk-to-reward ratio. Deciding on the percentage of the deposit to be used for a single trade is equally crucial.

- Continuous Skill Refinement: This is an ongoing necessity as markets continually evolve. It's vital to stay updated with the latest trends and adjust your trading strategy accordingly. Attending lectures and webinars on the subject can also be beneficial.

- Strategy Automation: The growing trend of employing trading robots stems from their ability to reduce a trader's workload. Crafting your own trading bot today is far from the Herculean task it once was.

Trader salary: how they vary globally

Traders' earnings not only fluctuate based on trading instruments or strategies, but they also vary from country to country. Hence, to gauge a trader's income, one must factor in geographic differences.

We often hear tales of traders hitting the jackpot, amassing fortunes in the millions. But in reality, a trader's paycheck doesn't always reflect these astronomical figures.

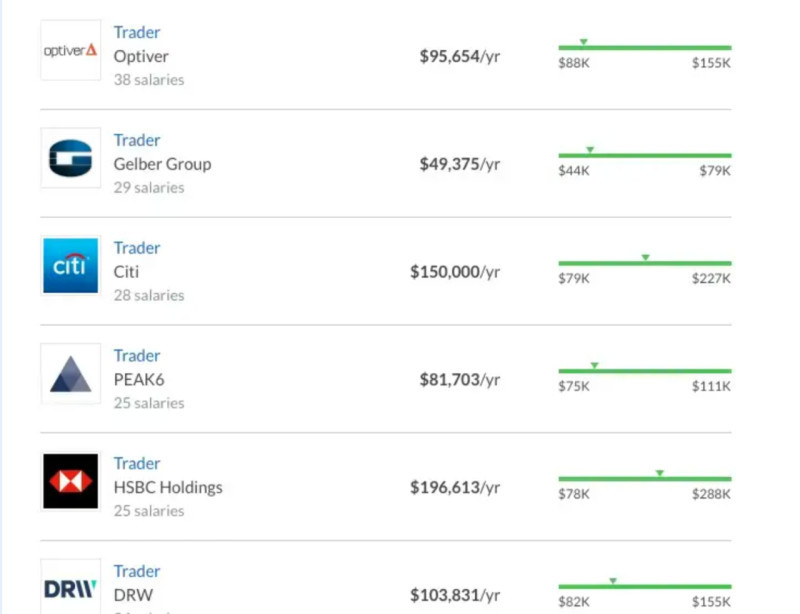

Starting with those employed by major financial institutions, let's examine the average salaries of traders across different countries.

In the UK, the average annual salary for traders ranges from £60,000 to £117,000. Junior traders typically earn around £50,000 annually, while trading assistants pull in about £35,000.

Now, let's pivot to the European continent, where trader earnings break down as follows:

• France: Approximately €60,000 (with a low-end of €38,000 and a high of €108,000).

• Germany: Roughly €75,000.

• Italy: Close to €46,000.

• Spain: €48,000.

Wall Street traders often sit atop the earnings hierarchy, boasting an average yearly income of $123,000. Down under, Australian traders pull in around AUD 102,000 annually.

In Japan, the average trader's salary is about 7 million yen a year. In China, they earn approximately 159,000 yuan annually, while in Singapore the figure is around SGD 120,000 per annum. In the Russian Federation, traders can expect to earn around 114,000 Russian rubles monthly.

It's important to note that these figures typically represent base salaries, exclusive of bonuses. In several countries, traders are eligible for annual bonuses that can even double their base salaries, effectively doubling or more their total compensation.

How much do traders earn per month?

When discussing the earnings of individual traders, or freelancers, it's quite challenging to pinpoint a specific figure. A lot depends on how much time a person spends trading and their experience.

It's worth noting that novice traders shouldn't expect to achieve high profits right away. The norm for them is often more about losing money than making it. It's essential to be prepared for this, and it's advised to trade only with personal funds and not to take any loans for this purpose.

Reaching a decent level of earnings often takes years of work. However, many novice traders become too confident when they manage to make a few successful trades early on. Trading might appear to them like a game where deals can be made on a whim.

One of the rules every trader should firmly grasp is that investing $1 will not earn you $100. A trader's income is typically measured in percentages, and on average, it amounts to 10-30% per month. With higher-risk strategies, this could go up to 100-200% annually.

It's easy to do the math. With an initial investment of $1, in the best-case scenario, you might earn $2. But if you invest, say, $1000 and opt for a moderate risk level, you could earn another $1000, and under favorable conditions, even $2000.

However, it all depends on the risk. This means you might earn $100 one day and lose $500 the next. There are prosperous periods when one successful trade follows another, but there are also "stagnant" times when no profit is made, and the capital might even decrease.

Trader's starting capital

From the previous sections, we already have an idea of how much a trader can earn. Now, it's essential to understand how much one needs to invest to achieve the desired income level.

In the Forex market, trading can start with as little as $1. However, with such a small investment, you shouldn't expect any significant income. These accounts are referred to as 'cent accounts' and are primarily used for educational purposes.

It is believed that with an amount up to $100, one can learn to trade. Such capital is sufficient to gain skills in opening and closing positions, as well as placing protective orders. For most beginner traders, this amount is acceptable in the sense that it won't hurt too much if lost.

Subsequently, one can increase their deposit to $1000, $5000, or more. It's essential to have enough capital in the account that allows executing multiple strategies and trading various instruments. In this way, profits can be made even from minor price fluctuations.

Buying stocks is a bit simpler and more straightforward. You need to decide which assets you wish to acquire and determine their price. Then, decide how many shares you can afford, establishing your initial investment amount.

However, to minimize risks, it's advised not to invest all your funds in one particular asset. Consequently, one should select multiple companies in which to invest.

To create a diversified portfolio, a significant investment might be required. But with a well-thought-out asset selection, the higher the initial investment, the greater the potential returns.

How to trade cryptocurrencies

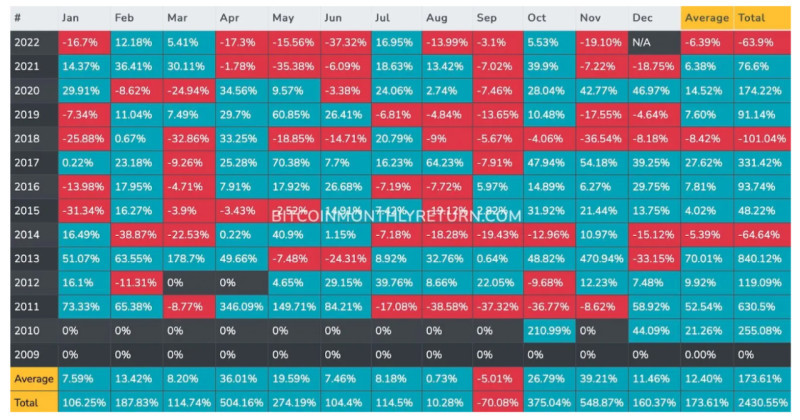

Cryptocurrencies are becoming an increasingly popular asset for traders worldwide. This popularity isn't accidental, as this market is rapidly evolving, and the potential profits can significantly surpass those from other sectors.

Crypto is a highly volatile asset. Its value can change substantially over a short period, allowing traders to capitalize on these fluctuations.

So, what are the primary methods or strategies for profiting from cryptocurrencies? One can employ short-term or medium-to-long-term strategies. Let's delve deeper into this topic.

- Direct Trading: This encompasses any short-term cryptocurrency operations, including scalping and intraday trading. The value of a cryptocurrency can shift within minutes, allowing for daily profits.

- Hodling: Also known as "buy and hold". A user buys coins and simply keeps them in their wallet until they reach a predetermined value, after which the crypto is sold.

- Speculative Hodling: Investing in potential breakout coins that might show substantial value growth in the future.

- Staking: This involves holding coins with the potential of earning commission in a specialized wallet designed to support the blockchain network.

- Mining: Extracting coins using specialized equipment.

- Portfolio Investments: In this case, it's crucial to select the right coins to compile an investor's portfolio.

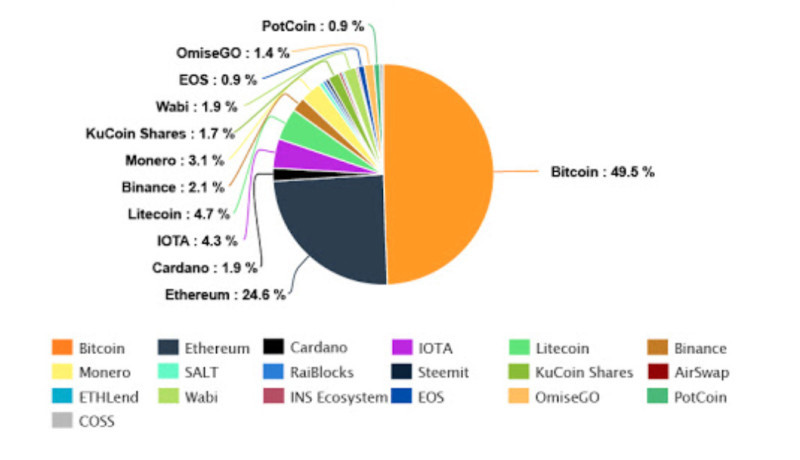

To effectively utilize any of the above methods, it's essential to choose the right coins. A trader's or investor's portfolio should be balanced, typically consisting of 4 to 8 different cryptocurrencies.

There are two types of crypto portfolios:

• Concervative (the low-risk one) implies that the biggest part of the portfolio (about 70%) consists of most popular and reliable coins that make top 5. The other part comprises coins of top 10, and the rest 5% are highly volatile digital assets.

• The aggressive (with a high level of risk) portfolio is divided 50/50 between reliable coins and top-50 cryptocurrencies (25%), and highly volatile assets that might exhibit substantial growth (25%) or significant decline.

How much do crypto trader salary earn?

There's an important rule in cryptocurrency trading: when Bitcoin starts to grow, other coins soon begin to follow its lead and also increase in value.

With the right cryptocurrency portfolio composition and proper approaches to trading, profits can reach several hundred percent annually. At the same time, considering the high level of risk, one can lose all or part of the invested funds.

If a user employs a more aggressive approach when building their portfolio, they might "hit the jackpot" with a sharp rise in a particular coin. However, with the same approach, one could also lose money if the cryptocurrency suddenly drops in value.

According to some experts, for trading to become the primary source of income, an initial capital of at least $10,000 is required. Even in such a situation, profit is not guaranteed, and this capital may not be multiplied.

Even with a return of 200% per annum on an initial investment of $100, the maximum earnings would only be $200. With this amount, a trader certainly cannot sustain themselves or support their family.

In addition to active trading, it's also possible to earn passive income from cryptocurrencies. In this case, there's no need to constantly be in front of the computer screen monitoring the slightest price changes of various coins.

Naturally, the desired income level determines the required initial investment. Therefore, this earnings method is suitable for those ready to invest $100,000 or more. With such volumes, one can expect to receive passive income of $1,000 per month or even more.

When and how to withdraw money from the account

After earning their first profits, traders handle them differently. Some rush to withdraw every last cent, fearing the loss of their money, while others take out a portion and leave the rest for new transactions. Some don't withdraw at all, enjoying watching their balance grow.

It's not wise to jump to extremes, meaning either withdrawing all the money at once or leaving it all in the account. It's essential to find a "golden mean" – an option that suits the specific individual.

Professional traders recommend withdrawing a portion of the earned funds to have a tangible result from their efforts. This also provides emotional satisfaction and an additional incentive to continue progressing in this direction.

To determine the right time to withdraw funds, several factors should be considered:

• Objectively evaluate the results of work;

• Conduct regular analysis;

• Have a clear trading plan;

• Build a diversified portfolio;

• Don't rush to extremes and refrain from panicking.

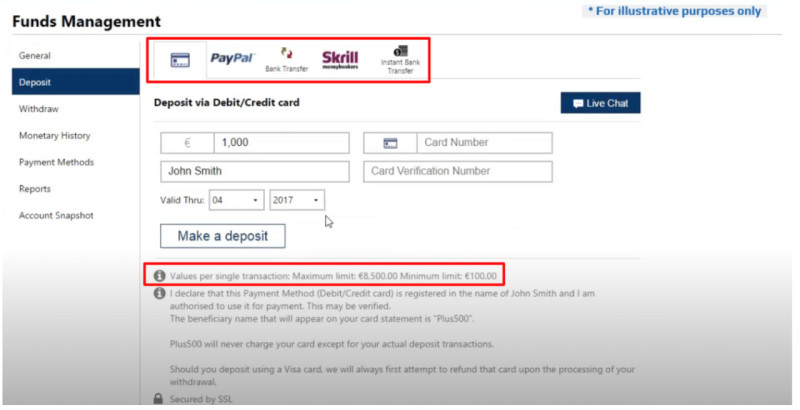

In addition to this, even at the stage of selecting a brokerage company, it's essential to clarify all the nuances related to depositing and withdrawing funds. Some companies charge a fee for this, while others do not.

Also, pay attention to the fact that withdrawal times and other conditions depend on the currency in which the funds are withdrawn. Typically, withdrawing in local currency can be quicker and without fees, whereas foreign currency operations often incur an additional charge.

An optimal time to withdraw money from the account is when the initial deposit has grown by at least three times. It's hard to pinpoint a specific amount since everyone starts with different initial capital.

Moreover, keep in mind that you'll need to pay taxes on the withdrawn amount. Often, this procedure is handled by the broker, so your job is to ensure there's enough money in the account to cover this.

Alternatives to trading

As derives from our previous discussion, trading is not as simple as it may seem to be. It requires much time, effort, and money.

In addition, the psychological aspect should be factored in, as traders often experience high levels of stress. For these reasons, some individuals opt for other means of generating income in the financial markets. Let's explore the primary alternatives in this section.

- Investing is a long-term method of allocating funds that doesn't require constant monitoring of market prices. Investment horizons typically range from 1-5 years or longer. With wise asset selection, one can achieve a steady, albeit modest, annual return.

- Copy trading is suitable even for beginner traders since it allows earnings without trading independently. The essence of this approach is that a user subscribes to the account of a successful trader, and all of that trader's actions are automatically mirrored in the subscriber's account.

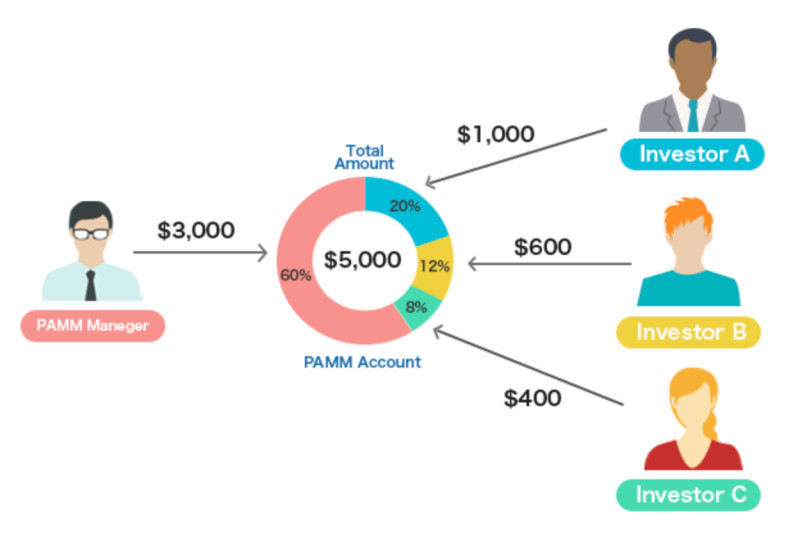

3. Managed Accounts (PAMM, MAM) operate on a principle similar to copy-trading. However, in this case, a user invests their funds into an account managed by a trusted individual, who then conducts trades and earns a commission for their services.

4. Algorithmic Trading is the type of trading utilizing specialized computer programs (trading bots). Trading bots can be semi-automatic (advisors) or fully automatic (robots). The former only provide signals, while the latter can execute trades independently.

One might consider blending various trading methods to potentially achieve higher returns. Beginners can start with copy-trading or PAMM investments. As they gain more experience, they might transition into roles such as signal providers or portfolio managers.

Investment income

In our previous discussions, we've delved extensively into the earnings of traders, but the world of financial markets offers more than just active trading. Enter the realm of investment income, a realm characterized by its passive nature—requiring minimal ongoing effort from investors.

Here, funds are invested once, then locked away in investments for several years. Long-term investment is widely acknowledged as one of the less precarious approaches to financial deployment, even though it often presents relatively modest potential for returns.

There are several ways to invest:

1. Savings Accounts: These represent investments with the lowest risk profile, albeit offering the least profitability. Interest rates on savings accounts may fluctuate by country, but, generally speaking, they tend to hover around the inflation rate—averaging at approximately 4% annually.

2. Indexes: these include the colossal stock market indexes like the S&P 500, Dow Jones, and FTSE 100. These indices encompass a multitude of companies; for instance, the S&P 500 is home to 500 of America's largest corporations. Investments in such instruments may yield returns ranging from 8% to 12% per year.

3. Stocks and Bonds: A prudent strategy often involves the simultaneous use of both these instruments, as relying solely on stocks can be excessively risky. Stocks, besides appreciating in value over time, may also offer additional income in the form of dividends. In the grand scheme of things, this method can potentially generate returns ranging from 10% to 20% annually.

It's important to understand that in such a scenario, monthly income will be modest, unless you happen to have a couple of spare million dollars lying around. With a small amount of investment, passive income will also be limited.

Some experts consider investing more as a means of preserving capital rather than significantly multiplying it. Undoubtedly, putting your money in a bank, even at a modest interest rate, is a more advantageous choice than stashing it under the proverbial mattress and waiting for inflation to erode its value.

How to avoid scammers

In the realm of trading, where financial ebbs and flows are the order of the day, traders dedicate ample time to understanding how and how much they can earn. However, it's equally pivotal to delve into how a trader can lose everything and the strategies to prevent such a scenario.

When a trader salary chooses a brokerage firm judiciously, the outcome largely hinges on their own knowledge and experience. A trader, armed with a robust trading strategy and the knack for sealing successful deals, will witness their deposit steadily grow.

Conversely, if a trader is bereft of sufficient experience and relies on luck for making deals, a rapid depletion of the deposit can be anticipated. Considering the high risks perennially present in financial market trading, even a trader with a million dollars in their account is not immune to losses.

Another scenario involves unscrupulous brokers, who are on the prowl to misappropriate inexperienced traders' money. Fraudsters often masquerade as intermediaries in financial markets, luring clients through advertising and enticing conditions.

Subsequently, they fuel users' interest and zeal by orchestrating ostensibly profitable deals. The trader, witnessing their deposit burgeon, becomes enticed to invest more in the pursuit of higher earnings.

However, when the user decides to withdraw all their earned funds, the company suddenly encounters various technical difficulties, such as glitches, delays, or similar issues.

Scammers aim not only to seize the money they have already coaxed away but also to secure additional payments. For instance, they may stipulate that only a round sum can be withdrawn, necessitating further account replenishment.

Another trick in the scammer’s arsenal involves persuading users to install a special app on their phone. Often, this software is malware, enabling scammers to access the user's personal or payment data. Consequently, they can access banking or other information and withdraw money from the account.

In the treacherous waters of trading, where opportunities and threats coexist, traders must navigate with caution, ensuring their hard-earned money doesn’t fall into the hands of these financial pirates.

Conclusion

In this article, we have explored various earning methods for traders and examined how much they can potentially earn monthly or annually from their activities.

It's crucial to understand that a user's income level is influenced by numerous factors: knowledge and experience level, the time dedicated to trading, initial capital, trading strategy, and much more.

The salaries of professional traders vary across different countries and exchanges. As for individual users, calculating their potential income can be quite complex.

Traders' profits are typically measured in percentages. Employing low-risk strategies, the average income ranges from 10% to 30% per month, while a more aggressive approach can yield up to 100%-200%.

However, it's vital to comprehend that a potentially higher income level always comes with a higher level of risk. That's why seasoned traders advise never to trade with your "last" money or borrowed funds. Only invest an amount you are prepared to lose in trading.

Beyond trading, there are other opportunities to earn income in the financial markets. Moreover, with some of them, you may not need to trade yourself (for example, copy trading) or you can invest money for the long term and earn passive income (investing).

You may also like:

Back to articles

Back to articles