The world of trading is drawing an increasing number of enthusiasts globally. Yet, only a few truly consider it as a full-time career and primary source of income. In reality, trading is as serious and demanding as any other job out there.

Is it possible to make a living with trading? Let’s explore this question in our article. We will delve into different types of trading, see who it is suitable for, provide insights on how to start, and discuss the potential career ladder in this realm.

To get a deeper understanding of the professional trader role and the essential steps one must take to embrace this profession, check out our comprehensive guide What is a trader?

What do professional trader do?

Let's dive deep into understanding who traders are and what their profession entails. In essence, traders operate within financial markets, making profits from the price difference between buying and selling an asset.

Traders can operate in various market segments, be it stock, currency, commodities, or others. Their trading tools are diverse and include currency pairs, stocks, bonds, and precious metals, among others.

Traders broadly fall into two categories:

- Institutional traders: Those working in financial institutions, which could range from banks, brokerage firms, and investment funds to specialized entities that focus on trading specific commodities or assets.

- Retail traders: Independent traders operating on their own. They invest using their own capital and assume all risks. While they enjoy the full spectrum of profits, they also bear any losses independently.

Institutional traders interact with counterparts and conduct negotiations on a daily basis. Retail traders might not engage in such interactions, but both groups have something in common: trading, in any form, is an intensive endeavor demanding significant energy, instant response, and sharp analytical skills.

Aspiring to be a professional trader in established institutions requires specialized education in economics or finance. Retail traders do not need to have a formal educational background but they still need to have some form of training, whether through reading relevant literature or undergoing specialized courses.

One of the trader's paramount responsibilities is to conduct market analysis. This helps in identifying optimal entry and exit points for buying or selling an asset. Mastering analysis skills is a cornerstone for a trader's success.

Is trading for everyone?

Many training institutions selling their courses will confidently say that anyone can become a successful trader. But is it really so?

In theory, yes, almost anyone can trade. But in practice, it is not for everyone. Let's figure out who this profession is tailored for and who might be a better fit elsewhere.

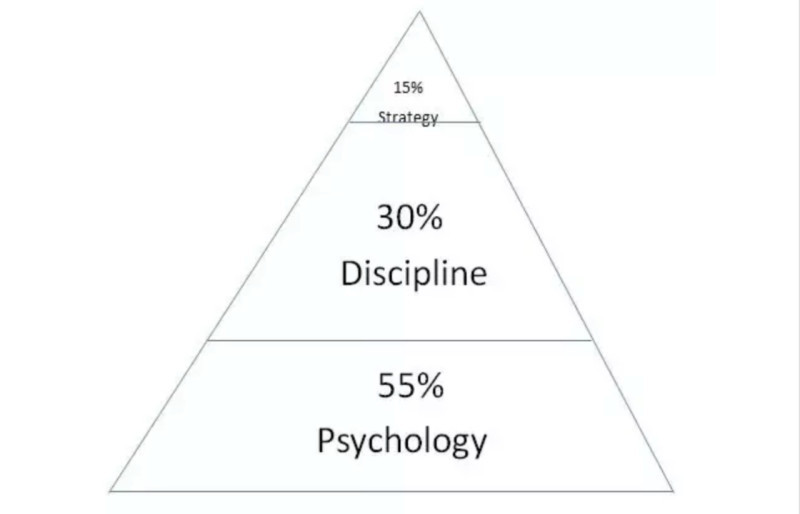

There is no "trading gene" or inherent talent for trading that one is born with. However, certain psychological traits can influence one's aptitude for the job.

For instance, impulsiveness, often mistaken for enthusiasm, can be a trader's downfall. Those who are drawn to the thrill of risk might better opt for casinos or sports betting. In trading, what is essential is a calm demeanor, discipline, and the ability to make thoughtful and calculated decisions.

A trader's inner drive is crucial since their earnings depend heavily on their own performance. A genuine interest in the field, a passion for learning its intricacies, and an unwavering commitment to refining their skills are fundamental in this area.

The world of trading is laden with stress and other psychological challenges. Hence, resilience to stress becomes a vital trait. The capacity to manage emotions and not let them interfere with trading decisions is pivotal to success.

Additionally, the desire to dedicate ample time for active trading, constant market analysis, and decision-making regarding position openings is at the heart of a trader's journey.

If someone lacks this proactive element, they might consider switching to investing to earn passive income. However, it is essential to note that while investing can be lucrative, it often requires considerable initial capital, which might not be feasible for everyone.

Can trading be combined with a full-time job?

Many people are hesitant to dive into trading as a full-time profession. It is not uncommon for individuals to juggle a 9-to-5 office job while exploring trading during evenings or even late at night.

However, it is vital to understand that achieving significant results in trading while balancing it with another job is a tough act. This is especially true for short-term and mid-term strategies, where a trader's continuous engagement is crucial.

Still, even with a primary job, there are steps you can take on your journey to becoming a professional trader. Let's discuss what they are.

1. Choosing a trading style: This involves aligning your trading approach with your personality, available free time, and individual nuances. Often, those with time constraints lean towards mid-term strategies or investment, primarily because active trading demands more time commitment.

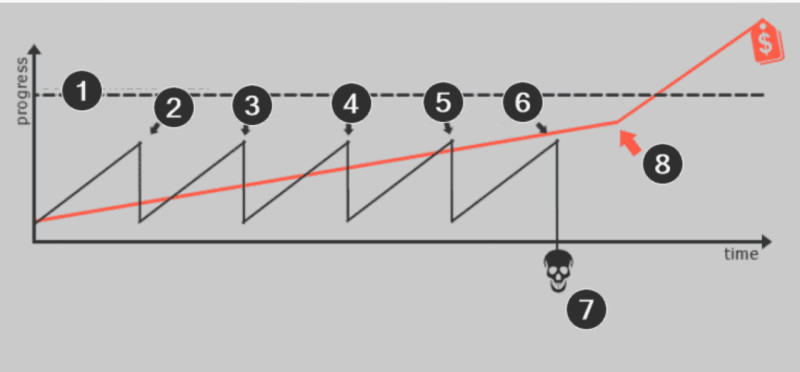

2. Systematic approach: constantly switching trading strategies or making trades without a consistent system is not the best approach. Without a systematic approach, tracking progress and analyzing the causes of successes or failures becomes challenging. It is better to stick to a single strategy and constantly improve it.

3. Planning: Preparing for trading is among the most vital stages in any trading style. Preparation primarily involves conducting market analyses. To do this, allocate days when you have the most free time, such as weekends.

4. Resilience: A trader's journey will inevitably encounter both successful and unsuccessful trades. It is essential to handle setbacks effectively. It is also crucial to set goals and work towards them, evaluating not only the outcomes but also the process itself.

5. Setting priorities: Nowadays, everyone faces numerous distractions that waste our time: television, social media, binge-watching shows, and so on. If inclined, one can redirect this time to more productive activities, such as studying and practicing trading.

6. Focus on the present: Avoid speculating about future earnings or how much you should invest. Instead, break down your greater goal into smaller steps. As you accomplish each step, gradually progress forward.

7. Practice on demo accounts: Practicing on a demo account is a crucial part of the learning process, providing hands-on trading experience. However, don't get too carried away with demo trading. There is a distinct difference between demo and real trading environments.

8. Recognize your advantages: Not needing to be constantly glued to a computer screen monitoring the market gives you some degree of freedom. When trading isn't the sole source of income, you feel more confident and relaxed which leads to fewer mistakes.

When to leave your primary job?

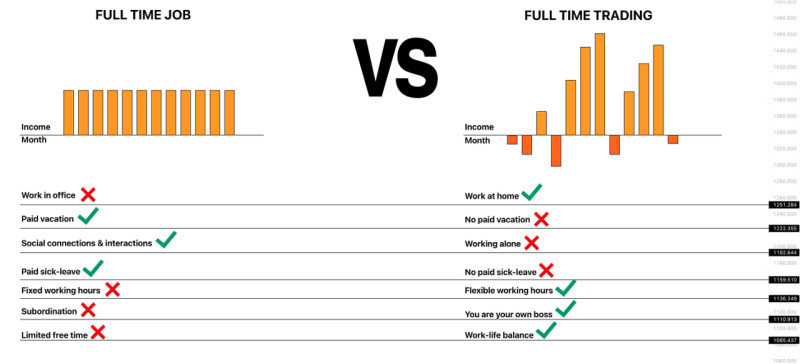

Almost every novice professional trader dreams about making trading their primary occupation and main source of income. Therefore, many who juggle a job with trading often wonder when they can depart from their office routine and embrace trading full-time.

To answer this question, we must consider several factors. To make it simpler, let's use an imaginary currency as an example so that we do not get confused by specific numbers and provide a general understanding of how it works.

Let's say you already have 500,000 units in your account, a substantial amount sufficient to sustain yourself for several months. However, it is essential to consider what the initial deposit was.

If your initial investment was 250,000 units and you managed to double it, that is a sizable achievement. But in this scenario, we can't definitively say that the trader has acquired enough experience and hands-on training to master all the necessary skills.

On the other hand, if the initial amount was around 20,000-30,000 units, and the trader managed to multiply this amount by more than ten times over some time, this is an impressive indicator. In this case, we can confidently state that the trader has truly become a pro in this field.

When a trader grows a small starting deposit into a significant amount, it indicates that they can provide themselves a comfortable living solely from trading. They can easily earn between 50,000 to 100,000 units a month.

You can set your own work schedule, spend more time with family, or indulge in hobbies. The only challenge lies in setting up a comfortable home workspace and adapting your lifestyle in line with this new vocation.

As an independent trader, your earnings solely depend on you. Yet, with higher income potential, risks also escalate.

Hidden challenges of trader’s life

To someone, trading might seem like a mere game, perhaps even an endeavor that doesn't demand much effort. But is this perception accurate? Is the profession of a trader truly a walk in the park? Let's delve deeper into the topic.

While we have mentioned that one can start trading without a formal education in economics or finance, there is no escaping the essential training that comes thereafter. Every trader must have a thorough understanding of how markets operate, the variables affecting price shifts, and fundamental concepts like margin, leverage, and others.

One of the major challenges in trading is the emotional toll it takes. Traders experience significant psychological pressures and heightened stress levels, especially those who employ short-term strategies, which involve multiple transactions within a single day.

Such traders often find themselves in a continuous state of tension, leading to the release of stress hormones. This emotional rollercoaster, with its rapid ups and downs, can be mentally exhausting.

Another aspect of trading that is rarely discussed is monotony. The repetitive nature of certain actions, especially market analysis, can be wearisome. Traders often spend hours monitoring charts, tracking their fluctuations, keeping an eye on the order book, and observing other vital indicators.

True, medium to long-term strategies might not require as much screen time due to fewer transactions. However, each trade, irrespective of the strategy, must be meticulously planned and executed.

One of the paramount skills a trader must possess is analytical capability. This is not always innate, which means many have to learn and continually hone this skill throughout their trading career.

Pros and cons of being a trader

Like any other profession, trading has its benefits and drawbacks. Let's take a closer look at them in this section.

Advantages:

• Flexible schedule: Traders can choose the most convenient times to work, tailoring their trading strategies and instruments accordingly.

• Financial independence: Trader's earnings depend solely on their efforts, not on any higher-up management. The sky's the limit when it comes to potential profits.

• Potential for unlimited profit: As mentioned above, a trader's income is only limited by their abilities, ambitions, and trading opportunities.

• Freedom to move: One can work from anywhere in the world and at any time. All a trader needs is a computer or another device and an Internet connection.

• Freedom to choose: Traders can select the assets they trade, how much capital they wish to invest, and when they want to trade.

• Accessibility: Anyone, regardless of their educational background, can take up this profession. What is crucial is the desire to learn trading and actively engage in it.

• Minimal initial capital: Beginners do not need vast sums. Trading can begin with as little as $100-$200, allowing newcomers to understand the principles of financial markets.

Disadvantages:

• Emotional strain: Traders are susceptible to stress and strong emotional turmoil, often because decisions must be made rapidly, and not all decisions lead to favorable outcomes.

• Lengthy preparation: To make trading a primary profession, considerable time is required. This encompasses both theoretical learning and practical applications.

• High level of risk: While trading is not about luck and entails meticulous calculations, risks are always present. Markets can unexpectedly turn, often contrary to predictions, forcing traders to consistently balance risk and reward.

How to become an institutional investor

Trading can be approached in various ways: by working in specialized firms or independently. Let's first discuss how one can become a professional, or institutional trader.

Firstly, it is essential to get a specialized education. Often, major firms require not only a bachelor's degree but also a master's degree in finance or a related field.

The second crucial step is to undergo an internship, perhaps as a trading assistant. The essence of this role is to work alongside an experienced trader, follow their directives, and practically immerse oneself in the intricacies of the profession.

The next move involves acquiring a license or undergoing certification. This process might differ from one country to another, but this step provides the right to secure a full-fledged position in any financial institution.

Being a trader in financial institutions has several advantages:

• Access to more significant capital, leading to more extensive trading opportunities.

• The ability to utilize the most potent and advanced software.

• Priority access to news and other essential information.

However, there is another side to the coin. An institutional trader is an employee who must adhere to the directives of management and the firm. Their earnings are typically limited to a salary with some additional percentage as a bonus.

Nevertheless, professional trader have ample prospects for career advancement and can achieve substantial incomes. Even if one doesn't secure a position in a large international firm right after graduation, starting in a medium-sized firm is viable. After gaining 3-4 years of experience, one can transition to bigger institutions.

How to become an accredited investor

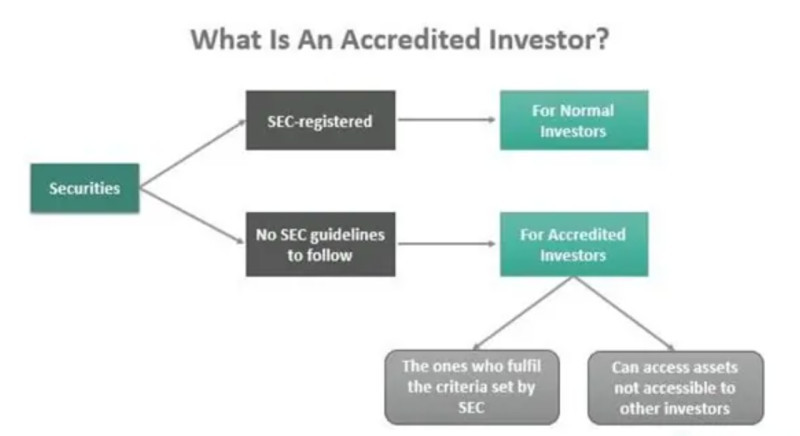

When discussing the profession of a trader, we can't ignore the concept of a qualified investor, or accredited investor. Let's delve into who they are, how to attain this status, and the opportunities it brings.

A qualified investor status can only be obtained by market participants who have demonstrated that they possess a significant amount of skills and experience. This status grants them access to a broader range of trading instruments.

Distinguishing between qualified and unqualified investors allows the latter to make less risky trades and, consequently, incur fewer losses. This is because certain trading instruments are simply unavailable to them.

Automatically, such status is assigned to various financial institutions. However, for an individual to acquire this status, they need to meet one of the following criteria:

- Own assets up to a certain amount. This can include not just liquid assets but also investments in stocks.

- Have at least three years of experience working with securities. The period is reduced to two years if the candidate has worked for a company already possessing the status of a qualified investor.

- Maintain a specific annual trading turnover (requirements can differ from country to country) and execute at least 1 trade per month and 10 trades annually.

- Have a relevant education that confirms the investor's financial literacy and qualification.

Unqualified investors have access only to basic assets with a low-risk level. In contrast, qualified investors have access to a wider array of assets, including:

- shares of foreign companies;

- participation in IPO transactions;

- shares of various funds.

Bottom line

In this article, we have explored the fundamental aspects surrounding the profession of trading. While many newcomers initially combine trading with another job, eventually, some transition entirely into this field.

There are two main categories of traders: professional trader working for various financial institutions and retail traders who work independently. Both paths have their unique advantages and drawbacks.

Engaging in trading offers a certain degree of freedom since one can trade anytime, anywhere, as long as there is a stable internet connection. However, trading also comes with high levels of stress and emotional strain.

This is precisely why trading is not suitable for everyone. To trade successfully, several qualities are essential: analytical skills, resilience to stress, a proactive attitude, the eagerness to learn and improve, and intrinsic motivation.

To become an institutional trader, one must acquire a specialized education, undergo internships, and obtain a license. In contrast, to become a retail trader, it is enough to take training courses before diving into the trade.

To ascertain if trading can become one's primary job, it's crucial to ensure that the account balance can be sustained for several years. If the initial capital was about ten times smaller than the current amount, it speaks volumes about a trader's adequate level of experience.

You may also like:

Back to articles

Back to articles