"Money loves silence." This quote belongs to John Rockefeller, an American entrepreneur, the first dollar billionaire, and one of the wealthiest people of the 20th century. To this day, most people who have achieved great financial success adhere to this principle.

Many of the world's successful best stock traders are no exception. Through online trading in the financial markets, they have not only earned respect in professional circles but have amassed great fortunes. By the way, we have already discussed who traders are and their roles in global exchanges in the article What is a trader.

It is safe to say that lucky and wealthy investors avoid the limelight. However, the achievements of some of them are so significant and their trading results are so impressive that they simply cannot escape public interest and global recognition.

There is no surprise! After all, for novice best stock traders, these successful market sharks serve as a primary reference in the trading field. Some even become true legends, having a great influence on the development of global financial markets.

Moreover, in the biographies of such legendary traders, beginners often find hints and behavioral models that might help them become equally wealthy and famous in the future.

In this article, we will talk about top traders, how they earned their titles, and how they managed to profit even during challenging market times.

George Soros

If you have ever come across online lists like "10 most famous traders of all time," there is a high chance that George Soros's name was at the top or near it. In our list, we placed this legendary trader in the first place.

Today, Soros is known globally as an American financier, businessman, investor, and manager of one of the world's largest hedge funds. However, his life began much more modestly.

Soros was born in 1930 in Budapest. After enduring the hardships of war in Nazi-occupied Hungary, in 1947, young George went to study in the UK. He had no doubts about his future profession—he wanted to be a financier.

After successfully graduating from the London School of Economics, this impoverished Hungarian immigrant moved to the world's financial capital, New York. There, the active and sharp-witted young man easily found work as a stockbroker and diligently studied the intricacies of the financial markets.

After several years of trading securities and working in international arbitrage trading, Soros established several offshore investment funds. In this light, his ambitions grew. In 1973, the successful financier founded a hedge fund named after himself.

A few years later, whether out of modesty or other reasons, George renamed his venture to Quantum Fund. With each passing year, his consortium of investors thrived.

Soros was brimming with innovative (and very bold for those times) investment ideas, demonstrating an exceptional ability to predict situations in international exchanges and financial markets. Thanks to this, by 1980, the businessman's wealth was estimated at $100 million. For many, this would seem like the pinnacle of success, but for Soros, it was just the beginning of a legendary journey.

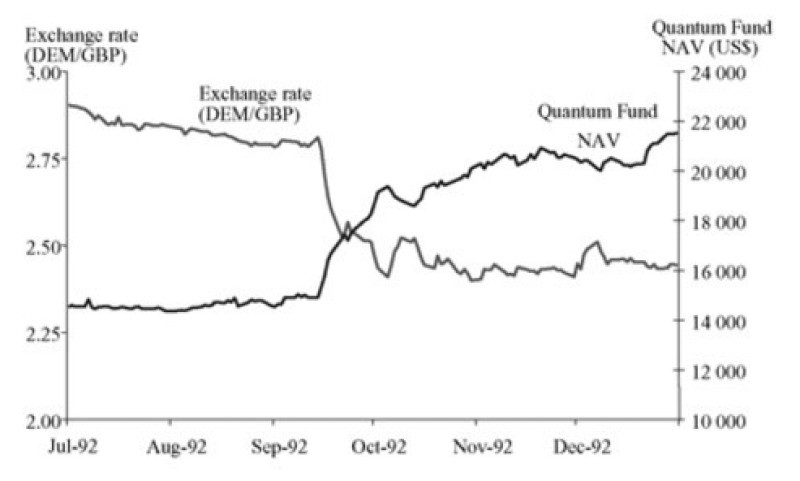

In 1992, the investor’s name became known worldwide. With his unique financial intuition, Soros brought down the national currency of the UK, the pound sterling.

Specifically, on September 16, 1992, he predicted the UK's exit from the European Exchange Rate Mechanism. As the British currency devalued amid political decisions, Soros quickly grasped the situation, earning about $1.1 billion on the international forex market in just one day.

However, Soros did not limit his genius moves to Europe's currency markets. In 1997, he turned his attention to Asia, made speculative deals on local currencies, and once again amassed significant wealth.

Curiously, many analysts still regard George Soros as one of the pivotal participants in the Asian financial crisis of 1998. Experts believe, for instance, that he played a particular role in the crash of the Malaysian ringgit.

However, even if this is the case, the Malaysian episode marked the last significant venture of the legendary financier. In the early 2000s, Soros delegated the active investment of his fund to his employees and shifted his focus to philanthropy.

Despite this, for over forty years, Soros's Quantum Fund has consistently delivered capital growth for its investors. At times, this growth rate reached 20-40% annually. At the time of writing, the esteemed financial magazine Forbes valued Soros's net worth at $8.6 billion.

Market analysts and biographers studying Soros's life argue that his distinctiveness lies in his fearlessness to take risks. He always trusted his intuition and instincts, which enabled him to respond quickly and decisively to financial market shifts.

Today, in addition to the titles "billionaire," "financier," "businessman," and "hedge fund owner," Soros can also be recognized as a "philanthropist." For over 20 years, George Soros has been involved in charitable projects worldwide, offering help to those in need.

Furthermore, he owns the Open Society Foundation, which champions democratic freedoms and upholds human rights globally.

To sum up, the unique qualities of trader George Soros, which elevated him to global businessman status, are his impeccable instincts and a profound understanding of stock and financial markets.

In his ventures, Soros consistently applied various scientific methods and tested hypotheses. He invested modest amounts in these experiments and later scaled up successful projects. This approach minimized losses from unsuccessful orders while adhering to risk management principles.

Thanks to his incredibly accurate currency movement predictions and fearless attitude toward making vital investment decisions, Soros mastered the art of reaping massive profits, amassing a billion-dollar fortune in a relatively short period of time.

A significant principle for Soros has always been portfolio diversification. He never held just one type of trading asset in it. His portfolio included both high-risk and protective assets with varying profit-risk ratios for investment tools.

While wise investments in major company stocks and the acquisition of assets were primary sources of income, the trader's hallmark was undoubtedly his speculation in the international Forex currency market.

Soros had the special skill of profiting from opening positions in the direction opposite to that chosen by most best stock traders. He confidently bought undervalued assets in declining markets and sold them when most traders rushed to buy.

Hedge funds are investment funds that pool investors' capital. The primary goal of these alliances is to maximize returns on the combined investments of investors while maintaining specified or the lowest possible risk levels.

A philanthropist, in a broad sense, is someone who selflessly helps others. In a narrower context, it refers to someone who engages in charity or provides financial support to society and its individual members.

Risk management is a set of rules that help traders determine how much to invest in the market and what level of financial loss is acceptable for them.

An investment portfolio is a collection of various trading instruments owned by an individual or a legal entity.

John Arnold

John Arnold is second on our list of the world's best traders. Compared to the previous person, who celebrated his 92nd birthday in August 2022, Arnold can certainly be considered a youngster and one of the youngest billionaires globally.

He was born in 1974 in Dallas, Texas, USA, to a typical middle-class American family. From a young age, he understood that he would have to pave his way to success without the help of influential relatives.

Interestingly, Arnold showed an interest in business during his youth. At just 14 years old, he started his own company, selling collectible sports cards to friends and classmates.

John focused on his studies, and by high school, he excelled in mathematics. This proficiency allowed him to easily gain admission to Vanderbilt University, from which he graduated in just three years.

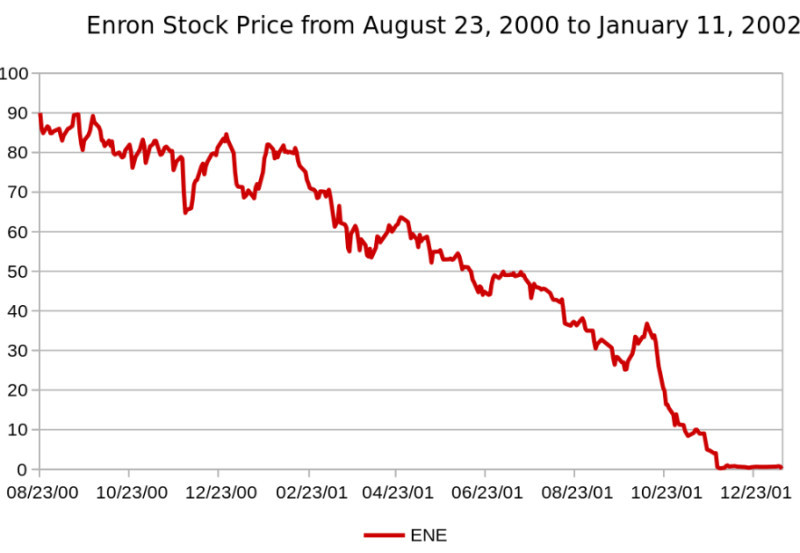

Despite his academic achievements, John Arnold began his journey to wealth as a regular trader at the energy company Enron. However, true talent always finds its way to significant success. Having joined Enron in 1995, he traded oil and gas. Management soon recognized his potential and promoted him to a managerial position. Just six years after first stepping into Enron, Arnold earned the company $1 billion.

Curiously, the company awarded John a bonus of $8 million out of these earnings.

However, good times do not last. The energy corporation soon declared bankruptcy because of years-long manipulations in reporting by the company's management. Using offshore entities, Enron's leaders concealed massive losses from investors, aiming to present the company's financial situation in a better light.

Arnold decided to leave the company with the $8 million he earned. This initial capital helped John take his first confident step towards becoming a billionaire. External investments certainly supported the budding entrepreneur, but the money earned at Enron played a crucial role in this story.

Importantly, the future legend was one of the few key employees of the infamous company who managed to avoid prison and charges of large-scale fraud.

Investing his own money and additional funds from investors, in 2002, he founded his own energy company in Houston, Texas—the hedge fund Centaurus Energy—and became its manager.

Many of John's contemporaries wondered why he would establish a fund specializing in oil and gas trading, especially given the recent Enron bankruptcy scandal. After all, the market was not very volatile, and investors were losing opportunities for earnings.

They forgot they were asking this question of a financial genius who had already anticipated everything.

Thanks to the experience he gained at Enron and his unique skills in analyzing energy markets, John quickly made Centaurus Energy attractive to any investor. At its peak, the company offered its investors a remarkable 300% annual return, unheard of in the energy sector! As the investors became richer, so did Arnold.

Why did he succeed?

He was not afraid to take risks! While other companies were cautiously testing the waters and hesitant to make bold moves, John's venture confidently expanded. Where competitors saw crisis and despair, John saw opportunities for profit.

A few years later, the crisis subsided, energy prices started to rise steadily, and American banks regained confidence. They began to monitor oil and gas markets and hire specialists to work in them. John Arnold and his company had already secured the top spot in this field. As a result, investments poured into the fund, and the capital under the company's management grew significantly. Everyone wanted to collaborate with Arnold, even though Centaurus Energy charged notably higher fees than other hedge funds.

Today, Centaurus Energy charges its investors quite high rates, on average 1.5 times higher than similar market players. The company takes 30% of the profits (whereas most competitors take around 20%), and for the past 15 years, their profits have never been below 200% annually. This is an astonishing figure, especially when the largest funds in the sector typically offer a maximum of 30–40%.

That is why Arnold's enterprise will never lack clients, and those eager to work with Centaurus Energy will always be lined up.

Thanks to his genius, hard work, outstanding analytical abilities, and fearlessness in facing obstacles, renowned trader John Arnold rapidly raised his company's capital from $8 million to $3 billion. By the age of 33, Arnold, a young man from an ordinary American family, had already earned his first billion, transitioning from a millionaire to a billionaire almost overnight.

Arnold's key strength is undoubtedly his impeccable strategic business planning. He possesses an extraordinary logical mindset that allows him to anticipate several steps ahead. In most instances, this skill enables him to make significant gains.

In his deals, Arnold relied heavily on fundamental analysis, which was always his primary tool. He was well aware that to minimize risks, every trader should have a clear understanding of the current market situation. He constantly focused on factors that could influence price movements. He endeavored to stay updated on the world's economic and political sentiment 24/7.

However, his trading approach was not just about rationality. Arnold believed that peak success in the market could only be achieved by skillfully combining the results of fundamental analysis with a deep understanding of human psychology.

One more of John's traits is his immense ambition to become wealthy and successful. This dream was made a reality through his relentless perseverance, hard work, and self-discipline. By methodically improving his education and continuously gaining knowledge in various fields, this legendary man conquered the world of financial trading.

Currently, Forbes estimates the trader's net worth at $8.6 billion and has crowned him the youngest billionaire in the United States.

However, John's accomplishments are not limited to financial success. Together with his wife, he founded a charitable organization that actively funds developments related to medicine, healthcare, education, and law.

Steve Cohen

When compiling the list of the world's best traders, we found it necessary to include Steve Cohen. Born in 1957 in Great Neck, New York, he grew up in a regular Jewish family. Steve was the third of seven siblings. Growing up in such a large family taught the future genius how to concentrate under any circumstance.

Schoolwork came easily to the astute Cohen, which left him plenty of free time to play poker with friends. Even then, the young boy earned his first pocket money, while simultaneously studying the game's rules and techniques.

Later in an interview, the billionaire would reveal that these childhood poker games taught him to judiciously evaluate the risks and outcomes of every move, to always keep a cool head, and not to go beyond what is reasonable.

After finishing school, Steve had no trouble getting into the University of Pennsylvania. He did not ponder long over choosing a major; he always wanted to study economics. In 1978, Cohen earned his degree in economics and was determined to link his future with the stock markets.

He started by investing a thousand dollars in brokerage firm Gruntal. After getting substantial profits from his initial investments, Steve continued meticulously crafting his ideal investment strategy.

Interestingly, that same year, Gruntal's management noticed the young trader's successes and offered him a position. Just six years later, investors entrusted Cohen with a securities portfolio worth $75 million.

The company was so impressed with the young investor's talent that they gave him six traders to oversee. From there, Cohen confidently spread his wings and dove into international trading with great enthusiasm.

Results soon followed. Steve consistently secured profitable deals for Gruntal, helping the company offset years of losses caused by other best stock traders' unsuccessful transactions.

Despite his remarkable achievements at Gruntal and the immense respect from its leadership, Cohen eventually decided to leave and start his own business. In 1992, he established hedge fund SAC Capital Advisors on Wall Street.

During the first year, the new company's performance appeared to be quite modest. The initial capital under Cohen's management was just $20 million, with $10 million of his own savings and another $10 million from external capital.

By the end of 1993, SAC Capital had attracted investments amounting to $13 million. The reason was that in the 1990s, investment funds typically charged 20% of the investors' profits as their own compensation.

In his own firm, Cohen set a higher management fee. As the company was still young, investors could not predict its performance in the financial markets and were hesitant to trust a new fund. However, this issue was just a matter of time. In a very short period, Steve and his dedicated team of traders doubled the total profit. From then on, the popularity of SAC surged.

Initially, Cohen focused on day trading* . However, the market was constantly changing, competition was continuously increasing, and opportunities for profit were diminishing. Furthermore, numerous hedge funds, modeled after SAC, started to pop up in the American market.

Adapting to the situation, the savvy trader shifted to long-term trading* and portfolio managers, each specializing in a specific industry sector. Thanks to this strategy, SAC Capital Advisors' annual return skyrocketed to 29%. The fund charged a whopping 50% of the investors' profits as its fee while competing companies typically took just 20%.

By 2000, the legendary trader's fund was generating a 73.4% profit for its clients, and the company was making over 300 trades daily.

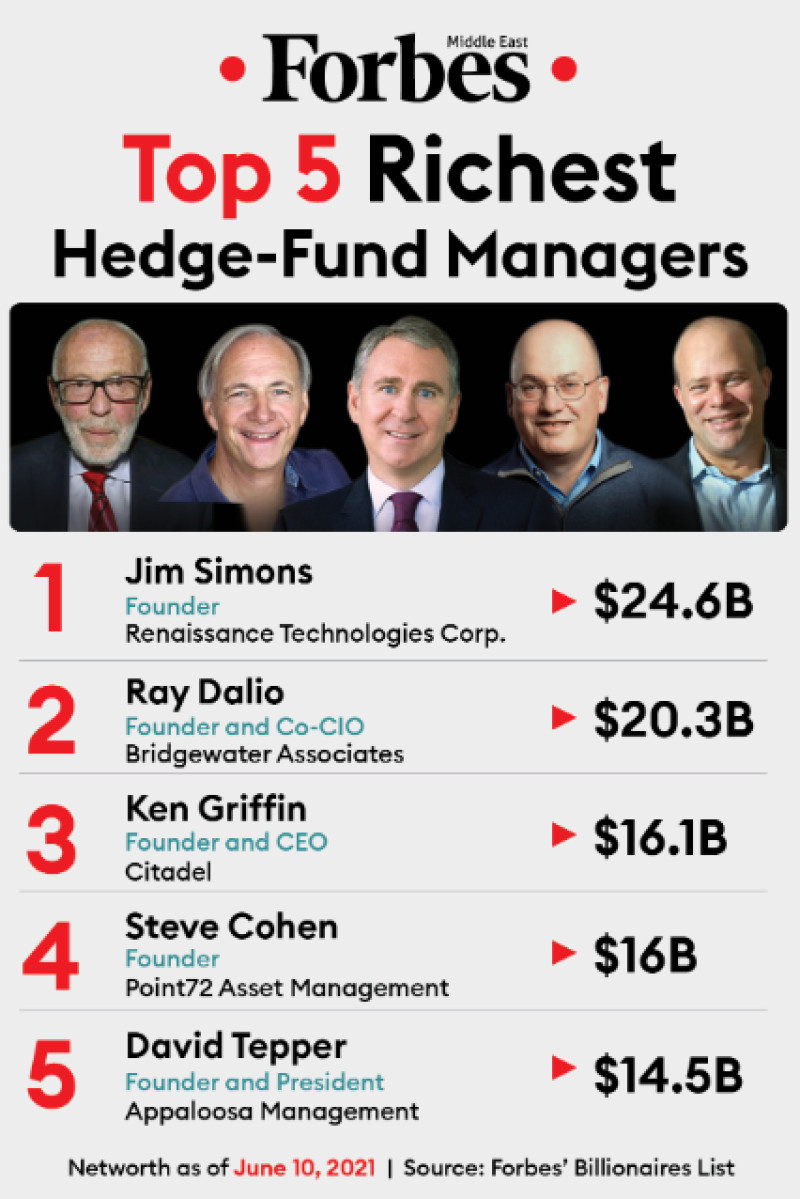

In 2011, Forbes ranked Steven Cohen as the 114th richest person in the world. That year, his net worth was estimated at $8.3 billion.

However, the euphoria was short-lived. In 2013, a major scandal broke out: the FBI accused the fund's employees of insider trading. Cohen later had to cease external investments and shut down SAC, one of the most profitable hedge funds in US history.

However, in 2014, the brilliant trader launched his hedge fund, Point 72, in Stamford, Connecticut. Since then and to this day, Cohen has been managing his personal capital, focusing on early-stage investments. That same year, he also established the Point 72 Academy, dedicated to training hedge fund managers worldwide.

In 2015, American business magazine BusinessWeek named Steve "the most influential trader on Wall Street." Today, the legendary businessman's net worth is estimated at $9.2 billion.

Presently, Cohen and his wife Alexandra are actively involved in philanthropy. The couple financially supports projects related to education, healthcare, and the arts.

In 2014, the Steven & Alexandra Cohen Foundation allocated $30 million to study post-traumatic stress and research related to biomarker testing.

Considering all the above, it is easy to see why we confidently included Steven Cohen in our world trader list. Let us look through the main points that prove the genius of this global financial trader.

Cohen, coming from a modest Jewish family, managed to become a true market shark. He astonished the world with his unique ability to profit regardless of market conditions.

The legendary trader set new standards for investment fund returns and transformed his initially humble company into one of the most successful in the industry within the United States.

In the professional trading community, he is known as a gifted analyst with a knack for accurately predicting future crises in various economic sectors.

The investment model of this brilliant trader, developed in the early 2000s, remains highly popular among traders and is still relevant today.

Cohen's name has not faded and never will. Day by day, his trademark methods and strategies are integrated into modern securities trading systems, assisting traders in achieving impressive profits.

It is important to understand that Stephen Cohen's biography is not just about his ability to earn billions in the stock market, but more about his invaluable contribution to the evolution of trading. Undoubtedly, the immaterial legacy of this legendary investor for today's best stock traders is as vital as the story of his financial success.

*Day trading is a strategy that involves a trader concluding their trades within one business day without rolling over open transactions to the next.

*Long-term trading is a trading strategy based on holding positions for an extended period, that is, from several months to several years.

Why focus on these traders?

Certainly, the traders we have mentioned are not the only legendary people deserving of attention and admiration. There are dozens, hundreds, even thousands of investors worldwide who established the golden rules of trading and merit extensive articles about their journeys and expertise.

However, we selected representatives from three different ages, nationalities, faiths, and backgrounds to prove that anyone starting in the global financial market today might be a legend tomorrow.

What do the individuals we discussed have in common? Primarily, an innovative approach to trading. The heroes of our list were not afraid to break the mold, challenge the old school of trading, and present their own financial instruments to the world.

They did not fear risk. When making new deals, these businessmen focused not on potential losses but on what they could earn via previously unexplored ways. They played big, with their investments totaling millions of dollars and their profits reaching billions.

Failures and obstacles did not deter them from their path to success. Thus, Soros survived the Nazi occupation, while Cohen came from a poor, large Jewish family. Despite difficult childhoods, global political unrest, wars, worldwide crises, legal battles, and FBI accusations, these individuals managed to make their mark in global trading thanks to their perseverance, drive for success, immense self-belief, and continuous learning.

The lives of these three became exemplars for modern traders, and their experiences act as motivation for constant improvement. These people have dedicated their entire lives and careers to trading.

Conclusion

Why is it important for both novice and experienced traders to know about the world's best investors, what helped them achieve remarkable successes, and how they amassed their fortunes through trading? The fact is that one cannot reach the pinnacle of any field without understanding its past.

This principle applies to trading as well. By studying the stories of the successes and failures of legendary traders, we can uncover the secrets of their financial accomplishments and ways to avoid grave mistakes.

Online trading in global markets is one of the most challenging and emotionally charged professions. To truly master this field, one needs to learn consistently and intensely.

Unfortunately, there is no educational institution worldwide where one can attain the qualifications of a professional trader. Thus, all that remains for us is to diligently learn from the experiences of those who have already achieved outstanding results in this arena.

All best stock traders, regardless of their transaction count, should clearly understand that every legendary millionaire was once a beginner. They entered the trading world from ordinary and real life, just like any of us. Nobody is born an experienced trader with profound knowledge and the ability to sidestep any trading pitfalls. Everyone starts at the same point.

However, only those who work hard, learn, rise after each fall, develop their unique trading strategy, and consistently strengthen their character achieve success. Such people will eventually top the list of those who have amassed vast fortunes in global financial markets. Their names have become renowned among traders worldwide.

You may also like:

Back to articles

Back to articles