Countless insightful books about global stock trading have been published. There are a lot of video tutorials and business articles on the subject. Given all this, you might assume that What is a trader is a lucrative yet dull activity, suited only for serious and important individuals.

Contrary to that belief, trading has its quirks! Even those unfamiliar with stock trading have probably heard of "bulls" and "bears". Bulls are traders who buy assets, expecting their value to increase. In simpler terms, they bet on rising prices. On the other hand, bears believe that their chosen assets will continuously decrease in value. Thus, when the market experiences a rapid price drop, it is termed a "bear market."

These quirky animal comparisons add a touch of levity to the serious world of trading. But it does not end with just bulls and bears. Recently, financial news often mentions the "crypto whale", referring to a big player in the cryptocurrency space.

By the way, we have covered who traders are and their roles on global exchanges in an article titled "Trader".

Today's focus is on an even quirkier term from the animal world used to describe traders – "hamsters". Let's dive into who these "hamsters" in the stock market are, why this amusing nickname fits so well in the trading world, and why some market participants use it to label others.

Understanding hamsters in trading

In the financial world, "hamsters" refer to newbie traders who, driven by intense emotions or panic, make trading mistakes. But don't be mistaken; this isn't a term of endearment or sympathy. More often than not, "hamsters" are those market players who, in their eagerness to make a quick profit, overlook potential risks. They might haphazardly load up their investment portfolio* with assets, often way more than they can afford, neglecting technical analysis* and bypassing risk management*.

This behavior is reminiscent of an actual hamster stuffing its cheeks with more food than it can consume. Consequently, a "hamster" trader often ends up losing a significant portion, if not all, of their capital, chasing elusive huge profits.

Online, the term "hamster" has an even broader definition. According to some trading dictionaries, it denotes a retail trader with a small account balance. This draws a parallel with a tiny, jittery creature that's easily spooked and protective of its modest stash. In trading contexts, any small-scale trader, regardless of experience or expertise, might sometimes be dubbed a "hamster".

But why does this happen? The reasons are clear: limited trading experience, or at times, none at all. "Hamsters" struggle to pick effective trading strategies, and often misjudge the assets they're trading and their associated leverage*.

They dive headfirst into online trading with little to no understanding of its complexities and governing principles. Their most glaring oversight is investing funds in assets with the unwavering belief that these investments will not only recoup their initial outlay but earn them much more.

As for the origins of the term "hamster" in the financial realm, there's an ongoing debate among online communities. Some traders believe that this terminology made its way to global markets from the cryptocurrency sector.

In 2015, when the global cryptocurrency buying frenzy began, inexperienced traders rushed to buy digital assets, especially Bitcoins, at high prices, hoping to resell them later at a hefty profit.

This behavior resembled eager hamsters scurrying about, grabbing anything they could and stashing it away for better days. The term soon found its way into the securities, commodities, and precious metals markets.

Some traders believe that the term "hamsters" has always been used in exchanges to describe traders trying to grab as many assets as they can: buying low with the hope of selling high later. However, these traders often bought at peak prices, making it nearly impossible for them to sell at a higher rate. Such missteps earned them the "hamster" label.

*Investment Portfolio: A collection of various trading instruments owned by an individual or entity.

*Technical Analysis: A set of tools that traders use to assess the current financial market situation and predict potential changes by identifying statistical price patterns.

*Risk Management: A set of guidelines that assist traders in deciding how much to invest and determining acceptable loss limits.

*Leverage: A financial metric that helps traders understand the relationship between changes in their investments and corresponding shifts in returns.

Hamsters’ common mistakes

We have identified that the main issue with novice traders is their eagerness to profit in a field they barely understand. But it is not enough just to know who the so-called "hamsters" of the exchange are. It is crucial to recognize the mistakes they often make:

• They buy assets at peak prices and sell at the lowest when the market dips.

• They trade with excessively high leverage*.

• They blindly trust predictions from amateurs. Instead of developing a solid trading strategy, they base decisions on internet tips, friends' advice, or unreliable sources.

• A favorite tactic of these hamsters is to trade on gut feelings or impulses, completely ignoring market analysis indicators.

• They set unrealistically high-profit expectations, sometimes aiming for over 100% annual returns.

• They are easily swayed by market hysteria and tend to follow the crowd. For instance, they rush to invest when asset prices spike due to significant news. However, when the news becomes old, asset prices plummet, leaving these traders empty-handed. Examples include announcements of successful medical drug trials or triumphant space missions.

• This leads to another frequent rookie mistake: they close their trades at significant losses even with minor market fluctuations.

• These hamsters struggle to control their greed, which can sometimes be overwhelming. Attempting to make huge profits, they often engage in dubious trades, like buying illiquid and unstable assets, hoping they have magically pinpointed their growth trajectory.

• Shortsighted beginners cannot handle losses. While professionals might cut their losses and offload some assets when needed, the typical hamster will not concede. They fear losing even a tiny portion of their capital and end up making irrational decisions, including selling all assets at clearly disadvantageous rates.

*Leverage refers to funds that a trader borrows from a broker to make larger trades, amplifying potential investment returns.

Example of hamster behavior

Imagine a rookie trader (we will call him the "hamster") who just joined an exchange, funded his account, and bought the popular digital coin, XRP, ready to dive into trading.

Later, he watches as his cryptocurrency experiences a sudden surge or "pump."* In the morning, it was priced at 50 rubles, but by afternoon, it was skyrocketing to 125 rubles.

So, what do seasoned market players do in such situations? Drawing from their vast experience, they know that the best time to enter the market during a pump is at the very start. Thus, it is crucial to quickly determine the price at which they will sell their XRP.

So, a savvy trader might aim to buy the coin when it is still around 70-80 rubles, then immediately place a sell order* at 100-110 rubles.

But what about our hamster?

He watches the continuously rising XRP price with hesitation and indecision. Only when the coin hits 100-125 rubles does he suddenly deem it worth every penny – even at 125 rubles. Swiftly, he buys the asset, neglecting to set up a sell order. The notion of a coherent trading strategy does not even cross his mind, he is just preoccupied with dreams of what he will spend his gains on.

The following events are textbook. In a few hours, the XRP price might climb even higher, say, to 150 rubles, before sharply plummeting. Naturally, panic sets in for the novice. He comes to terms with the fact that he will not recoup his full investment, but he still hopes to salvage something. In a hasty move, he sells his XRP for 70 rubles, forgetting he bought it for 125 rubles.

*Pump refers to a manipulative price increase in financial markets, usually followed by a sharp drop.

*An order is a directive given by a trader to a broker to buy or sell a specified quantity of financial assets.

Shearing hamsters

While newbie traders often hurt themselves by panicking and losing hard-earned money, there are plenty out there looking to profit off these inexperienced "hamsters". The process of extracting money from scared novice traders is known in trading lingo as "shearing the hamsters." Market veterans can employ a myriad of tactics to exploit these beginners. Today, we will spotlight two of the most common.

First up is the trap set for novices when they initially step into the market. Imagine someone who's constantly bombarded with ads promoting profitable crypto investments. They have seen YouTube videos showcasing successful crypto investors turning $1 into millions and think, "I can do that too!" So, our eager hamster buys a couple of digital coins, dreaming of turning his $100 into those YouTube millions. Little does he realize that for the uninitiated, there are not many options to exchange fiat money for cryptocurrency without significant losses.

There is only one real approach – typing "buy crypto" on a Google search bar. This search presents a vast array of online exchanges, seemingly offering a wealth of choices. However, there is a catch – exorbitant exchange fees. For instance, if our "hamster" trader opts for Bitcoin (which most newbies are drawn to), many crypto exchanges can charge up to 30% in commission, with blockchain fees consuming another 10%. That's quite the raw deal.

So, what advice for these market newcomers? If you are serious about trading, seek guidance from a trusted, experienced individual. It is paramount to trust this person, and even more so to trust their financial market experience. A seasoned trader will likely help you exchange coins at a fair rate without ripping you off.

The second tactic exploiting these "hamsters" is through signals*. Newbies often seek out authoritative figures, hoping their expertise will lead to instant millions. When there is demand, supply is not far behind. Many might have come across individuals who set up websites, Telegram channels, or social media accounts proclaiming themselves as brilliant market analysts. These "experts" share tales of traders becoming rich and successful thanks to their precise forecasts. They start publishing signal information and predictions about price movements. For instance, an "analyst" might predict a dump of a specific cryptocurrency on a particular exchange that evening.

An advisor urges traders to buy a certain asset immediately, claiming that the current price drop is artificial. Once it is over, he predicts the coin's value will soar again.

Following this advice, many traders, often referred to colloquially as hamsters, rush to the crypto exchange and patiently await the predicted drop. Sure enough, a minor dip occurs, and these elated traders confidently buy up the cryptocurrency, eagerly anticipating a price rebound.

After that, the major holders of this digital asset start placing large sell orders at reduced prices. Naturally, the price takes a sharp dive.

These hamsters panic and scramble to sell their recently acquired crypto at any given rate, desperate to recover at least some of their investments. This heightened frenzy accelerates the market panic, sending the coin's value plummeting. New traders end up selling their assets for mere pennies. Meanwhile, major crypto holders calmly withdraw their open sell orders, allowing the market to stabilize on its own.

Once equilibrium returns to the exchange, savvy traders begin to sell their assets, which were scooped up from the panicked hamsters for next to nothing, at fair prices. They then lock in their profits.

Are you new to the market? Here's a key piece of advice: Only trade with money you can afford to lose. Determine an amount, and if losing it will not be catastrophic for you, that's what you should be willing to risk.

Stay calm! Markets often rebound after a sharp drop. So, avoid making hasty decisions in the heat of the moment.

Be patient. Give it a few days for the situation to normalize. By doing so, you are likely to not only preserve your investments but potentially even get profits!

However, exchanges do experience unexpected events or "black swans."* These can range from the delisting* of assets, hacks, and thefts from the exchange to even a founder's* bankruptcy.

*Signals refer to trading recommendations based on market analysis, guiding buy and/or sell decisions.

*Black Swan is a term first coined by Nassim Nicholas Taleb in 2007. It represents unforeseen, inevitable, and rare economic, political, and social turmoils that have significant global implications.

*Delisting means removing assets from the exchange's trading list.

*Founder generally refers to the visionary behind an idea. More specifically, it could be the person who establishes a company or launches a startup.

How not to become hamster?

Many seasoned market players say that every newbie trader will, sooner or later, make typical rookie mistakes. However, it's crucial that newcomers only hear about these "rookie pitfalls" and not experience them firsthand. That's why we've created a brief guide to safeguard your assets.

Start by getting a good grasp of global financial markets and trading basics. Consider taking a trading fundamentals course, do your research, or watch online webinars and lectures from leading experts.

Before you risk your own money, get familiar with concepts like risk management, trend reversals, timeframes, indicators, support and resistance levels, day trading, long-term trading, and more.

It is essential to avoid getting caught up in widespread panic. Of course, keeping your cool while watching your investment plummet is tough. However, you must develop a trading strategy and stick to it, regardless of emotions or market frenzy.

Resist the urge to invest all your money in assets that have been skyrocketing for days. Remember, impulsiveness, spontaneity, and panic are a trader's worst enemies during online trading.

Don't invest blindly in unknown assets! Before buying, do thorough research. Dive into the company's details, check price trends, statistics, and key metrics.

Avoid trading on margin. Trade with your funds, especially if you are just getting started in the world of trading. While margin can be tempting, learning to use it wisely takes time.

Mastering the tools of fundamental analysis is crucial. This foundational skill for traders will undoubtedly enable you to anticipate price movements in the future.

To minimize risks while maximizing profitability, every trader must clearly grasp the current market conditions. Always keep a keen eye on factors that can influence price movements. After all, an asset's price isn't some arbitrary figure; it reflects real supply and demand. These trends often hinge on prevailing global economic and political sentiments.

Factors such as shifts in a nation's monetary policy, investor reactions to recent economic and geopolitical events, news headlines, updated macroeconomic statistics from countries, and even wars, pandemics, or natural disasters can all induce significant currency pair fluctuations.

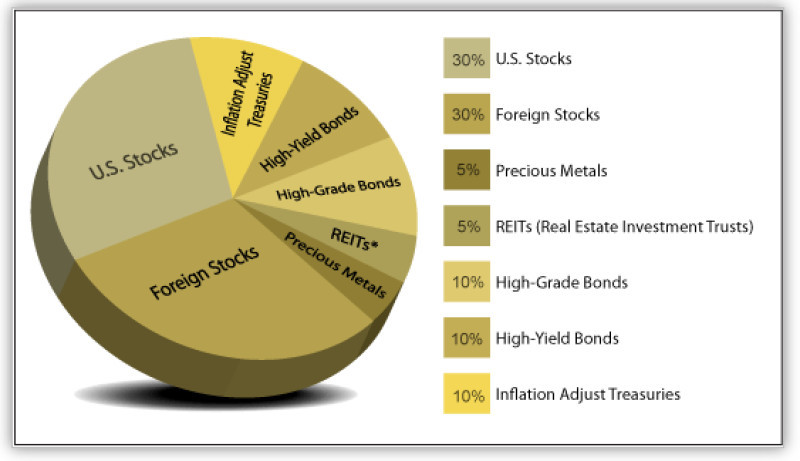

Lastly, it is important to invest time and effort in diversifying your investment portfolio. It is ill-advised to hold just one type of trading asset. Add stocks, indices, bonds, cryptocurrencies, precious metals, and other assets to your portfolio.

A key principle of diversification is to include uncorrelated assets in your portfolio. This creates a balance and acts as a safety net: when one asset's price drops, another has the potential to rise.

Market professionals advise reviewing your portfolio at least annually to reduce risks and realize any losses.

*A trend reversal occurs when the market's overall price direction shifts from a downward to an upward trajectory, or vice versa. Reversal points refer to horizontal lines that help identify key levels likely to trigger price changes.

*Time frame represents the specific duration used to group price quotations when plotting elements on an asset's price chart.

*Indicators are tools used for analyzing and predicting price changes in financial markets. Simply put, they're calculations based on the volume and price of a particular trading instrument.

*Support and resistance levels are horizontal lines drawn at price lows or highs, respectively.

*Day trading is a strategy where traders wrap up all trades within a single trading day, without carrying open positions to the next day.

*Long-term trading is a strategy centered on holding positions for extended periods, ranging from several months to years.

Conclusion

Today, we have delved into explaining who hamsters are in the trading world, why this quirky nickname fits perfectly in the trading landscape, and why some market players use it to label others.

From what we have covered, it is clear that the online trading community has not settled on a definitive understanding of the term "hamster trader". Every trader perceives it differently.

But one thing is certain: no trader wants to wear this amusing label. Calling someone a hamster implies they are greedy, jittery, frantic, and lacking expertise.

Moreover, these hamsters always seem to be at a disadvantage as they constantly face off against the more seasoned and adept market players known as "sharks". Every trading shark is more than happy to profit from the jittery, frantic, and sometimes naive hamster.

On a side note, if after reading this you feel you might be a typical hamster, do not get disheartened. Many professional traders have been there.

It is crucial to learn from your mistakes to avoid repeating them. Educate yourself on trading, start with small amounts, and do not rush to leverage, hoping to gain big immediately.

You may also like:

Back to articles

Back to articles