People unfamiliar with the world of financial markets often perceive trading as a simple endeavor: some aim to sell assets at a higher price while others want to buy them cheaper. But, in reality, it is far more complex.

To consistently profit in the stock market, traders should master a wide range of techniques. These strategies empower financial market participants to trade most effectively and lucratively.

We have previously delved into the world of traders and their roles in the global financial ecosystem in our article titled What is a trader?

While these trading strategies share a common goal, they can vary significantly. Differences might emerge in their approach to market analysis, asset management, or position opening.

Having examined numerous trading methods based on the above criteria, financial market experts have identified swing trading as one of the most effective and practical approaches.

The primary advantage of this strategy, as highlighted by seasoned traders, is that it does not require constant market monitoring. Yet, the trading technique still captures significant market movements.

So, let's dive deeper into what swing trading entails, uncover its core principles, and understand how to harness this strategy to maximize profits.

What is swing trading?

To understand swing trading, let’s first break down its name. In the context of trading, the word “swing” refers to price changes or fluctuations.

So, swing trading is a method based on a powerful impulse movement that can be tracked, caught, recorded, and utilized for profit.

A more detailed definition of swing trading is a trading style aimed at recognizing the cyclical nature of price movements to subsequently profit from these price fluctuations.

This trading strategy sits between day trading* and long-term trading.* It offers the opportunity to make intraday trades while also permitting rolling over the position to the next day.

Commonly, when describing the swing trading method, one might come across the belief that positions typically remain open for 3 to 5 days. However, given the high volatility and peculiarities of different markets, this timeframe can range from just a few hours to several weeks.

Of course, swing trading can be done on even smaller timeframes,* but long-standing statistics suggest that profits tend to be less significant in such cases.

Surprisingly, many traders view swing trading as a new style in the realm of online trading. There is some truth to that. In fact, the method came into widespread use only a couple of decades ago, even though the history of swing trading spans over 70 years!

The term was first employed by George Douglas Taylor in the 1950s. It was in his book, "The Taylor Trading Technique," that he first drew readers' attention to the possibility of maximizing income thanks to market cycles lasting from 3 to 5 days.

Over the past 70 years, traders have refined this method to perfection, mastering the art of garnering substantial profits through swing trading.

*Day trading is a strategy that entails closing trades within a single working day without carrying any open positions over to the next day.

*Long-term trading is a trading strategy focused on maintaining open positions over an extended period, ranging from several months to years.

*Timeframe refers to the specific time interval used to group quotes during the formation of price chart elements for a trading asset.

Key principles of the method

At its core, swing trading revolves around catching price fluctuations to amplify profits. Another notable characteristic of swing trading is the trader's intention to achieve as much income as possible with the least number of executed trades.

Below are some crucial conditions under which the swing trading strategy would be most effective.

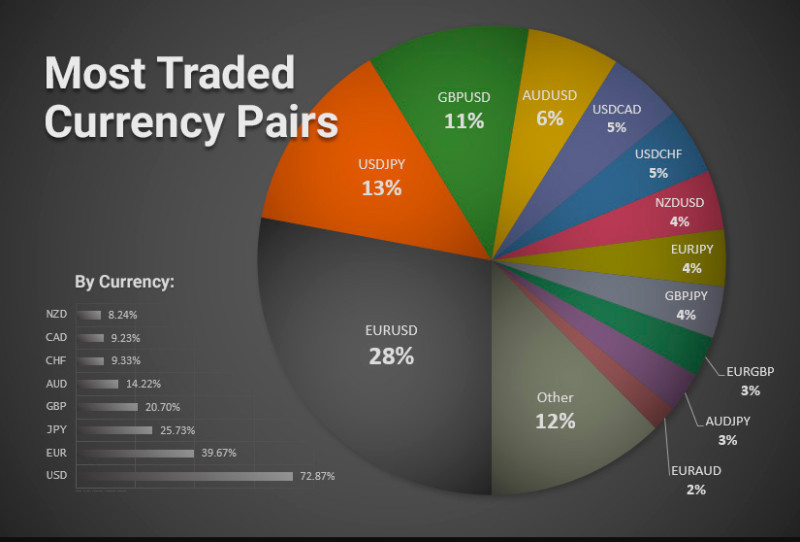

It is vital to focus exclusively on the major currency pairs (EUR/USD, GBP/USD, AUD/USD, USD/CHF), avoiding cross rates* and exotic* currency pairs.

Additionally, the swing strategy demands a minimal level of leverage* and the utilization of no more than 2-3 trading assets simultaneously.

The opening and closing of positions are based on technical analysis rules.* Furthermore, those market participants choosing the swing trading method should approach the selection of entry points meticulously and thoughtfully.

An ideal entry point can be the moment when the price rises immediately following the trade opening. If the asset price is heading toward a loss for 2 or 3 hours, you should close the trade manually as soon as possible.

A rapid price spike can be instantly utilized. Later, this will allow you to re-enter the market during a price pullback. Remember that a swift, albeit minor profit in swing trading always builds up to significant gains.

It is not recommended to open positions at the start of trading on global financial markets. The best moment for closing positions is ahead of important news releases that can substantially influence the current market scenario.

Moreover, experts recommend closing positions during an evident trend reversal* and altogether refraining from entry if there are doubts about the situation's mid-term progression.

Therefore, technical analysis serves as a foundation for swing trading. At the same time, swing traders also need to understand the basics of chart analysis* and trading volume analysis.*

An aspect deserving specific attention here is fundamental market analysis. To minimize risks while ensuring profitable trading, every swing trader must have a clear grasp of current market conditions. They should always focus on factors capable of influencing price movements.

After all, an asset's price is not an artificially constructed measure but a genuine reflection of supply and demand. These, in turn, are heavily influenced by the prevailing economic and political climates globally.

Factors like changes in a country's monetary policy, investors' reactions to recent economic and geopolitical events, news backgrounds, and fresh macroeconomic data can cause significant fluctuations in currency pair rates at any given time.

Events with the most potent influence - capable of pushing asset prices up or bringing them down into the financial abyss - are natural disasters (like floods and tsunamis) as well as wars and pandemics.

*Cross rate is the exchange rate between two currencies, neither of which is the US dollar.

*Exotic currency pair is a forex pair that consists of a currency from a developing economy and one from a developed economy.

*Leverage is the use of funds that a trader borrows from a broker with the intention of entering into trades with larger sums and amplifying potential investment returns.

*Technical analysis is a set of tools that allow a trader to assess the current situation in the financial market and predict its potential changes by identifying statistical patterns in asset prices.

*Trend reversal is a market situation where the general price movement changes from a downtrend to an uptrend, and vice versa. Pivot points are horizontal lines that help identify key levels capable of provoking price changes.

*Chart analysis is a subtype of technical analysis. It is based on the methods of collecting, studying, and processing various patterns and graphical objects on price charts. These patterns assist market players in discerning price movement regularities based on statistical data and predicting its subsequent behavior.

*Trading volume analysis is a technical analysis tool that tracks trading activity at a given time and the intensity of trading for a particular asset.

Positions in swing trading: close or hold?

The key principle of swing trading states that only winning trades should be carried over to the next trading day. Consequently, all losing positions should be closed by the end of the current day.

It may sound rather straightforward, but it is more complicated in real life. Depending on the unfolding price movement and the specific situation, each swing trader must decide whether to roll over the position to the next day or to lock in profits immediately, seeking new opportunities the following day.

But traders are not left in the dark when faced with this dilemma. Several tried-and-true self-help methods, backed by years of experience of millions of traders, can assist in this endeavor.

Firstly, it is vital to conduct a thorough analysis of the trend movement approaching the day's end and gauge its potential. This gives the basis to the carry-over rule: only carry over a trade if the position confidently sits in the profit zone.

However, there can be challenges. Sometimes, the candlestick marking the opening of the trading session is exceptionally strong. Moreover, the market might open with a gap.* In these cases, a swing trader can exit a position at a stop-loss* order only at its extremum point, risking significant slippage and thus elevating the risk.

Definitely, the market can open in favor of traders’ positions. If a trader is fortunate enough, the market might open near the closing point. The temptation is high, and very often, traders grapple with the ultimate question: should they close a position or carry it over to the next day?

Speaking about significant factors that could boost the trend's momentum, it is essential to mention notably positive global news released during the day. It is crucial to get confirmation that the market is flooded with substantial volume on this news, consistently driving the traded asset's price in the trend's direction.

Another indicator of trend continuation is when the market closes above the previously achieved extremum points. Such a scenario can prompt a group of opposing traders to close their positions at stop-loss levels, thus perpetuating the trend's direction.

For a more informed decision, wait for the trend to exhibit potential movement before the trading day ends. In other words, trades shouldn't close near the counter-trend line. If this condition is met and the position is well entrenched in the profit zone, you can carry it over to the next trading session with no doubts.

With all this in mind, we can formulate a concise but essential rule for swing traders: only carry over profitable positions and do so exclusively when significant factors affirm the current trend's strength and its prospective potential.

*Gap is a situation in the market characterized by a noticeable difference between the closing price of a previous chart and the opening price of the next chart.

*Stop-loss is a type of protective order that a trader sets for the automatic closure of a trade. A stop-loss helps in capping potential losses.

*Extremum points are the highest or lowest points reached by the price of a traded asset.

Advantages and disadvantages of swing trading

A distinct advantage of swing trading, and a reason it is loved by traders globally, is that this method does not require constant market monitoring.

Compared to the equally popular day trading method, swing trading certainly demands much less time. This strategy lets traders spend minimal time in front of the screen without the need for constant chart-checking and endless trade executions.

At the same time, swing trading offers users vast opportunities to gain profit irrespective of the market direction. Compared to intraday trading strategies, swing trading can yield more substantial profits.

Another significant upside of swing trading is the constant honing of one's skill in interpreting financial markets. Moreover, this method suits those traders who have an innate feeling for accurately determining which trades will be profitable and which won't.

A vital ability for a swing trader is to identify the prevailing trend and utilize it efficiently for maximal returns.

Swing trading does not demand the use of indicators,* eliminating the struggle with their lagging nature.* Many seasoned market players believe that the absence of indicators in swing trading strategy is what makes it so effective.

An additional bonus of swing trading is its constancy and unchanging nature. While technical indicators might require optimization, swing trading techniques have remained virtually unchanged for over seven decades.

Despite its long history, the effectiveness of swing trading remains undiminished, which is why it continues to be employed by traders, analysts, and investors from all over the world.

Despite the many advantages listed above, it is essential to understand that swing trading is not a magical solution for every trader.

Compared to intraday trading, swing trading demands lengthier time intervals. This means that traders may need to invest more capital upfront in trades.

Besides, swing trading tends to be more suitable for experienced market participants than beginners. Effective trading using this method requires experience.

Without specific skills, for instance, a trader wouldn't be able to identify the trend direction, determine the market cycle phase, or predict price behavior. Moreover, lacking fundamental knowledge about financial markets means a trader can not adequately assess potential risks and returns.

Another essential aspect of the swing method pertains to the trader's personality, temperament, and trading objectives. In other words, a strategy that is very profitable for one trader might prove disastrous for another. It is not just about finding an effective trading strategy; it is also vital to ascertain that it aligns with one's personality and trading style.

From a psychological viewpoint, swing trading is best suited for impulsive and somewhat emotional traders. Such market players often rely heavily on their intuition.

Since the swing trading strategy requires monitoring the market situation only once a day, the temptation to jump into trades impulsively is virtually eliminated.

Considering the points raised above, the following might seem contradictory. However, a vital trait for traders who choose this trading approach is patience and resilience. The swing trading style sometimes requires trades to remain open for several days.

Calmness is another essential quality for those dreaming of profiting via swing trading. Even if the market starts moving in an unplanned direction, maintaining composure is crucial.

Therefore, if you manage to genuinely grasp the essence and nuances of swing trading, and if you master detailed market analysis and its dynamics, applying this trading method will certainly yield significant profits.

Importantly, even the most calculated actions do not guarantee perpetual profits or the absence of losses. Sometimes, during extended waiting periods, numerous attractive trading opportunities might be missed. Such is the cost of swing trading. However, once committed to this strategy, it is essential to remain calm and confident.

In essence, the selection of a trading style is a personal decision made by the trader, influenced by past trading experiences, individual characteristics, and trading objectives. Regardless of the chosen approach, the primary compass should always be a balanced risk-to-reward ratio.

*Indicators are tools used to analyze and predict price changes in financial markets. In simpler terms, they are computations based primarily on the trading volume of a specific financial instrument and its price.

*The signals of most indicators are based on past price information. Such lagging aspects can negatively impact both the amount of profit a trader makes and the overall success of a trade.

Bottom line

In this article, we have attempted to showcase all the nuances, advantages, and disadvantages of swing trading. Despite the extensive details provided, the essence of this strategy can be concisely defined as trading in the direction of the trend and entering trades during pullbacks.

However, regardless of its apparent simplicity and versatility, swing trading won't be suitable for every trader. Even professional market players sometimes struggle with this strategy and fail to profit from it.

Moreover, many traders have suffered significant losses when applying this style. Thus, before giving a firm “yes!” to swing trading, it is imperative to determine if this method is right for you.

It is especially important for beginners in the global financial markets to think twice before taking action. Before diving into swing trading, it is crucial to first understand all the pitfalls of the market, acquaint oneself with the basics of both fundamental and technical analysis, and only then commence trading.

And always remember, regardless of the trading style you choose, the risk-to-reward ratio should always be the key factor when entering the market.

You may also like:

Back to articles

Back to articles