In today's digital era, it's common to hear statements like, "You can make money online out of thin air." While this shouldn't be taken literally, it raises an intriguing question: Is it possible to earn online with minimal effort, time, and personal investment? The answer is a resounding yes, especially when it comes to online investing in stock markets.

Let's examine how modern international markets meet these criteria. Global financial exchanges are now fully accessible online, eliminating the need for physical presence. Minimal effort? Absolutely. Investing in stock markets can be done comfortably from your armchair using just a computer, tablet, or smartphone with internet access.

And what about the time commitment? Surprisingly low. Sometimes, investing in assets can take just a few minutes. Naturally, we all aim to invest little and earn big, and stock market investments often fulfill this goal perfectly. By choosing the right investment, you can potentially multiply your capital manyfold.

For those new to this realm, our article "Investing for Beginners" offers a comprehensive guide. It details the steps to choose the perfect investment for you and ways to significantly profit from it.

Given all these points, it's clear that investing in modern online markets can be a straightforward and lucrative option. The only remaining question is how to make that very first investment correctly.

That's why today's review is dedicated to the topic "Starting Your Investment Journey." Alongside covering the essentials of this process, we'll introduce you to handy apps that make investing easy and wise. This part of the training will be called "Investment Opening Application." So, let's dive in!

How to get started

Despite its allure and promise, investing requires careful groundwork and answers to a couple of crucial questions before taking the plunge:

How much money am I willing to invest?

Before you dive into complex calculations to figure out the ideal amount, remember the golden rule: never invest your last penny! Start by building a financial safety net. Only once you've secured this should you consider investing your spare funds into assets.

What exactly is this "financial safety net," and how big should it be? Financial literacy experts commonly suggest that it should be at least three months' worth of your salary.

This can be in the form of cash or funds in your accounts. Such a sum ensures that you, as a novice investor, can handle unforeseen circumstances and related expenses without having to worry about opening an investment company losses or hastily selling off assets and withdrawing money from your brokerage account.

Online stories often tout the idea that you can start investing with as little as one dollar. While this is technically possible, the reality is more complex. Online investment incurs certain costs: transaction fees, time spent trading, etc. So, setting absurdly low investment budgets isn't advisable.

A balanced approach would be to invest an amount whose potential loss wouldn’t adversely affect your lifestyle. The online stock market can be unpredictable, capable of either boosting your capital significantly or leading to losses. Market newcomers, due to their inexperience, may not always start on a profitable note.

There's a chance that a beginner investor might lose a portion of their invested funds. However, this should not be seen as a failure, but rather as a norm, and sometimes, a valuable lesson.

Losses provide the experience needed to develop more effective trading strategies and introduce the investor to the principles of risk management*.

How much time am I willing to spend?

Your time commitment to investing depends on how involved you want to be in the process. If you choose to take on the responsibility yourself, you'll need to dive deep into the world of investing, which requires a significant time investment.

This involves educating yourself through professional courses or YouTube tutorials, reading thematic books, finding investment applications, subscribing to expert channels, and joining investor chats.

An alternative is to seek the assistance of a broker, a licensed company authorized to trade stocks on behalf of investors.

The broker acts as an intermediary between you and the global financial markets. By engaging a brokerage firm, you maintain the right to make decisions about buying or selling assets and entrust the broker to execute your instructions.

There's also a third option that completely frees you from the time investment in making transactions: entrusting your funds to a management company. In this case, you sign a contract with an investment fund, and professionals then handle your capital and the profit generation. Of course, this service comes at a certain fee.

It's important to note that in this form of interaction, the funds do not change ownership, and the managing fund does not receive direct benefits from transactions with the capital.

What principles should I adhere to?

Investor behavior principles in global markets are called an investment strategy. It encompasses various aspects: the goal, duration, frequency, periods of investment, and the amount. An important separate item is deciding on the profit you expect and the level of loss you find acceptable.

Let's start with the investment goal. It's important to determine why you want to invest. Some might want to save for a new car, others for buying a house, and some for a secure retirement. Choose a goal that motivates you and keeps you going even during unstable periods and difficulties.

Next, decide on the investment term. This depends on your goal and when you will need the money. Typically, strategies are divided into three main categories:

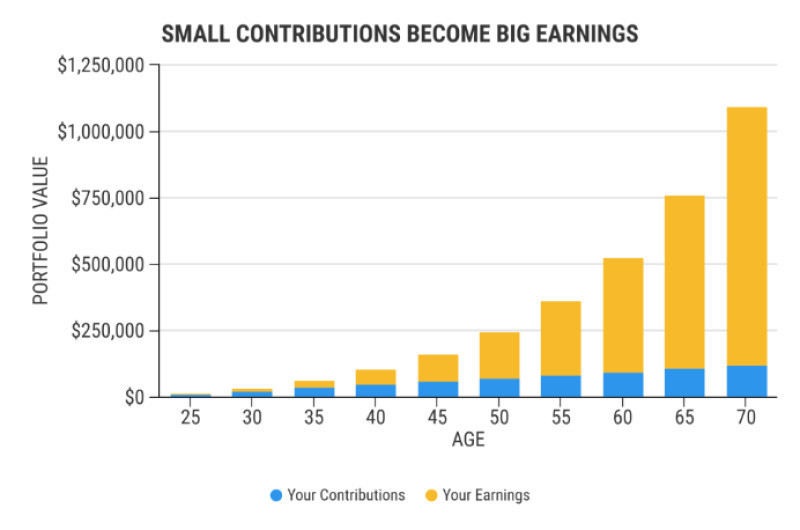

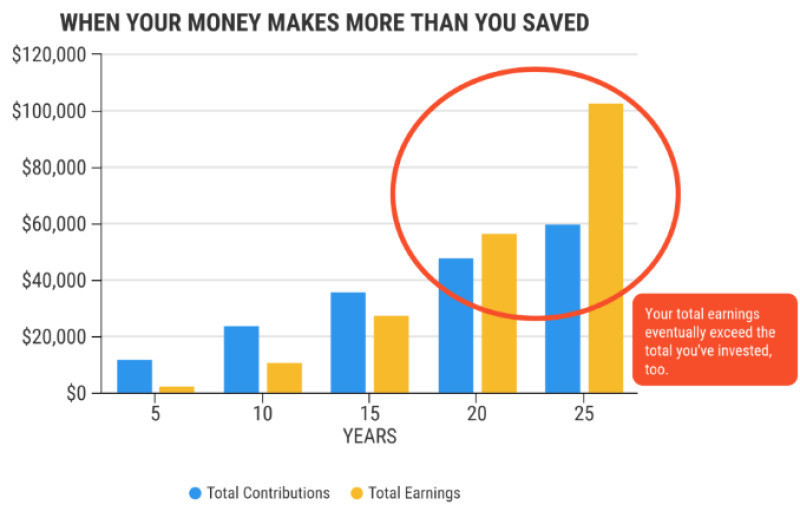

- Long-term: You can expect a return on investment in no less than three years.

- Medium-term: You invest for a period from one to three years. Suitable investment options for this category could be the securities of large international companies with a solid reputation and regular dividends, as well as corporate bonds.

- Short-term: This is ideal for those planning to withdraw money from the market in less than a year. The most suitable trading instruments here are liquid assets, i.e., those you can sell at any moment, such as stocks and bonds.

Each of these opening an investment company durations has its advantages and disadvantages. Long-term and medium-term strategies do not require constant monitoring of traded assets. All you need to do is keep an eye on the overall market situation and occasionally adjust the contents of your investment portfolio. However, in these cases, you can't expect an immediate return of funds from the market.

Meanwhile, the rules of a short-term strategy allow you to withdraw your funds quickly and at any moment, but they require the investor to be much more involved in market processes and to react swiftly to their changes.

The profitability of such investments heavily depends on the short-term fluctuations of the asset prices you've invested in. Another important point is that in short-term investing, you should always be prepared for significant losses.

Why is it Important to have and strictly adhere to an investment strategy?

The truth is that the investment process is always associated with the risk of losing money. This risk is especially high when novice investors start acting on impulse, intuition, or the advice of acquaintances.

Being present in global markets requires a cool head and precise calculation. Only a clear and well-thought-out strategy will help ensure this. However, it's important not to stick to a 'one-plan-fits-all-life' rule. No matter how perfect it may be, it's worth reviewing it from time to time. Due to the constantly changing market situation, assets that were incredibly attractive just a month ago may become unprofitable. Such a trading instrument might be in your investment portfolio. What if there's more than one?

Investments need control. Therefore, it's important to keep your finger on the pulse of market changes, adjust your strategy to them, continually assess your assets, and correct their composition.

*Risk Management refers to a set of rules that help a trader determine the most suitable investment volume for entering the market, as well as an acceptable level of financial loss.

*An Investment Portfolio is a collection of trading instruments owned by a single investor, whether an individual or a legal entity.

What to avoid when starting to invest?

- Don’t believe the myths

Many beginners mistakenly believe that a large sum of money is required to start investing. In truth, anyone interested can embark on this journey.

Many brokerage firms advertise that you can start trading on the stock market with them with just one dollar in your pocket.

Another common myth among beginners is that investing is only for the wealthy. This idea is paradoxical because many wealthy individuals became so precisely by choosing to invest.

- Don’t invest everything you have

Before you start investing, create a reliable financial safety net for yourself. Aim for at least three, or better yet, six months’ worth of salary. This doesn’t necessarily mean keeping your money under the mattress - you can put it in a bank deposit to work for you.

Only after fulfilling this vital condition should you confidently start investing. Remember: only invest an amount whose loss won’t impact your life.

- Don’t leave it to luck

If you’re determined to invest independently, make sure to get some basic training. Read professional literature and visit thematic forums.

Many companies operating in global financial markets offer beginners the chance to test their skills in demo modes, which carry no risk of losing funds.

- Don’t let your emotions guide you

Impulsivity is a frequent error among novice traders. Random decisions often lead to many failures and, as a result, the loss of capital. Avoid abrupt reactions to even minor price changes in your chosen asset.

You should only act decisively if the quotes change significantly and persistently. It's crucial to set a loss limit you're willing to bear. For example, if an asset falls in price by 15%, it's wise to sell and secure your losses.

It might be tempting to wait for a price rebound, but this can lead to even more significant losses.

- Don’t put all eggs in one basket

If you've decided to invest in company stocks, choose organizations from various business sectors. This helps diversify risks.

Even if you've always dreamed of making money from oil giants' stocks, it's not wise to invest all your money in them. When global oil prices drop, the share prices of companies in the oil and gas sector invariably fall too, and you'll lose money.

If your investment portfolio includes stocks not just from your favorite oil giants, but also from, say, the pharmaceutical or chemical industries, this will help minimize the risk of capital loss. Thus, even if one asset decreases in value, profits from other investments can compensate.

Moreover, you can take an even more global approach to diversification. Your investment portfolio can be filled with various asset categories, such as stocks, bonds, precious metals, commodities, cryptocurrencies, etc.

- Don’t fall for grand promises

You might have seen online ads from intermediary firms promising "Up to 200% earnings per day from investing." Remember, only scammers can guarantee anything in the stock market.

A reliable and responsible broker not only talks about profits but also always warns about risks. Understand that the global financial market situation changes every minute, and despite all the grand promises, you are ultimately responsible for your decisions.

Investing with mobile apps

With the widespread use of smartphones, starting to invest is now just a few minutes and clicks away. Just download an investment app on your iPhone, iPad, or Android device – like the InstaForex Mobile Trader app – and you're ready to dive into the world of global markets!

Remember, your investment experience, preferences in trading instruments, or strategy should be uniquely yours. There's an app out there for every investor.

If you're not ready to spend much time on the initial setup, don't worry. We've done the legwork for you by finding the perfect investment app: InstaForex's Mobile Trader.

Mobile Trader is an excellent solution for those eager to step into investing without being tethered to a PC at home. Its functionality mirrors traditional desktop solutions, but its mobility offers round-the-clock access to market information from wherever you are.

By downloading Mobile Trader, you gain instant access to detailed analysis of financial instruments, manage your account easily, and stay up-to-date with market news!

Features of Mobile Trader app

- User-friendly interface

- Quotes of the most popular assets

- Access to over 300 trading instruments

- Detailed fundamental and technical analysis

- Real-time quotes

- 24/7 economic news

- Secure connection with 128-bit encryption

- Minimal data usage

- Clear charts for simplified investing

- 24-hour online chat support

An essential feature for beginners in Mobile Trader is the demo account. This account allows you to test trading instruments without making a deposit.

Mobile Trader users can invest in securities from global corporations like Tesla, Amazon, Microsoft, Apple, JPMorgan, Johnson & Johnson, and others. The app works equally well on both Android and iOS devices, optimizing the investment process and making stock market operations simple and understandable.

Conclusion

The key takeaway from our guide is this: the journey of a thousand miles begins with a single step. In investing, as in any endeavor, the most important thing is to start – despite fear, doubt, and prejudice.

Remember, even the most famous and wealthy investors once started just as tentatively as you might be now. But they took that crucial first step and are now reaping the rewards.

Another important point: opening an investment company profits aren't just a stroke of luck or fortune. They result from significant efforts, emotional discipline, and carefully thought-out steps and decisions, which begin right from the start – your first investment.

Investing your personal funds in assets is something you can start doing today. The size or term of the investment isn't as important as being well-prepared.

Begin with simple steps: familiarize yourself with the functioning of global financial markets, analyze your early mistakes, refine your strategy, and keep moving forward. By understanding all the nuances, advantages, and drawbacks of investing, you can reach any financial peak.

And to make this task easier at the start, choose the most accessible and straightforward tools, like an investment app.

You may like:

Back to articles

Back to articles