Sometimes investors, especially beginners, may think they have found a “gold mine” in a rapidly growing sector or company and are tempted to invest all their savings in it for a huge return.

However, it's important to remember that no asset can consistently grow or decline in value indefinitely. Eventually, trends change: growth periods can shift to declines, and vice versa.

The influences on these processes are numerous and complex. One way to protect your investments against potential risks is to diversify by investing in multiple instruments. This article discusses this strategy in detail.

For a more comprehensive understanding of how to start investing, consider factors and risks, and learn about the pros and cons, refer to "Investing for Beginners."

What are portfolio investments?

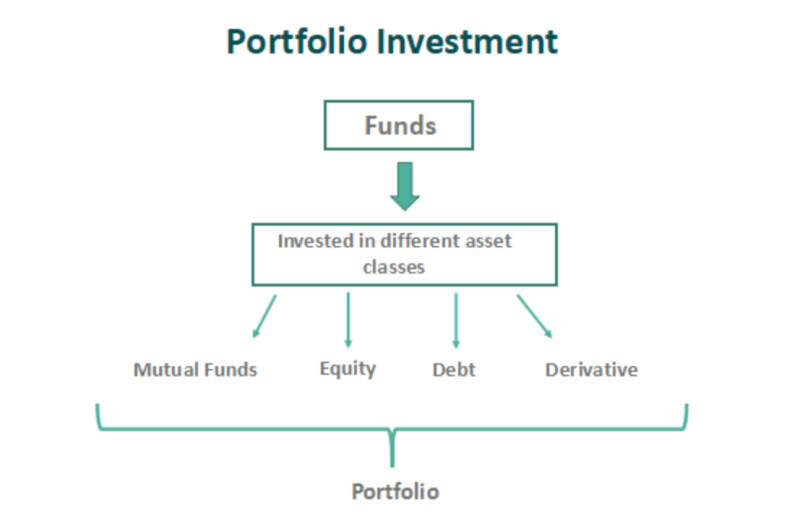

Portfolio investments originated when securities were physically held in portfolios. Today, physical portfolios are obsolete as most assets and transactions are digital, but the term remains. It refers to a "buy and hold" strategy, meaning assets are bought for long-term holding in anticipation of value growth.

A fundamental rule for all investors, regardless of capital size, is not to "put all your eggs in one basket." But what does this mean in practice?

It might seem simple to analyze the market, pick the best asset, and invest everything in it. However, this is not how investing works. Such a strategy can lead to losing everything in an instant.

To avoid such scenarios, investors should distribute their capital across multiple assets. These assets should be diverse in nature, differing in risk levels, returns, liquidity, volatility, and other parameters.

Additionally, these instruments should span various sectors. This approach ensures a balanced portfolio, as a decline in the value of one asset won't result in the loss of the entire portfolio. Losses from certain instruments can be offset by gains from others.

Types of portfolio investment

Portfolio investment types can be classified based on several criteria:

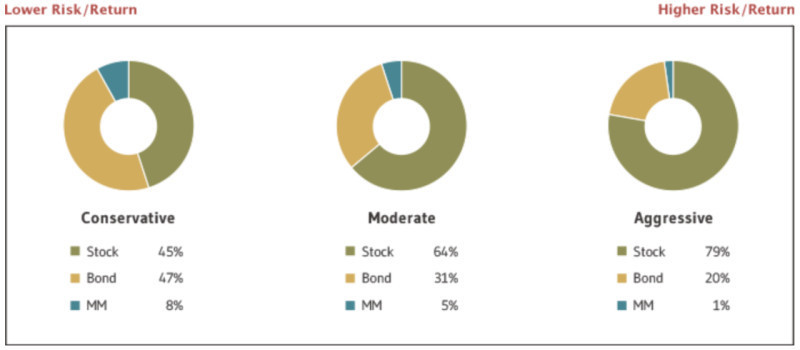

- Risk level:

- Low-risk: More than 50% conservative assets like government bonds;

- Moderate: A mix of low-risk, reliable instruments, and riskier assets like stocks;

- High-risk: A significant number of potentially high-reward but high-risk instruments, like stocks of emerging companies.

- Involvement degree:

- Active: Requires constant monitoring of quotes and adjustments, often applied to high-risk portfolios;

- Passive: No need for continuous tracking. Analysis is done once before adding assets to the portfolio.

- Investment term:

- Short-term: 1 to 3 years;

- Medium-term: 3 to 10 years;

- Long-term: Over 10 years.

- Profit generation method:

- Growth-oriented: Profit from rapid asset value increase, e.g., startup stocks;

- Income-oriented: Earnings through dividends, e.g., stocks of large companies or bonds with regular coupon payments.

Understanding Discretionary Management

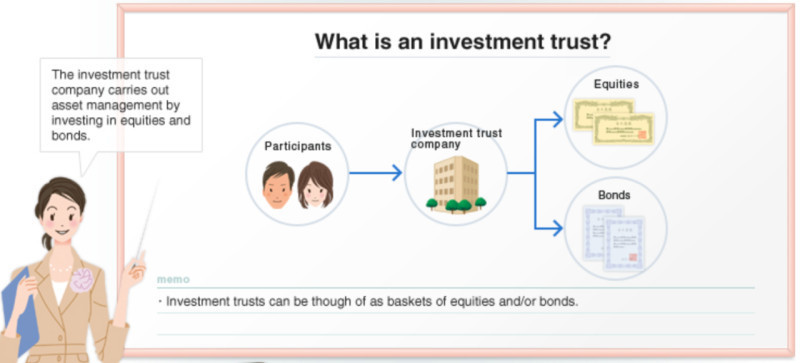

When faced with decisions about what and how much to invest in, many, especially beginners, find themselves at a crossroads. Often, they possess the capital but lack the knowledge and experience in investing. To address this, there is a specialized service known as discretionary management, which we will explore in this section, particularly in relation to portfolio investments.

In discretionary management, a professional manager or company oversees the investor's assets. Crucially, ownership of the assets remains with the investor, not transferred to the manager.

The manager is authorized to handle and transact with these assets on behalf of and in the interest of the owner. Their motivation lies in earning a fee, either a fixed amount or a percentage of the profits generated.

Discretionary management in financial markets takes three main forms:

- Mutual Funds: These involve pooling capital from several investors and managing it collectively. The funds are invested in securities and other assets, with a documented strategy outlining the allocation across different instruments. This form is particularly suitable for beginners due to low entry amounts and fees starting at 0.2%.

- Standard Strategies: These are pre-developed algorithms by managers for their clients to utilize. Each package offers investments in specific asset classes, such as foreign company stocks. Entry costs are generally higher than mutual funds, and these services are provided by companies, accessible remotely via mobile apps. The service fees typically range from 1-2% of the invested amount.

- Individual Strategies: Tailored to each client, considering their financial capabilities, expected returns, and acceptable risk levels.

This option suits investors able to commit large sums, often in the thousands of dollars, with commissions up to 5% of the total investment.

Discretionary Management vs. Self-Investing

Having explored various discretionary management options, it may seem like an ideal, hassle-free investment method. However, it's important to compare it with self-investing to determine the best fit for you.

Self-investing requires specific knowledge in the field. It's not enough to just choose a broker and open an account; understanding what to do next is crucial. Many open accounts but hesitate to make their first trade due to a lack of know-how in timing and executing trades.

Successful investing demands market analysis and identifying entry points, which require learning and practice. Additionally, self-investors must independently select a balanced mix of assets with varying potential returns and risks, a task that is time-consuming and complex.

Thus, many beginners turn to discretionary management. Choosing a reliable manager is vital since they will make transactions on your behalf using your assets.

Both approaches carry risks: self-investors might incur losses, and managers can also make unsuccessful trades. However, professional managers or companies usually have the expertise to trade in a way that offsets losses.

A manager is also better positioned to understand market dynamics and can create an investment portfolio with instruments tailored to your specific goals and needs.

Ready-Made Investment Strategies

As mentioned earlier, there are various ways to engage in portfolio investments. One such method involves using ready-made investment strategies that allow investors to replicate the trades made by their authors on their own accounts.

To use this option, one needs to open an account with an intermediary company and select one of the available strategies. After funding the account, it should be linked to the chosen strategy. Note that only one strategy can be connected to an account at a time.

In this scenario, the investor essentially delegates the responsibility for their account's activity, as investment decisions are made by another person or company, not by the investor themselves. However, it's important to realize that these actions impact the results on your account. Therefore, having at least a basic understanding of how investments work, how assets are selected for a portfolio, and what influences them is beneficial.

Beyond this approach, one can consider pre-arranged options where an optimal mix of assets has been pre-selected to achieve various investment goals.

For example, a popular formula by R. Dalio, known as the "All Weather Portfolio," allocates 40% + 15% to bonds (long-term and intermediate-term), 30% to stocks, 7.5% to gold, and 7.5% to commodities.

This shows how an overall investment can be diversified across multiple instruments, thereby maximizing portfolio diversity and minimizing potential risks.

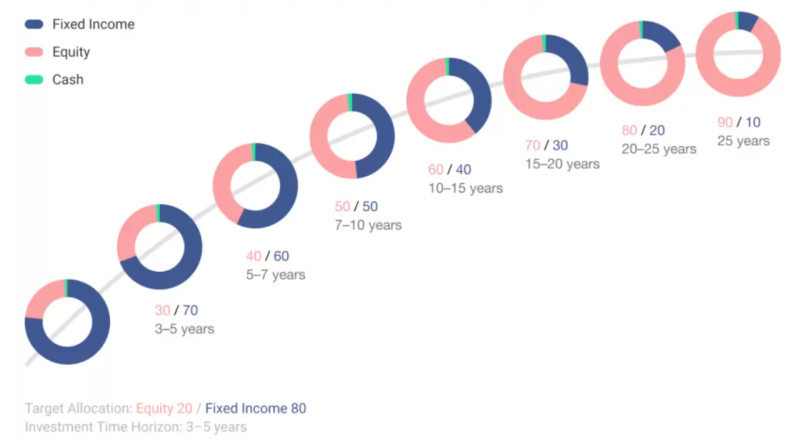

Another well-known formula is the 40/60 strategy, implying investment in just two assets: stocks and bonds. Depending on the investment period, this ratio can change: the longer the time frame, the more it can shift towards higher-risk assets.

In its classic form, 40/60 allocates 40% to stocks and 60% to bonds. This is a viable option for an investment period of 5-7 years. For periods of 10-15 years, the ratio can be adjusted to favor stocks more, like 60/40, and for 20-25 years, even 80/20.

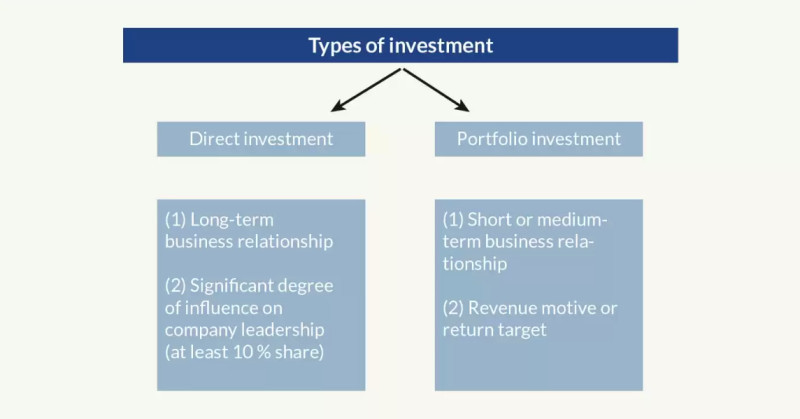

Portfolio Investments vs. Direct Investments

To better understand portfolio investments, let's compare them with direct investments, as they have several key differences.

Firstly, the goals of these investment types vary. The aim of direct investing is to control and participate in a company's management to facilitate its growth and development. In contrast, portfolio investments have two main goals:

- earning profit, including passive income from dividends, stock and bond price appreciation;

- minimizing potential risks.

The choice of investment instruments also differs based on these goals. In direct investing, an investor acquires a significant share of a company, often at least 10% of the total volume or a part of its equity capital.

In portfolio investing, diversification is paramount, so funds are allocated across various assets with different risk and return potentials.

Another distinction is the required capital. Major purchases like a large stock package or commercial real estate demand substantial sums. In contrast, purchasing a small number of stocks doesn't require huge investments.

The risk level also differs: direct investments carry high risks due to the difficulty of liquidating large, illiquid assets. With portfolio investments, it's easier to offload loss-making assets and replace them with more profitable ones.

Investment horizon is another significant difference. Direct investments are long-term, betting on the increase in asset value over time. Portfolio investments offer various options, including short- and medium-term.

Advantages and Disadvantages

Like any investment, portfolio investments have their pros and cons. Let's start with the advantages:

- Diversification: Building a portfolio allows for an optimal risk-return ratio, considering investment duration, personal goals, and interests.

- Passive income: Adding certain assets to a portfolio can generate additional income, such as dividends from company stocks, bond coupon payments, rental income from property, etc.

- Low initial capital: Unlike other investment types, portfolio building doesn't require substantial initial capital. One can start with small amounts, buying a few stocks or bonds, and gradually expand the portfolio.

- Ready-made solutions: There are pre-tested portfolio options available, tried and tested by many traders over the years. Each trader can find a combination of assets that suits their current needs.

- Accessibility: This investment type is available to every potential investor. No special equipment or education is needed, just basic understanding, some initial capital, and an internet-connected device.

The disadvantages of portfolio investments include:

- Lower returns compared to direct investments, which can offer significantly higher potential returns. However, it's important to remember that higher returns come with higher risks.

- Risk of capital loss: Investment can be unsuccessful, and an investor can lose all their funds. However, this is more likely with investments in a single asset. Proper portfolio formation reduces these risks.

Rules of Building Portfolio

Having delved into how portfolio investments work, it's time to discuss how users can properly construct their portfolios for maximum benefit.

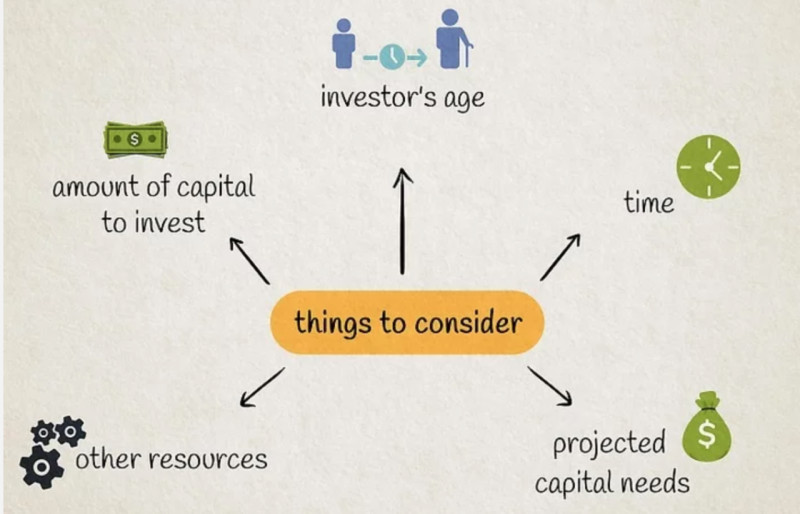

Several rules should be adhered to when forming an investor's portfolio. Here are the key ones:

- Define your investment goal. Goals can vary: saving for a major purchase or important event (like buying a car or funding a child’s overseas university education) or simply protecting your savings from inflation and other economic factors.

- Determine your investment timeframe. This is derived from your goal: specific objectives may have more immediate timeframes, such as before a child finishes school. For protecting savings, the period might be longer.

- Establish your risk tolerance. It's vital for each investor to understand their risk tolerance, whether ready to risk everything for substantial gains. Remember, the higher the potential return of an asset, the higher the potential risk.

- Consider fees and taxes. Be aware that intermediaries charge fees for their services: managers – for handling your trades, brokers – for independent trading. Additionally, income from some investments is subject to taxes.

- Select assets for your portfolio. Consider all the above points, but also ensure that your portfolio includes protective and liquid assets. This means including reliable, low-risk instruments and highly liquid assets that can be easily sold if necessary.

- Never invest your last funds. The money you plan to invest should be free from any obligations, including debts. It should also not be funds set aside for other purposes.

- Create a financial safety net. Before investing, set aside enough money to sustain yourself for several months in case of job loss or emergencies. This prevents the need to withdraw funds abruptly from your portfolio.

- Rebalance your portfolio. Monitor key events, like quarterly company reports or central bank decisions, and track how your asset values change. Gradually move away from certain assets and acquire others.

Conclusion

This article has explored the key aspects, advantages, and disadvantages of portfolio investments. This method is considered the most optimal and correct way of capital allocation, as it involves diversifying funds across multiple assets.

Investing in a single instrument carries many risks. You could lose all your invested funds if the market situation suddenly turns unfavorable. However, if capital is spread across various instruments with different risk-return ratios, losses from one can be offset by gains from another.

The longer the capital investment period, the more high-risk assets can be added to your portfolio. Besides durations, investment goals should also be considered.

If this all seems too complex, or if you lack the time or desire to delve into portfolio formation nuances, you can use ready-made strategies or seek the help of a discretionary manager.

The former involves pre-formulated portfolios with various asset ratios, risk levels, goals, and timeframes. In the latter, the manager selects the best asset combination for you, conducting transactions on your behalf and in your interest.

You may like:

Back to articles

Back to articles