Many people doubt the profitability of investing in any assets and choose to simply keep their savings at home. They think this is correct, although money simply loses its real value. How can you maintain or even increase your savings? What is better to invest in if a person still decides to do so? We will try to answer these and other questions on this topic in this article.

You can learn more about investing, its advantages and disadvantages, as well as how to start investing by reading the article “Investing for Beginners.”

Why you need to invest

Why do some people invest all their free and sometimes raised funds in some assets, while others prefer to simply keep them in a safe deposit box? Because they understand that money should work.

After all, the savings that are kept at home may be stolen. Besides, a fire or flood may occur, and in this case there will be nothing left of the money. But it's not only that. Even in the absence of such force majeure circumstances, they lose their value.

The fact is that money in any currency depreciates. Although the amount of money remains the same, its purchasing power becomes less every year. That is, for the same amount you can buy fewer and fewer services and goods.

This is primarily due to inflation, that is, a general increase in prices for consumer goods. This indicator may remain unchanged for a long time, or it may grow rapidly like it was during and after the coronavirus pandemic, for example.

In addition, investing capital allows you not only to preserve it, but also to increase it. At the same time, you can steadily receive passive income from some assets, while others can be resold at a higher price over time after purchase.

This becomes especially relevant when there is a dream or goal, for example, to carry out expensive surgery or send a child to study abroad. Not everyone has all the necessary funds for such needs close at hand.

However, if you understand how much exactly and for what time the funds will be needed, you can easily calculate how much and at what interest you need to invest now. You can invest once and not save from each salary.

How to start investing

You do not need a huge start-up capital to begin investing right away. Investing has become available to many people with even small savings.

There is no specific amount you need to start investing. It all depends on what exactly a person wants to invest in. To purchase real estate, fairly large sums will be required, but to purchase several shares or bonds, much smaller investments will be enough.

It would certainly be a good idea to take some investment training. This is necessary in order to understand how the market works, how it operates and how different assets behave in different conditions.

Before you start investing your savings, you need to conduct a market analysis and select assets in accordance with your goals and risk appetite. You need to understand that the higher potential returns of an instrument, the higher the risk.

You also need to decide on the strategy and investment horizon, that is, indicate for how long the capital investment is planned and what profit the investor aims to receive during this term.

Next, you need to select an intermediary, that is, a brokerage company, and open an account. In general, brokers are not needed to acquire all assets, but they are required to enter some markets.

For example, retail investors do not have direct access to the stock market, and any transactions can only be made through brokers. In addition, securities today are not presented in paper form, but only in electronic form, so depositary services will also be required.

How profitability and risk related

Let's talk about how risk and return relate to each other before discussing what the best investments are. These two concepts are inextricably linked with each other.

There is a well-known expression: “Free cheese can only be found in a mousetrap”. This means that to get something, you need to do something. Otherwise, you may seriously risk your health and life and try to get it for free.

Is there a high risk in this situation? Definitely yes. Is the profit potential high? High indeed. Do you get the point? If you take a big risk, there is a chance to gain a lot or lose everything (in this case, life).

This example can easily be applied to investments. Every investor must understand that any investment poses risks. The bank may go bankrupt and not return your money, the company may go bankrupt and its shares will fall in price several times, and so on.

However, the greater the return an investment promises, the greater the risk it is associated with. This is an axiom that needs to be ingrained in your mind. If you want to invest in shares of a promising company, be prepared for the fact that it might go bust, although it really can grow and enrich you.

It is important to understand a priority for the investor: the desire to take risks and try to hit the bonanza at once or take less risk and earn money gradually.

At the same time, each investor’s risk tolerance is individual. What seems acceptable to one is completely unsuitable to another. It is important to take into account many factors here: psychological aspects, financial and social situation, the presence of an “airbag” and so on.

There is another important factor - time. The longer the investment term, the risk of loss is reduced and the hypothetic profit increases. Therefore, it is better to invest capital for a longer period, about 10 years.

How to control and reduce risks

So how can you avoid or minimize risk in investments? One way is to invest capital only in the most reliable assets, such as government bonds, for example.

However, this is not interesting from the point of view of obtaining potential profit. Therefore, some investors have doubts about the sense of such investment. But there is another way - a more interesting one for making a profit.

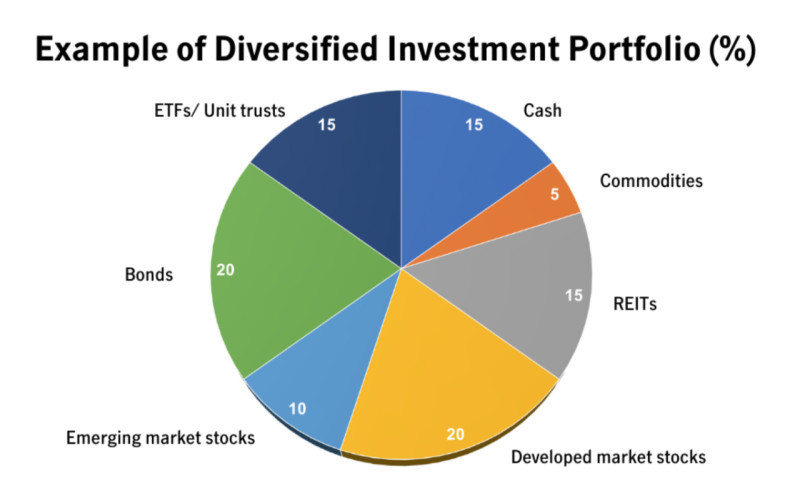

This method consists of compiling an investment portfolio, that is, distributing capital between several assets with different levels of risk and potential profitability.

At the same time, the assets must be fundamentally different from each other. For example, you cannot invest all your savings even in different companies from the same sector, since any problems in this area will immediately deal a blow to all companies. Assets for the portfolio must be from completely different sectors.

A well-designed portfolio helps reduce the overall risk of all investments by adding a mix of high-, medium-, and low-risk assets.

It is clear that no asset can constantly generate profits, while another may constantly generate losses. However, with the help of a portfolio, the user has the opportunity, if necessary, to cover losses from one instrument with the help of profits from another.

The market does not stand still. The financial goals and preferences of investors themselves change. Over time, the portfolio should be revised. Instruments that have ceased to generate income can be replaced with potentially more investment profitable ones.

Types of portfolios

Investment portfolios can be classified on various grounds. Portfolios differ according to the terms of investments:

• Short-term – from 1 to 3 years;

• Medium-term – from 5 to 10 years; and

• Long-term – over 10 years.

Importantly, if we talk specifically about investments, a longer period can provide greater profitability. This is because markets are more volatile in the short term and asset values can fluctuate quite a bit.

Depending on the level of risk, the following portfolios are distinguished:

• Conservative ones include low-risk instruments, such as government bonds or shares of the largest companies. Such options are preferred by investors who are not ready to take on any risks;

• Moderate ones contain assets with different levels of risk: both more reliable and riskier. This could be a combination of securities of new companies, government bonds, mutual funds, and so on;

• Aggressive ones include high-risk assets: shares of developing companies, bonds of companies with low ratings. Such portfolios can only be formed by experienced investors who know how and what they can quickly make money on.

Aggressive portfolios are not recommended for novice investors since an in-depth analysis is a must-do before the formation of such a portfolio. You can’t just wake up in the morning without prior preparation and invest money in a startup.

The ratio of assets in each portfolio may be different depending on the preferences of each speculator. There are also ready-made formulas, one of the most famous: 40% of the portfolio should be bonds, 30% - stocks, 15% - medium-term bonds, 7.5% - gold, and 7.5% - raw commodities.

How to create an investment portfolio

So, we have already grasped the main rule of investing: do not invest all your savings in one asset, but build a portfolio. This is the essence of how to make the most investment profitable investments.

Let's look at how to correctly compose an investment portfolio and select assets for it. Several principles must be followed when forming a portfolio:

1. Invest in different instruments. This means different classes, industries, currencies and countries.

2. Conservative approach. The portfolio must contain reliable instruments with a low level of risk, for example, bonds that bring a fixed income even during a crisis.

3. Liquidity. It is necessary to have highly liquid instruments that can be sold in a short time at a favorable price if necessary.

As already mentioned, portfolios can be formed individually for each investor, or they can be created using ready-made formulas. In any case, before investing, you need to determine a few important points for yourself.

Determine the purpose of the investment - what exactly and in what time frame the money will be needed. The ratio of instruments in the portfolio depends on this: the faster the money is needed, the greater the level of potential risk.

• Choose a strategy. This point is inextricably linked with the previous one. If you need finance quickly or in large amounts, are you ready to risk what you have now for this? Otherwise, capital should be invested for a longer period and with a moderate level of risk.

• Select assets for investing capital - based on the previous points, you need to select specific instruments for your portfolio. Depending on the desired level of risk and potential income, the portfolio itself is formed.

Most lucrative investments

As has been said more than once, the most investment profitable way is to invest capital not in one instrument, but in different ones. However, let's try to figure out which assets should be chosen at this time.

It is important to pay attention to the pros and cons of each instrument when investing in it. In addition, the experience of the investor is of some importance, since preliminary market analysis is not a simple task.

So, what investments are considered the most lucrative? We will examine each category in more detail in this section. Many users put three groups of assets in first place: real estate, gold, and deposits in state banks.

Let's start with real estate - this is the most obvious asset that first comes to mind when you hear the word “investment”. Investing in real estate can be carried out for two main purposes: resale and rental.

Depending on what goal the investor pursues, he/she chooses different types of buildings. In the first case, it is necessary to enter the project as early as possible to get the best price. In the second place, you can buy near the end of construction to hand over and receive rental payments as quickly as possible.

Real estate is a powerful asset that is always in demand, this is its great advantage. Moreover, this applies to both residential and commercial real estate. But there are also disadvantages, for example, a large amount of initial investment.

The next instrument is gold and other precious metals. Gold tends to continually rise in value, which is why it is considered a good asset to invest in. In addition, just like real estate, it is a tangible asset that you can physically see and have at your disposal.

However, this tool also has its disadvantages. One of them is the lack of passive income. Precious metals simply lie in the safe deposit box and can be inherited by your children or grandchildren. In fact, investments are “frozen” for an indefinite period.

The third popular asset is a bank deposit. It is popular because it has a fairly low level of risk. Deposits are insured, so in the event of bankruptcy, deposits will be returned.

However, the interest is usually much lower than what you can get from other instruments. This is the best way to preserve, not increase, capital. In addition, do not forget that profits from bank deposits are subject to taxes.

Other investment instruments

Let's look at what other instruments are available for investment profitable investments, in addition to the above. We have repeatedly mentioned securities, currencies, including cryptocurrencies, and there may also be items of art, brands, or intellectual property.

Securities, along with the assets mentioned in the previous section, are very popular among investors. Moreover, in this category there are instruments with different levels of risk. Bonds, especially government bonds, are one of the most reliable and stable assets, albeit with a small income.

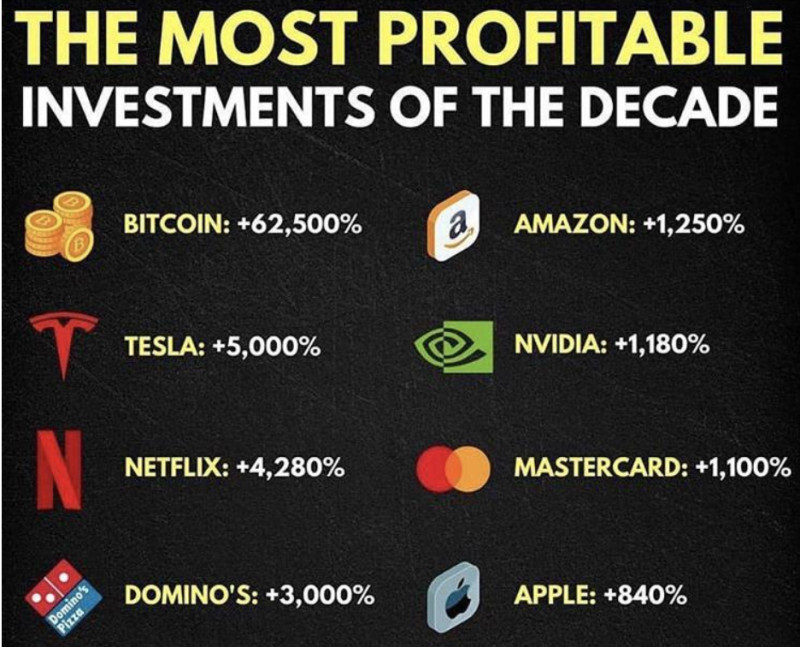

Shares can also be different: there are securities of large companies that have been traded in the stock market for a long time and show constant growth, they are called “blue chips”. There are other, younger and growing businesses whose shares can “shoot up” or burn out.

If you invest in a young business with the right evaluation, you can multiply your investment several times over a fairly short period of time. Such securities can zoom up by 500% and 1000% in a few years. In addition, some companies pay dividends to shareholders. This is passive income.

You can invest money in various currencies, including crypto, only betting on their further growth. Such an investment will not provide any passive income. Here, it is also important to take into account the rule of diversification: invest in different currencies, and not in just one.

Investing in art or intellectual property is a sophisticated category. It requires careful selection of assets and preliminary analysis. If the object is truly worthwhile, its value will grow indefinitely.

However, there are also pitfalls: you can encounter scammers and buy a fake instead of the original. Also, the cost of such things is highly susceptible to fashion and the influence of time: authors and their creations can be unclaimed for a long time, and at one moment appear at the top.

Investment rules

If you do not approach the process of selecting assets and investing your capital in them responsibly, even the most lucrative investments will not ultimately bring the desired income. We tried to collect the guidelines for you in this section.

1. Invest only free money, that is, those funds that in case of failure you are ready to lose and this will not affect your well-being in any way. Also, this should not be money set aside for education, health, or other needs. Under no circumstances should you invest borrowed funds.

2. Create a financial safety net. This point complements the previous one. In case something goes wrong, you should have funds left to support yourself and your family, if any, for 4-6 months.

3. Always evaluate the profitability/risk ratio when selecting assets. Remember that the higher the potential profit, the higher the risk. In addition, it is also necessary to take into account the time factor: the longer the period, the greater the would-be income.

4. Never invest all your capital in one asset. This is the basic law of investing - portfolio diversification. Select different assets because this will reduce overall risks.

5. Set yourself a goal. This is important because it gives you motivation to move towards that goal. Apart from the goal, you need to set a time horizon for achievement, this will make the goal more specific.

6. Revise your portfolio. The market does not stand still, conditions change and, accordingly, the profitability of various instruments. Don't be afraid to exclude some assets and add new ones to your portfolio.

7. Don't panic. Investing is a long-term process. Market quotes may fail at some point. If an investor looks at the chart at that very moment, he may have a desire to urgently sell the asset. However, in the long term, the situation will normalize.

Conclusion

In this article, we looked at how to invest money in such a way as to save and increase it. The most lucrative investment method is a portfolio. That is investing capital in several different instruments.

If you want to safeguard your savings from losing their value, they must provide additional profit. To do this, they can be invested in various asset classes: real estate, precious metals, securities, and so on.

For an investment to be as investment profitable as possible, you need to distribute all available savings between assets with different levels of risk and, accordingly, different levels of potential profitability.

The portfolio must contain reliable, stable instruments with low risk, as well as highly liquid assets that can be sold at any time at the market price.

If we talk about specific assets that are considered the most investment profitable and reliable for investing, these are real estate, gold, and deposits in large banks.

Each of these instruments has its advantages. For example, real estate can provide passive income, and metals are steadily rising in price. The bank deposit earns interest and is insured.

You may like:

Back to articles

Back to articles