In times of instability and global calamities, people think about how to safeguard their savings. Many understand that inflation erodes the value of money. Thus, it needs to be invested in some assets. Gold and other precious metals have been known as highly reliable investment in gold instruments since ancient times.

During periods of economic turbulence and global upheavals, people consider ways to protect their savings. Many realize that inflation can render money worthless, so they need to invest it somewhere. Gold and other precious metals have long been recognized as some of the most reliable investment instruments. In this article, we will discuss how to invest in them wisely and what the advantages and disadvantages of such investments are.

There are plenty of options for capital investment. To properly select assets for investment and to identify the strengths and weaknesses of each, we recommend reading the article "Investing for Beginners."

Understanding precious metals

Before we figure out how to invest in gold, let's discuss the idea of precious metals and their key features.

Precious or noble metals are highly resistant substances. They have several important characteristics that distinguish them from other substances:

- They are rare in nature and difficult to extract;

- They are almost not subject to corrosion and oxidation in air;

- They have an inherent shine, which gives them jewelry value.

There are four main noble metals:

gold;

silver;

platinum;

palladium.

Substances from the first two categories are most often used in jewelry manufacturing. Besides, at different times, they were used to make cutlery, dishes, coins, and other items.

The other two metals are used in the automotive industry (for manufacturing catalysts), electronics, and medicine (for making pacemakers and surgical tools).

There are several factors that influence the value of precious metals:

- Supply and demand. Commonly, the demand for these items steadily increases, while supply is limited due to rarity and the complexity of extraction.

- Mining. On the one hand, it is a complicated and labor-intensive process. On the other hand, developing countries where labor is much cheaper currently dominate this industry.

- Government reserves. State authorities prefer to keep part of their reserves in gold. Practically every country to this day has some gold reserve.

The weight of precious metals is measured in grams, but another popular unit of measurement is the troy ounce. This measure is 31.1 grams and is used in international metal trading.

For example, when you read economic news and stock market reports, they indicate the price not per gram, but per troy ounce of the metal in question on the trading floor.

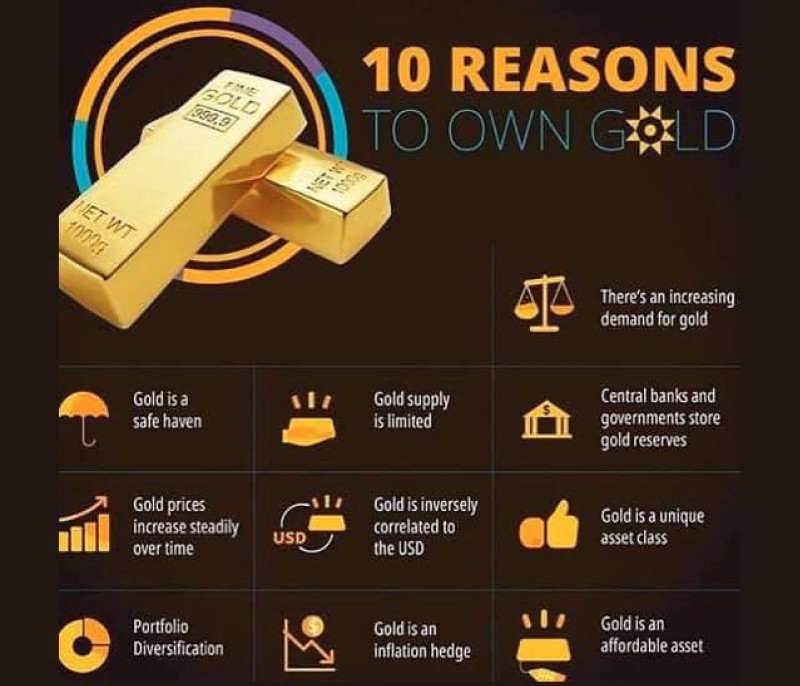

Why it makes sense to invest in metals

Precious metals have always been valuable throughout history, even during wars and economic crises. Unlike cash and securities, which need to be backed or secured by something, metals are valuable in themselves.

Historically, precious metals, primarily silver and gold, were used as a means of payment for various goods. However, over time, money displaced metals and completely replaced them, making metals an asset of investment in gold.

They are considered safe-haven assets, designed to preserve savings during economic downturns. This is because investing in precious metals can safeguard capital from the impact of inflation.

During periods of market uncertainty, demand for gold and other metals commonly increases. This asset attracts investors because of its reliability and consistency.

The increase in the value of this asset is driven by interest from major players, particularly central banks. As mentioned earlier, central banks buy gold to replenish their reserves.

Investing in precious metals is a popular way to diversify an investment portfolio. However, it is not recommended to allocate more than 10% to this instrument.

There are various ways to invest, which we will discuss further. Previously, one of the most common methods was to purchase bullion of precious metals and physically store this.

Currently, there are other ways to invest in metals. However, it is important to understand that if you intend to invest capital in real objects, these should be long-term investments. Precious metals are not suitable for short-term investments.

Investing in gold

Some people confuse investing with acquiring jewelry. For instance, buying gold or silver jewelry is often considered a good investment, but this is not entirely accurate.

The issue is that jewelry typically uses lower-grade precious metals (585, sometimes even less). Therefore, the actual gold content in such an alloy is just over half.

Moreover, the final price of jewelry includes the cost of the craftsman's labor who made it, as well as any precious or semi-precious stone inlays. You will hardly sell such pieces at their original price.

However, in some countries, like the UAE, purchasing jewelry is equated to investing. This is because they use high-grade gold in jewelry manufacturing, and pieces are sold with minor retail margin.

Importantly, only rare, antique pieces, which might be sold at art auctions, have real investment in gold value.

In bullion and coins acquired as investment objects, 999 fine gold is used. This means the alloy is almost free of any other impurities, so the investment is essentially in the metal itself.

Furthermore, bullion and coins are tangible objects that can be physically touched and stored in a vault. However, they have their peculiarities: any damage, even minor, can significantly reduce the value of the bullion.

The situation with coins is even more interesting: many are issued in limited quantities, adding extra collectible value. The value of such coins can increase faster than the price of the metal itself.

Ways of investing in gold

Having established the rationale for investing in precious metals, let's explore how to implement investments in gold specifically.

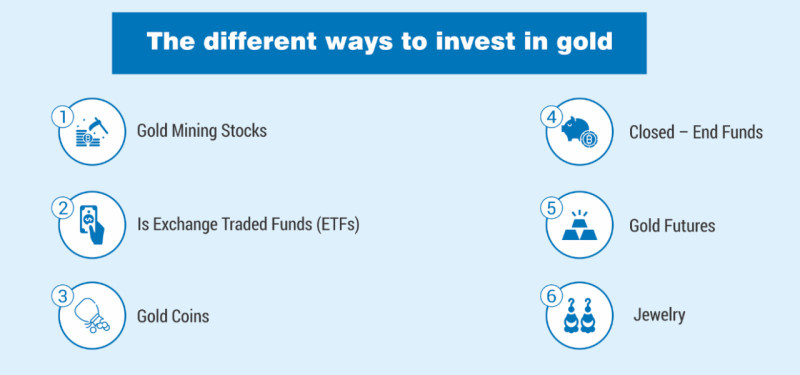

There are five primary methods for investing capital in this asset:

- Buying bullion and coins is the simplest and most straightforward investment option. These assets can be purchased from banks and stored in a bank vaults or a personal safe boxes. Investing in bullion makes sense for a minimum period of 3-5 years.

- Unallocated metal accounts (UMAs) are linked to the value of a precious metal. It is similar to any bank account, but the currency is metal. Real gold is not actually purchased, but the deposit can be "cashed in" at any time, meaning the physical asset can be obtained.

- Futures Contract is a contract in which one party agrees to buy the commodity from another party in the future at a pre-agreed price. If the asset's value increases by the time of purchase, the buyer profits as they have the right to buy at a lower price.

- Purchasing shares of companies mining precious metals means investing not in the end product but in its production. The logic is simple: as the value of gold increases, so does the value of these companies' shares. This is a form of "indirect" investment in gold.

- Investing in mutual funds and ETFs is another indirect investment method. It means investing in funds that deal with precious metals. Profits are made from the difference between the buy and sell price of the metal, distributed among the fund's participants.

How to start investing

Before embarking on gold investment, there are several important steps to consider:

The first step is choosing the goal and method of investment. We have already discussed this as the main option. You should decide on the investment term. For long-term investment in gold, consider buying coins or bullion. For medium or short-term gains, investing in company shares or mutual funds might be suitable. Use the standard trading strategy of “buy low, sell high.”

The second step is selecting a bank or broker. Depending on the chosen instrument, bullion and coins should be purchased from a bank, which is a legal organization providing all necessary documents and maintaining the bullion in perfect condition.

Unallocated metal accounts (UMAs) are also opened in a bank. To buy shares or futures, open an account with a brokerage firm. Choose a reliable brokerage firm with the best conditions for buying the assets of your choice.

Finally, ensuring safe storage of precious metals is particularly relevant for physical gold purchases. As we mentioned, any damage immediately devalues bullion or coins. Ideally, they should be stored in special packaging in a bank vault or personal safe box.

Advantages and disadvantages

Like any other form of capital investment, investing in gold has its pros and cons. Let's begin with the advantages of investing in this asset.

Among the advantages are:

- Stability. The value of gold undergoes minimal changes even during market turmoil. In fact, during crises, many turn to this asset, leading to an increase in its price. Additionally, there is a gradual and steady increase in value over time.

- Variety of investment options. There are various ways to invest in gold, from buying actual bullion or coins to investing in stocks of companies involved in gold mining.

- Easy purchase. Buying gold bullion or coins is straightforward. One can simply visit a national bank branch with their ID and purchase the required amount of gold. Banks also offer storage services.

- Inflation protection. Compared to other traditional instruments, such as bank deposits, gold is a more advantageous investment. The rise in gold prices typically outpaces inflation rates.

- Collateral for loans. Precious metals can be used as collateral in credit agreements, thanks to their high value and reliability.

The disadvantages of investing in gold include:

- Storage challenges. Physically purchased precious metals need storage. The two main options are bank safe deposit boxes or home safes. Storing in a bank safe deposit box incurs additional costs.

- Risk of theft. Stemming from the storage issue, many choose to store bullion at home to avoid bank fees, making it an attractive target for theft. Additionally, if one wishes to return gold to the bank, authenticity testing is required. These two drawbacks do not apply to unallocated metal accounts (UMAs) and stock purchases.

- Purity. Gold is measured in karats, with 24-karat being the highest. To avoid issues with purity, it is important to buy metals only from licensed sellers.

- Low short-term returns. Gold is not a high-profit asset in the short term. Investments in precious metals should be made for periods of 10 years or longer. Additionally, this instrument does not generate passive income.

Gold for diversification

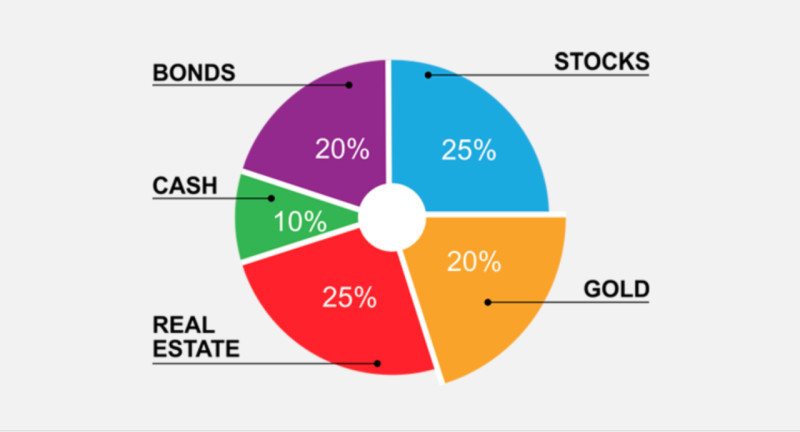

As previously mentioned, gold can be considered a means of diversifying an investment portfolio due to its reliability and stability. However, it is crucial not to just add various instruments to the portfolio, but to properly determine each one's proportion. This article focuses on gold investments, so let's discuss the share of this asset in a portfolio.

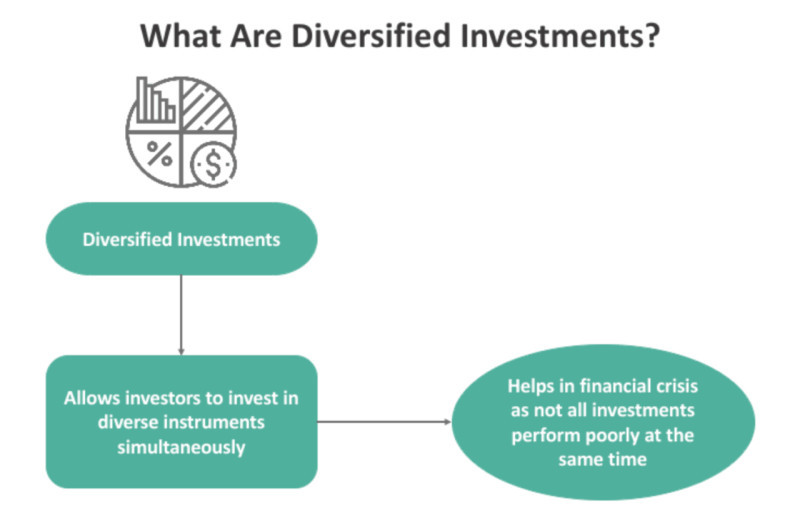

Why diversify investments at all? It seems easier to invest all funds in a single asset, such as stocks of a major company or a commercial real estate property. However, investments do not work that way. No single instrument can constantly yield profits. There are periods when assets underperform and instead of generating profits, they start incurring losses.

During such times, if all money is invested in one asset, the investor starts to incur losses and panic. This often leads to urgently selling off assets at a loss. In a balanced investment portfolio, however, profits from some assets can offset losses from others. Thus, during periods when some instruments decline in value, it does not have a severe negative impact on the overall income.

So, how can one diversify their portfolio? What instruments can be added? It depends on the investor's goals, tasks, and capital size, but a universal formula can be derived, which we will discuss in the next chapter.

Gold's share in portfolio

During times of instability and prolonged inflation, investors turn their attention to tangible assets whose value is more stable. Hence, investing capital in such instruments seems the most reliable and justified.

In practice, portfolios consisting only of stocks and bonds have performed poorly in recent years due to high global consumer price inflation rates. In contrast, tangible assets provide protection against the impact of inflation.

For private investors, gold and real estate are suitable assets, even for beginners. More experienced investors might consider art, vintage cars, and other valuable items. The challenge of investing in tangible instruments lies in the difficulty of valuing these unique objects and their generally low liquidity.

With securities, it is simpler to determine their value as they are traded daily on exchanges, allowing for easy access to their current price. They also have high liquidity, making them readily sellable at market prices.

Gold sits somewhere between the aforementioned groups of instruments. On the one hand, it is a tangible asset, but on the other, its value is easy to check anytime, and it can be sold at a reasonable price.

Overall, it is advised not to allocate more than one-third of the total portfolio to assets like precious metals and real estate. Specifically for gold, it is not recommended to invest more than 10% of the portfolio, with a suggested share of 5-7%.

Investing in other metals

We have discussed in detail how to invest in gold as well as the pros and cons of this investment in gold method. However, at the beginning of the article, we mentioned that there are other precious metals.

Let’s take, for instance, silver. Its cost is significantly lower than gold's price. For example, the price of a 50-gram silver bar is less than that of a 1-gram gold bar.

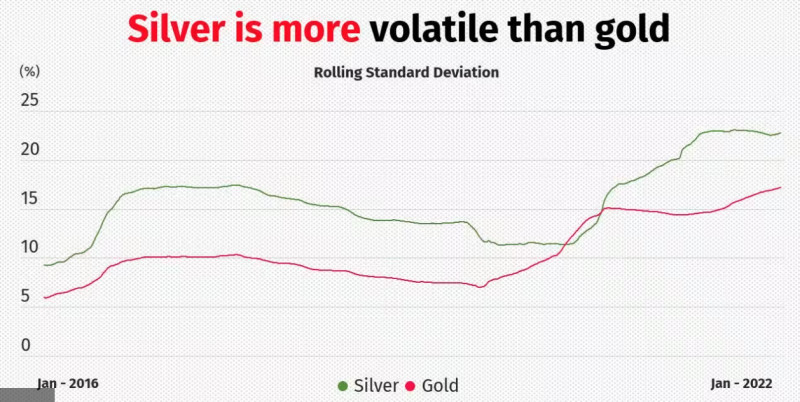

Besides, silver is more volatile, meaning its value changes more frequently and with greater fluctuations than gold. Therefore, this asset can be used not only for investment purposes but also for trading. The strong price fluctuations of silver enable earning profits over short periods.

As for platinum and palladium, these metals are primarily used in the industrial sector. Hence, their value is heavily tied to the demand from enterprises.

Many investors, especially beginners, avoid investing in these assets. Such investments require serious analysis and continuous monitoring of the market situation.

Unlike gold, these metals lose value during crises and economic downturns due to the slowdown in the manufacturing sector. Their value is also influenced by environmental standards as well as scientific and technological progress.

For example, the need for platinum and palladium increases due to stricter environmental regulations regarding exhaust emissions. They are primarily used in the manufacture of catalytic converters, which clean automobile emissions.

However, the development and popularization of electric vehicles gradually lead to reduced corporate demand for these metals. Electric cars do not need catalytic converters as they do not emit exhaust gases.

Given their predominantly industrial use, purchasing these metals in bar form does not make much sense. Although platinum is also used in jewelry making, it could be considered for purchase.

Conclusion

In this article, we have examined various aspects of investing capital in gold and other precious metals. However, investments in these assets have unique characteristics that should be carefully assessed.

One such feature is the value of precious metals, which is not affected by inflation or crises. Unlike money, which must be backed by something, metals are valuable in and of themselves.

Additionally, you can purchase bars or coins made from these metals, which are real, tangible assets that you can fully own and hold in your hands.

One of the most well-known instruments for capital investment is gold. However, purchasing jewelry made of this material is not considered an investment, as often gold of the highest purity is not used in these items.

Another important point to consider when buying gold bars and coins is their storage. It can be done either in a bank safe vault, which is the most reliable method, or in a home safe box.

However, funds can also be invested in other ways: through unallocated metal accounts (UMAs) or in the stocks of mining companies. It is also worth considering the possibilities of investing in other precious metals.

You may like:

Back to articles

Back to articles