Nowadays, the topic of investing is more relevant than ever. The variety of traded assets, potential profits, and the availability of investments have influenced the globalization of the online market. We also recommend you read the article "Investments for beginners".

This article aims to bring to light the importance of education in such a challenging but interesting sphere as investing. We will consider education a tool for achieving long-term financial goals. We will take a close look at types of education and talk about the importance of each of them.

Although investing has become popular and accessible, it has also become risky. Often, novice investors neglect one of the main rules of investment: continuous learning and self-improvement. As a result, the main fear of any investor comes true and they lose all their money. That is why it is necessary to be especially attentive when learning how to work in online markets.

We will also try to consider education from two points of view: theoretical education and practical education. Theoretical education is all the theory that a novice investor learns throughout the course. After completing reading books, watching webinars, attending video lectures, and listening to podcasts, a person engages in practical education.

This is all the experience a person gains from being an active investor and making trades in online markets. Finally, let us compare the importance of theoretical education and practical education and understand if one can exist without the other.

And finally, we will discuss which type of education is right for you.

Investment training

First of all, let us figure out what investments are.

Investments are money put into shares of companies, commodities, real estate, and other assets to receive income in the long term.

Long-term perspective is the keyword here. Since there is such a notion as trading (a trading activity with different assets aimed at getting income in the short term), there is a need to separate and explain these concepts.

The fact is that investors and traders are often confused. They are two different concepts.

- Traders, as a rule, trade mainly currencies, as they are quite volatile (unstable) and there is a possibility of rapid growth, for example, in the US dollar during one trading day. Thus, a trader receives income in the short term by selling dollars.

- Things are somewhat different for investors. Investors put in money hoping that, for example, the company's shares will grow and bring income for a long time or constantly according to analysts' forecasts. Thus, part of investors' income is passive.

- Traders have to monitor news, price charts, and analytical reviews all day long in order not to miss the moment of buying or selling.

- Diversification is vital for investors, while traders pay less attention to it. Investors can buy assets of different types (real estate, stocks, stock indices, and mutual funds). If traders are engaged in diversification, they buy currencies of different countries.

In our article, we will focus on investors and their education.

How to start learning investment training

Before looking for educational courses, you need to find the answer to the most important question: Why do I need to invest? Learning will go much faster and easier if you have clear motivation.

You may have various goals:

- Increasing retirement savings

Everyone knows that it is better to worry about such things in advance to ensure a secure existence.

- Major purchase

Real estate, a car, a country house, or a yacht—these purchases require a huge financial outlay. Income-generating investments can bring your dream closer.

- Children's education

At the moment, schooling is becoming more expensive, and the cost of university tuition is increasing exponentially. Many investors start their careers because of the desire to reduce the financial burden of such expenses.

- Travel

This is the most obvious goal for which a person starts a career as an investor. It is quite costly to travel across a country, or the world, or to enjoy the benefits of traveling. To travel, one needs to invest.

- Financial cushion

Such an investment goal also exists. We do not know what will happen tomorrow, so many people are engaged in investments just in case of large unforeseen expenses. There are even special bank deposits with the right of early withdrawal without restrictions if the entire amount is required.

Once you determine the goal, it is time to consider the types of training, which could be free or paid. Since there are quite a lot of them, we will consider a particular type in each section.

Online courses

Online courses are currently the most popular type of investment education. Most banks, brokers, online universities, and other trading-related organizations offer their courses for novice investors. Courses could be both free and paid, varying from 1,500 to 60,000 rubles.

When choosing this kind of training, it is worth looking for reviews of the program, the company providing it, and the instructors.

Moreover, look for information on as many websites as possible. Often unscrupulous providers of educational lectures write laudatory reviews themselves and support activity on social networks.

So, you have checked everything and made sure that there is no deception. Now you should examine what a potential education provider offers.

What online investment training course contains

- A clear cost of the course

A website or a landing page should contain the final cost that you will pay. You do not necessarily have to leave your phone number to find out how much these courses cost.

- Testimonials from real people who have gone through this school

If they leave their contact information, you can contact them and ask about everything in detail.

- Statistics of people who were able to start investing after taking the course and their contacts.

- A full description of exactly what you will get on these courses

Some crafty vendors are very creative in describing the educational program of their courses and fail to answer specific questions.

So, we have dealt with online courses. Let us move on to books, a fundamental source of information.

Books

As we know, books have always been the main source of information. In this section, we will consider them a source of information about investing. Learning through books was considered a cornerstone for almost 4,500 years. Today, the situation has changed a bit. People get most information through the Internet. Nevertheless, here are a few examples of successful educational books.

“The Intelligent Investor” by Benjamin Graham

Benjamin Graham is one of the founders of the modern investment approach. His book was published in 1949. It gained popularity almost immediately after its publication. It is still reprinted every five years. Moreover, Warren Buffett considers this book a basic one and says that it should be on the shelf of every investor. The book is about fundamental analysis and its application to online markets.

“Ten rules for financial success” by Burton Malkiel

The book was written by a professor of economics at Princeton University, Burton Malkiel. In his book, the professor explains how to create a trading strategy. He also focuses on the importance of diversifying assets. The book is easy to understand and is suitable for all readers who are interested in investments.

“Warren Buffett's Ground Rules” by Jeremy C. Miller

Oddly enough, the author of the book is Jeremy Miller, a market analyst. Buffett does not write books. Jeremy Miller has compiled a list of letters from Buffett to the partners of Buffett Partnership Limited (BPL), an investment company, from 1956 to 1970. In these letters, Buffett told investors in detail what results they were able to achieve in six months and, most importantly, how they did it. Based on these letters, the author of the book developed several rules of investing that guided Warren Buffett and brought him great wealth.

“Common Sense on Mutual Funds: New Imperatives for the Intelligent Investor” by John Clifton Bogle

The author of the book is a legendary US entrepreneur and creator of the investment fund management conglomerate, The Vanguard Group. Moreover, he created the widely recognized Vanguard 500 Index Fund, in which Warren Buffett also invested.

The book focuses on how to choose a primary asset class to invest in and stay with index funds that may bring you passive income or opt for more active trading, such as intraday trading.

“The Investor's Manifesto” by William J. Bernstein

This book is most notable for its plain language and easy perception of information. After all, its author, William Bernstein, is not only an expert in investments but also a neurologist. Therefore, the book is written easily and with the humor inherent in all doctors.

Like the above-mentioned authors, William Bernstein also created the investment management conglomerate, Efficient Frontier Advisors LLC. Thus, by writing the book, he decided to share his knowledge about portfolio investing, that is, investing in index funds.

Webinars

Since both the world and technology are developing incredibly fast, in this section we will touch on such types of training as webinars. There is an incredible number of them available today. There are webinars introducing the profession as well as webinars reviewing new market trends and explaining how to adapt to the existing trading conditions. Most of them are free.

So, let us go through this variety of webinars.

A good webinar for investors should include

- A clear cost of participation

As we have mentioned before, some careless webinar providers may hide the full cost of the webinar and offer to pay additional sums for the lecturer's answers to students' questions, download materials, access to private chat, and so on.

- Real reviews about the broker, lecturer, or webinar

It is very important to find real reviews about the event, the broker who conducts the webinar, and the lecturer. The webinar’s quality shapes information perception and the ability to apply it. Check reviews on different resources. It is desirable to check at least five resources.

- Confirmation of a lecturer’s qualifications

Sometimes dishonest information providers offer to look at actors who read out the text on paper. Usually, in the announcements of seminars, they announce the names of lecturers. It is incredibly important to check on these lecturers and make sure of their qualifications.

- Quality video and sound equipment

The equipment quality used for conducting a webinar is also of great importance. If the sound of the lecturer's microphone is poor and the picture freezes, this can affect the overall impression and information perception, thus negating all the benefits of attending the seminar.

- Useful feedback from the lecturer

Many webinar organizers offer participants to stay and ask questions after the lecture. This way, investors can correctly interpret the meaning of the entire webinar and put the knowledge into practice.

So, we have sorted out the basic requirements for a webinar. Nowadays, webinars are one of the most popular ways to gain investment knowledge. It is short, up to two hours, contains a lot of information, and is focused on the latest trends and market movements. In addition, you can immediately apply your knowledge in practice.

Podcasts investment training

In this section, we will be exploring a new way of learning about investing. Learning through podcasts is an interesting and mobile way of education.

Let us think back to all the previous ways. Which of them can be called mobile? Is it an online course? No, they usually last a few days with mandatory attendance and activity. Is it a book? No, when you read books, you need to take some notes. Is it a webinar? No, 1-2 hours of presence are required.

Let us first figure out what a podcast is.

A podcast is an audio program on a particular topic that you can listen to on a recording. There can be several participants, or even one.

A Russian listener began to be interested in podcasts not so long ago, only in the 2020s. Meanwhile, in the West, podcasts have existed for more than 15 years.

So, now we will discuss the advantages of podcasts in general and in terms of investment education.

Any topic

- Podcasts are versatile, as they can be devoted to any topic. You can choose a topic you are interested in, such as the Fibonacci method, and you will surely find a podcast about it.

Mobility

- The second advantage is the complete mobility of the person who listens to the podcast. People can take the subway, do exercises, go to work, or do domestic chores. Since all podcasts are recorded, a person can absorb information and then, if necessary, listen again and take notes.

Multitasking

- A podcast listener has the advantage of doing several things at the same time. This saves a lot of time and allows you to learn new information on the go. In this way, learning to invest becomes an interesting activity.

Entertainment

- A podcast is both an educational and entertaining tool. Therefore, even the most complex podcasts about difficult topics, for example, Bollinger Bands will become more understandable thanks to the hosts, who use associations, examples from life, stories, and tips.

Offline mode

- On long trips, the Internet connection is not always stable. Most podcasts can be downloaded for free and listened to without Internet access. This is certainly a great advantage.

Convenient format

- One more major advantage is that all podcasts are short. This is a really convenient format in a multitasking world.

So, we have focused on the benefits of podcasts in learning investing. Among other ways of learning, podcasts stand out thanks to their novelty, approach, versatility, mobility, and innovation. In the modern world, it is necessary to quickly adapt and learn to get information while doing two or three things simultaneously.

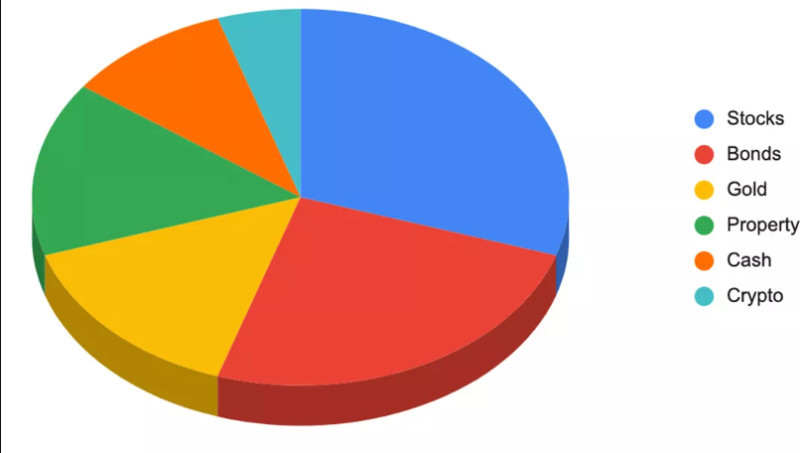

Portfolio diversification

Portfolio diversification is a topic that should be included in the investing course for beginners. Diversification principles are considered fundamental in the work of an experienced investor. Let us find out what it is.

Portfolio diversification is investing in different assets. In other words, you should not invest only in stocks or commodities. Otherwise, your funds may burn up. Portfolio diversification is the principle of asset allocation in such a way that if one asset becomes cheaper, other assets can balance the portfolio and reduce the risk of losses.

In simple words, let's quote Mark Twain's character: "Put not all thine eggs in the one basket."

Investors should apply diversification to:

- Reduce risks

With funds spread out, you reduce the risk of losing all of your invested money. Thus, you increase your chances of getting a bigger income.

- Increase profits

Properly managing multiple asset classes can increase your profits several times and enhance your investor skills.

- Quickly switch between asset classes.

This means a situation where you no longer want to hold your capital in precious metals, for example. You can relatively painlessly reallocate those funds and invest them in something else since you have not invested all your money in gold.

The benefits of diversification are obvious, and it is important to clarify that this topic should be included in your investment education program.

Conclusion Investment training

In this article, we have discussed how beginners can choose the right form of education if they decide to get into investing. We have focused on some conservative ways, including books, and new ones such as online courses, webinars, and podcasts. We have also explored the topic of investing and tried to understand what it means. We have found out what the difference between traders and investors is and how short-term investments differ from long-term ones.

Now, beginning investors can answer the main question: why do they want to start investing?

We found five basic goals that people want to achieve by investing. They are comfortable retirement, children's education, a major purchase (house, apartment, car, yacht), travel, and a financial cushion.

We have also gone into detail about the benefits of an innovative form of learning - podcasts. It is possible to listen to them even without the Internet. It is a convenient way of learning, as it is easier to understand complicated issues thanks to the simple and adapted dialogue of the presenters.

Among other things, the main advantage of podcasts is that they multitask. This means that a person can learn while doing routine things or traveling. So far, only this learning format has been able to offer this kind of leeway.

According to the article, the main rule for an investor is continuous learning and self-improvement. Theoretical education is accompanied by practical education. Investors get experience through practice.

Let us finish the article by saying that the importance of education in investments is underestimated. That is why there are still too many beginners who neglect basic knowledge, make numerous mistakes, lose all their funds, get disappointed, and stop investing. This approach is fundamentally wrong.

Even Warren Buffett refreshes his basic knowledge from time to time and makes daily analysis of the market situation.

During the heyday of the investment industry in the 20th century, all leading investors emphasized the dire need to know basic definitions, constantly educate themselves, and develop trading strategies based not on intuition but on the cornerstone of investment education.

You may like:

Back to articles

Back to articles