Digital currencies emerge almost daily. However, not all of these projects turn out to be successful and make it into the top 20 or even the top 100 cryptocurrency list. Nevertheless, whether a particular coin makes it into the top rankings or not does not always indicate that it is a failed project.

Each asset needs to be considered not only within the scope of its position in the rankings but also taking into account other factors. For each specific user, different parameters are of paramount importance, and these are the ones they will pay primary attention to.

In this article, we will discuss how cryptocurrency rankings are compiled, what factors are taken into account, and how these rankings can be utilized. We will also examine the key features of some cryptocurrencies, occupying both top and lower positions in the rankings.

Cryptocurrency list

Currently, there is a vast number of digital currencies in the world. This is because practically anyone can create such currencies, and for some types, specialized programming knowledge is not even required.

However, not all cryptocurrencies gain popularity and commercial success. To achieve this, it is not enough to just create and launch a digital coin; it also requires a considerable amount of effort and resources to promote it.

However, many creators stop developing the currency and do not engage in its promotion. For this reason, many of us have never even heard of some cryptocurrencies, although they have existed for several years.

Digital currencies do not have any material equivalent or backing. Their value is determined solely based on supply and demand and is built on the trust of users in them.

Therefore, promotion and recognition are key to success when launching a cryptocurrency. There are approximately 3 million different digital currencies in the world, but many of them are unknown, others are dead, and still, others are fraudulent projects. Only a few are well-known and used for various purposes.

Cryptocurrency rankings

How does a particular digital currency make it into the top 10 or at least the top 100 in the cryptocurrency list? Who and by what criteria compile these lists? Why is Bitcoin ranked first, while SNM cryptocurrency is ranked 1759th? Let's figure this out in this section.

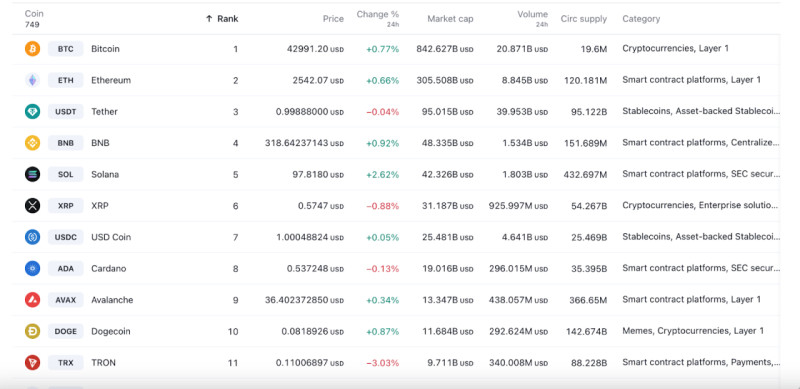

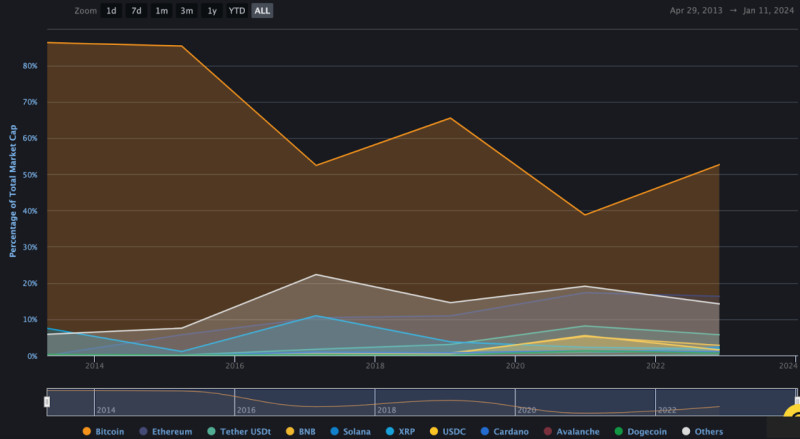

Cryptocurrency rankings are compiled based on various grounds. The following parameters are most commonly used for compiling rankings: market capitalization, trading volumes, price fluctuations, as well as user interest.

Various methodologies can be applied in compiling rankings: weighted averages or comparative analysis. In the first case, a coefficient is assigned to each parameter, then all coefficients are summed up, resulting in the final indicator. In the second case, currencies are compared and ranked according to specified indicators.

The key factor in compiling any ranking is the timeliness of information. In the case of digital currencies, indicators can change very quickly, so the ranking should provide the possibility of updating information on each coin in real-time.

How rankings affect decision-making

Rankings are compiled taking into account a large number of factors, so they are a good source of information for investors when making decisions. A high ranking generally indicates the status of the coin's developers, currency stability, and relatively low volatility.

Digital currencies with lower rankings, such as Luna cryptocurrency, have less demand among investors. However, this may be due to the coin's ranking and other factors that investors consider.

In addition, different investors may have different goals: some want to earn a lot and quickly, which is only possible with new currencies that are just entering the market. However, the risks are also higher, as the coin can disappear as quickly as it appeared, without achieving any success.

Any ranking can be subjective and change over time, so relying solely on this data is not advisable. It is necessary to be able to analyze the market situation correctly and make informed decisions.

How to read rankings

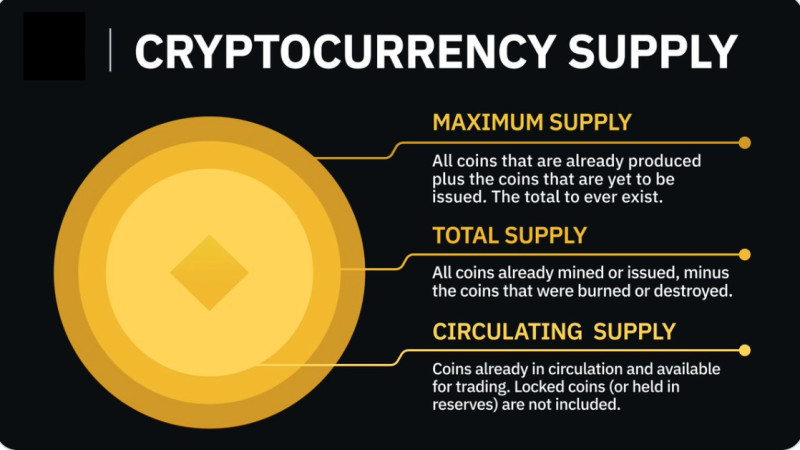

When an average user sees a table, that represents a ranking, he may not immediately understand how the cryptocurrency list is compiled. To do this, it is necessary to understand what each parameter denotes and how it is determined.

For example, the UNFI cryptocurrency at the time of writing this article occupies the 594th place by capitalization. This is the aggregate market value of all assets in circulation. It is calculated as the coin's value multiplied by the total amount of currency.

The next indicator taken into account is the price. When compiling rankings, the average value is taken into account, which is calculated based on indicators from different exchanges. An increase in the asset's price attracts more investors, potentially increasing the coin's ranking.

Trading volume is a parameter that is more relevant to traders than investors. This is because this parameter allows for determining the liquidity of a particular coin. Trading volume takes into account the total number of operations performed with the asset within a specified period.

Other factors to consider

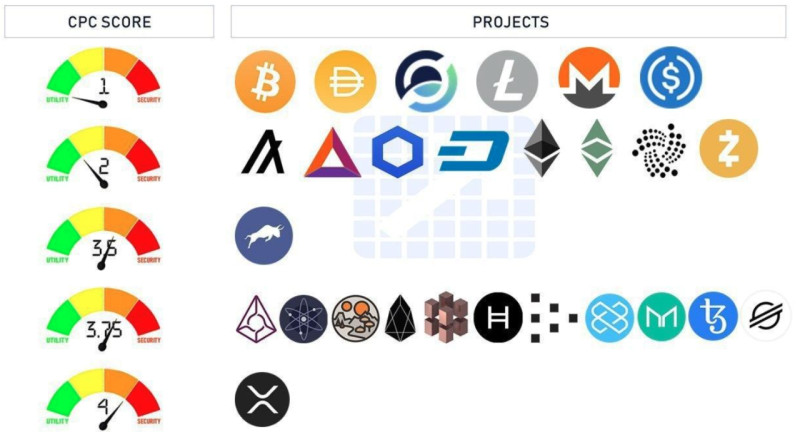

In addition to all the parameters mentioned above, other factors influence the position a particular currency can occupy in the ranking. One such factor is some unique characteristic, feature, or technology that the project possesses.

For example, the AXS cryptocurrency and the network in which it operates differ from others in that this platform is a blockchain game. Players have full control over it, earning their income in AXS tokens, and thereby can influence the project's further development.

Another significant factor is regulation and legal support. Clear and transparent regulation instills trust among investors, which in turn has a positive impact on the cryptocurrency's ranking.

And the last but not least important component is the development team. The reputation of the people directly involved in the coin's development and promotion, and their activity on social media and events, directly affect the currency's image and, consequently, its ranking.

How to use cryptocurrency rankings

In light of all the above about the rankings of digital currencies, it can be understood that they take into account a fairly large number of factors in assessing crypto assets. Therefore, it is logical to assume that a coin entering the top 20 or top 30 currencies and even the top 100 cryptocurrency list considering their total number, has a good reputation.

For example, at the time of writing this article, the Gala cryptocurrency ranks 88th in the ranking, which contains over 2 million digital currencies. This is another "gaming" currency used in a service that creates blockchain-based games. The Gala Games platform rewards players with gala tokens for participating in games.

However, the coin's position in the ranking and the ranking itself should be checked against several factors. These include the reliability of the data source - verified platforms should be chosen, consideration of various criteria, analysis of current trends - studying a particular currency dynamically.

In addition, it is important to compare potential risks and returns. When there is an opportunity to "hit the jackpot," it is often associated with a higher level of risk. The choice always remains with the investor, however, relying solely on one source of information is not advisable.

Where to find cryptocurrency rankings

Cryptocurrency rankings, as mentioned earlier, are based on several parameters of each cryptocurrency. The list is published by the organization that compiles the ranking on its website.

For example, on the CoinMarketCap website, you can find information that the ICP cryptocurrency ranks 16th. In this case, the positions in the ranking are distributed according to the first indicator - the market capitalization.

Companies that track changes in the value of digital currencies and compile rankings include cryptocurrency exchanges, news websites, data aggregator sites, investment portfolio trackers, and others.

Each website provides opportunities for ranking digital currencies according to various parameters, including market capitalization, total trading volume, price fluctuations, etc. The user can choose which criterion to use for compiling the list.

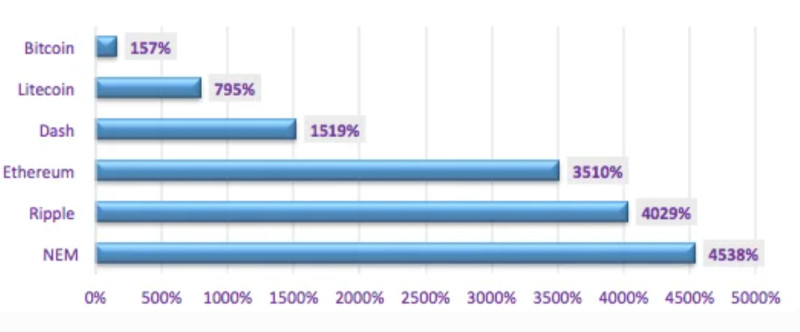

How crypto can gain over 1,000%

As mentioned multiple times, the value of cryptocurrencies can change significantly within short periods. Significant increases or decreases can be attributed to various factors.

For example, in 2022, there was a period when the value of the APTOS cryptocurrency increased by 10,000% in a single moment. This occurred almost immediately after the coin's launch and the beginning of trading paired with the more well-known coin USDT. However, the value soon rolled back to lower levels and stabilized around $8-10.

Imagine how much could have been earned on this coin at the time of its price surge. To not miss out on such moments, analysts periodically create rankings of the most promising coins.

Experts analyze various factors that can influence the price of a particular coin and make forecasts regarding which currencies may soar shortly. Using this data, users can make decisions regarding investing their funds in crypto assets.

How crypto can decline in value

In addition to powerful growth, cryptocurrencies can also demonstrate significant decreases in value. For example, in the same year 2022, two fairly well-known coins suffered crashes: Terra (Luna) and the FTT cryptocurrency.

A scandal involving the founder of the FTX exchange, which issued FTT tokens, led to a rapid 80% decline in the currency's value in just one month. This once again confirms the high levels of risk associated with investing in cryptocurrencies.

Each of these projects can disappear as quickly as they appeared. Moreover, many of the emerging new digital currencies turn out to be fraudulent schemes designed to extort money from users without providing anything in return.

And even a powerful momentary rise in cryptocurrency value does not guarantee its further growth and prosperity. Growth can turn out to be short-term, followed by an equally powerful decline in the coin's price. This can happen for several reasons, which is why it is so important to constantly monitor quotes and keep track of the market situation.

Is it true that crypto is not subject to inflation?

Against the backdrop of rising consumer prices in almost all countries worldwide, many people begin to think about how to preserve their savings. One way is to invest funds in various assets, including digital currencies, for example, the UMI cryptocurrency.

Let's try to understand whether this is the case and whether cryptocurrency can protect against inflation. One of the main arguments in favor of this is the fact that the issuance of coins is strictly limited, and their exchange rate is determined strictly based on supply and demand.

It is necessary to understand that the price of all cryptocurrencies is to some extent linked to the rate of the first and main coin - Bitcoin. However, cryptocurrencies cannot be assessed separately from everything else happening in the economy.

Currently, cryptocurrencies are used as a means of payment in only a few countries, and not everyone can use them to pay for goods and services. Accordingly, digital currencies mainly attract traders who speculate on fluctuations in their value.

Which coins are worth investing in

Since we have started discussing the prospects of investing in various cryptocurrency assets, let's try to figure out which coins are worth investing in and why. There are different opinions on this matter, and an investor should not rely solely on any rankings or lists.

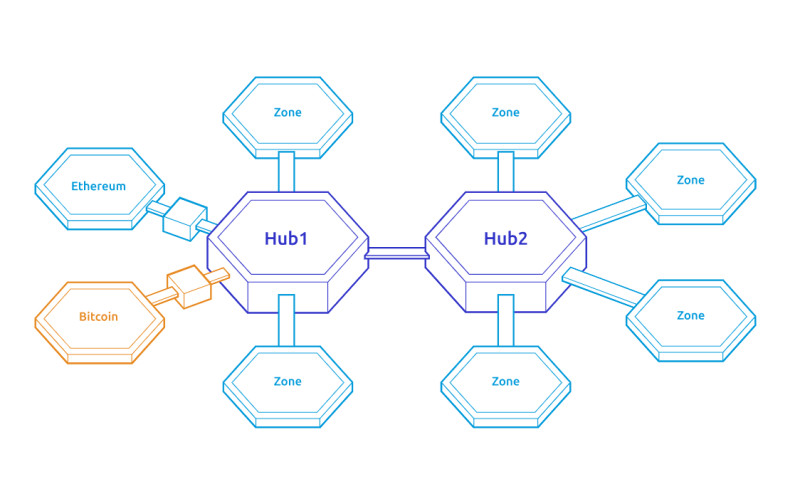

In addition to searching for information online, one should conduct an analysis and identify those features that can give a significant advantage to one coin over others. For example, the ATOM cryptocurrency is considered one of the promising coins due to the unique Cosmos platform on which it operates.

One of the key factors for success is the innovative approach of developers, meaning the creation of something fundamentally new for faster transactions, cheaper implementation, or network scalability. In the case of the Cosmos network, this is the creation of a cross-platform system capable of uniting multiple blockchains.

Additionally, a significant factor is the promotion of cryptocurrency. To attract users' attention to their product, developers engage public figures who popularize the currency, consequently increasing its value.

How to track the emergence of new coins

Many investors, despite the increased risk, prefer to invest in new digital currencies that are just entering the market, for example, the HFT cryptocurrency that appeared at the end of 2022. Let's discuss the services that allow tracking the emergence of new coins in this section.

We have already mentioned that new cryptocurrencies appear practically every day: these can be tokens of large projects or just new coins not backed by any resources. Only a few of them manage to become truly successful; some simply disappear from the arena shortly after appearing.

One of the simplest ways to learn about the emergence of a new crypto asset is market monitoring. It can be done using the same resources where we find cryptocurrency rankings. Another way is to track exchange listings where news about the release of a new coin or the appearance of a new pair is announced.

One way to acquire a new digital currency is through an ICO, i.e., an initial coin offering to investors. After the coin is listed on the exchange, it can be purchased, and one becomes a holder. The most important thing at this moment is not to make a mistake in choosing the coins for investment.

Popular cryptocurrencies

If you ask an average person how many cryptocurrencies they know, the first thing that comes to mind is, of course, Bitcoin. But there are other well-known and popular coins that users have heard of, one of them being Ethereum.

In this section, we will talk about what Ethereum and Ether are, and what the difference between them is. In short, the main difference is that Ethereum is a whole financial platform, while Ether is a digital currency created for use within this system.

Ethereum can be used to create services or applications. However, Ethereum is just a technology, while applications created with its help have real value and can bring real benefits.

Ether as a cryptocurrency is quite popular among users. It has a lower cost than Bitcoin, and transactions with it are much faster. Also, its issuance is not limited, unlike Bitcoin. Currently, the price of 1 Ether (ETH) is approximately equivalent to $2,223.

Supporting networks

In the process of their operation, large blockchain networks face the problem of scalability. This means that due to a large number of transactions, the system simply cannot process them, and the processing process can take several hours.

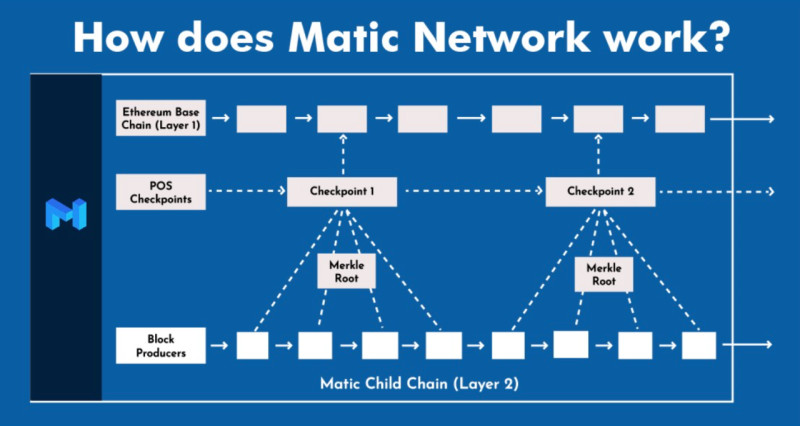

To "unload" the main networks and reduce the load on them, second-layer networks are created. One such solution is the Matic cryptocurrency and the Polygon network, which used to be called the Matic Network (hence the name of the token).

The main task of Polygon is to reduce the load on the Ethereum network. It is not an independent network or a competitor to Ethereum but an auxiliary project that cannot exist separately from it.

The Matic cryptocurrency is an internal token of the Polygon project designed to pay fees and conduct operations in this network. The cost of one token is just under $0.80, and the total maximum supply is 10 billion tokens, with almost all of them in circulation.

The Graph project

When using blockchain technology, users sometimes need to obtain some information. For this purpose, there are special services, one of which - The Graph - operates similarly to the Google search service on the internet, and the GRT cryptocurrency is its utility token.

The main function of The Graph network is to index and organize data in one or another blockchain. At the same time, one of the key features of the blockchain network is preserved - decentralization. This network uses GraphQL technology to group blockchain data into subgraphs on the API.

The GRT token appeared before the project itself and allowed to raise part of the funds for its implementation. Currently, this currency supports the operation of The Graph network, which works with blockchains such as Ethereum, Polygon, Avalanche, and others.

The cost of GRT is symbolic and is less than 20 cents. The currency is used for various purposes: financing, staking, payment for services, as well as as a reward for the work of network participants.

What is Ripple

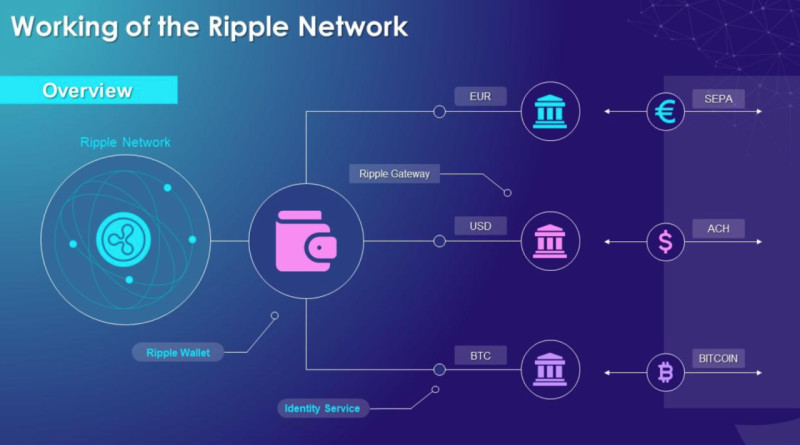

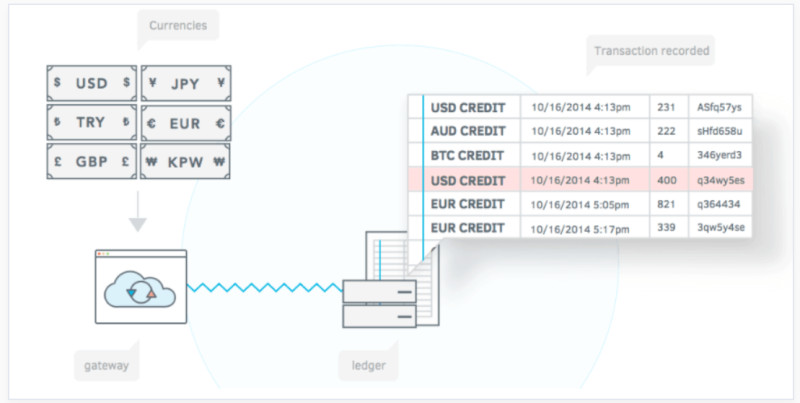

Another cryptocurrency – Ripple – is popular among many users. However, it is not just a cryptocurrency. It is a whole system for conducting intercurrency and international payments. Therefore, it traditionally occupies high positions in the list of cryptocurrencies.

That is, first of all, it is a system for making payments, created similar to the SWIFT interbank system. Also, in this system, there is its internal currency - Ripple (XRP). How to buy Ripple and use it for payments will be discussed further.

The feature of this currency is that it is used even by banks for currency exchange operations. At the same time, like other networks based on blockchain technology, it is characterized by decentralization.

Currently, the cost of XRP is quite low, at just over 50 cents equivalent. Ripple is traded on 29 exchanges, so it is quite easy to buy, which can be done for fiat money or other cryptocurrencies.

How BNB managed to enter the top 5 cryptocurrencies list

Another popular cryptocurrency, entering the top 5 of all digital currencies, is BNB. What is BNB, and what can it be used for, we will talk about it in this section. This currency is the utility token of the Binance exchange.

Initially, BNB was a token and operated on the Ethereum blockchain platform, but subsequently, its creators decided to move it to their network platform. This is both a plus and a minus, as outside the Binance exchange, it is impossible to trade with this currency.

For the same reason, it cannot become a universal means of payment and replace fiat money. Nevertheless, it offers many other advantages, such as reducing the commission size, a large number of currency pairs, and high transaction speed - the exchange processes about 1.4 million transactions per second.

Currently, the value of this coin is almost $320, with a significant price increase occurring last year literally within one month. Also, the growth of the exchange rate is contributed by the "burning" policy, when some coins are simply destroyed, which reduces the coin's supply and thus increases its value.

How Solana made it to the 5th spot in the ranking

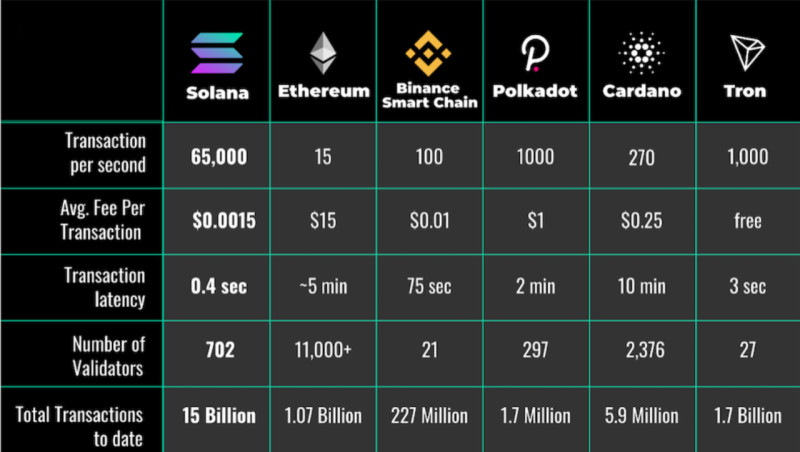

Solana, like many of the previously mentioned digital currencies, is not just the SOL cryptocurrency but also a unique network. Its uniqueness lies in the fact that it uses a special consensus algorithm different from other networks, called Proof of History.

Thanks to this innovative algorithm, Solana allows for the verification of multiple blocks simultaneously, rather than one by one, significantly speeding up the entire process. Additionally, the fees in this network are significantly lower than in other well-known networks, which makes transactions cheaper.

Although the SOL cryptocurrency was initially issued to serve the network, it has now expanded beyond its blockchain. Additionally, the Solana Pay system has been launched for conducting payments without intermediaries.

It is considered that the Solana network is becoming the main competitor to the Ethereum network. It outperforms in transaction processing speed and is also more environmentally friendly, consuming less electricity. The current value of SOL is around $100.

Cardano in the top 10 cryptocurrency list

Analogously to other digital currencies we have discussed earlier, Cardano is not just the currency itself but also a separate blockchain platform. The ADA cryptocurrency has some features that distinguish it from other tokens and coins.

The main feature of this network is a special consensus protocol that provides high speed and scalability. Thanks to this, it becomes possible to create decentralized applications, decentralized finance, and implement other goals and tasks.

The Cardano cryptocurrency is the utility token of this network, used to pay fees and conduct operations in the eponymous blockchain network. The network's performance is higher than many others, reaching 250 transactions per second.

The cost of the ADA cryptocurrency is low, just over 50 cents, making it accessible to many users. Cardano is considered the first third-generation cryptocurrency, which means it has great potential for scalability and efficiency improvement.

What is Avalanche

Since the emergence of the first digital currency, developers of each subsequent project have sought to surpass their predecessors in some way. The AVAX cryptocurrency is no exception, and its creators aimed to surpass the functionality of the Ethereum platform.

The uniqueness of the Avalanche platform lies in the fact that three networks are combined on one platform: X-Chain, C-Chain, and P-Chain. The first is intended for creating and exchanging tokens, the second for creating smart contracts, and the third for coordinating network validators.

Thus, these networks simultaneously address the tasks of decentralization and scalability, as well as increase the speed of transactions. All transaction fees are paid using the platform's token - AVAX.

The cost of one token is just over $35, with a maximum supply of 720 million tokens. Thanks to the periodic burning of some coins paid as transaction fees, the total number of tokens in circulation decreases, and their value increases.

Trust Wallet creates its cryptocurrency

There are many different options for cryptocurrency wallets to store digital assets. One of the most well-known and reliable ones is Trust Wallet, which supports all major blockchains and cryptocurrencies.

So, what is TWT cryptocurrency? It's a native token developed by the Trust Wallet system to serve its network. With this token, users can make payments within the platform and also receive certain benefits.

If a user plans to use the Trust Wallet, it makes sense to also acquire TWT tokens. This allows access to additional features and a higher level of security. Additionally, owning this token provides the opportunity to participate in the management of the system.

The value of TWT is symbolic, just over $1. It is worth noting that the total token issuance was reduced by its creators from 90 billion to 1 billion to increase demand for the currency.

What is Toncoin

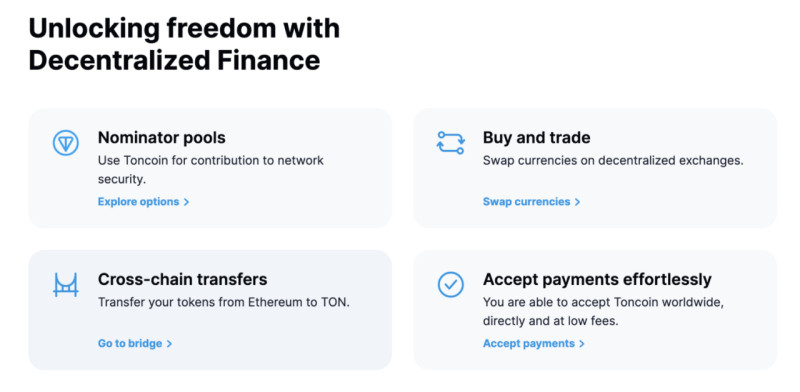

Developers of the well-known and popular messenger Telegram decided to create a decentralized network based on blockchain technology. Thus, the Ton cryptocurrency appeared, which is used in this network.

The network itself was created to attract a large number of users and enable them to conduct fast and accessible operations. Its feature is that it is an open network that allows simultaneous use by billions of users.

Initially, this coin was called Gram, but its issuance was prohibited by the US SEC. As a result, developers suspended work on this project, and later another organization used the open-source code and continued development, naming the currency Ton.

The value of this coin is just over $2, and the total supply is over 5 billion. The coin is used to confirm each operation and to pay rewards to network validators.

Tron cryptocurrency in the top 20

Tron, like many of the aforementioned cryptocurrencies, is not only the name of digital money but also a platform. What is TRX cryptocurrency, and what can it be used for? Let's try to figure it out in this section.

Like the BNB token, Tronix was initially launched on the Ethereum platform but was later moved to its platform. Initially, this network was created for use by authors of digital content.

Currently, the Tron blockchain platform allows for the development of decentralized applications, smart contracts, and other options. The currency itself is used for trading on the exchange, in games, and as rewards for users.

The value of TRX is around $0.10, making it quite accessible. Similarly to the previous currency, a portion of the issued tokens is regularly burned, reducing the supply and increasing demand for Tronix.

Stellar Lumens in the top 30 cryptocurrency list

The Stellar network bears resemblance to another, even more, renowned coin network – Ripple, and this isn't by chance, as one of Ripple's founders also became the creator of the Stellar network. Within the network operates its native currency – XLM -- used for conducting transactions.

The foundational idea behind creating this blockchain is the ability to facilitate payments in all types of currencies. Transactions involving two different currencies are processed in fractions of a second without any intermediaries, enabling the network to conduct up to 4,000 operations per second. Additionally, the network has its protocol.

A distinctive feature of the XLM token is that it cannot be mined. It should be purchased to be used. The currency is utilized by users within the network to pay transaction fees, primarily for international transfers between individuals or organizations.

The value of this token is relatively low, just over $0.10, with a total supply of over 50 billion units. Initially, the company issued 100 billion tokens, but half of the total volume was burned during currency usage.

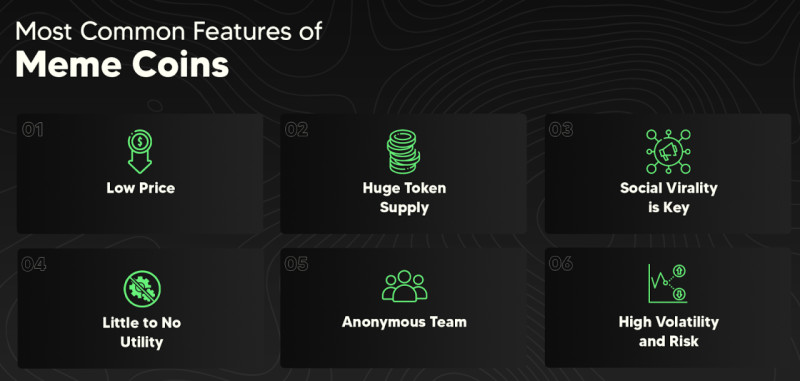

Meme cryptocurrencies

Meme cryptocurrencies are typically created based on some humorous content found on the Internet – images known as memes. The first and most popular meme coin was Dogecoin, launched in 2013 based on the Doge meme.

Shiba Inu cryptocurrency is another well-known representative of this category, initially created for entertainment purposes. The symbol of this coin became the Japanese dog breed – Shiba Inu, depicted on the currency's logo.

Originally, the coin was developed on the Ethereum platform. However, the growing popularity of this currency led to the creation of its decentralized exchange, ShibaSwap. Currently, the coin can be purchased on many major cryptocurrency exchanges.

The value of Shib is quite symbolic, less than $0.01. Initially, the total number of tokens reached 1 quadrillion, but part of the coins was destroyed, resulting in a current total supply of around 497 trillion. This helps maintain the coin's value at a low level.

Pepe Frog coin

Cute dogs are not the only creatures that have attracted the attention of Internet users. Another well-known meme is the Pepe frog, based on which another famous digital currency was created – Pepe cryptocurrency.

This project is relatively new, as it emerged in 2021. Thanks to high interest and the coin's growing popularity on social media, its value increased by 900% in just one day, and within the first three weeks, the market capitalization exceeded $1.5 billion.

As a result of such success in the market, new meme cryptocurrencies began to appear actively; however, many of them lack liquidity. Initially, the Pepe coin was traded only on decentralized exchanges, but due to high demand, it appeared on traditional cryptocurrency exchange listings.

The currency's value is currently very low, less than one cent. The total coin supply is over 420 trillion units, but the coin's supply gradually decreases as a portion of the fee from each transaction is burned.

Cryptocurrency Fantom

In discussions about cryptocurrencies and their transactions, we often mention two characteristics: transaction speed and scalability. Each new emerging coin attempts to address these two issues and one such project is FTM. Let's try to understand what it is and how this digital currency can be used.

Fantom is a cryptocurrency and a blockchain network of the same name designed for developing smart contracts. This network is interesting in that it uses its consensus algorithm and transaction recording mechanism: transactions are not grouped into blocks but are simply sequentially connected into one chain.

The Fantom coin itself is the network's internal currency and is used to pay fees and reward clients for participating in staking. Transactions are instantaneous, enabling the network to process over 1,000 transactions per second.

The value of the cryptocurrency FTM is just under $0.40, with a total coin supply reaching 3.17 billion, making this currency quite accessible. Demand for this coin is growing due to the innovative technologies employed in the network.

Cryptocurrencies not included in the top 100

We have talked a lot about how not all digital currencies become successful. However, the position of a coin in the ranking is influenced by a fairly large number of factors.

The fact that a cryptocurrency did not make it into the top 100 does not necessarily mean that it is a bad coin and should not be considered an investment project. Let's consider the example of a token like the dYdX cryptocurrency: what it is and how it can be used.

The dYdX project is an independent decentralized cryptocurrency exchange that allows users to trade cryptocurrencies. The unique feature of the exchange is the ability to engage in margin trading and the presence of two pools: security and liquidity.

The dYdX token is the utility token of this network, used for paying for services and participating in voting. Coin holders have the right to vote within the platform's closed community. The value of dydx is around $3, with a total issuance of 1 billion units of currency.

How to create your tokens

The total number of digital currencies exceeds 2 million, and new coins are appearing practically every day. This is because the process of creating a currency does not require a vast amount of knowledge and skills. There are special platforms that allow you to do this in a short time.

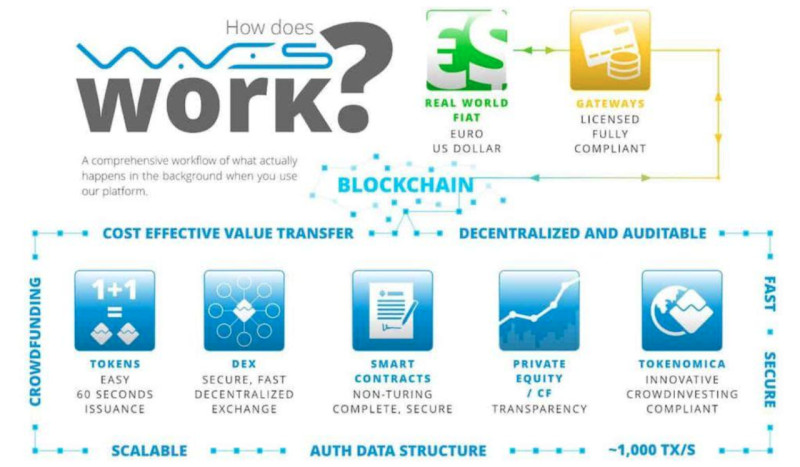

One such opportunity is the Waves cryptocurrency and the platform of the same name. Developers of this platform claim that creating a new token will only take 1 minute and 1 token.

Additionally, with the Waves coin on the platform, you can perform various other actions: trade crypto or fiat currencies, exchange coins on the exchange, engage in staking, receive rewards for verifying transactions, and so on.

The value of one token is just over $2.5, with a total issuance of over 110 million units of currency. This token can be purchased through exchanges or obtained through mining.

Challenges faced by blockchains

As mentioned multiple times, there are two main difficulties that many blockchain networks eventually encounter. One is transaction processing speed, and the other is the scalability issue. Developers of new digital currencies try to overcome these challenges with their projects.

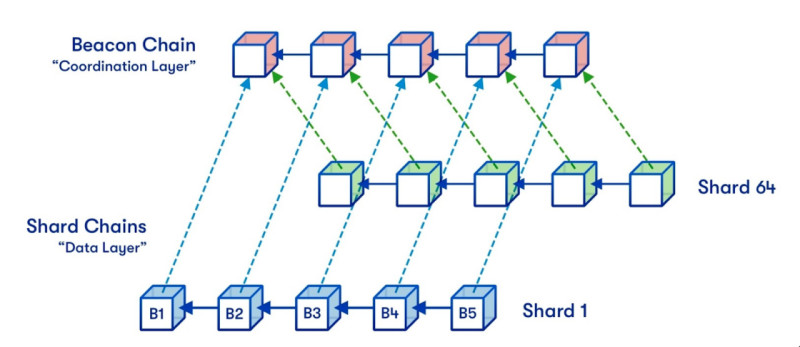

One such solution is sharding, which is applied in the Zilliqa network, with its native token being the ZIL cryptocurrency. What is sharding? It is a technology that allows the network to be divided into separate segments (shards), each processing incoming data in parallel.

A notable feature of this network is that as new nodes emerge, the network's throughput increases. In other networks, conversely, a larger number of nodes decreases transaction processing speed and platform performance. Additionally, Zilliqa has a programming language called Scilla.

The cryptocurrency ZIL is the project's native token, granting the right to use the platform, conduct operations, and develop applications. The token's price is around $0.02, with a total issuance of 21 billion units.

Competition among cryptocurrencies

Every new project in the digital currency space that emerges in the market aims to surpass its competitors in one or more parameters. Thus, new competitor currencies to well-known and popular coins are created.

One such project is the EOS cryptocurrency, positioning itself as a competitor to the Ethereum platform. This project not only has its currency but also its platform with the same name. Notably, this network does indeed have several advantages over Ethereum.

One of the most significant advantages is the absence of transaction fees. Additionally, the network allows for several thousand transactions per second, with a claimed capacity reaching a million transactions per second.

The EOS cryptocurrency is the native token of this network and acts not only as a means of payment but also gives its holders voting rights in decision-making. The value of one token is around $0.80, with a total circulation of about 1 billion units of currency.

Bitcoin competitors

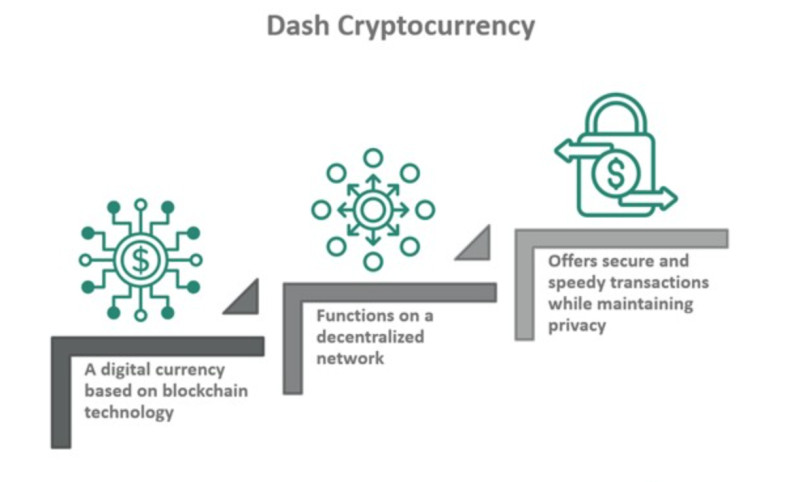

Bitcoin is the first and most famous of all digital currencies that have ever existed. Therefore, it's not surprising that developers are trying to replicate the success of this coin or even surpass it in some aspects. One such project is the Dash cryptocurrency, which we'll discuss now.

What makes this currency better? Firstly, the transaction speed in the Dash network significantly exceeds the speed of transactions in the Bitcoin network: transactions are instantaneous thanks to the InstaSend technology. Secondly, the transaction fees in the Dash network are substantially lower.

Another important feature of this network is decentralized governance, in which all holders of the dash currency can participate by voting. Special nodes called master nodes are provided to maintain the network's smooth operation.

The Dash token is the native coin of this network, but it is also used in everyday transactions: in some countries, goods and services can be paid for with this currency. The value of Dash is around $30, with a total supply of over 11 million units.

Asian projects

Asian countries have long earned the title of leaders in high-tech industries. Of course, they couldn't overlook digital currencies and blockchain technologies associated with them. One of the bright representatives of coins from this region is the CFX cryptocurrency. Let's delve into what it is and how it works.

Conflux is not only the name of the coin but also a blockchain network designed for global payments and the creation of decentralized applications. The platform provides its clients access to a network that has high scalability potential due to a special consensus algorithm.

There is also the possibility of interaction with other platforms thanks to the ShuttleFlow technology, which allows for asset exchange with other networks, such as Ethereum, BNB Chain, and others. Additionally, it is the only blockchain project permitted in China.

The CFX token is the native currency of the Conflux network, intended to support the system's operation and growth, pay transaction fees, and reward miners. The value of CFX is around $0.20, with over 3.5 billion tokens in circulation.

Cryptocurrencies and social networks

Developers of platforms for digital currency transactions constantly strive to add new features and capabilities. One such additional option became the integration of digital currencies and social networks, successfully achieved by the mask cryptocurrency.

Mask Network is a platform aimed at finding solutions to protect users' social network data. Key features of using this network include message encryption readable only by specific individuals, protection of private conversations, currency exchange, and fee-free cryptocurrency transfers.

To ensure the operation of this platform, the development team created its currency - the Mask token. Users who own this asset can participate in network governance.

The currency's value is nearly $3, with a total issuance of 100 million tokens. However, not all coins are in circulation, and the currency supply is limited. Interesting fact: many users associated the mask coin with Elon Musk, which significantly boosted its price at a certain stage.

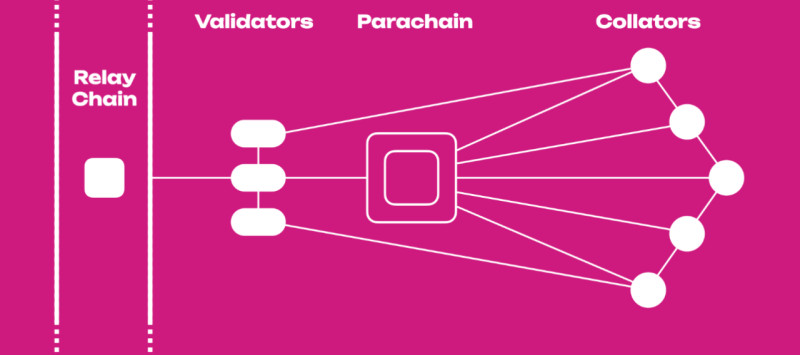

What are parachains

The principle of operation of all well-known networks that deal with digital currencies is based on blockchain technology. However, each of these networks has its drawbacks and limitations, complicating users' interaction with the blockchain.

Therefore, developers try to overcome these limitations, and one solution is to create parachains, united into one common network. An example of such a parachain is the GLMR cryptocurrency and the network it serves.

So, a parachain is the same blockchain but with the ability to merge with other networks for joint operation. The most well-known network connecting many parachains is the Polkadot project.

It's within this network that the chain Moonbeam operates, with GLMR being its native token. These tokens are used to pay fees within the network, launch infrastructure, and reward collectors. The value of GLMR is just over $0.40, with over 820 million units of currency in circulation.

Gaming tokens in cryptocurrencies list

Some digital currencies are developed specifically for individual projects and cannot be used on other platforms or exchanges. One of the most prominent examples of such currencies is gaming tokens, such as the SLP cryptocurrency.

This token is used on the Axie Infinity platform, which is an online game with the Play-to-Earn concept. This means users earn rewards for playing the game, winning battles, and creating new characters.

The primary token on this platform is the AXS currency, as mentioned earlier. However, other currencies are used on the platform, one of which is SLP (Small Love Potion), which is paid out as a reward to players, and later these funds can be used to purchase characters.

The SLP token is created on the Ethereum blockchain, and its value is symbolic, less than $0.01. As for the total number of tokens in circulation, it is quite difficult to determine, as the coins are constantly used in the game and burned. However, their quantity is estimated in the tens of millions.

Sports and crypto

At first glance, how are sports and digital currencies related? There is a connection between them, although not the most direct. Several years ago, the idea emerged to develop a platform for interaction between sports teams and their fans.

Thus, the Socios.com project was born, which has its currency - the CHZ cryptocurrency, thanks to which fan tokens can be issued and traded. A fan token is a digital asset that belongs to a specific team and gives its holder the right to participate in its life.

Many famous football clubs have already joined this platform, the first of which was the Italian Juventus. Fans can use fan tokens in various ways: to obtain tickets, souvenirs, invitations to exclusive events, and so on. Teams receive additional funding as a result.

The CHZ cryptocurrency is the utility token of the project, which can be exchanged for fan tokens on the specialized Chiliz platform. This currency cannot be mined; it can only be purchased or received from another user. The price of CHZ is around $0.09, and the total supply is almost 9 billion units.

Crypto lending

Lending is not limited to traditional banking institutions anymore; nowadays, it is also available on cryptocurrency platforms. However, the difference lies in the fact that instead of institutions, users on the platform lend funds to each other.

One example of such platforms is the LeverFi project and the Lever cryptocurrency, which serves as the utility token of this platform. It is a financial platform where every user can use leverage for crypto trading, but they need to provide collateral.

Among the key features of this platform, we can highlight the following: the opportunity for passive income, attracting borrowed funds for trading, and pooled collateral for risk distribution among users.

The lever cryptocurrency is used to manage the platform, with the focus not so much on the number of tokens held by the holder but on the locking periods. Users receive rewards for locking their tokens for extended periods. The value of Lever is less than $0.01, with a total circulation of around 29 billion coins.

How BitTorrent service launched its crypto

BitTorrent is one of the largest file-sharing platforms in the world, with millions of active users. To simplify the process of transferring large files without using a central server, a network protocol was developed.

In 2018, this network was acquired by the blockchain network developer Tron, which we have discussed before, to provide data storage services for decentralized application creators. Later, the independent BitTorrent Chain (BTTC) blockchain was launched with its currency - the BTT cryptocurrency.

The BitTorrent network already had its digital currency, but after the launch of BTTC, developers had to re-denominate it. As a result, over 50% of the "old" coins were burned, and two types of tokens appeared: BTTOLD and BTT. The "old" coins will still be in circulation, but the supply of BTT has increased to 990 trillion.

The token prices are symbolic, less than one cent. This currency can be used to pay network fees, earn rewards through staking, and participate in network governance and voting.

Conclusion

In this article, we have explored how rankings of various cryptocurrencies are compiled. The list is based on a combination of several factors and parameters, according to which positions are allocated.

Typically, the primary parameters considered in all rankings are market capitalization, asset value, and trading volume. In addition to these, attention is paid to factors such as key features, development team, and project regulation and legal support.

Positions in the rankings are determined based on the aforementioned parameters, compiled by cryptocurrency exchanges, tracking websites, and aggregators. These lists can be found on the websites of these organizations. Moreover, these rankings are dynamic, as cryptocurrencies are highly volatile and subject to change.

Every new project entering the digital currency sphere seeks to address the key challenges faced by existing blockchains. The key difficulties of blockchain technology include the need to increase transaction processing speed and scalability without compromising decentralization.

Back to articles

Back to articles