Luna Classic (LUNC) is the rebranded name of the LUNA token, which is no longer traded on most exchanges. This asset is referred to as the Terra network. To date, this project is known as Terra Classic.

In other words, the cryptocurrency Lunc is a native digital asset of the Terra Classic network. Its main function is to provide stability to the price of the stablecoins that operate in this network.

Terra project history

Terra is an innovative blockchain protocol that was created for global payment systems. The company behind the development of this project is Terraform Labs.

The Terra protocol involves the use of stablecoins, which are crypto assets whose value is tied to the value of fiat currencies (dollars, euros, and rubles).

The most popular stablecoins on the cryptocurrencies list are Tether (USDT), Binance USD (BUSD), and USD Coin (USDC).

Thanks to these assets, investors can invest their money with minimal losses and also convert their digital coins into stablecoins on decentralized exchanges (DEXes).

Stablecoins are a kind of insurance for investment portfolios against the increased volatility of cryptocurrencies.

However, the existing stablecoins have one big disadvantage. It is their centralized nature. Smart contracts can realize only the delivery of tokens, but the storage of currencies is handled by custodial services.

Actually, the search for a solution to this problem was the reason for the creation of the Terra project.

Terraform Labs and its Terra project were founded in 2018 by Daniel Shin and Do Kwon. The goal of these enthusiasts was to create a decentralized payment system that would provide its users with the fastest and cheapest transactions.

The new platform included a mechanism for securing stablecoins and maintaining the exchange rate, as well as smart contracts, which are used to process transactions on the platform.

As envisioned by Shin and Kwon, the stability of the price of stablecoins was to be supported by a native Luna token and an automated algorithm that would be responsible for issuing and burning these digital coins.

Do Kwon himself is a certified programmer, who graduated from Stanford University with a degree in computer science. However, just being a diploma holder was not his intention, as he was in a hurry to invent something new or improve the existing one. He founded Anyfi, a P2P communications company. Before that, he worked for a while as a programmer at Apple and Microsoft.

Daniel Sheen graduated from the Wharton School of Business at the University of Pennsylvania. In addition to Terra, he is one of the founders of South Korea's largest marketplace, TMON, and a co-founder of the startup incubator, Fast Track Asia. Shin did not stop there either and created an investment firm called Bass Investment as well.

In August 2018, Kwon and Shin decided to launch the initial funding stage of the then new and unknown innovative project Terra. In fact, they did not take a risk for anything, as the idea of the project seemed interesting and promising to many people.

At first, such leading crypto exchanges as Binance, OKEx, and Huobi Global decided to fund the project. Global investment funds Hashed, Polychain Capital, and Arrington XRP Capital also joined the funding.

As a result, the startup managed to raise an impressive amount of money to realize their ideas—as much as $32 million. At the same time, they managed to issue 385,245,974 LUNA coins.

The blockchain project broke into the market by integrating the payment system into a global coalition of e-commerce partners. This coalition consists of 16 major firms. Here are some of them: Woowa Brothers, TIKI, Qoo10, Pomelo, and many others.

Columbus' blockchain was launched in April 2019. After that, the Testnet Soju test network, the Faucet trial network, and the TerraStation network for transferring coins via the Ledger Nano S cryptocurrency wallet became available for users and developers.

In July 2019, the Terra project began interacting with Chai, a South Korean program for electronic mobile payments. This program engaged Terraform's blockchain to process transactions.

In 2020, Do Kwon began creating the Anchor DeFi protocol, which provided the opportunity to profit from deposits in the project's stablecoins.

At the very beginning of 2021, Terraform Labs received a large amount of funding—$25 million. Investors were such major players in the crypto market as Coinbase, Galaxy Digital, and Pantera Capital. The company's executives used the money received to create and improve the Anchor and Mirror protocols.

The company continued its development and achievements, which attracted new investors. Thus, in 2021, the Terra project managed to attract another $150 million. Galaxy Digital, Arrington XRP Capital, and BlockTower did not spare their money for the development of the company. The company sent this money to the Ecosystem Fund, which sponsors protocols and platforms.

Terra ecosystem’s uniqueness

The Terra project is a decentralized blockchain platform. It is unique in that it is a complete ecosystem that includes:

- a mechanism for securing digital coins (i.e., stablecoins)

- exchange rate maintenance

- blockchain oracles

- smart contracts (they automatically process transactions on the platform)

The creation of Terra means the creation of a global and efficient payment system that does not have a single control center (i.e., it is decentralized) but still provides very fast and very cheap transactions and international payments.

Although Terra is not the only platform that offers stablecoins to users, it still has some fundamental differences from other similar projects.

The first of them is that the Terra platform can work on several blockchains at once. This feature provides a high degree of decentralization. To offer such a feature, Terra uses the Cosmos SDK and Inter Blockchain Communication (IBC) technology.

The second difference is that Terra operates on a Proof of Stake (PoS) consensus mechanism. The network is maintained by a group of validators, who get rewards for performing their operations (e.g., they receive rewards for computations and transactions).

On the Terra platform, hundreds of transactions can be processed in one second, and it takes approximately six seconds to validate transactions. The average cost per completed transaction is only a few cents.

The Terra ecosystem is represented by 15 stablecoins, such as TerraUSD (UST), TerraKRW (KRT), TerraMNT (MNT), etc. Users can create new stablecoins linked to any fiat currency.

TerraUSD (UST)

In 2020, Terra became a partner of the crypto exchange Bittrex Global, after which the TerraUSD (UST) stablecoin appeared. This new coin was labeled as an interblockchain stablecoin by the developers.

They wanted to make UST available so that anyone could access it on major blockchain platforms, including Ethereum, Solana, Polkadot, Algorand, and Binance Smart Chain (BSC).

Today, the UST stablecoin can be found on the Uniswap (V2), 1inch Exchange, Sushiswap, and Terraswap platforms. Through the Terra Bridge, transfers can be made between the Terra, Ethereum, or Binance Smart Chain blockchains.

UST is different from other stablecoins because it is easily scalable and more decentralized, and users also can transfer it between blockchains (due to Terra compatibility).

This feature prevents other problems that could have arisen due to the lack of scalability. For example, the problem that arose on the Maker platform: due to the sudden collapse in demand for the DAI stablecoin, its value exceeded the dollar exchange rate by more than 10%. It is clear that after that, users began to withdraw their money from the Maker platform en masse. As a result, it was even removed from the list of the DeFi Pulse monitoring service.

Terra blockchain-based protocols

The first one is Anchor, which can be safely called a credit and savings platform. Its mechanism provides four functions:

- depositors

- liquidators

- liquidity providers

- borrowers

Anyone with an internet connection can deposit, borrow, or lend funds to anyone.

Both fiat currencies and UST stablecoins can be used, which reduces inflationary pressures.

The annual return can be 20%. One can also be rewarded for supporting PoS blockchains.

The VAsset bond asset is the main instrument of this protocol. Thanks to it, the user confirms their right to own tokens that are in staking.

By the way, Anchor had the highest yield on crypto platforms in the autumn of 2021.

Terra's next blockchain protocol is Mirror. This is a protocol for assets that have been issued based on other instruments, such as futures or stocks.

The user here has the opportunity to invent tokens that can track the price of any asset, such as shares of giants like Amazon or Meta Platforms. The collateral will be the UST stablecoin.

You can make money here by investing in stocks, trading tokens, or adding them to liquidity pools.

It is also possible to combine protocols, which will enable users to earn income without losses. When the market trend is bullish, it is more profitable for an investor to use Mirror to buy tokenized securities. If the market is bearish, the Anchor functionality will be more suitable, as it will be more efficient in this case.

The Pylon protocol has both payment and savings instruments, as well as products from the DeFi sphere related to stablecoins.

One more Terra blockchain-based protocol is the decentralized ecosystem Valkyrie, which already has a new rewards system designed for marketing campaigns. All data about referrals (that is, members of an affiliate program who signed up on the recommendation of another member) is stored on the blockchain. This system allows users who invest in the ecosystem to earn a direct profit.

StarTerra is also a Terra-based protocol. It is a gamified platform with NFT and asset-stacking capabilities. You can also compete in games on this platform.

In addition to the described protocols, there are other equally important developments. For example, the Terra Bridge, whose bridge allows the transfer of assets from one blockchain to another (Ethereum, BCS, Harmony).

Or, for example, Chai, a famous Korean wallet designed for mobile payments. Its feature is that it supports KRT tokens and also offers users good discounts for transactions in coins.

Or, for example, the MemePay wallet, which is popular in Mongolia and supports MNT tokens.

What happened to LUNA

LUNA is the native token of the Terra project and is used to keep prices stable.

This token was considered highly capitalized and it was among the top ten cryptocurrencies. However, its growth stopped near $120 per coin, followed by a price collapse of almost 100%.

The fall of the UST algorithmic stablecoin and the LUNA token came as a shock to the entire crypto industry. In just a couple of days, the savings of a huge number of users were devalued, and the multimillion-dollar assets of large companies collapsed in value.

Shortly before the failure, the Terra ecosystem was second only to Ethereum regarding TVL (which includes MakerDAO, Uniswap, Compound, and other long-lived decentralized platforms). The Anchor platform was ranked third in the DeFi Llama rankings.

This collapse occurred due to the connection of the Terra ecosystem to its algorithmic stablecoin, TerraUSD (UST). After that, UST suddenly lost its peg to the dollar, and its related cryptocurrency, LUNA, was virtually devalued.

In fact, even at the peak of the success of LUNA and UST, some pessimists did not believe in the inviolability of the Terra system. Thus, towards the end of 2021, a certain Freddie Raynolds (Twitter user) decided to speak out about this project, thus warning the crypto community. He spoke about the vulnerability of Terra and coordinated attacks using impressive capital.

In the spring of 2021, that is, before the collapse of the Terra system, the interest rate on deposits in Anchor suddenly dropped below 18%. This decision was made to smooth out the growing controversy and, of course, to solve some problems, such as lowering the project's reserves.

However, users responded by withdrawing their assets from the protocol en masse. Thus, on May 7, Anchor had 14 billion UST in deposits, and just a day later, there was 11.77 billion UST. That is, in just 20 hours, the volume of deposits decreased by a significant 16%.

Against this background, the stablecoin lost its peg to the US dollar for some time. On May 8, UST cost approximately $0.98.

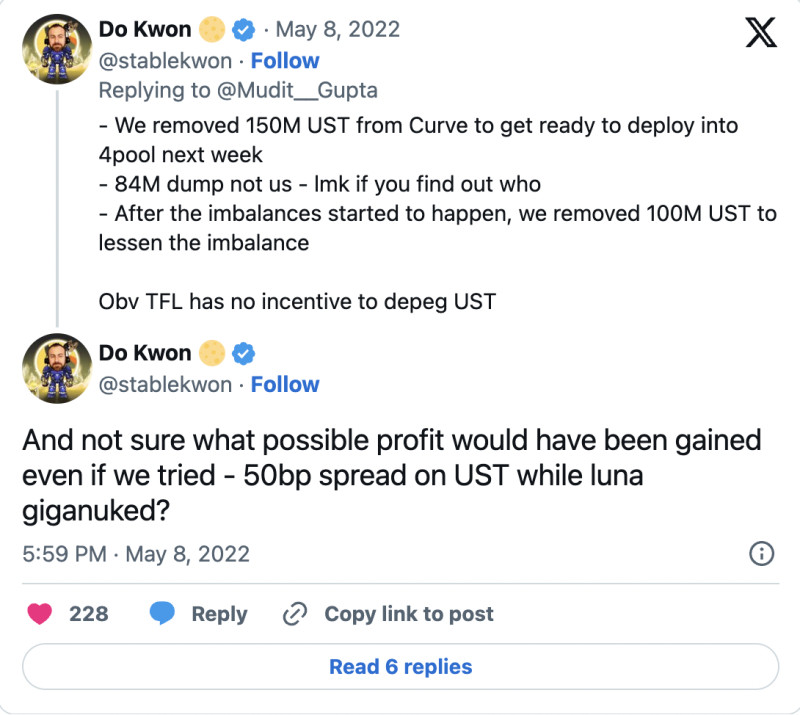

Mudit Gupta, the head of the Polygon project security department, said that the incident with UST was associated with some suspicious transactions. He assumed that on May 7, Terraform Labs removed 150 million USTs from the Curve decentralized exchange, after which some unknown address transferred more than 84 million USTs to the Ethereum network. However, only a couple of minutes passed, and those ETHs were dumped. According to Gupta, this is what triggered the sell-off.

Almost immediately afterward, the company withdrew an additional 100 million UST from the Curve exchange.

When the UST exchange rate started falling, some unknown users started selling ETH and buying UST. The coin started trading below the peg level, allowing the unknown user to make a profit.

Terraform CEO Do Kwon decided to explain himself to the community. He stated that his company withdrew 150 million UST from the Curve exchange for the sole purpose of preparing for the launch of the 4pool pool. The executives later decided to withdraw an additional 100 million UST to ease the imbalance.

At the same time, Do Kwon said that his company had nothing to do with the transfer of 84 million UST to the Ethereum network. He assured the public that the company had no intention of decoupling its stablecoin from the US dollar.

To somehow remedy the situation and support the UST exchange rate, Luna Foundation Guard (LFG) offered to lend funds to OTC firms, in particular, $750 million in bitcoins and another $750 million in stablecoins.

The Luna Foundation was expecting traders to become active, thus maintaining the parity of the Luna Foundation reserve pool, which is denominated in BTC.

The organization later released its updated Bitcoin address. It announced that it would continue to lend to market makers (i.e., those who help keep the prices of financial instruments at a certain level).

At the same time, the market continued to crumble. On May 5, bitcoin began to fall. Five days later, it was already testing support at $30,000. Notably, most altcoins began to decline even faster.

Amid the general panic and collapse of the crypto market, UST lost its peg to the dollar again. On the night of May 10, its value collapsed below $0.62, and on May 11, it slid below $0.23. The cryptocurrency LUNA, which was used to issue this stablecoin, collapsed by more than 80%.

Do Kwon tried to salvage the situation and even presented a plan to restore the price of UST, in which the supply of UST holders had to be absorbed first. According to the plan, the pace of LUNA issuance had to be accelerated. One unit of UST should be available to exchange for $1 in LUNA at any time. Kwon expected that this would enable the system to absorb UST faster.

However, LUNA fell below $1, and UST consolidated near the $0.5 level. Following them, the exchange rate of Anchor's flagship project token (ANC) collapsed as well.

The major South Korean crypto exchanges could not get past the collapse of LUNA. Thus, Coinone stopped trading this asset. The exchanges Korbit and Bithumb published warnings on their platforms for traders not to rush to buy the asset.

On May 12, the price of LUNA was already at $0.05. Terraform Labs presented several measures to restore its ecosystem. One of them was to increase the base pool of LUNA and increase the issue of cryptocurrency. It was supposed to remove the necessary number of USTs from circulation as soon as possible.

However, such measures were criticized online. Many feared that increasing the issuance of cryptocurrency would only accelerate the death of the system and lead to a complete devaluation of LUNA.

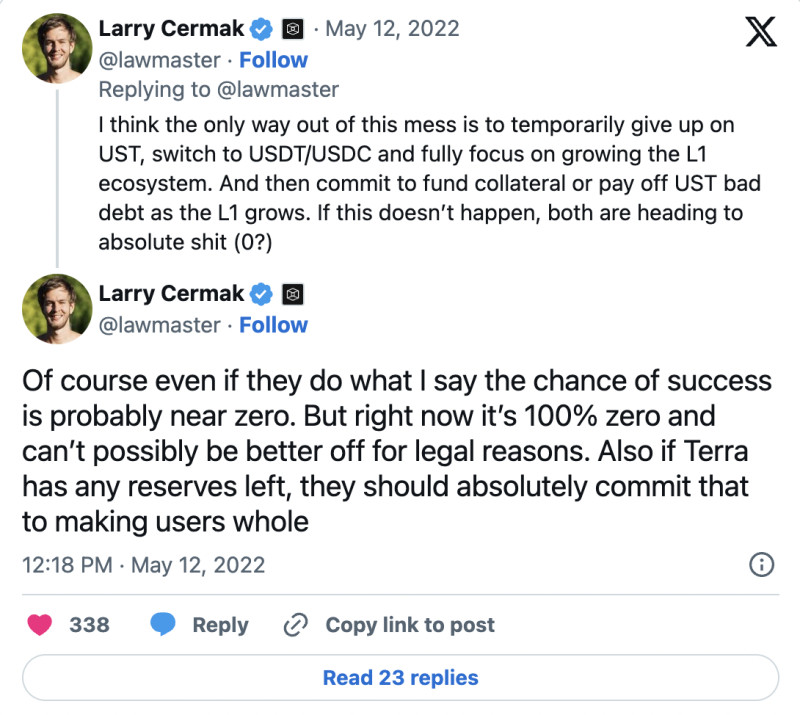

TheBlock analyst Larry Cermak suggested that the only right decision for Terraform Labs executives would be to abandon UST. He advised the company's executives to focus solely on developing their core network and paying off their stackablecoin debt.

Terra developers have suspended their blockchains several times in light of these events. After the first suspension, LUNA quotes were slightly above the $0.01 mark. On May 13, the value of the asset had already reached $0.00006, after which the Binance exchange removed almost all trading pairs with LUNA and UST from the spot market. However, later, trading of these assets was resumed.

Terraform Labs, in an attempt to improve the situation, expanded the LUNA supply to a gigantic 6.5 trillion coins. As expected, this led to the depreciation of the asset.

The co-founder and CEO of blockchain platform Terraform Labs, Do Kwon, is still wanted by Interpol. He is accused of having misled investors about the stability of UST and failed to warn that a decline in the value of the stablecoin below the acceptable level (its dollar peg) would bring down the entire Terra system.

The executives are also accused of not having a reserve of assets on the platform to keep UST and Luna at a psychologically important level.

After Terra collapsed

After the collapse of Terra, the company decided to launch a different network to somehow improve the hopeless situation.

Thus, the original Terra blockchain became Terra Classic, and its own token was renamed Terra Luna Classic (or LUNC). The LUNA community did a fork and created a new asset called LUNA 2.0. Thus, the original LUNA asset became LUNC (Luna Classic), borrowing much of the value of the original network.

Today, the Lunc cryptocurrency is worth hundreds of times less than a cent, trading near $0.00009.

The collapse of the Luna ecosystem, the events that contributed to it, and the aftermath of it all proved once again that the cryptocurrency market is not immune to sudden global drops.

This is how this system works. A resounding defeat of any major project could bring down the entire sector.

The market collapse amid the death of one project could be explained by several factors.

First of all, a huge number of users almost immediately decide to leave the market. It is no wonder that, as trust in technology is lost, people panic and rush to take their money.

The second reason is that any large asset is always represented on DeFi platforms and in the form of price-equivalent tokens separate from its network.

A sudden drop in the exchange rate of a key asset could cause a collapse of other networks as well, thus raising doubts about the correctness of the formulas of many projects, even those that seem indestructible at first glance.

It is also important that many projects interact with each other, for example, by investing in each other or owning huge shares of all existing coins on the market. Sales of large stocks of digital assets cannot pass by on-chain analysts. Thus, any negative event in the crypto world after it appears in news feeds could push the weakened asset even lower.

Interestingly, stablecoin UST was considered a respected asset before Terra’s collapse. UST was a decentralized stablecoin that did not depend on having real dollars in reserves at all.

Many major analytical resources equated UST with DAI, calling it an alternative to the centralized stablecoins USDT and USDC. It was almost impossible to find a resource or channel that would broadcast UST and LUNA in a negative light.

Notably, many projects that used algorithmic price pegging were always recognized by the crypto community as doomed to detach the price from fiat currency and, subsequently, to defeat. However, UST was treated more favorably, and for some reason, this project was rarely questioned.

What Lunc users may see in future

The exchange rate of new and old Luna tokens has not yet been established. Some crypto exchanges have not yet decided to unfreeze all these tokens. It is unclear what awaits cryptocurrency holders on other networks.

The prospects of both LUNC and its projects are unclear. It is unclear whether the company will be able to support two tokens or whether there will be only one, and how it will eventually make this choice.

The fate of the UST classic is also interesting. Today, it is not perceived as a stablecoin but as a real speculative asset with high volatility. What are the options for using this asset in the future? Now, for example, it is sometimes used to pay network commissions.

The collapse of the Terra project is perhaps the most high-profile event in the crypto industry. Indeed, no DeFi project has ever grown to such magnitude before its complete collapse.

The future of the very concept of algorithmic stablecoins is also difficult to predict. There is no trust in such projects and assets among cryptocommunity participants. In addition, new algorithmic stablecoins are losing their peg. There are still a lot of questions with no answers.

Back to articles

Back to articles