Some digital currencies are pegged to specific blockchains and perform several utility functions on them. For example, they are used to pay fees for transactions in these networks or to reward miners or validators.

However, among blockchain technology networks, other types of platforms act as exchanges for trading and executing other token transactions. One of these platforms is the Hashflow exchange and its token – the HFT cryptocurrency. We will explain what it is and how it is used in this article.

To learn more about different blockchains and their capabilities, the characteristics of various digital currencies, as well as how they rank in various lists, you can read the article "Cryptocurrency rankings."

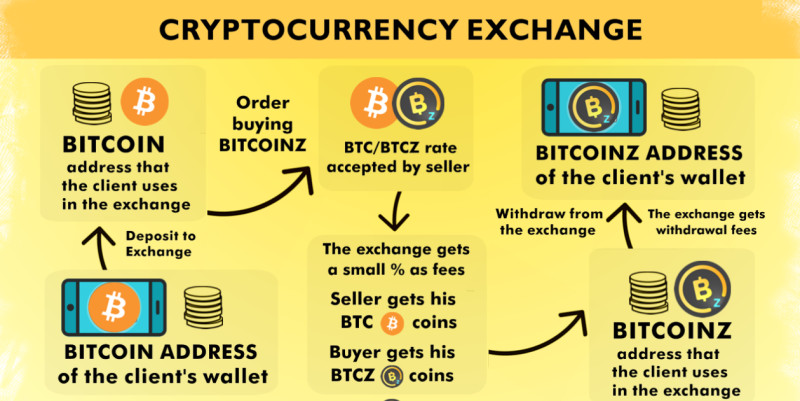

Cryptocurrency Exchange

Any exchange is a specialized platform for trading various assets. For example, stocks of different companies are traded on the stock exchange, commodities are traded on the commodity exchange, currency exchange involves the exchange of currencies, and so on.

Following this logic, it is easy to understand that cryptocurrency exchanges facilitate the trading of digital currencies. On such platforms, you can buy and exchange both cryptocurrencies among themselves and digital coins for fiat money.

Cryptocurrency exchanges perform the following activities:

- Making speculative trades with coins to profit from short-term fluctuations in their value;

- Exchanging one digital currency for another or for fiat money.

The use of cryptocurrencies for trading is due to their high volatility, i.e., sharp fluctuations in value over short periods. For comparison, the price of stocks can fluctuate within 30% over a year, while the price of cryptocurrencies can change by thousands of percent within a few months.

Thanks to this, trading on cryptocurrency exchanges can start with minimal initial investments, and you can profit several times more than the deposit amount. However, there is another side to the coin: a higher level of risk, as cryptocurrency prices can behave unpredictably.

Cryptocurrency exchanges differ from Forex because in the latter case, quotes are determined by the platform itself, so it is not real asset value or real exchange. On cryptocurrency exchanges, the real exchange of digital coins owned by users takes place.

However, trading on these exchanges is very similar otherwise: you need to try to predict the direction in which the price of a particular asset will move to profit from it. Various tools are used for this, such as charting and using them for technical analysis, and so on.

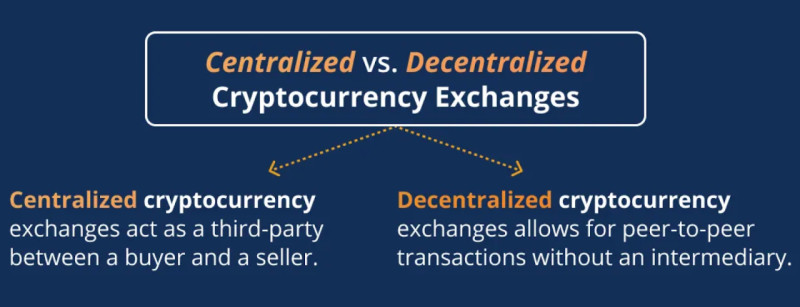

Types of Cryptocurrency Exchanges

So, we have already established that you can trade crypto on specialized platforms. Let's get to know them better in this section. All cryptocurrency exchanges are divided into two major categories:

- Centralized;

- Decentralized.

It would seem impossible, given that one of the key characteristics of digital currencies is decentralization. They are not subject to or regulated by any governmental bodies; nevertheless, trading with these instruments can be carried out on different platforms.

Centralized exchanges (CEX) refer to platforms where trading with fiat money was initially conducted, and later the possibility of trading digital currencies was added. On such exchanges, you can exchange crypto for dollars, euros, or any other currencies.

Before starting to use such platforms, it is necessary to undergo a mandatory registration procedure and a fairly complex verification process, i.e., identity confirmation. Each user has a key to their coin storage, similar to a bank vault.

Decentralized exchanges (DEX) differ from the previous type in that they do not have a central governing body. They operate on blockchain technology and have special nodes through which all transactions are conducted.

At the same time, a client of such a platform also needs to register and verify to carry out operations on the exchange. It is believed that decentralized exchanges can provide greater security for client funds than CEX due to more complex protection mechanisms.

In addition to exchanges, you can buy and exchange digital currencies at specialized exchange offices. Unlike exchanges, where the buyer and seller interact, and the exchange acts as an intermediary between them, the exchange itself interacts with clients.

Cryptocurrency exchanges charge a commission for their services. Mostly, their services are used to acquire crypto for fiat money, so it is necessary to choose platforms with the most favorable conditions.

Types of decentralized exchanges

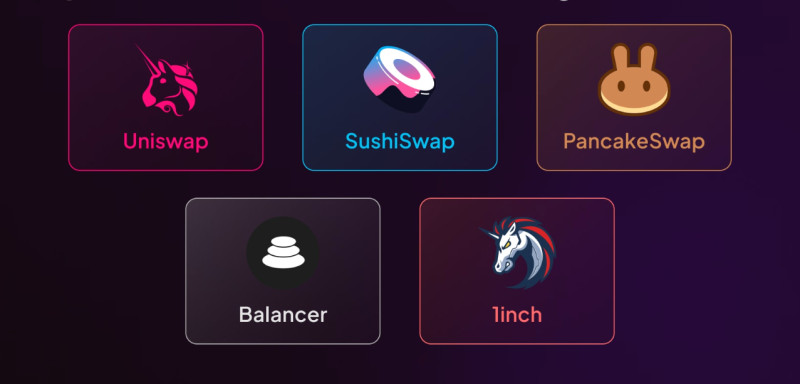

We have already covered the main characteristics of both CEX and DEX. Before discussing the Hashflow exchange and its token, the HFT cryptocurrency, what it is, and where it is used, let's look at several decentralized cryptocurrency exchanges that hold key positions in this industry.

One of the leading platforms is Uniswap. It was one of the first platforms to emerge in this market. This exchange belongs to the category of automated market makers (AMM).

Trading on this platform is carried out according to the AMM protocol and the use of liquidity pools. The exchange supports a large number of tokens, but is only based on the Ethereum blockchain.

Another well-known exchange is Curve, primarily designed for users trading stablecoins. This platform allows trading similar-priced tokens while paying a small fee.

The platform operates on the AMM protocol, similar to the previous exchange. Trades are executed via smart contracts, although the commission size may vary depending on transaction volume and rate differences.

PancakeSwap exchange supports trading tokens of a different standard than the previous two – BEP-20. It operates on the Binance Smart Chain blockchain. The platform has its own token, which is used for staking and participating in other activities within the platform.

The SushiSwap platform was created by Uniswap developers, but it has a significant difference. It has its own token, which has value as its holders can themselves become liquidity providers and create their own pools.

1inch is a platform that collects data from other exchanges and aggregates them into one network. Thus, on one platform, a user can see quotes from different platforms and choose the best option for making a trade. Additionally, there are tools for market analysis and risk management.

The key difference of the dYdX exchange is that it provides opportunities for margin trading, i.e., trading with leverage. Here, users can not only exchange tokens but also lend and borrow them.

Hashflow Exchange

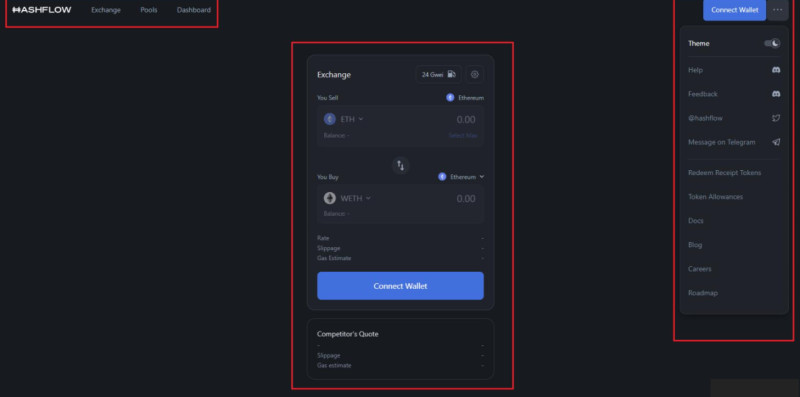

One of the prominent representatives of decentralized exchanges, which appeared just a couple of years ago but has already made a name for itself, is Hashflow and its utility token – HFT cryptocurrency. What it is and what its features are, let's consider in detail in this section.

As mentioned earlier, most decentralized exchanges apply the AMM protocol. This means that asset prices on the exchange are calculated by automated systems using a special mathematical formula.

However, this system is inefficient and has several drawbacks, one of the most significant being slippage. During user connections, delays occur, leading to slight changes in price. Moreover, slippage tends to accumulate gradually.

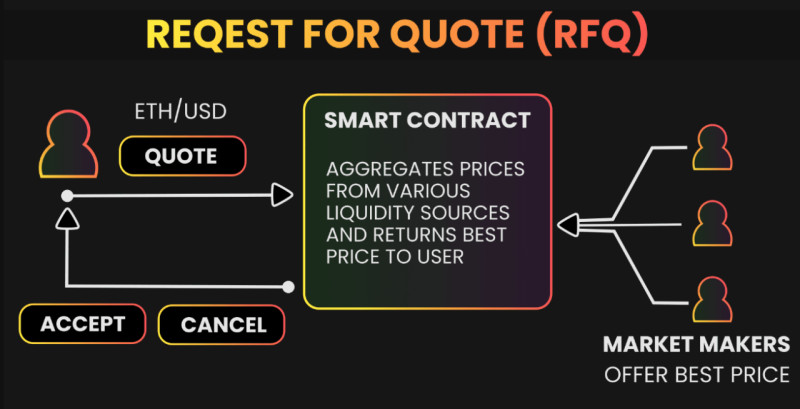

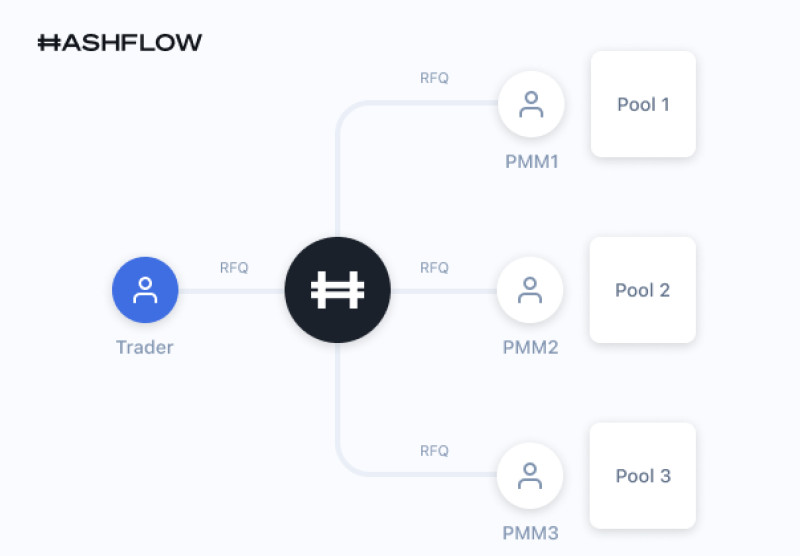

Instead, the Hashflow platform uses a different pricing mechanism: the Request for Quote (RFQ) model, where data is provided directly by market makers. Thanks to this, trading occurs with zero slippage and increased security.

An important feature of this platform is that transactions are concluded at the prices displayed. At the same time, no transaction fees are charged. Thus, Hashflow solves two user problems at once: slippage and high fees.

Additionally, this platform allows transactions not only within a single blockchain but also between multiple networks. The list of blockchains available for trading includes Ethereum, Polygon, Avalanche, and others.

Moreover, Hashflow guarantees the execution of transactions at the displayed price, as the market maker, when creating the order, signs a commitment to supply the required volume at the agreed price.

How Hashflow works

As mentioned earlier, the Hashflow project uses a special hybrid mechanism for obtaining quotes from market makers managing liquidity pools. This mechanism is called RFQ and allows obtaining quotes off-chain.

At the same time, market makers sign quotes with a cryptographic signature, which prevents them from subsequently changing them. Thus, the transaction is carried out at the agreed price without the risk of fluctuations.

In other networks, users have to pay gas fees, for which Ether currency is required. The Hashflow platform enables gas-free trading, so there is no need to pay anything extra to acquire tokens.

Market makers pay a commission for gas and provide quotes with the commission already included in the price. And since this fee is fixed, there will be no surprises for the user.

Moreover, for the end-user, it doesn't matter how market makers form and calculate the price they offer. Users can compare offers from different market makers and choose the most advantageous one for themselves.

Additionally, thanks to this mechanism of obtaining quotes, transactions on Hashflow are protected from slippage and "invisible taxes". The latter refers to MEV, or Miner-Extractable Value, which is obtained by miners arranging transactions in a block to get maximum benefit.

Hashflow Exchange allows transactions with various digital assets directly. For example, a user can request the simultaneous sale of 5 Ethereum and the purchase of a certain amount of AVAX tokens.

What is Hashverse

In addition to the decentralized trading platform, the project developers have launched the Hashverse platform. This platform combines elements of gamification and decentralized finance, attracting a wider range of users.

One of the main goals of this platform is, first and foremost, education through gaming, namely quests and competitions. Users can create their own HFT characters – their avatars. With these characters, they can participate in staking and complete various tasks.

Moreover, HFT tokens allows their holders to participate in voting on governance decisions. The more HFT a user has, the greater weight their vote carries, and they can also make their own proposals.

Achieving high positions in the ranking rewards users. Thus, in a gaming form, traders study trading strategies and tactics, as well as analytics on decentralized finance. Completing quests allows gaining the necessary experience and real financial rewards.

The quests themselves combine educational tasks and a storyline that engages players. The essence of the game is that citizens fight against the dominance of artificial intelligence, which has established its dictatorship on the planet.

Additionally, players can join forces and create teams to participate in competitions and receive rewards for victory. Thus, the platform encourages teamwork, inclusivity, and a competitive spirit. For example, in the first season of the game, a prize pool of 1 million HFT tokens was distributed.

Understanding HFT cryptocurrency

We have already discussed what the Hashflow platform represents and have mentioned the project's own currency – HFT – several times. Let's delve into what it actually is and why it's needed.

We have already mentioned that on the Hashflow network, transaction fees are not charged. Unlike most other platforms where utility tokens are primarily used to pay fees, on Hashflow, this is not required, and HFT tokens serve other functions.

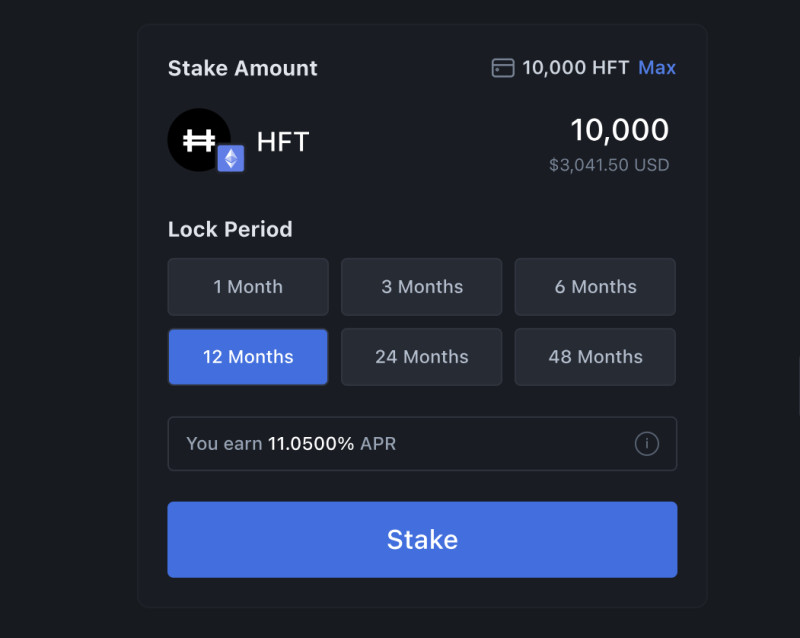

HFT is the utility token of the Hashflow cryptocurrency exchange, which performs two important functions:

- It is distributed as a reward and to maintain the health of users on the Hashverse gaming platform;

- It gives holders the right to participate in governance voting on project matters.

Thus, to participate in governance, staking of tokens is required. The more tokens are staked and the longer their lock-up period, the greater the weight of the holder's vote.

Additionally, tokens are used on the Hashverse gaming platform. Users need to monitor the health indicators of their characters in the game and adjust the number of tokens accordingly. All rewards in the game are also paid in HFT currency.

The value of one token at the time of writing the article is symbolic, just over 30 cents. The total issuance is 1 billion tokens; however, not all of them are in circulation at the current time. Furthermore, developers plan to annually add a 4% issuance after all HFT tokens are in circulation.

Uniqueness of Hashflow

So, what are the key features of the Hashflow platform that make it unique and stand out among other similar projects? Let's try to understand which characteristics specifically influence the growing popularity of DEX.

The first feature is the strong team of developers. Previously, the company's founders worked in well-known corporations such as Google, Amazon, and Microsoft. Therefore, they have significant experience in the financial sector as well as blockchain technology.

Hashflow allows users to execute trades at the prices they see on the screen without slippage. This becomes possible thanks to a unique mechanism of requesting quotes directly from market makers, after which the price is fixed by their signature and thus not subject to change.

Thanks to this, within just under two years of its existence, the network has amassed over 150,000 unique users actively engaged in trading on the platform. And the total trading volume on the platform exceeds $10 billion.

Holders of HFT tokens can use them for two purposes: participating in staking and earning passive income, as well as participating in project governance by voting and proposing initiatives themselves.

Another interesting feature is the gaming platform Hashverse launched by the development team. This platform not only allows creating characters and playing but also provides knowledge and practical experience in the field of decentralized finance.

One of the key features of Hashflow is the ability for cross-platform trading. This means that a user can simultaneously sell currency on one blockchain and buy on another without intermediaries and high gas fees. This applies to any ERC-20 standard tokens.

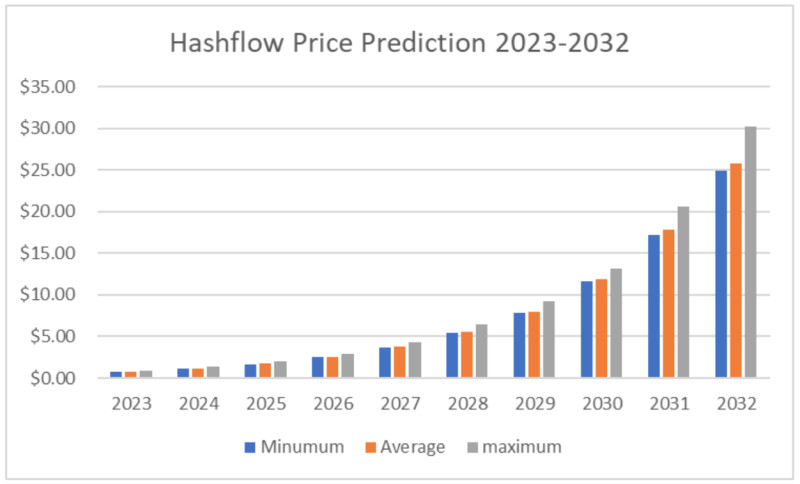

Prospects of HFT cryptocurrency

The Hashflow platform has only been around for a couple of years, yet its popularity is growing rapidly. What is this due to and how can it affect its token price – the HFT cryptocurrency? Let's try to understand this in this section.

Hashflow is not the first or only decentralized exchange. However, it has several significant advantages over other platforms and continues to evolve constantly. The main advantages include the absence of slippage and cross-chain trading without bridges.

For example, with the release of version 2.0, cross-chain trading between Ethereum and Solana became available on the platform. This update confirms the project's intention to further expand the circle of potential clients by attracting them with new trading opportunities.

In general, the cryptocurrency market is quite unpredictable, and predicting the value of digital coins is quite challenging. This is because it primarily depends on supply and demand, i.e., the popularity of a particular currency, and artificially influencing these factors is practically impossible.

However, the stable operation of the Hashflow exchange instills confidence in investors and traders regarding its utility token. As long as the exchange operates and projects created by it such as Hashverse exist, the demand for the HFT token will not diminish.

Furthermore, the project has significant potential for performance and scalability improvements, which will attract even more customers. The Hashflow platform allows for the creation of NFTs, unique tokens existing in a single copy.

And thanks to the gamified Hashverse platform, which combines educational and gaming elements, the project attracts a larger number of users. Even greater engagement and the formation of a loyal community are achieved through the ability for HFT token holders to participate in project governance.

Conclusion

In this article, we have explored the cryptocurrency exchange Hashflow, its gamified platform Hashverse, and its native token – the HFT cryptocurrency, what they are, and their key features.

Exchanges can be centralized and decentralized. The former has been around for many years in a more familiar format, where trading in securities, commodities, and much more has been conducted for decades.

Decentralized exchanges are a relatively new phenomenon. Their activities are based on blockchain technology, which allows them to operate without any central governing body.

Hashflow's blockchain stands out among other similar networks as it is a platform for exchanging and trading digital assets. Its key feature lies in the fact that this trading can take place between different platforms without intermediaries.

Also, thanks to a special mechanism for requesting quotes, which differs from other platforms, the Hashflow exchange manages to avoid slippage. This means that trades are executed at the price that the user sees on the screen.

For education and greater community engagement, the development team has created the gamified platform Hashverse. It allows users to create characters and gain knowledge and rewards through completing quests on decentralized finance topics.

Rewards on the platform are paid in the native currency – HFT. Moreover, holders of these tokens can participate in staking, thereby having the right to vote on project management issues.

Back to articles

Back to articles