Today, there are more than 10,000 different cryptocurrencies in the world. The total crypto market capitalization is already $1.7 trillion.

Cryptocurrencies are assets that are not issued or regulated by a central bank. Virtual currencies are unique in that no monetary authority can control them.

Their issuance and accounting are implemented through a decentralized system of algorithms.

The most widely used cryptocurrency is Bitcoin, which accounts for more than half of the market, or more precisely, $507 billion.

Ethereum is second in popularity. ETH has a market capitalization of $190 billion.

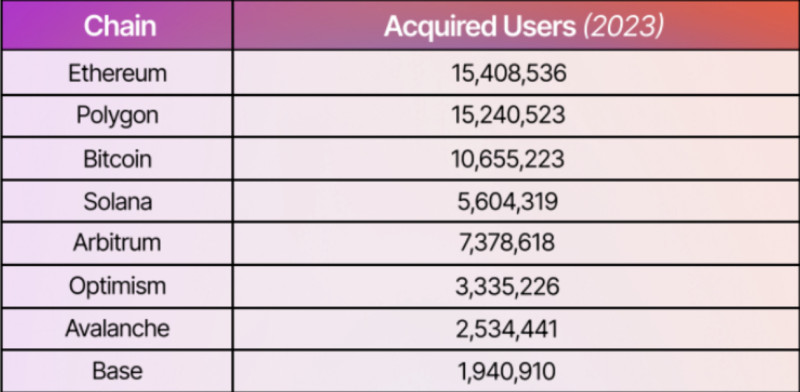

Blockchain analytics firm Flipside has recently conducted a comparative analysis of eight networks by the number of active users, ranking the most popular blockchains in 2023.

The Ethereum network with 15.4 million active addresses topped the list. The Polygon network came in second with 15.2 million users. Curiously, Bitcoin which has the highest market cap lagged far behind. BTC saw only 10.7 million acquired users in 2023.

Now let’s take a more in-depth look at what Ethereum is.

History of Ethereum

Ethereum (ETH) is one of the most popular cryptocurrencies and a decentralized blockchain platform, which is used to create smart contracts, decentralized applications (DApps), and services.

Ethereum was created in 2013 by Russian-Canadian programmer Vitalik Buterin and Gavin Wood.

In 2021, the 27-year-old Buterin, who was born in Kolomna, Russia, was crowned the youngest crypto billionaire in history. At that time, his fortune was estimated at $1.09 billion.

Buterin reached billionaire status after ETH hit a record high of $3,000. On February 1, 2024, the token was trading at $2,357.

Vitalik Buterin and his parents lived in Russia until the age of 6 when they immigrated to Canada. At the age of 17, Buterin founded Bitcoin Magazine and became its lead whiter.

As fate would have it, Buterin's passion for cryptocurrencies left him no choice. Due to lack of time, he was forced to drop out of university. However, thanks to this decision, he was awarded a fellowship worth $100,000 by the Thiel Foundation.

By the way, the fund was founded by Peter Thiel who launched PayPal, the largest electronic debit payment system. Thiel aimed to support entrepreneurial young people opting for personal innovative projects against formal education.

What is the Ethereum cryptocurrency according to Buterin? The uniqueness of the ecosystem he created initially lay in the fact that digital coins served not only as payment assets but also allowed users to exchange resources between various web applications existing in a unified peer-to-peer network.

The Ethereum project was launched in test mode in the summer of 2015. Nine months later, Ethereum released the Homestead protocol, after which the network went live at full capacity.

Interestingly, Buterin didn't come up with the name of his invention for a long time. He simply searched Wikipedia for a beautiful word that could denote a special intangible environment filling all the world's space. Buterin liked the description of an organic compound that often appeared in old physics theories - ether.

Although the project was only launched in 2015, Buterin began talking about it two years earlier. In November 2013, he first voiced the idea of creating decentralized applications and a blockchain platform that would enable their creation.

The first version of Ethereum - Frontier - was launched on March 12, 2015.

Ethereum's decentralized distributed platform launched on July 30, 2015, made it possible to develop free applications.

On September 16, 2015, an advertisement for the test version of the Ethereum wallet was launched.

In the spring of 2016, Homestead, the first stable version of Ethereum was released. After that, the developers officially recognized their product as safe.

Later in the same year, hackers stole 7.9 million coins worth $132.7 million. The incident showed that the developers had jumped to conclusions about the security of their network as users' assets were still at risk.

On January 1, 2017, the price of one Ethereum coin hit $8.05. The market capitalization reached $700 million.

In March 2017, the price of one token soared to $46, with the daily trading volumes reaching $450 million.

A year later, the cryptocurrency's value skyrocketed to $1000 after the Ethereum team announced the release of the Go Ethereum: Iceberg client.

In early 2019, Ethereum managed to surpass Ripple to become the second-largest cryptocurrency.

By the end of 2020, the Ethereum ecosystem underwent one of its biggest transformations: the transition from the energy-intensive proof-of-work (PoW) to the eco-friendly proof-of-stake (PoS) consensus mechanism.

Ethereum network technology

The Ethereum cryptocurrency is based on blockchain technology, offering a decentralized and distributed system where network nodes are formed by centralized servers instead of individual user computers.

At the heart of Ethereum lies the Ethereum Virtual Machine (EVM), a computer that interconnects the entire cryptocurrency network. In other words, the EVM synchronizes all computers participating in Ethereum, ensuring each network participant possesses a synchronized copy of its computational state.

The EVM plays a crucial role in determining the rules for computing the new valid network state on a block-by-block basis.

Changes to the network undergo rigorous verification processes to uphold system integrity, facilitated by the implementation of a proof-of-stake (PoS) consensus algorithm.

Notably, Ethereum was initially based on a proof-of-work (PoW) consensus algorithm. However, in 2022, Ethereum underwent a historic transformation, transitioning from PoW to PoS. This marked a shift from traditional coin mining to staking.

Staking involves participants depositing their cryptocurrency holdings to support the blockchain network, facilitate block creation, and validate transactions. In return for staking their coins, participants receive rewards in the form of additional cryptocurrency credited to their accounts.

The system's operations are implemented through trusted nodes known as validators, which play a critical role in maintaining the network's integrity and security.

There are three primary types of nodes within the blockchain network:

- Full nodes: these nodes store all data of the blockchain and actively participate in verifying transaction information.

- Archive nodes: these nodes ensure data integrity and offer a robust transaction history.

- Light nodes: unlike full nodes, light nodes do not store data regarding network changes. Instead, they are required to verify transactions by communicating with full nodes to obtain up-to-date information about the network's status.

Validators, while not requiring substantial computing power for mining blocks, play a crucial role in either creating new blocks or validating those generated by other validators.

As a reward for their contribution, validators are compensated for their block creation or validation activities.

The blockchain records every change made to the network within its blocks. Transactions conducted on the network are public, enabling any user to access them through specialized blockchain browsers such as Etherscan.

To engage in transactions on the Ethereum network, users must acquire a certain number of digital coins within the network. Additionally, it is necessary to pay a commission fee, commonly referred to as "gas," for any action performed on the network.

Gas is referred to as a unit of measurement for the amount of computations that are essential for executing operations within a cryptocurrency network.

For each operation to be carried out, specific computational resources are required, which is why each operation involves the payment of a fee. The price of gas is precisely that fee necessary for an operation on the Ethereum network to be completed successfully.

It's worth noting that the gas fee is charged in ETH, but the prices are most often denoted in tiny fractions of ether called gwei. To clarify, 1 gwei equals 1,000,000,000 wei (or 1/1,000,000,000 ETH).

The price of gas is not constant. It varies depending on the network's congestion. The higher the congestion, the more expensive the operation will eventually cost.

Developers can upload programs to the network, which are also called smart contracts. Any developer has the opportunity to create a smart contract on the network. Moreover, any user can execute code containing smart contracts.

Smart contracts are necessary to enable developers to create complex user applications freely. These can include marketplaces, financial instruments, various games, and more.

What is Ethereum? What makes it unique? The blockchain is unique in that it enables the creation of:

- Smart contracts

- Complex programs

- Decentralized applications (DApps)

- Decentralized financial services (DeFi)

- Non-fungible tokens (NFT)

- Decentralized exchanges (DEX)

- Tokens (other cryptocurrencies)

- Metaverses

Decentralized applications (or DApps) are applications that can be based on the integration of several smart contracts. They can serve any purpose, but what sets them apart from other applications is that they are decentralized. That is, they ensure user privacy.

Decentralized financial services (DeFi) are comprised of an array of specialized applications and services functioning on the blockchain. This means they are designed around the distinct principles of a seamless, ongoing chain of blocks that each hold specific data.

In simple terms, DeFi makes finance as accessible as possible, allowing users to carry out transactions and any financial operations directly with each other, without any intermediaries such as banks or brokerage firms being involved in their interaction. The software of the decentralized ecosystem enables communication between buyers, sellers, lenders, and even borrowers.

A non-fungible token (NFT) signifies a user's ownership rights to some virtual objects on the network. The object can be images as well as copyright assets in the form of music or any other file. For example, the first tweet or cut scenes from the film "Pulp Fiction", or even memes – all are available in NFT format and are worth a lot of money.

The very first SMS message was sold for $150,000. The first message on Twitter by the founder of this social network, Jack Dorsey, went for almost $3 million. Elon Musk put one of his tweets up for sale as a non-fungible token with a bid of $1 million.

Decentralized exchanges (DEX) are platforms where cryptocurrency trading and circulation occur. However, unlike traditional exchanges, DEXs allow clients to exchange assets without the involvement of any regulatory bodies.

A token represents a store of an asset or value in a blockchain. Tokens can embody a diverse range of assets, from virtual currencies to equities, bonds, and other forms of securities, extending to artworks and real estate holdings. At its core, a token is any asset form. Regarding Ethereum, it fundamentally represents a form of token.

Tokens are built on top of an existing blockchain such as Ethereum. They are used for various purposes, including fundraising through ICOs, accessing platforms, or representing some asset. Tokens are traded, bought, and sold just like any coin.

Following the launch of a new blockchain project, tokens associated with the project are typically released and subsequently traded by investors. These tokens serve as the key to engaging with the platform developed by the project's team, with their valuation directly correlating to the project's performance and acceptance in the marketplace. A prime illustration of this is Ethereum tokens, which were introduced within the Ethereum network.

Furthermore, the Ethereum network could potentially create a metaverse — a virtual reality based on blockchain technology. This could include video games, various virtual events, and more.

The primary distinction between Ethereum and Bitcoin is rooted in their operational capabilities. Unlike BTC, Ethereum uses the Proof of Stake algorithm and does not support mining on conventional computing hardware. However, Ethereum enables the development of decentralized applications, setting it apart from Bitcoin's more singular focus on being a digital currency.

From its inception, Bitcoin was designed as a blockchain system for transferring value. Ethereum, on the other hand, was initially conceived as a platform for launching decentralized applications (DApps) and smart contracts.

How to buy Ethereum

Now let’s find out how to purchase Ethereum. There are 7 ways to buy it with fiat money.

- Cryptocurrency exchanges

For instance, crypto exchange Binance offers various options for purchasing cryptocurrency, including buying it from other users via P2P or using a bank card for payment.

- Exchange services

One such service is Prostocash. It's quite user-friendly and allows for a quick purchase with no need for verification. However, exchange services have one significant drawback – their exchange rates are less favorable compared to cryptocurrency exchanges.

- P2P platforms

An example would be the Bybit P2P platform. Cryptocurrency exchanges on these platforms occur directly with other users, eliminating the need to deposit fiat currency into the exchange.

- Crypto wallets

One of the most popular wallets is Trust Wallet. Many wallets offer the option to pay with a bank card, but it is important to note that not all countries provide this opportunity to their residents. Or, this method might be available in some countries but at an unfavorable rate.

- Telegram bots

These are special bots that operate within the Telegram messaging app, often supported by exchange services. For example, you can use @Baksman_wallet_bot.

- Payment systems

Users often turn to the Payeer payment system. It is quite convenient for quick currency exchanges within a single account.

- Cryptocurrency ATMs

Their main disadvantage is that they are located exclusively in large population centers. However, these devices allow for the purchase of cryptocurrency with cash.

Cryptocurrency can also be acquired through mining, but after Ethereum's transition from the proof-of-work mechanism to the proof-of-stake one, completed with the activation of The Merge in the fall of 2022, this process became impossible. Mining has been replaced by staking.

Staking is a form of passive income where market participants hold their digital coins on a PoS algorithm and support the blockchain's functionality. This, in turn, entitles them to a certain income in the form of rewards.

To be an Ethereum validator, it is necessary to install special software on your computer and lock 32 ETH coins in your crypto wallet. Validators receive a reward of 2 ETH for each block added to the blockchain.

The most popular software for running a light node is Go Ethereum (Geth).

To get a full node up and running, it is essential not only to install the client software but also to have specific computing resources, namely a multi-core processor with at least 8 GB of RAM and a storage device of at least 500 GB.

If a user cannot for any reason independently stake 32 ETH coins and configure the node, they can become a participant in one of the staking pools, meaning joining a group of other participants.

In this scenario, the virtual currency is received by a validator who then shares their earnings with other investors.

Staking pools can be found on specialized platforms or cryptocurrency exchanges. There are crypto wallets that allow users to participate in staking directly, without the need for intermediaries like third-party services. Such wallets are referred to as hot crypto wallets.

Not long ago, the developer of the MetaMask crypto wallet announced the launch of a new service for staking on Ethereum. This new service aims to streamline the startup of validator nodes. Therefore, clients will be able to delegate the validator's duties without the need to purchase equipment or join a pool. The importance of this service lies in the fact that users will maintain control over their own account and the funds in it.

This service will be accessible through the MetaMask Portfolio platform. To start working with it, one needs to deposit either 32 ETH (approximately $76,000) or another equivalent amount.

With this new update in Ethereum staking, users can expect an annual profit of 4%, taking into account a 10% commission fee withheld by MetaMask.

Rotkiapp creator Lefteris Karapetsas was outraged by the 10% commission fee. He pointed out that with such a high commission, MetaMask's offer appears unattractive.

Cryptocurrency wallet for storing Ethereum

A cryptocurrency wallet is a special program that allows users to manage, store, and execute various actions with their digital coins. Upon registering a cryptocurrency wallet, a user acquires both a public (open) and a private (closed) cryptographic key, which serves as access to the program.

Access to the cryptocurrency is regulated through a blockchain platform.

Cryptocurrency wallets come in two types:

- Hot (online storage)

- Cold (offline storage)

Hardware cold wallets are recognized as the most secure for storing virtual coins. However, they have one drawback – they are slower in transaction processing and are not the most user-friendly for beginners.

On the official Ethereum website, there is a link to a special service that helps users find wallets that suit their needs, using a range of filters.

The most popular cryptocurrency wallets for storing Ethereum are hot wallets like Metamask (which is browser-based), Trust Wallet (which is software-based), and Myetherwallet (also browser-based).

Unique features of Ethereum

What is Ethereum? What makes it unique? And why is it so popular among users? Its uniqueness lies in the fact that its network offers users a more flexible and larger infrastructure than Bitcoin.

Ethereum enables the creation of various applications and innovative services such as DeFi or crypto lending. This feature makes the Ethereum network the most popular among both developers and investors.

Ethereum as a platform for decentralized applications (DApps) is extremely popular because it is relatively easy to work with blockchain technology. For instance, almost anyone with at least basic knowledge of the Solidity programming language can deploy a smart contract using client software.

Another feature of this second-largest cryptocurrency by market capitalization is the inability to shut down smart contracts, which means the network guarantees the autonomy and security of applications.

In addition to the above features, Ethereum has no emission limit. However, this does not mean that Ether is issued without any restrictions. The network system includes a specific algorithm that limits the number of coins in circulation.

In August 2021, the Ethereum network implemented the EIP-1559 update, which modified the structure of gas fee distribution. After the update, a portion of the collected coins is burned.

Risks and challenges for Ethereum

The Ethereum network faces numerous risks and challenges, with the main ones being:

- maintaining scalability and performance

- ensuring smart contract security

- regulatory control and various legal aspects

- the threat of centralization (regulation)

- stiff competition from similar blockchain platforms

Let's delve into the scalability and performance of the network. Ethereum's blockchain is designed as a tool for launching decentralized applications. The more applications there are, the more the main blockchain becomes overloaded.

A prime example of this occurred in 2017 when the CryptoKitties game overloaded the Ethereum blockchain to the point that transaction fees skyrocketed.

Ethereum developers must enhance the cryptocurrency's blockchain to maintain high transaction speeds at the lowest possible cost, while also preserving a high level of decentralization.

Undoubtedly, Ethereum has serious competitors like Tron, Solana, Cardano, and TON, which are all vying for a significant share of the similar platform market. Despite this, the Ethereum platform remains the most popular platform for decentralized applications.

Regarding regulation and legal aspects, some validators comply with the US Treasury Department's Office of Foreign Assets Control (OFAC) requirements to block transactions that violate US sanctions. For this reason, the Ethereum network is heavily criticized for censoring transactions within its network.

Moreover, Ethereum faces risks associated with the centralization of stakers. Many users participate in staking through pools, which has led to a situation where either large Ethereum holders or the pools themselves have become major stakers.

What future awaits Ethereum?

Ethereum kicked off 2024 on a positive note. Over just the first 12 days, it crossed the $2,500 mark and even managed to surpass $2,600. The rise was primarily marked in the second week of the year, following a relatively quiet first week.

The crypto market is currently in anticipation of the launch of Ethereum-based exchange-traded funds (ETFs) sparked by the approval of spot Bitcoin ETFs. Many analysts believe that a similar step regarding Ethereum is imminent.

Will Clemente, a co-founder of Reflexivity Research, predicts that Ethereum ETFs will be approved in May 2024.

Interestingly, ChatGPT also forecasted that the approval of spot Bitcoin ETFs would positively affect Ethereum's price.

However, the neural network has yet to predict the exact price range. Most likely, the price of Ethereum could be between $5,000 and $7,000. According to ChatGPT's predictions, Ethereum's price could increase 2 to 2.5 times from its current level. In a bull case scenario, the cryptocurrency could rise to the area of $8,000 to $10,000.

On January 9, analyst Michael van de Poppe also predicted a bullish run for the second-largest cryptocurrency by market capitalization. He noted an imminent “liquidity candle” that could see ETH/BTC retest lows before gaining strong upside momentum.

From a technical point of view, the coin is currently in a bullish trend, with no pullback candles on the weekly chart. The 50-week moving average (in orange) and the 200-week moving average (in blue) have recently formed a golden cross (one crossed the other from below upwards), which is a bullish signal. There is a high probability that the price will climb to the resistance level of $3,600, while last year's high of $2,447 will act as support.

Overall, Ethereum has great upside potential as demand for it and its blockchain (widely used for launching decentralized applications) remains quite high today. This situation leads to an increase in gas fees, which in turn is expected to contribute to the higher price of ETH.

The Merge event, namely Ethereum's transition from the proof-of-work mechanism to the proof-of-stake one, significantly influenced the platform's overall growth. This resulted in the implementation of scaling solutions and a reduction in energy consumption, which also positively affects the value of ETH in the long term.

In the spring of 2024, the next Bitcoin halving will occur. This historically significant event can impact not only Bitcoin's price but also the prices of many cryptocurrencies, including Ethereum.

There is a possibility that Bitcoin could reach a new all-time high. According to analysts, the top cryptocurrency by market capitalization could soar to $100,000 after this event. Ethereum is also projected to set a new price record by climbing to $7,300.

However, judging by the cryptocurrency price dynamics over the past years when halvings have occurred, it suggests that this price level is unlikely to be reached before 2025.

Thus, the most important events in the crypto world in 2024 will be the Bitcoin halving (mid-April) and the anticipated launch of ETFs for Ethereum (presumably in May). If Ethereum dips (similar to the scenario with Bitcoin funds), the $2,200 level could be seen as a good point to enter the market with long positions.

Back to articles

Back to articles