The dYdX cryptocurrency is a native token of the leading decentralized financial platform DYdX, which is used for a variety of purposes, such as participating in voting, as a staking reward, or as a payment for services.

Dydx is a decentralized derivatives exchange where clients can trade contracts without providing personal details.

As far as derivatives trading is concerned, DEX exchanges have always been known for drawbacks such as lack of liquidity, high commissions, slippages, and rather slow speed

The Dydx project tried to solve this problem by offering its l2 protocol on the Ethereum network. This allowed the company to reduce commissions and significantly increase the speed of transactions.

The project is also known for having a decentralized lending system, which means that network participants can block trade assets (a list of cryptocurrencies) at a certain percentage. However, over time, the platform closed this function and left only perpetual futures.

Creation and development of Dydx project

Dydx is a relatively young startup that originated in San Francisco. The idea behind Dydx was to allow traders who are outside of the United States to be able to buy and sell cryptocurrencies. Let us first focus on the creation and development of the Dydx project.

Dydx turned out to be one of the most successful startups. According to CoinGecko data, on September 27 and 28, 2021, the Dydx platform recorded transactions worth $18.6 billion. At the largest US crypto exchange, Coinbase, this figure at that time was only $5.9 billion. Thanks to this fact, the revenue of Dydx for that year soared to $75 million.

Antonio Juliano is the founder and author of the idea for the company. He grew up in Pittsburgh and studied at Princeton University as a programmer. It cannot be said that during his university studies, he was actively interested in the crypto world. He immersed himself in this industry a little later, already after graduating.

Initially, Juliano dreamed of applying his knowledge exclusively to some IT startups to eventually become a successful entrepreneur in this field.

However, in 2014, Fred Wilson, a popular venture capitalist, delivered a lecture that Juliano attended. Wilson spoke fervently about Coinbase, his breakthrough ideas, and their realization.

This story inspired the future founder of Dydx. He finally realized what field he was interested in and what he wanted to do after graduation.

Wilson's lecture impressed the young enthusiast Juliano so much that after graduating from the university in 2015, he started working at Coinbase. There, he took a position as a software developer and paid attention to all the subtleties of this business. Curiously, at that time, there were not so many employees in the company, and Juliano was the hundredth member of a small company at that time.

However, he worked at Coinbase for only a year. He decided to go to the actively developing company Uber, which was then creating a mobile application for searching, calling, and paying for cabs, which is one of the most popular in the world.

Having gained some experience, Juliano decided to start creating a search engine for cryptocurrency applications. This idea, unfortunately, did not receive a proper response and, accordingly, development. Juliano is sure that his idea was a breakthrough, but it did not become successful for the reason that, at that period, it was simply ahead of its time.

However, Antonio was not deterred by this failure, and he still wanted to work in the field of cryptocurrencies and create something innovative. Juliano began to study financial markets in detail. His experience at Coinbase gave him an idea of how a large cryptocurrency exchange can originate and evolve. At some point, all this baggage of knowledge and skills led the young programmer to the idea of creating his own exchange.

Juliano's observations of other crypto exchanges and platforms led him to the conclusion that all financial markets develop according to a strict scenario: first an asset appears, and then it starts trading on spot exchanges. We are talking about those exchanges that allow their clients to directly own their assets. Coinbase and Bitcoin function according to the same principle.

In 2017, exactly at the time when cryptocurrency IPOs flooded the market, Antonio Juliano received a substantial $2 million from the Andreessen Horowitz venture fund, investment company Polychain Capital, and Coinbase co-founders Brian Armstrong and Fred Ehrsam, as well as other popular investors.

The new cryptocurrency exchange, Dydx, appeared in 2018. Its peculiarity was that users bought ether not for their own money but for borrowing. It was necessary to borrow these funds precisely through the Dydx platform. Thanks to this principle, traders received additional borrowed funds, thus increasing their potential profit. Losses in this case also increased.

By 2019, the crypto exchange Dydx daily performed transactions worth $1 million.

In 2020, Juliano's company introduced perpetual swaps, that is, derivatives, which at that time were becoming in demand thanks to the Hong Kong exchange, Bitmex.

The point is that perpetual swaps are linked to the BTC price, and the user does not have to own them at all. Perpetual swaps do not have a limited expiration date, which distinguishes them from futures.

After the launch of such an instrument, Dydx skyrocketed to the top of the exchanges, with daily transactions of $10 million and more.

According to Juliano, two major changes in the work of the platform led to a rapid increase in transaction volumes.

In April, the Dydx platform introduced StarkWare blockchain technology. This new technology made Ethereum-based transactions many times faster. Previously, clients of all decentralized exchanges based on Ethereum had to wait for the completion of their transaction for about a minute and also pay Ethereum a certain commission for the spent electricity, from $50 to $100.

With StarkWare's technology, the commission became noticeably lower, and the transaction realization became simple and fast. A user simply conducts it, and the data is updated almost instantly. This became a real innovation in the crypto world, as previously, transactions on decentralized finances were more time-consuming and cost customers significantly more.

Another significant change is that Juliano entered into a partnership with a Swiss fund. This was necessary for the company to launch the Dydx cryptocurrency token. In addition to this, Juliano applied a marketing technique under the beautiful name of "liquidity mining."

"Liquidity mining" means that users now have the opportunity to get monetary rewards for trading on this exchange. Dydx has decided to pay customers with their own currency, thus attracting new users.

These considerable changes greatly affected both the rise of Dydx itself and the entire market. Thus, the daily volume of transactions on the platform jumped from $30 million to $450 million. Surprisingly, this happened in just one month. Some time later, the volume of transactions conducted on the platform exceeded $2 billion.

In fact, the marketing technique "liquidity mining" has a significant disadvantage as it often involves fictitious trading. This means that one person can register two accounts and then simply trade with himself. In this way, the person is rewarded by the platform.

Dydx noticed that the number of transactions on its platform involving the cryptocurrency token Compound amounted to a substantial $1.7 billion. In fact, this number is 10 times higher than the volume of transactions with the same token on all other exchanges.

As a result, Dydx was forced to conduct an investigation, after which it became obvious that such a volume of transactions was a result of fictitious trading. It is clear that the platform refused to pay remuneration to these traders.

After that, the company introduced monitoring programs that detect fictitious trading using both common sense and technical analysis.

The Dydx exchange has a majority of users residing in Europe and Asia. However, in September 2021, the People's Bank of China announced that all transactions using only cryptocurrencies would be considered illegal.

Americans, by the way, also do not use this platform when trading cryptocurrencies. The fact is that the US also has strict legislation that prohibits its residents from using this exchange.

Dydx does not allow its users to store funds on the exchange. It also does not possess any license. The crypto exchange does not perform KYC checks, although they are mandatory for regulated financial institutions.

At the same time, Dydx actively uses third-party services to monitor the digital wallets of its clients and identify illegally obtained funds.

This approach to control and regulation allows the company to save money on compliance (a system of measures in which the company operates in accordance with the law and regulators) and still maintain a relatively high level of profitability.

The last time Dydx raised venture capital funding was in June 2021, when it received a significant $215 million from investors. At that time, more than $25 million worth of transactions were made on the stock exchange every day.

Dydx platform features

Let's focus on the features of the Dydx crypto exchange that distinguish it from other similar platforms.

The first feature is decentralization. The platform operates on the basis of the Ethereum blockchain, which gives it independence from centralized organizations and management.

The second feature is the transparency of all the processes. In other words, any transaction on the platform is recorded in one public database. This principle supports transparent and fair trading on the platform.

The third feature of the exchange is its flexibility. On the Dydx platform, it is possible to trade a variety of digital assets. You can also develop your financial products and, in general, realize any innovative idea.

The Dydx exchange protocol is publicly available. It determined the pace of development and improvement of the project itself. Thus, the platform is based on the Ethereum blockchain and contains Level 2 technology from the StarkWare developer. Thanks to all of this, Juliano managed to reduce transaction volumes and remove the traditional gas commission.

By partnering with the StarkWare developer, the company guarantees a non-custodial protocol, which means the democratization of trading and increased network bandwidth.

The lending function on the platform gives the user the opportunity to exchange the received token for an asset. Let's say a client buys an asset using borrowed money, makes a profit at the end of the transaction, and, of course, closes the debt. The client may sell the asset, and receive an income, thus settling the debt.

The leverage of 1:10 and 1:25 makes it possible to trade with a large volume of assets and earn money.

On the Dydx platform, you can also use perpetual contracts, and such futures have no expiration date. For your reference, the Dydx crypto exchange is the first project to allow users to trade perpetual futures. To date, the most popular trading pairs are BTC/USD, ETH/USD, AAVE/USD, and LINK/USD.

Dydx supports 4 different order types:

- market (carried out at the price of the digital asset on the market, a rise or fall in value is predicted);

- limit (an order is realized under certain conditions, there is a possibility to close it early);

- stop-limit;

- trailing stop (the position will be opened until the trader makes a profit).

Dydx customers can independently choose the types of services on the platform, namely, exchange, staking, trading, or lending.

Dydx crypto exchange, like any other, has its advantages and disadvantages. Its advantages are the following:

- Dydx allows customers to use smart contracts. Thanks to this, many processes are automated and simplified.

- The platform provides its clients' accounts with a fairly high degree of security. Fraudulent manipulations on the exchange are minimized thanks to the use of blockchain technology and smart contracts.

- The platform is transparent, i.e., all transfers of funds are recorded in the blockchain database, which guarantees full transparency of transactions and tracking of their history.

- The platform has a user-friendly interface, which is intuitive for any user. Traders with absolutely any level of experience can easily understand the functions and features of the platform.

- Dydx offers various training materials, which will come in handy for those who are just starting to work with cryptocurrencies.

- The platform can be called quite safe because it uses a variety of protection means, including mandatory registration by two-factor authentication and the use of modern encryption methods.

- The crypto exchange has low commissions for fund transfers.

The platform has some disadvantages:

- It is available in a limited number of countries.

- Dydx, like any other trading platform, involves a high risk of losing money as a result of unsuccessful trading.

dYdX cryptocurrency

Now let's move on to dYdX cryptocurrency. dYdX is a token that is used on the Dydx platform to earn rewards for mining and participating in staking pools, as well as for discounts on the crypto exchange.

Today, dYdX is traded on 79 exchanges, such as Nami.Exchange, Binance, Bitrue, ByBit, and many others.

The maximum trading volume is observed for the DYDX/USDT trading pair. It is $57.3 million, which is 82% of the total volume across all exchanges.

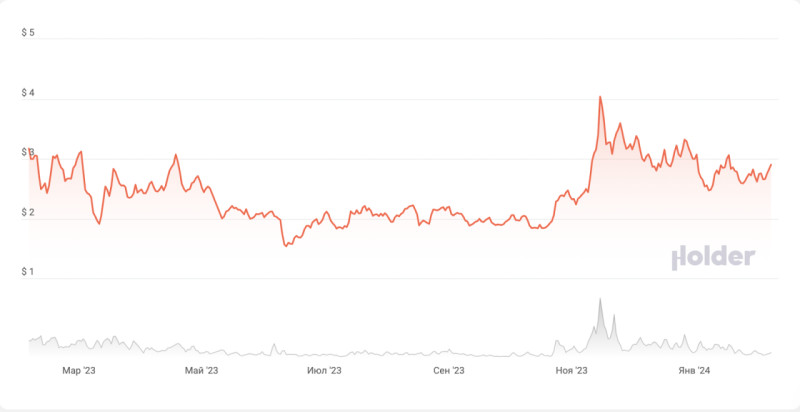

Over the last week, the minimum price for dYdX (DYDX) was recorded at $2.66 on February 4. As of February 8, one unit of dYdX is trading near $2.9.

The dYdX coin is favorable to hold, especially because users have the right to vote within the exchange's closed community.

There is a total of 1 million dYdX tokens in the cryptosphere, which will be distributed among the project participants within five years.

This is how this will happen:

- 50% of the coins will go to the dYdX community, including liquidity providers, traders, staking traders, and the most active users. Part of this share will go to the community treasury.

- 27.73% of the coins will go to investors who were very active during the initial period of the project's existence.

- 15.27% of the coins will go to members of the official dYdX team. These are the founders, advisors, and employees of the company.

- 7% of tokens are intended for those advisors and employees who will join the platform in the future.

dYdX token features

There are two types of staking pools on the Dydx platform.

The first one is the security pool. It creates a safety cushion for users who engage in Dydx staking. This pool ensures that its members continue to receive rewards in proportion to the number of tokens in the pool. However, if users decide to withdraw their coins at some point, they will need to wait 14 days, and then submit a request.

The second is the liquidity pool. It is important to ensure the network effect of liquidity and to encourage professional market makers to put money into the platform. Market makers should develop new trading pairs on the dYdX Layer 2 protocol. Stakers, on the other hand, will receive dYDX in proportion to their delivered tokens in the liquidity pool. These tokens can only be retrieved after 14 days.

Currently, the market makers of the dYdX Layer 2 protocol are Singapore-based crypto company Amber Group, Wintermute, and DAT Trading.

dYdX token holders can vote for:

- safe pool payout in case of money loss

- certain risk parameters for the Level 2 protocol

- inclusion of new coins in the Level 2 protocol

- contract management

- for market makers to become participants in the liquidity staking pools.

There are three types of rewards that the platform offers to dYdX token holders:

- Retroactive mining rewards.

This reward is shared between dYdX users who are trading on the Layer 2 protocol and those users who have been members of the platform for a long time.

The amount of the reward depends on the activity of the users and the level they belong to. However, the retroactive mining feature cannot be used by US residents because of restrictions.

- Trading rewards

Trading rewards are intended for all traders who trade on the dYdX protocol. They will be distributed to motivate participants to use the dYdX protocol and to speed up liquidity processes.

The size of the reward depends mainly on the user's trading activity and the volume of trades on the platform.

- Liquidity provider rewards

It can be received by users with active Ethereum addresses. The main thing is that they must have maintained a minimum volume of 5% in the previous epoch. Such liquidity providers will receive dYdX tokens after 28 days.

This type of reward is designed to last for five years. The main purpose of these rewards is to increase the market liquidity of the dYdX token in the long term.

- Discounted trading fees

These depend on the number of tokens in the wallet. For example, if a dYdX holder has more than 10,000 tokens, they will get a 15% discount on all fees.

DYDX coin growth potential

To date, many cryptocurrencies have shown 30–50% growth. If someone fails to make money on it, this should not be a reason for grief. On the contrary, altcoins have just started their growth.

Today, there is a huge variety of altcoins in the crypto world, among which the native token of the Dydx platform occupies a special place.

During the peak of the past bull market in 2021, the dYdX exchange rate was as high as $28. However, like most altcoins, it lost 95% of its value during the bear cycle.

Since May 2022, the dYdX coin has been in an accumulation phase and is now trading within the range of $1–$3.5. It has been doing so for over a year and a half. There is a high probability that buying cryptocurrency in this range may bring good profits in the long run.

Decentralized crypto exchange Dydx is a platform with advanced financial tools. It supports margin trading, and its trading volume today reaches $2.6 billion, which is more than 25% of the volume of all existing DEX platforms. Dydx's trading volume exceeds that of any other traditional exchange, except for Binance.

Dydx cryptocurrency is ideal as a spot purchase or as an investment for the medium to long term, with the potential for approximately 2-4 times growth.

Back to articles

Back to articles