BNB is the coin (Binance Coin) of the Binance crypto exchange, which is one of the most famous utility tokens in the world. Initially, BNB cryptocurrency was created entirely as a means of payment. In other words, investors used it to pay fees on the Binance exchange and within the Binance Smart Chain network.

Today, BNB cryptocurrency supports the operation of the whole Binance ecosystem and also offers discounts on fee payments.

BNB serves as a utility cryptocurrency, meaning it is used exclusively for internal payments. Its value directly depends on the development and functioning of the platform itself. In this sense, the existence of the coin resembles the mechanism of how securities or company stocks work: when a company is successful, the price of its shares will trade high.

At the dawn of BNB, it was a true token, meaning it was based on the ERC-20 standard, using the Ethereum blockchain. However, the Binance company later moved BNB to its own network.

BNB coins cannot be mined, and this is perhaps their main distinction from many other cryptocurrencies. BNB can be bought on the Binance cryptocurrency exchange itself.

The creation story of Binance project

Before discussing what BNB is, it makes sense to discuss the crypto exchange Binance, recall its creation story, and outline its main characteristics in broad strokes.

Binance is universally recognized as the largest cryptocurrency exchange on the planet in terms of daily trading volumes of digital currencies. Arguably, only this platform offers a wide range of trading tools that can be bought or sold without undue complexity.

On the Binance platform, you can find more than 600 crypto coins, several times more than its closest competitor, Coinbase. But how did the company achieve such success?

Let's start from the beginning, in 1977, in Jiangsu province, China, where future genius, crypto fan, and founder of Binance Changpeng Zhao was born. The boy's father taught philosophy at various higher education institutions. It turned out that the Zhao family head was a victim of the persecutions of the Cultural Revolution unleashed across the country by Mao Zedong.

The leader of China at that time dreamed of establishing communism in the country and combating Marxist revisionism. During the same period, all intellectuals in the country were labeled as pro-Western.

Unwilling to reconcile with the reality and fleeing persecution, the Zhao family moved to Vancouver, a city on the west coast of Canada.

In the new country, the immigrants from China lived very modestly. Young Changpeng worked two jobs – by day at McDonald's and by night at a gas station.

Despite all financial difficulties, Zhao's parents bought their then 12-year-old son an IBM PC XT 286 computer. It was a very costly purchase at the time, especially for a financially modest family. However, Changpeng's father was convinced that his son needed this computer to learn the basics of programming. The bread winner firmly believed that such skills would definitely help his son achieve a better life. Indeed, he was not wrong.

Changpeng Zhao interned at a software development company, later joined a Japanese trading company operating outsourced at the Tokyo Stock Exchange. There, Zhao worked on developing systems for high-frequency trading, which would allow transactions to be executed in seconds.

Initially, Changpeng was attracted to working in the major and developed city of Tokyo. Later, he realized the main essence of all this activity – huge money flowed within the industry.

In 2013, Zhao gradually became acquainted with the world of cryptocurrencies. Once, during a poker game, his best friends – founder of the cryptocurrency exchange BTC China Bobby Lee and crypto investor Ron Cao – told him about Bitcoins and blockchain.

Zhao became interested in this topic and decided to dive into the essence of digital currencies and encryption technologies. It was at that period that he decided to focus exclusively on digital assets, cryptocurrencies, and the creation of similar ecosystems.

Changpeng didn't spend long pondering a plan to conquer the crypto industry but decided to act immediately. He converted all his savings into Bitcoins, quit his job, and joined the digital wallet service blockchain.info as an employee.

After that, he changed his position from an ordinary employee to the CTO at the cryptocurrency exchange OKCoin. The team of this platform opened Zhao’s eyes to all the shortcomings of such projects. He realized that trade volumes were unjustifiably inflated, audit reports were manipulated repeatedly, and bots were constantly exploited.

In this position, Zhao became disillusioned with crypto platforms and left his job without regret. One could simply give up and stop trying to break through in such a field, but why not attempt to create something more acceptable and adequately functioning in this area with all the accumulated experience? Essentially, Changpeng was obsessed with this idea in the following years.

All existing cryptocurrency exchanges at that period were truly problematic. They could not offer users normal conditions. For instance, almost all of them had very low performance, could not provide users with a high level of security for their funds and data, and also had quite high commission fees. In short, the crypto industry was filled with dubious platforms where it was dangerous to invest one's money.

Changpeng Zhao's team tried to overcome these established patterns, which many had already resigned themselves to, and intended to offer their potential clients something fundamentally new – an innovative platform that would simplify trading, turning it into a simple, cost-effective, and more secure process. Thus, the idea of creating the Binance cryptocurrency exchange was born.

Additionally, Zhao intended to develop his own cryptocurrency, which would be used exclusively on his platform and have some additional functions.

In 2017, Zhao managed to attract investors to the project he devised. Eventually, his team successfully carried out an ICO, i.e., an initial coin offering, raising a total of $15 million.

What exactly is BNB? This coin is actually one of the outcomes of this financing, as it allowed the team to issue 100 million digital units. For the earliest investors, the cost of one coin was only $0.1.

Thanks to the sale of Binance Coin tokens, Zhao raised $15 million and, just 11 days after the ICO, announced the launch of his product.

Zhao’s project, the new Binance exchange, became so successful that just six months later, Germany's largest financial conglomerate, Deutsche Bank, defined the crypto platform he created the No. 1 exchange with a profit of $200 million.

In just 180 days, Changpeng Zhao became a true flagship of the crypto market and occupied its main niche.

In 2018, Binance temporarily suspended its operations for a short period to update the architecture of its platform and improve it. Amazingly, as soon as Binance was operational again, 240,000 new users registered with the platform in the first hour.

In January 2018, Binance was recognized as the largest cryptocurrency exchange on the planet. At the same time, a photograph of Zhao was featured on the cover of Forbes, the most authoritative and famous economic periodical in the world.

By 2020, the average daily turnover of the platform was already at $3.88 billion.

As we've mentioned, Binance Coin was initially planned as an ERC-20 token on the Ethereum platform. But by 2019, answering the question “what is BNB” no longer involved talking about the Ethereum platform as Binance developers created and launched their own blockchain (named Binance Chain), to which they transferred BNB.

This decision significantly improved the token's performance and greatly increased network security.

From that period, BNB began to rapidly increase in price. Ultimately, it turned into one of the most popular and highly sought-after digital assets in the crypto world.

At the time of preparing this material, the total market capitalization of BNB was $54,934,456,160.

By this indicator, the cryptocurrency occupies the 4th place in the ranking of the world's largest aggregator of cryptocurrency data, CoinGecko. Remember, the market capitalization of a digital asset is calculated by multiplying the price of BNB by its quantity in circulation. Currently, there are 153.86 million tokens on the market.

Features of BNB project

In this chapter, let’s delve deeper into what BNB is and the features it possesses.

Firstly, the BNB token operates exclusively on Binance Smart Chain (BSC), which is a blockchain with high throughput, quick transaction confirmations, and low fees. BSC was developed by Changpeng Zhao's team specifically for this purpose – for the fastest and most efficient trading of digital assets on their own exchange.

Secondly, BNB supports a variety of protocols, such as BEP-20, ERC-20, BEP-2, Avalanche, etc. This feature means that coins can be easily exchanged for any other cryptocurrencies and can be used on any other blockchains.

Thirdly, BNB coin holders can expect to receive discounts on fees when operating on the Binance exchange. However, the size of the discounts will directly depend on the number of coins held in the user’s account.

Another feature is the ability to vote. BNB holders have the opportunity to participate in voting on any changes on the Binance platform. In other words, users can influence the development of the platform and improve its operation.

Next, there’s the opportunity for users to participate in Binance Launchpool. Binance Launchpool is a platform where clients can profit by participating in various Binance Smart Chain projects. BNB holders can use their coins to participate in this Launchpool.

Another feature of the project is systematic coin buybacks. The Binance exchange constantly buys back BNB coins and burns them. This means that the total number of coins gradually decreases, which increases their value over time.

One of the distinguishing features of the BNB token is that it is one of the fastest-growing digital assets in the world. The sharp increase in the cryptocurrency's value occurred in 2021 during the stunning rally.

Undoubtedly, the growing value of the coins is also related to the fact that the Binance exchange itself has become increasingly popular each year. Currently, the company is facing some difficulties, but we'll talk about those later.

Furthermore, the Binance Coin cryptocurrency boasts reliability and security. As part of the Binance ecosystem, it can confidently be used for storing and using digital assets.

The fact that Binance is recognized as one of the largest and most reliable cryptocurrency exchanges in the world means millions of users globally trust it with their funds.

Clearly, Binance Coin offers many advantages to its holders, providing them with discounts on fees, the opportunity to participate in voting, the chance to earn some profit on Launchpool, and also ensuring reliability and security for investors.

Let's be frank, like any digital currency, BNB has its drawbacks too. We will discuss the pros and cons of this virtual asset in more detail below.

Pros and cons of BNB

So, the undeniable advantages include:

- Minor fees. BNB holders receive discounts on fees when using the Binance exchange.

- Opportunity to participate in platform changes and development. BNB holders can participate in voting on various issues related to the further development of the trading platform.

- Profit opportunity on Launchpool. BNB tokens can be used to earn yields on Launchpool, a platform for launching new projects by the exchange.

- Use within the Binance ecosystem. BNB tokens can be used to access services and products available to users on the exchange (for example, free tokens and NFT giveaways or creating and sending crypto boxes with cryptocurrencies).

- Reliability and security. BNB coins, like the Binance exchange itself, are a reliable and secure means of saving and using one's funds.

The obvious disadvantages:

- High risk of price fluctuations. Like any cryptocurrency, BNB is not immune to price volatility, which can lead to significant changes in the value of the coin, even in the shortest terms.

- Direct dependence on the performance of the Binance exchange. The value and future of BNB coins directly depend on the development and prospects of the exchange itself, making the cryptocurrency quite vulnerable to risks.

- High risk of regulatory issues. BNB cryptocurrency could face regulatory difficulties. In practice, it has already encountered them.

- Limited use cases. BNB holders can only use the coins within the Binance ecosystem, meaning their use is quite limited.

Why didn't BNB show good results in 2023?

The BNB token, recognized as the 4th digital asset by capitalization, failed to demonstrate noticeable growth last year, even though many other cryptocurrencies actively rose in the charts. What is BNB? Clearly, it's the only major digital asset that missed a significant part of the rally in the crypto market. Due to the rapid rise in Bitcoin's price, the total market capitalization of the crypto market in early December 2023 increased by about $180 billion (i.e., by 12%). But BNB increased in value by a modest 1.7% during that period.

The reason is that Binance faced scrutiny from regulatory bodies in several countries in 2023. Consequently, on November 21, the US government found Changpeng Zhao's team guilty of violating anti-money laundering regulations. The company was also accused of aiding in circumventing the country's imposed sanctions. The Binance management agreed to pay a massive fine of $4.3 billion to the US government, and Changpeng Zhao decided to resign.

The US regulator eventually recognized the BNB cryptocurrency and the stablecoin BUSD as securities. However, the US Securities and Exchange Commission demanded that digital assets of the company's American division be blocked. As a result, some trading companies had to reduce their trading operations on the exchange.

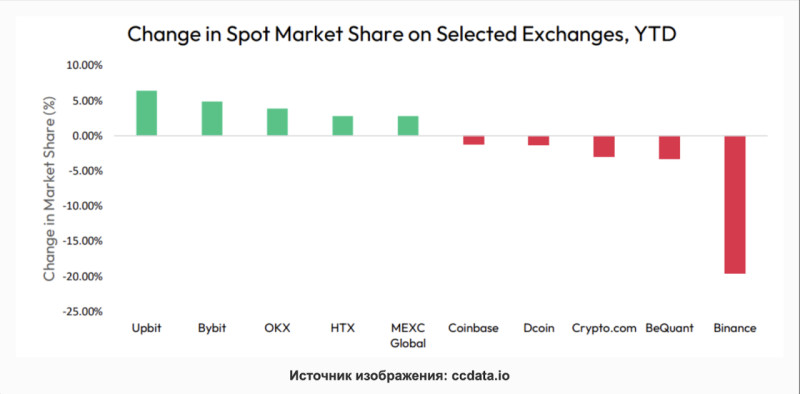

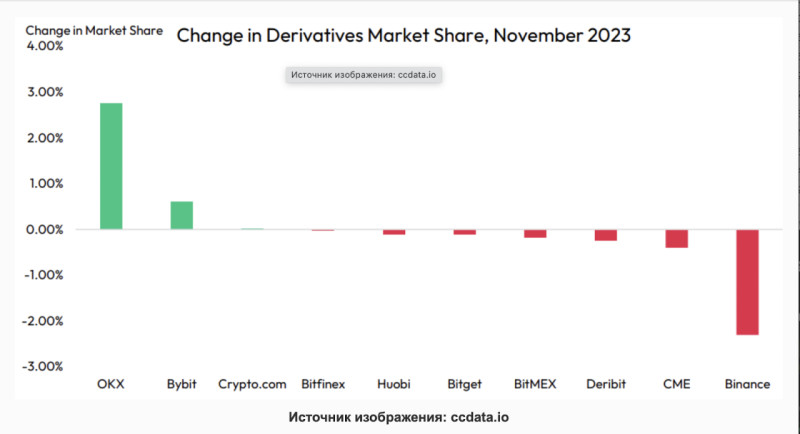

Binance is still considered the largest platform for trading cryptocurrencies and cryptocurrency derivatives. But, let's be honest, its market dominance has begun to decline. According to CCData:

- The exchange's share of spot trading fell to 32% in November (while at the beginning of 2023, this figure was at 55%).

- The exchange's share of the derivatives market shrank from 60% to 48%.

In November 2023, the Chicago Mercantile Exchange (CME) for the first time in history surpassed Binance in terms of Bitcoin futures trading volumes. Following the deal with the US government, Binance will likely lose its status as a leader in trading volumes. Competitors such as OKX, Bybit, and Coinbase could take the top spot, pushing Binance off the pedestal.

Interestingly, on the back of all these difficulties, the shares of Binance's main competitor, the Coinbase platform, went up in value. Simultaneously, the currency turnover on the Bybit exchange also significantly increased.

Exchange flows and new Binance CEO

According to statistics from the largest analytical platform for DeFi protocols, DefiLlama, in November 2023 alone, Binance clients withdrew digital assets amounting to $1.6 billion from its platform. This marked the second-largest 30-day outflow recorded last year.

However, in December 2023, the mass withdrawal from the exchange significantly dwindled, as about $400 million was transferred to Binance users' wallets.

Since the US government announced the penalty amount for the exchange, its cryptocurrency's price tumbled by 8%, even though the index of the 100 largest digital assets grew by approximately 14% at the end of last year.

So, what is BNB? It's an indirect indicator for the Binance exchange, explaining its negative dynamics.

However, looking at longer time frames, BNB, of course, outperformed its competitors. For example, since 2020, it has grown by about 700%, while the index of the top 100 cryptocurrency assets increased by 121%.

It's fair to say that Binance's reputation among clients outside the US remained relatively high during the cryptocurrency market crisis.

Binance is likely to remain the main trading platform for users outside the US for some time, but competition from Coinbase (and other major crypto platforms) will gradually pick up steam.

When Zhao finally admitted guilt after charges had been brought against him by the US authorities and stepped down the company CEO, Richard Teng took his place.

The new top executive decided to restructure the platform's operations so that the business would not suffer from new claims by American regulatory bodies, which could resurface.

Richard Teng has already announced that the exchange will start creating a new corporate structure that will resemble a traditional model. For instance, the new company head intends to establish a board of directors, specify a concrete physical address for the company, and henceforth conduct transparent financial operations.

The CEO believes all these changes will help the company grow in the long term.

Let's acknowledge that the business Zhao created is fundamentally strong. For example, the company's capital structure has no debt, and its revenue and profit continue to remain at a relatively high level.

Dark times of Binance Exchange and prospects for its cryptocurrency

In November 2023, Binance exchange and the US Department of Justice reached a pre-litigation agreement, in which Changpeng Zhao is accused of violating some US laws. Eventually, the cryptocurrency exchange has to pay the state a huge fine of $4.3 billion, unprecedented in the crypto community.

Furthermore, Zhao is required to incorporate independent observers into his company's staff, who will be granted unrestricted access to all operational activities of the exchange.

But that's not all. The list of obligations alone spanned an impressive 13 pages of text, including procedures that had not previously been applied to this company.

Accordingly, the platform must, upon the observers' request, provide access to any documents and records of any of Zhao's subsidiary companies.

Moreover, the observers should have informational access to the counterparties, all former employees of the company, all agents, intermediaries, contractors, and any third parties that have interacted with the company at different times of its existence.

The following entities will monitor the execution of this agreement:

- The Criminal Division of the US Department of Justice.

- The National Security Division of the US Department of Justice.

- The Counterintelligence and Export Control Section of the US Department of Justice.

- The US Attorney's Office.

- The Financial Crimes Enforcement Network (FinCEN).

From now on, Binance must comply with American requirements, but if observers identify any discrepancies with these requirements, they are entitled not to notify the company's management. Reports of non-compliance will not be discussed with the exchange CEO and will be sent directly to American watchdogs immediately.

The entire list of obligations resembles a consulting firm's manual. Fulfilling these obligations will cost hundreds of millions of dollars. Frankly, surviving a mutual audit from the Department of Justice and FinCEN will be nearly impossible.

The indictment of the cryptocurrency exchange in 2023 could not go unnoticed. Its share in the spot market plummeted over the year from 55% to 32%.

As for the derivatives market, Binance's share currently stands at 47.7%, the worst figure since October 2020.

BNB cryptocurrency is currently trading at $357.11 per coin.

Most likely, tough times for Binance will continue, meaning the BNB coin can expect further declines in value.

Back to articles

Back to articles