Indeed, there are many opportunities to earn from digital currencies, but it is essential to wisely assess all pros and cons, weigh all the risks, and only then make decisions. This article will examine the main ways to earn from crypto and the potential income that can be achieved with each method.

To learn more about the different ways to acquire digital currencies, including purchasing and getting coins through other means, one can refer to the article How to buy cryptocurrency.

Ways to earn from crypto

To determine how much can be earned from cryptocurrency per month, it is necessary to understand the different income options. After all, the amount of profit often depends on the chosen method, with some being more profitable than others:

- Trading is one of the most popular earning opportunities. Gains through fluctuations in market quotes of crypto are possible due to the high volatility of this asset. You can earn by both, the increase and decrease in the price of the digital coin.

- Investing is a long-term strategy in the crypto market based on the expectation of an increase in its price over time. To ensure that investments yield a good return, it is necessary to select coins with strong bullish potential, but also to diversify investments among several coins rather than focusing on just one.

- Mining involves verifying transactions and adding new blocks, for which miners are rewarded with new coins that are injected into circulation. Mining can only be carried out on chains with a specific consensus algorithm.

- Staking is similar to a bank deposit where a user stores a certain amount of funds in an account, which are used to support the operation of the network. In return, the user receives a reward.

- Lending involves lending digital money to cryptocurrency exchanges or other users directly for interest. This is considered a passive income opportunity.

- Ways to earn without initial investments are airdrops, faucets, and some others. These are programs in which tokens can be received for free in exchange for performing simple actions. However, it is important to be cautious to avoid falling into the hands of scammers.

The article will discuss in more detail the size of income that can be expected from each of the methods listed. However, it is important to remember that the higher the potential income, the higher the level of risk the user must assume. Therefore, all pros and cons must be weighed before applying any of the methods in practice.

How much you can earn from trading cryptocurrency

Trading is a popular way to earn not only on digital currencies but also on many other assets. However, cryptocurrencies are particularly attractive in this respect because they display high volatility: their value can change by several tens of percent in a single day.

Due to this characteristic, traders often choose digital assets as an instrument for trading and conducting short-term speculative transactions. Income can be earned both on the rise and fall of the digital coin's value. The key is to correctly predict the direction of price movement and open a trade in the right direction.

A position that is opened in anticipation of a price decrease is called a short position, and one that assumes an increase is called a long one. To accurately determine the direction of price movement and the market entry point, it is necessary to analyze the current market situation using various tools.

Choosing the right trading style and strategy is equally important: some prefer scalping, which involves transactions lasting from a few seconds to several minutes, while others opt for day trading, which involves making several transactions within a single trading day.

In any case, trading requires an active approach from the user as well as constant monitoring of the situation and, if necessary, taking actions. Thus, for many, trading becomes their primary activity, replacing traditional employment.

The profitability can vary from month to month, ranging from 3% to 30%, depending on the initial investment and the trader's experience. Additionally, traders should brace for unprofitable periods that consume part of the profits earned in previous, successful months.

Overall, few traders achieve success in trading cryptocurrencies, as some users enter the market completely unprepared, make random transactions, subsequently incur losses, and become permanently disillusioned with this form of earning. Nevertheless, some manage to succeed and can "share" their success with others.

For inexperienced users or those who simply do not want to delve into the intricacies of trading, there is a separate option—copy trading. It allows one to replicate the transactions of successful users on their own account and earn profits. Thus, one can earn from trading without practically any effort.

How much you can earn from crypto per month

Let's discuss how much can be earned using various income-generating methods. Investing, or holding, is one of the popular methods that does not require constant active participation, as in trading, but still has good potential.

One of the most important rules for any investor is not to invest all funds in a single asset; instead, it's necessary to create an investment portfolio that includes different types of assets. Different portfolio options can be considered.

| Type of portfolio | Asset composition | Return rate |

|---|---|---|

| Conservative | Low-risk assets: bonds, shares of reliable companies, precious metals, real estate | 4-12% per year |

| Moderate | Low and medium-risk assets: bonds, shares in mutual funds and ETFs | 12-25% per year |

| Aggressive | High-risk assets: startup stocks, hedge funds, IPOs, cryptocurrencies | 30% and above per year |

Considering portfolios that include only digital currencies, they can also vary.

- Conservative portfolios are mostly composed of well-known and reliable coins making up the top-5 cryptocurrencies (at least 70%), with the remaining part (about 25%) comprising coins from the top 10, and only 5% allocated to high-risk assets that could show significant growth.

- Aggressive portfolios are those where about 50% consists of reliable coins from the top 10 digital currencies, and the remaining 50% is equally divided among potentially profitable coins, which also carry high risk and are within the top 100.

Regardless of the portfolio type chosen by an investor, constant monitoring is required apart from careful selection at the initial stage. However, the frequency of monitoring differs. Conservative portfolios should be checked up no more than once a year, while for aggressive ones, monthly checks or checks upon significant changes in profitability indicators are necessary.

How much you can earn on mining crypto

Mining is one of the opportunities to earn on digital currencies. Let's explore how much can be earned from cryptocurrency mining in a month, taking into account several specifics of mining digital coins.

First, mining requires special equipment. Currently, ASIC miners are the most in demand. Their cost varies depending on the specifications but starts from $1,500 and can go up to $4,000 and higher. Thus, the first nuance is the initial capital needed to purchase such devices.

Second, not all digital currencies can be mined, only those based on the Proof-of-Work (PoW) consensus algorithm. These include well-known coins like Bitcoin and Ethereum, as well as some coins based on their code: Dogecoin, Litecoin, Monero, Dash, and some others.

Third, besides the cost of equipment, mining requires significant electricity expenses, which are additional costs that the user must bear. Those who do not want to bear these costs on their own often team up with other miners to create farms to share the expenses and profits among their participants.

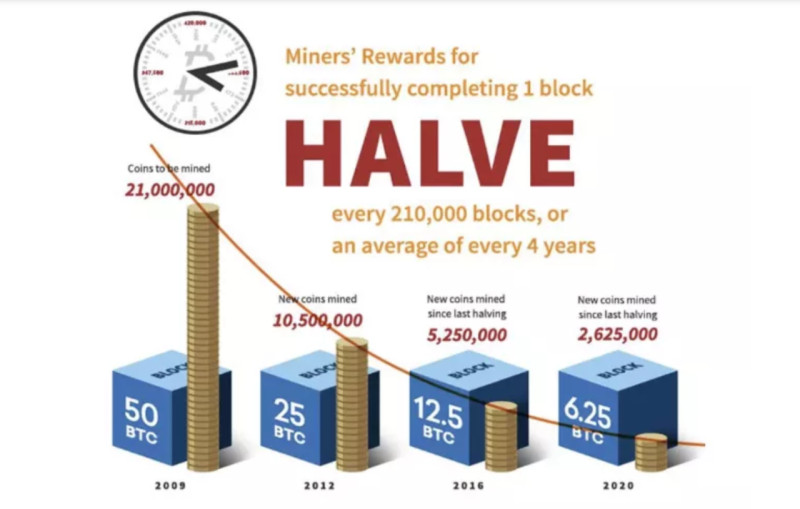

Fourth, the reward size for mining a new block gradually decreases. For example, in the Bitcoin network, this process is called halving and means that the reward size is halved every four years. Initially, it was 50 BTC, but by 2024, it is only 3.125 BTC.

Speaking of specific amounts that miners can earn per month, with ASIC equipment, one can earn about $500-$1,000. If joining together to create an ASIC farm, the earnings can increase to $3,000-$5,000 per month.

Another mining option without purchasing expensive equipment, is cloud mining. Users rent power for mining coins and receive the full amount of rewards without worrying about purchasing, placing equipment, paying electricity bills, and other expenses.

How much you can earn from staking

Staking is one of the passive ways to earn income on digital currencies. In this section, we will find out how much you can earn from cryptocurrency in a month through staking and discuss how it works. This option also has its specifics, which we will examine in more detail.

The essence of staking is that a user locks a certain amount of coins, which are the native currency of a particular network, on their account to support its operation. In return, they receive a reward in the form of interest or a fixed amount in the same currency.

Unlike mining, staking does not require special equipment. It involves buying a certain amount of tokens of a particular chain and "freezing" them in your account, meaning they are not used for transactions or other purposes.

Moreover, staking can only be carried out in blockchains that use the Proof-of-Stake (PoS) algorithm. This algorithm is more preferable as it uses far fewer resources than PoW, making it more environmentally friendly.

By participating in staking, a user can become a validator of the chain, performing functions such as verifying transactions and adding blocks to the chain. Alternatively, they can delegate these powers to other users who are already node owners and receive a portion of the rewards.

Commonly, the reward for staking is calculated as a percentage of the contributed amount, and this percentage varies significantly from one chain to another. Let's consider some examples of returns in different networks. In the Solana network, the return rate is about 7% annually, in Cardano it is about 3.5%, in Aptos and Avalanche - about 6%, and in Polkadot - up to 14%.

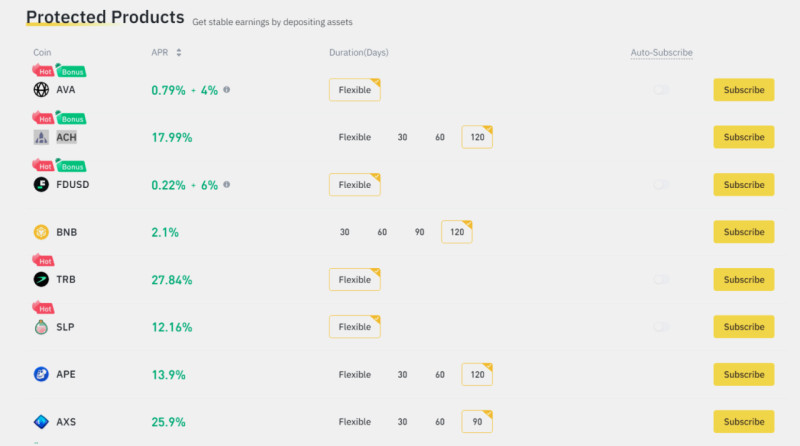

As you can see, return rates vary significantly across different networks. Additionally, the size of potential income is influenced by other factors, such as the lock-up period. Generally, the longer the lock-up period, the higher the interest rate. However, there are risks associated with theft or losing access to your tokens.

How much you can earn from cryptocurrency lending

Lending is another opportunity to earn passive income on digital currencies. We will delve deeper into how much you can earn from cryptocurrency in a month through lending and how it works in this section. For one party, it resembles a bank deposit, and for the other, a bank loan.

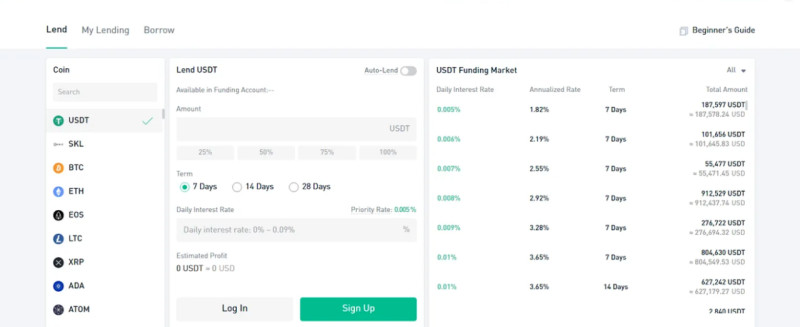

Users who have spare funds but do not want to engage in active trading to earn some gains can lend these funds to a cryptocurrency exchange, a specialized platform, or directly to other users.

For crypto exchanges and lending platforms, this is a good opportunity to increase their liquidity and provide greater opportunities to their clients, such as a higher credit leverage. The investor receives interest for the use of their money, which is often much higher than that on bank deposits.

Additionally, there are special P2P platforms that allow users to lend crypto assets to each other without intermediaries. Some users post their offers, specifying the amount and the interest rate at which they can lend funds, while others search for the most suitable offers.

The interest rate varies depending on the platform and the cryptocurrency used for lending. For example, the interest rate on the same exchange for one currency might be 5.5% annually, while for another it could be 8%, another exchange offers interest rates up to 12.7%, and a third up to 14.5%.

There is also an important difference between lending crypto assets and bank loans – the absence of regulation by government agencies. As a result, there are significant risks of losing funds if they are entrusted to an unverified platform, so careful consideration is necessary when choosing counterparts in this matter.

How much you can earn from cryptocurrency with $100

Even with a relatively small initial capital, it's possible to start earning income from digital currencies. Let's discuss how much you can earn from cryptocurrency in a month if you invest, for example, $100, and how to do it.

We have already discussed various ways to earn from crypto above, but we have not expanded on the topic of initial investments, including how much is needed to start earning income. There isn't a straightforward answer, as it again depends on the chosen method of income generation.

If we talk about trading, for instance, you can start with small investments, which you wouldn't mind losing in case of failure. Beginners are generally advised to start trading on a demo account, where they trade with virtual, not real, money. It's also recommended not to use more than 1%-2% of your deposit amount on a single trade.

Therefore, if the discussion is about a $100 deposit, you should not open a position of more than $2. Of course, the profit on such a trade will be small, amounting to only a few points. Later, as you gain more skills and experience, you can increase the size of your bets and, consequently, earn more profit.

Another option is to place bets over a longer term. However, this should only be done if there is a stable trend that will continue for some time. In such cases, you can expect a return of up to 10% per month. If the amount of the deposit increases, the amount of income will also grow.

How much you can earn from investing $100

Another popular way to earn from crypto is investing. We have already discussed how to do this, but not every investor has enough initial capital to buy several coins at once. Many have limited financial capabilities, especially those who are just starting.

For such users, many cryptocurrencies offer the possibility to purchase not a whole coin but a fraction of it. This primarily applies to expensive currencies such as Bitcoin or Ethereum. After all, not every potential investor has around $63,000 to buy a whole bitcoin, but with $100, you can buy 0.01 BTC.

Many investors who cannot afford to buy digital coins in full right away buy them in parts over a long time. The price of bitcoin tends to increase. It has skyrocketed by almost 194% within just one year.

There is even a strategy known not only in cryptocurrency investments but also in other assets, where an investor buys an asset for $100 every day. This is called a dollar-cost averaging strategy because he does not seek the best rate for buying an asset but buys it during both price increases and decreases, thus averaging the price.

As a result, with a gradual increase in the amount of investments, the size of the profits will also gradually go up. Thus, using Bitcoin as an example, we can see that by investing even $100, but daily or monthly as possible, you can achieve a decent return within just one year.

All in all, investing requires perseverance and consistency, but it's also important not to forget about diversification. We've already talked enough about it before. This aspect is important to remember, regardless of the amount of initial capital you have, whether it's $100 or $10,000.

How much you can earn without any investment

What should users do who have no initial capital but want to start earning extra income from digital currencies? There are several ways. Let's find out how much you can earn from cryptocurrency in a month using these methods.

The first method is airdrops, which are free distributions of coins to users for performing simple actions. Typically, each user receives a small amount of coins, totaling about $20-$30, and this does not require much time or effort.

Oftentimes, to participate in airdrops, users only have to register on a website, subscribing to a newsletter, or following the project's social media. However, it is important to note that if you are asked to pay money in exchange for tokens, it could be a scam.

You can participate in an unlimited number of airdrops, so you can gradually accumulate a decent amount of initial capital, which can then be used to earn income in other ways. It only requires monitoring the market and keeping an eye out for new promising projects.

Another interesting method is crypto games, some of which can be played entirely for free. This gives you a chance to earn by gradually completing tasks and receiving rewards, which can be monetized either for purchases and upgrades within the game or withdrawn and spent on other needs.

Another popular way to earn income is through affiliate programs. If a user already has an account on an exchange or platform, they can participate in an affiliate program. By attracting new users to the platform, they will receive a certain percentage of the commission from each of their transactions.

Each platform offers different terms. On average, you can earn about 20%-30% of the commission from each referred client. The amount of potential income then depends solely on the user's desire and how actively they recruit other users to their affiliate network.

Conclusion

In this article, we have explored the most popular ways to earn income from digital currencies and how much you can earn from cryptocurrency in a month using each of these methods.

You can earn from digital currencies even with a small initial capital. For example, to start trading, you don't need large amounts, yet you can earn up to 10% per month. Returns from investments can reach up to 30%, depending on the risk level and aggressiveness of the investment portfolio.

On average, you can earn from staking about 6% or more of the amount of blocked funds. Approximately the same can be earned from lending, although this largely depends on the specific currency and the conditions of the trading platform.

Even if you have just $100 or no initial capital at all, you can start earning income on digital currencies. For instance, participating in airdrops does not require any initial investments, and playing crypto games may require minimal resources to purchase characters, which can later be used to earn money.

Back to articles

Back to articles