Unlike traditional money, where central banks control the issuance of banknotes and coins, digital currencies do not have a centralized authority overseeing their release.

How are digital currencies created? Each cryptocurrency has its own mechanism for generating new coins. This process, known as mining, plays a key role, and users often need to collaborate in pools to maximize their efforts.

To learn more about other nuances of digital currency circulation, different types of cryptocurrencies, and how to earn with them, check out the article "Ins and outs of cryptocurrency.”

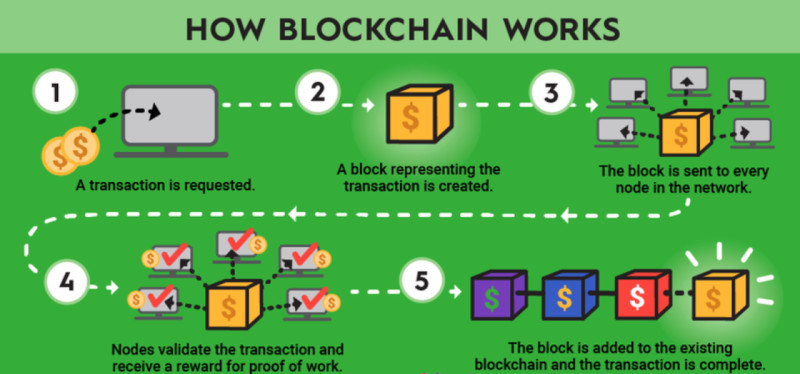

How blockchain works

Blockchain technology is at the heart of any digital currency. Thanks to this technology, cryptocurrencies boast decentralization, security, anonymity, and other key features. In this section, we will explain what blockchain is and how it works.

Blockchain is a technology that allows data to be stored and transmitted in the form of a chain of blocks. The name itself comes from two words: "block" and "chain." Each block in this network contains data and a link to the previous block.

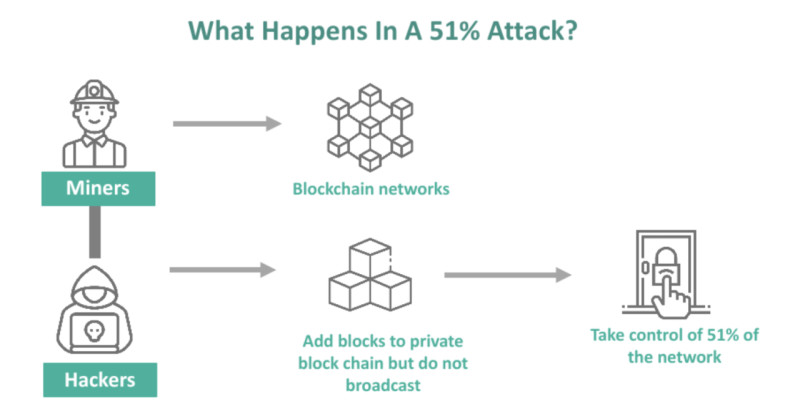

This structure ensures that the data is protected from hacking and tampering. All the information is stored and updated not on a centralized server but on numerous independent devices. Therefore, to change even a single transaction, one would need to alter the records on more than 50% of all devices in the network.

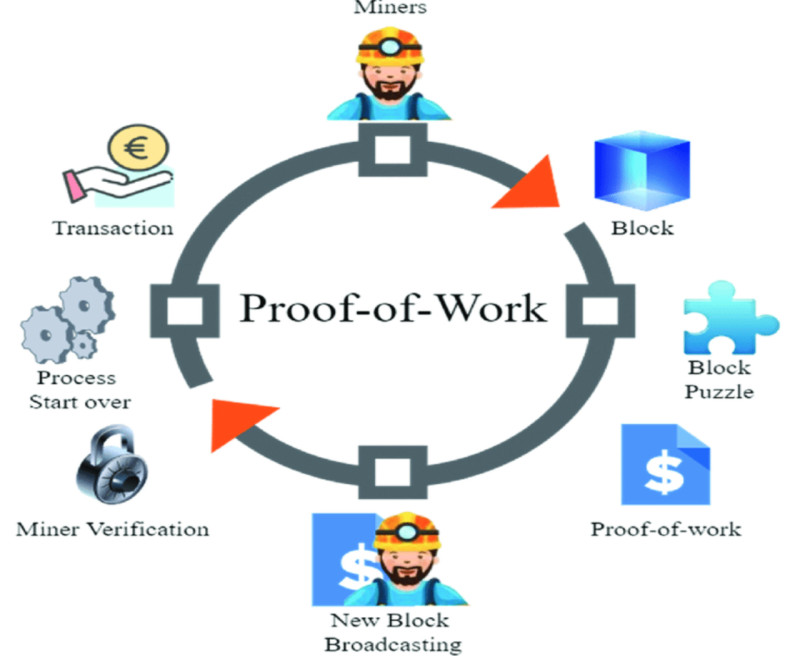

Another crucial component of any blockchain is the consensus algorithm, which is responsible for confirming transactions and adding them to the chain. In traditional banking, this function is carried out by banks, but in blockchain, it works differently. There are two main types of consensus algorithms: PoW and PoS.

PoW stands for proof-of-work, where participants solve complex problems, and the one who solves the task first becomes the winner and is rewarded with new coins. The transaction is added to a block, and the block is added to the chain. This process is called mining.

PoS stands for proof-of-stake, where there is no need to solve tasks. Instead, users need to own a certain amount of coins from the chain. By locking a specified number of coins, the user can verify and add transactions to the network, earning rewards in the process called staking.

The key difference between PoW and PoS is that in the first case, powerful specialized equipment and large energy resources are needed, while the second method is considered more eco-friendly. Additionally, PoS-based chains are easier to scale, making them more popular in modern networks.

How to mine cryptocurrency

Digital currencies differ from traditional money in that their issuance and circulation are not controlled by any single country or government body. As a result, their value is regulated solely by supply and demand, and they are not subject to inflation since new coins cannot be "printed."

In most cases, the total supply of a given cryptocurrency is limited to a pre-defined number of coins. The total number of units is set at the start of the cryptocurrency’s launch, but usually, not all coins enter circulation at once—only a portion of them.

The remaining coins are gradually released into circulation as the blockchain is used. There are several ways that these remaining coins enter the market, the most famous of which is mining, which we will discuss in this section.

Mining is the process through which new digital coins are released and enter circulation. This process is also called extraction since users need to perform a series of complex operations to receive new coins. These operations add new transactions to the blockchain, creating new blocks.

Once a transaction is added to the blockchain, it is permanent. It cannot be changed or canceled, even if the coins were sent to the wrong address. This is because the data is stored and updated on many independent devices. To alter even a single block, one would need to change all the others.

When digital currencies first appeared, mining was much simpler, and the reward for each added block was higher than it is today. For example, in 2009, the reward for one Bitcoin block was 50 BTC, but by 2024, it had dropped to 3.125 BTC.

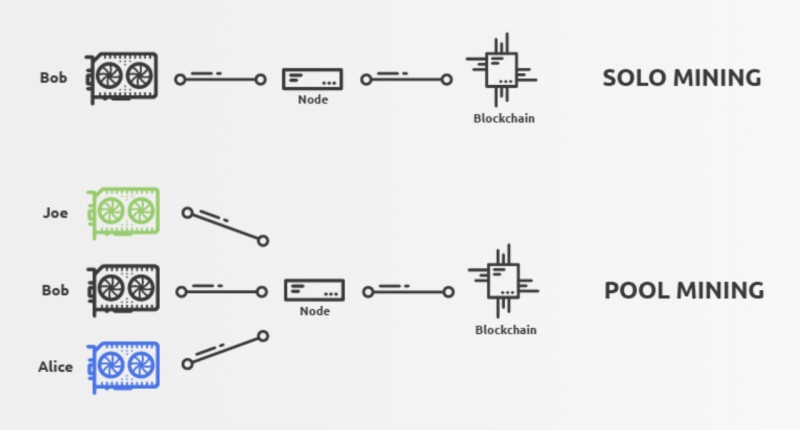

As mining has become more complicated and resource-intensive, it has become less reasonable for individuals to mine on their own. The costs often outweigh the potential earnings. For this reason, miners combine their resources and create pools, which we will discuss further.

Cryptocurrency pool

As solo mining has become less profitable due to rising costs, miners now join forces to secure a more stable income from this activity.

However, this does not mean physically combining resources in one location, where several users mine together. Such a physical arrangement is called a cryptocurrency farm, which is essentially a server or data center equipped with all the necessary infrastructure.

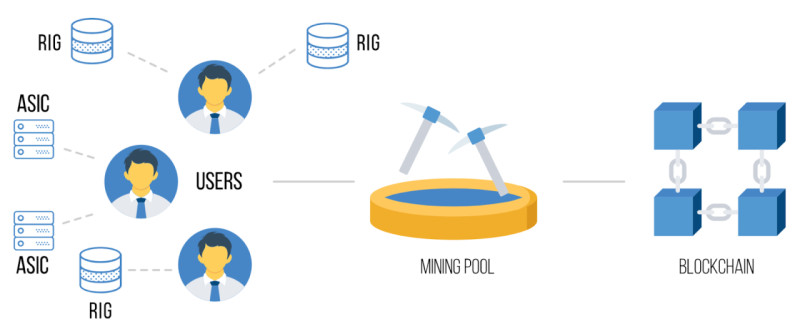

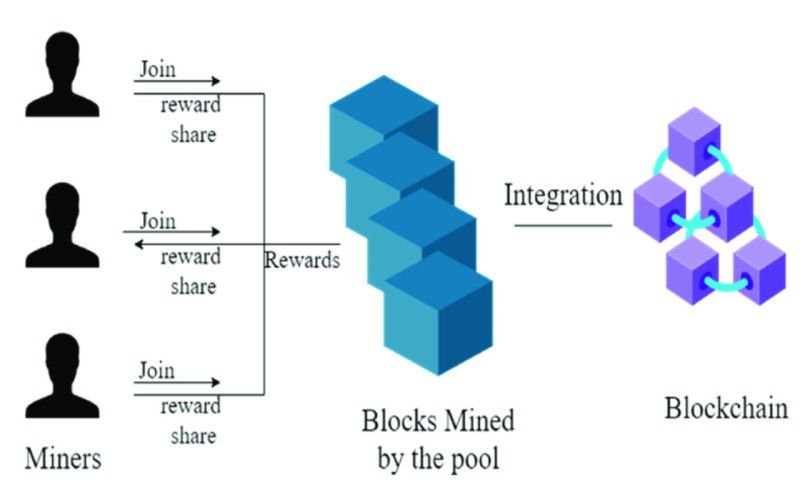

A pool, on the other hand, is a virtual aggregation of computing power. It operates through a server that distributes mining tasks among the participants. The main functions of such a server are to combine computing power and allocate tasks among the members.

Each pool has managers who coordinate the activities of the entire community. They keep track of the work done by each participant, manage the distribution of rewards, and handle other administrative tasks.

Additionally, the company that owns the pool's server takes a commission from the total reward earned by the pool members for validating a block. Typically, this commission ranges from 0.1% to 5%.

There are two ways to participate in a pool: either by completing the assigned tasks or by independently determining the amount of work. Timely task completion and providing the correct results are essential. If a participant misses the deadline, their result is not accepted, and they do not receive a reward.

Pools are mainly used for mining Bitcoin, as mining these coins is more difficult compared to other cryptocurrencies with similar consensus mechanisms, making solo mining almost impossible. However, the potential profit from Bitcoin mining is much higher than from less popular coins.

How mining pools work

The operation of any mining pool is based on several key factors. Now that we understand what a cryptocurrency pool is, let us take a closer look at how this concept is implemented in practice. The main components of a mining community are:

- Cooperative work protocol. This allows multiple pool participants to mine a block concurrently, dividing tasks among themselves.

- Mining software. This software ensures interaction between the server and the pool. It collects data and solves tasks. Once a solution is found, the software moves on to work on the next block.

- Shared mining software. This enables participants to pool their resources in a virtual space to solve tasks together.

To create a community, participants combine their device resources and direct them to a common account, which is connected via a server. The server then distributes tasks among participants using special software. Rewards are distributed based on each miner's contribution.

Thus, each member contributes to solving one large task. Each participant’s output is called a “share,” which is sent to the pool and aids in mining a new block. A miner’s share in the reward is determined by their contribution.

Mining is continuous. After a block is found, the chain presents a new task. The server sends this task to the pool members, and the process starts again. A key point is that the reward is divided among all miners who submitted shares, even if only one found the block solution.

Mining pools threaten decentralization?

The concentration of digital coin mining in a few large pools raises concerns about the decentralization of these blockchains. Users worry that pools might take control of the chains and impose their own rules.

However, these concerns are unfounded, as many users do not fully understand the function and role of mining pools in blockchain operations. It is important to note that miners have no governance rights over the chain. In fact, validators in PoS (Proof of Stake) chains can vote and participate in governance, but miners in PoW (Proof of Work) chains cannot.

Even if one miner or one pool verifies all transactions, this does not affect their ability to govern the chain. Their role is limited to verifying transactions and adding new blocks to the chain.

Additionally, pools rely heavily on the number of participants. The more members a community has, the more successful it can become. Conversely, when miners leave a pool, they weaken it.

Therefore, mining pools struggle to dictate terms to anyone. If a participant is dissatisfied, they can easily leave and join another pool, strengthening it instead.

As for malicious schemes, controlling a chain requires gaining control over 51% of the devices that record blocks on the network. In practice, this is very difficult, as these devices are often geographically distant from each other.

Even if participants from one or more pools unite to control the necessary number of devices, they would lose more than they gain. An attack on the network would undermine the chain, causing the currency they mine to lose value.

How to choose mining pool

Now that we know why miners join together and what a mining pool is, let us examine the key factors to consider when choosing one:

- Pool size. Generally, the larger the pool, the more frequent the payouts. This does not necessarily mean the payout amounts will be large, but the frequency will be higher.

- Reward size. Medium-sized pools may offer larger rewards than large ones, but payouts will be less frequent. Joining small pools may not be practical since rewards are issued very rarely.

- Supported currencies. Many pools now allow the mining of multiple cryptocurrencies with the same algorithms and can automatically switch between them based on various factors.

- Hardware requirements. While anyone can join a pool, each community may have hardware requirements, such as performance standards. Low-power devices increase the overall pool costs.

5. Reward distribution. It is important to understand how rewards are distributed, as this directly impacts mining profitability.

Some pools distribute rewards proportionally to the equipment’s power and time spent working, while others base payouts on individual contributions to finding a new block rather than total work time.

Advantages and disadvantages of mining pools

Just like solo mining, joining a pool has both pros and cons. In addition to understanding what a mining pool is, it is important to discuss its benefits and drawbacks.

Advantages of mining pools:

- Steady income. This depends primarily on the pool’s size. The larger the pool, the more stable the payouts, as the community can mine more blocks.

- Low entry threshold. Even users without powerful computers can participate, as all device capacities are combined.

- Simplified mining process. The increasing complexity of tasks makes it nearly impossible for one person with a single machine to solve them alone. In a pool, tasks are divided among participants, making them easier to complete.

- Technical support. The server and its supporting company offer help to community members, so users do not need to send blockchain requests themselves.

- Multiple currencies. Many large pools can mine several cryptocurrencies at once. The system automatically selects the most profitable currency and switches to mining it.

Disadvantages of mining pools:

- Reward distribution. The reward for a mined block is shared among community members, but each pool has its own distribution rules. Some members get more, while others may receive less or nothing.

- Joining a pool often requires paying a fixed fee or a percentage of the earnings. On average, fees range from 1% to 3% of the income.

- Compliance with rules. Each community has strict rules, and non-compliance can result in exclusion. These rules may include registration requirements or withdrawal conditions for personal wallets.

Cloud mining and pools

An alternative to joining a mining pool is cloud mining. Now that we have explained what a pool is in cryptocurrency, let us take a closer look at how you can mine digital coins without having specialized equipment.

It might seem like this contradicts the very idea of mining, but it is possible. You do not need to buy expensive equipment. Instead, you can rent it. Not only does this save you from the cost of purchasing hardware, but you also do not have to worry about setting it up or maintaining it.

Special companies offer such services, as they have their own data centers and handle the maintenance. These companies do not engage in mining themselves. They only rent out the equipment. Users can select the amount of power they need and pay only for that.

Due to their high capacities, cloud farms are quite efficient. Moreover, many of these farms are officially registered, which guarantees reliability and security. There are several options for cloud mining to choose from:

- Hosting: the user rents and manages an entire farm. You can work with the service provider through a cloud mining platform.

- Virtual hosting: the user rents only a server. The miner installs the software and controls the mining of coins independently.

- Power rental: the user rents computing power without participating in the maintenance of the equipment.

Comparison of cloud mining and pool participation:

| Parameter | Cloud mining | Pool participation |

|---|---|---|

| Equipment purchase | Not required | Required |

| Task selection | User chooses tasks | Tasks are usually assigned |

| Profit distribution | All profits go to the miner | Shared among all pool participants |

Currently, both methods of mining are in demand, allowing users to choose the one that best suits their needs. If you do not have equipment and electricity costs are high, cloud mining is certainly the better choice.

Conclusion

Each digital currency has its own way of releasing and bringing new coins into circulation. For currencies with a Proof of Work (PoW) consensus algorithm, mining is used to extract coins. This process verifies operations and adds new blocks to the chain, rewarding participants with coins.

In the early days, anyone with a PC and an Internet connection could mine. However, the process has become much more complicated, making solo mining almost impossible. As a result, users began pooling their resources and forming mining pools.

In these pools, devices are not physically combined in one place. Instead, with the help of a special server, the resources of individual devices are united virtually, allowing them to solve tasks faster and find new blocks more efficiently.

Even if one community member solves the task, the reward is shared among all miners. Each pool has its own rules for dividing rewards, and it is important to consider this when choosing and joining a pool.

Back to articles

Back to articles