Read a brief guide on exchanging cryptocurrency for fiat money and withdrawing it to a bank card, including platform selection, conversion procedures, and fund transfers.

People acquire digital currencies for various purposes, but in most cases, users aim to profit from them. To learn more about the diverse opportunities for purchasing cryptocurrency, refer to the article How to buy cryptocurrency.

After buying cryptocurrency and generating some income, users often want to utilize it further. Some use coins to generate higher income by reinvesting the earned funds, while others wish to use them for everyday needs such as shopping or making payments.

For these purposes, digital currencies need to be converted into real money and withdrawn to a bank account or card. This article will discuss how to do this correctly and legally. Besides, you will find out about the legal status of digital currencies in different countries.

Key features of cryptocurrency

All cryptocurrencies have distinctive features that set them apart from fiat money and other financial assets. Let's take a closer look at them before diving into how to withdraw cryptocurrency to a card and why it is necessary to do so.

- Digital existence. Cryptocurrencies exist only in electronic form and have no physical representation. Additionally, they are fully decentralized, meaning no single authority or organization regulates the issuance and circulation of such money.

- Blockchain technology. The operation of all cryptocurrencies is based on blockchain technology. This is a special ledger in which all transaction data is recorded and stored. A key feature of this ledger is that it is not managed by a central entity but by a network of individual computers located around the world.

- Issuance methods. Cryptocurrency enters circulation through various methods, such as mining or staking. Mining is performed using complex equipment and is energy-intensive, while staking is a more modern and eco-friendly method.

- Investment focus. Nowadays, digital currencies are viewed more as an investment asset than a means of payment. This is due to the fact that cryptocurrency is not legalized in all countries and is even banned in some.

- High volatility. Cryptocurrencies are highly volatile, which is both a plus and a minus. The advantage is that significant price fluctuations can be used for making profits. However, the downside is the high risk of capital loss.

- Trading platforms. Cryptocurrencies can be bought and sold on various platforms, including crypto exchanges, online exchangers, and P2P platforms. They can be purchased with both fiat money and other digital coins.

- Wallets for transactions. To perform any operations with digital currency, including storage, a special wallet is required. Wallets can be "hot" or "cold." The former have Internet access and can be used for daily transactions, while the latter does not have access and can be used for long-term storage.

How to make money with cryptocurrency

Cryptocurrency can be used for various purposes, but primarily, people strive to make money from it. Once earnings are gained, the question arises: how to withdraw cryptocurrency to a card or bank account. So, what are the ways to gain income from digital currencies?

One of the most common methods is investing (holding). This involves holding digital coins for a long time, anticipating that their value will increase over time. When choosing this strategy, it is essential to carefully select the assets to invest in, to not only preserve capital but also multiply it.

The next strategy is trading, which involves making short-term transactions of buying and selling digital currencies to earn a profit. This is possible due to the high volatility of cryptocurrency. Thus, profits can be made not only from price increases but also from decreases.

Another interesting and increasingly popular direction is trading NFTs. NFTs are non-fungible tokens, meaning they exist in a single copy, including art objects, musical works, and so on. These tokens can be created and sold to other users.

Additionally, one can earn by mining digital coins. The main methods are mining and staking. Miners solve complex problems, such as verifying transactions and adding new blocks to the network. For this work, they are paid in new coins.

The principle of staking is entirely different: users lock a specified number of coins to support the chain's operation. For staking, coin holders receive rewards and other benefits, such as the ability to participate in platform governance through voting.

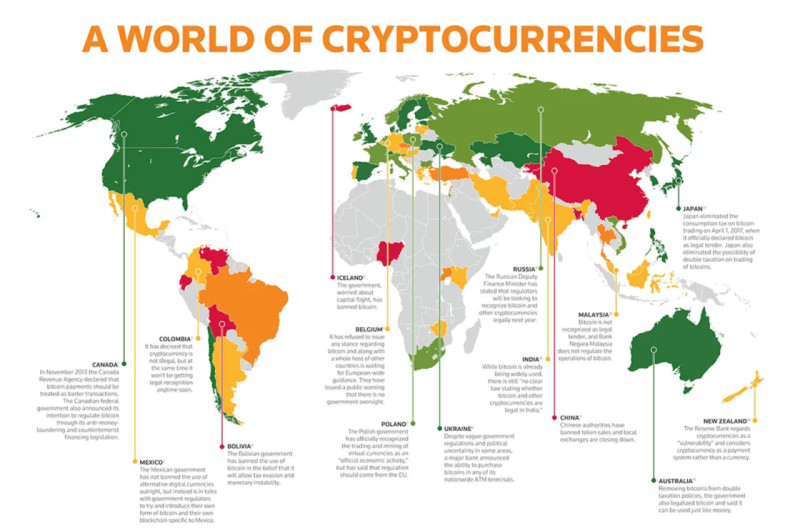

Legal status of cryptocurrency in various countries

The legal status of digital currencies varies across different countries. This leads to differences in how to withdraw cryptocurrency to a card. Let's look at the countries which have legalized cryptocurrency transactions, and which have not, along with the implications.

Earlier, we discussed the key features of digital currencies that attract more users to them. Primarily, these include the ability to make payments and transfers without intermediaries, reduced transaction fees, and the potential for capital investment.

Countries where digital currencies are most actively developing include the US, Japan, England, South Korea, and Canada. Japan was one of the first countries to officially recognize cryptocurrency as a means of payment.

In the US and South Korea, many startups and cryptocurrency exchanges are popping up. Cryptocurrency is actively used by traders and investors to generate additional income. This sector is also developing in Switzerland, Estonia, and other Baltic countries.

A crucial factor driving the development of digital currencies in the aforementioned countries is favorable government policies, high levels of technological development, and the adoption of regulatory acts that grant legal status to cryptocurrencies alongside national currencies.

Apart from developed countries, digital currencies are also gaining traction in nations where the national currency is unstable and highly susceptible to inflation, such as Venezuela and Mexico.

Most countries that are cautious about legalizing digital currencies express concerns that cryptocurrencies are or will be used for financial scams and money laundering. Therefore, some countries impose restrictions on certain operations with digital currencies.

For instance, in many countries, any operations with cryptocurrency are prohibited, including Iraq, Qatar, Tunisia, Morocco, Bolivia, Afghanistan, China, and others. In other countries, specific actions are banned. For example, mining is prohibited in Turkey, Israel, Kazakhstan, Indonesia, and others.

Is it legal to withdraw cryptocurrency?

Since digital currencies have different legal statuses in different countries, users may be puzzled about how to withdraw crypto. Therefore, before withdrawing cryptocurrency to a card, it is necessary to find out whether this is legal in your country or if it is better to exchange crypto for fiat money and then withdraw it.

Importantly, in countries where cryptocurrencies are not recognized as a means of payment on par with national currency, there is little point in transferring digital coins to a card. The reason is that it will be impossible to use this money, so it is more reasonable to exchange it for national currency.

Thus, we will primarily discuss platforms that allow you to convert digital coins into any national currency and then withdraw them to your bank account.

Even in countries where cryptocurrency transactions and all operations with them are completely legal, most of these countries require that income from crypto operations be taxed. Therefore, when withdrawing funds, you must declare the source of income and pay taxes on the amount.

In most countries, any profit made from digital currencies is subject to taxes. Each country has its own rules and tax rates for this sector. For example, in Austria, it is 27.5%, in Estonia – 20%, and in Belarus and Russia – about 13%.

However, there are countries where income from digital currencies is not taxed. In some countries, such exemptions are temporary. For example, they were valid in Belarus and Portugal until 2023. Currently, no taxes are paid on crypto in El Salvador, Singapore, and Malaysia.

In countries where the legal status of crypto is undefined or where it is not considered legal, citizens cannot turn to law enforcement to protect their rights in case of theft or other illegal activities.

How to withdraw cryptocurrency to card

Despite the growing popularity of digital currencies, many people still have some mistrust towards them. Since they cannot be held or touched, users often want to convert them into a more tangible form, that is, cash them out.

This can be done in several ways. Essentially, the same platforms used to purchase cryptocurrencies are also used for these purposes:

- Crypto exchanges

- Exchangers

- Crypto ATMs

- P2P platforms

- Telegram bots

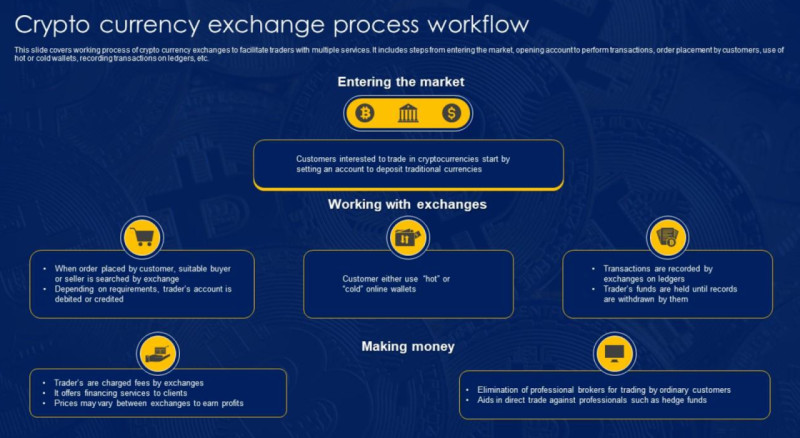

On cryptocurrency exchanges, a wide range of different operations can be carried out, including buying, selling, and trading crypto. To perform all these operations on an exchange, you need to register, open an account, and often go through the identity verification process.

On the exchange, you can exchange one digital currency for another or any other national currency. Exchanges also suggest wallets where crypto can be stored and coins can be withdrawn to a client's account.

Different methods of account funding and withdrawal are available on exchanges, allowing each user to choose the most suitable one. However, it is not recommended to store money on exchanges as they are often targeted by hackers, which can lead to loss of funds.

Exchangers perform the same functions as exchanges but with lower fees, which makes them popular among users. Like exchanges, exchangers act as intermediaries between sellers and buyers when exchanging fiat money for digital currency.

P2P platforms allow currency exchange directly between clients without intermediaries. This is both an advantage and a disadvantage. It is advantageous because there will be fewer and lower fees. However, it is a disadvantage because you may encounter unscrupulous counterparties and lose your funds.

Crypto ATMs are special devices similar to ATMs that allow you to withdraw digital money to your bank card with simple manipulations. However, this method has much higher fees than all the previously mentioned methods (5% and above).

Withdrawing through crypto exchange

So, we have already found out various methods for withdrawing digital currency. Now, let's delve into how to withdraw cryptocurrency to a card, specifically by examining step-by-step the process for each platform individually. We'll start with cryptocurrency exchanges, which are the most well-known and reliable options for withdrawing funds.

Commonly, users do not store their digital coins directly on exchanges as it is not very secure. Wallets are usually used for this purpose as they provide more reliable storage. For example, using software wallets allows for quick access to coins and transferring them to the exchange.

To conduct any operations on the exchange, you need to create an account, i.e., register and, in most cases, undergo verification. Verification means confirming your identity, which requires providing a copy of your ID (passport, ID card), as well as proof of residence.

After creating an account, you can fund it with any currency and then use that currency to buy digital money or simply transfer it to your account from the wallet where it is stored. From there, you can perform any operations with crypto, including trading, reselling, and so on.

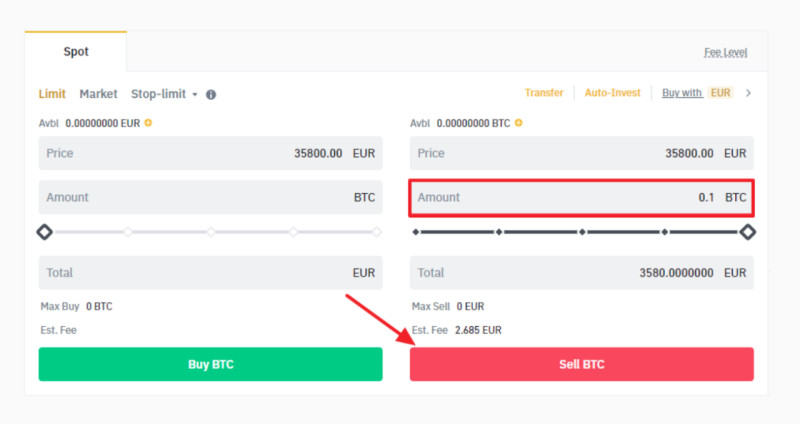

If you wish to withdraw the earned crypto money, you will first need to exchange it back into fiat money. This is also done in a trading mode on the exchange, after which the funds can be transferred to your bank account or card. However, remember that exchanges may charge a fee for each exchange transaction and for withdrawing funds.

The advantages of exchanges include high liquidity. This means that a large number of sellers and buyers are registered with them, making it easier to find a counterparty for a deal. Moreover, centralized exchanges operate in compliance with the law, making them reliable.

Withdrawing crypto through exchanger or P2P platform

If registering with a cryptocurrency exchange seems too complicated, you can use other options to withdraw cryptocurrency to a card. These options include online exchangers and P2P platforms. Let's examine these possibilities in more detail.

So, if a user already has cryptocurrency but wants to withdraw it, as mentioned earlier, it needs to be exchanged for any real currency. An online exchanger is perfect for this purpose. Exchangers set their own rates for exchanging one currency for another.

The main difference between an exchanger and an exchange is that the latter is suitable and even intended for active trading, while the former is solely for buying and selling. Additionally, crypto exchanges offer digital coin storage services, whereas exchangers transfer them to the specified wallet address provided by the user.

To find a reliable exchanger, it is necessary to study reviews from real users and find out how long the company has been in the market. It is important to check whether the company is legitimate to avoid encountering scammers who use phishing sites and other tricks to steal money from clients.

Moreover, it is essential to review the terms under which the exchanger outlet offers its services, such as how the commission is charged: as a percentage or the difference between the buying and selling price. Attention should also be paid to which digital currencies the exchanger supports and how long the transaction process takes.

Exchangers allow withdrawing funds both online to a bank card and offline - receiving cash at the company's office. For this, digital currency must also be exchanged for any fiat currency, and a funds withdrawal request must be made.

On P2P platforms, currency exchange is done directly between counterparties without intermediaries. On such platforms, you need to register and place your offer to buy or sell a particular digital currency.

Each user can select their own counterparties for transactions, but all operations are carried out at their own risk. In case of any unforeseen circumstances, it will not be possible to get the money back, as all blockchain transactions are irreversible.

Telegram bots and crypto ATMs for withdrawing cryptocurrency

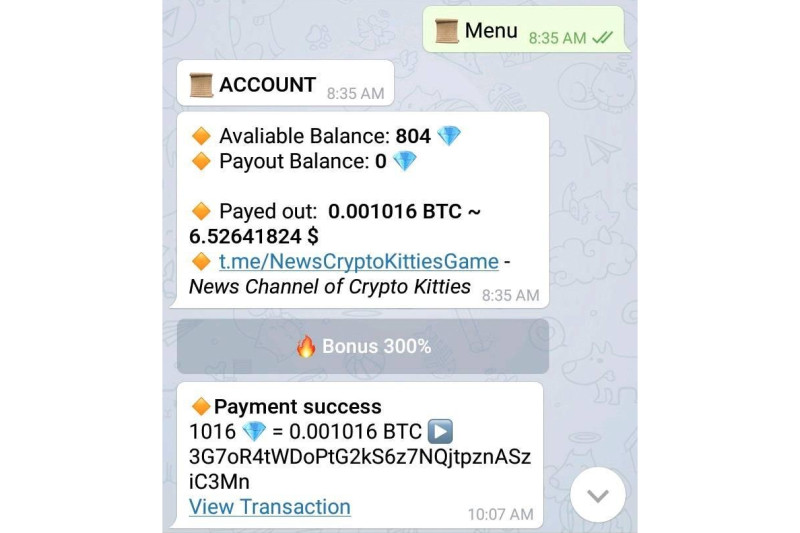

A relatively new method for buying and selling digital currencies is using Telegram bots. Let's explore how to withdraw cryptocurrency to a card using these bots.

What is a Telegram bot? It is a digital coin exchange service embedded in the Telegram messenger. These services allow not only transactions for buying and selling crypto, but are also used as a crypto wallet for storing coins.

Let's look at the advantages and disadvantages of such services in a table:

| Advantages | Disadvantages |

| Automation of all processes | Risk of encountering fraudulent software |

| Convenience and ease of use | |

| User-friendly interface | |

| All operations in one place | |

| Wallet function available |

When choosing a bot, consider several criteria:

- Supported currencies. Make sure that the bot supports the currency you are interested in.

- Functional features. Find out what functions the bot performs beyond basic trading. The more versatile it is, the more useful it will be.

- Registration and customization. This criterion is especially important for beginners, as a complicated customization process can scare off users.

- Ease of use. A convenient and user-friendly interface is a significant advantage for users.

When you need to withdraw cryptocurrency and get cash, the simplest and most convenient method is using crypto ATMs. They look and function similarly to regular ATMs but deal exclusively with digital currencies.

To withdraw money from such a device, select the "Withdraw" function, enter the desired amount, and scan the QR code from your crypto wallet, whether hardware or paper. Then, confirm the transaction and collect your cash.

Another relatively new and interesting method for converting and withdrawing digital money is a cryptocurrency debit card. This is particularly relevant for users who receive their salaries in digital currencies, as it allows them to use coins for various payments.

These cards are issued in partnership with Visa and MasterCard, so payments are supported by any retail and other outlets. You can top up the card via a website or app, and then simply use it for transactions. The card automatically converts crypto to fiat currency when making payments.

Conclusion

At some point, every user conducting operations with digital currencies faces the question of how to withdraw cryptocurrency to a card. This is necessary in daily life for various payments.

The first thing to consider is the legal status of digital coins in a particular country. Each state treats cryptocurrencies differently. In some countries, crypto money is accepted as a means of payment, in others as an investment instrument, and in some, all operations with them are prohibited.

Another important aspect is taxation. In most countries where crypto operations are legal, citizens are required to pay taxes on the profit earned from digital coins. Typically, this is a profit tax, which must be paid when withdrawing coins to your account.

Various methods may be used to withdraw funds, each with its own pros and cons. In any case, the funds must first be converted into any fiat currency before they can be withdrawn to a bank account.

Crypto exchanges are one of the most reliable options for exchanging coins and withdrawing them to your card. Similarly, exchangers and P2P platforms allow for exchanging digital coins for real money, after which these funds can be withdrawn to an account or card.

Back to articles

Back to articles