The article explains the concept of Airdrop in the cryptocurrency industry, describing it as a way to distribute tokens or coins to a community for free or in exchange for fulfilling certain conditions. What is a cryptocurrency airdrop about? In essence, it is the distribution of digital assets from a crypto project to various users' wallets.

Developers actively use this method because it helps to widely distribute crypto coins and tokens among both active and potential users. Moreover, this method is very effective for promoting the entire project.

As part of an airdrop, participants are commonly offered the chance to receive tokens for free, although sometimes earning the reward requires completing various tasks set by the organizers.

Airdrops became popular among users during the growing interest in Initial Coin Offerings (ICOs), which took place in 2017. They are still highly relevant in the crypto industry as a powerful marketing tool and an effective promotion strategy.

How have airdrops developed?

Airdrops gained popularity as a marketing instrument during the ICO boom in 2017 when token sale organizers offered users relatively small rewards for completing simple tasks on popular social media platforms. This approach undoubtedly enabled the rapid and widespread dissemination of information about new projects.

In 2022, airdrops were gladly adopted by DeFi projects, which distributed governance tokens among users of decentralized protocols and applications. This approach allows the project to quickly grow its community and stimulate demand for its digital assets.

NFT-related projects also make extensive use of airdrops: developers distribute free non-fungible tokens from their collections to their current or future users, sometimes as part of contests.

Why do cryptocurrency projects conduct airdrops?

Blockchain projects need to periodically expand their audience and increase the number of users, and airdrops, or the distribution of free tokens, are an excellent way to achieve this.

It’s clear that the more token holders there are, the more reliable the project is considered in the crypto industry. Once it’s deemed reliable, it will attract more users, and its tokens will increase in value. Additionally, the more supporters and token holders a project has, the more decentralized it becomes.

What is a cryptocurrency airdrop? It’s a way to incentivize users to actively engage with and promote the project, which ultimately leads to the growth of the initial user base even before the tokens are traded on exchanges.

Importantly, airdrops can sometimes only look like expansion. Therefore, before deciding to participate, it’s essential to analyze all factors. For example, if a cryptocurrency is held by hundreds of thousands of users but isn’t widely used, the project is unlikely to be sustainable and could even be fraudulent.

So, what is a cryptocurrency airdrop and what role does it play in the industry? Let’s list the details below:

- Airdrops increase a project’s popularity and awareness among network participants.

No doubt, the distribution of free tokens attracts attention to the crypto project, increases its popularity, and brings in new users and different investors. Any mention of the project in the media and social networks elevates its visibility, making it trend-worthy and giving it a certain significance. - Airdrops expand the user base and increase the number of users for a project.

To receive free tokens, users are often required to perform certain actions, such as following the project’s social media or installing special apps or extensions. This leads to users remaining engaged with the project and likely becoming active participants. - Airdrops increase the liquidity of the cryptocurrency in the market.

Distributing tokens to a broad audience can significantly boost demand and, consequently, the price of the cryptocurrency. Airdrops make the cryptocurrency more liquid and actively traded on exchanges. - Airdrops attract new investors and partners to the project.

The active distribution of cryptocurrency often draws the attention of potential investors and partners. The primary goal is to attract large investors who can provide substantial financial support for the project’s development. - Airdrops build trust in both the project and its cryptocurrency.

The free distribution of tokens demonstrates the project team’s commitment to promoting their cryptocurrency, actively spreading it, and engaging with users. Such involvement by the project team in development and communication with network participants fosters trust, attracting new users and additional investors.

Airdrop mechanism

Today, several types of airdrops can be found in the market. These typically involve the distribution of small amounts of cryptocurrency to various user wallets, often using Ethereum and Binance Smart Chain. Some crypto projects offer NFTs as rewards instead of traditional cryptocurrencies, although this method is uncommon.

Projects may distribute cryptocurrency for free or require users to complete certain tasks, such as following their social media, subscribing to a newsletter, holding a specific amount of coins in their wallet, and so on. Interestingly, even fulfilling all these conditions does not always guarantee receiving tokens.

Sometimes, projects reward only those wallets that have actively interacted with the project’s platform before a set date. For example, platforms like 1INCH and Uniswap used this method to reward their early participants, with rewards potentially reaching thousands of dollars—something not typical for most airdrops.

You can find cryptocurrency airdrops online, where many resources offer information on current and potential token distributions. Some of the most popular websites for finding news about upcoming airdrops include CoinMarketCap, CoinMarketCal, and Airdrops.io, as well as Twitter channels (Airdrop, DeFi Airdrops, and Cosmos Airdrops).

Airdrop vs. ICO: what is difference?

To better explain the idea of an airdrop in cryptocurrency, let’s compare it with an ICO. As you can see, they are not the same and should not be confused. The main difference between these methods is that airdrops do not require financial investments from participants, while ICOs are used specifically to raise funds through crowdfunding.

In an ICO, a crypto project team offers tokens for sale to attract investments. The popularity of ICOs began rising in 2014 following the Ethereum crowdfunding campaign aimed at supporting platform development.

The ICO boom occurred in 2017, with many new projects using this mechanism to raise funds for their ventures.

What types of airdrops exist?

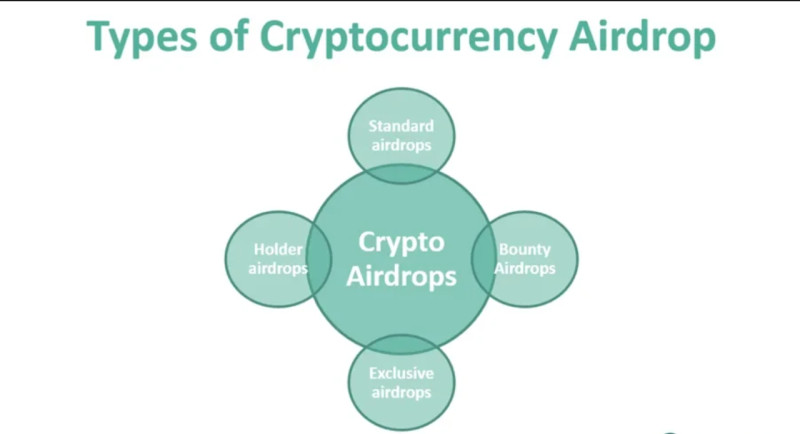

Crypto projects usually pursue various goals and use different strategies to achieve them. In the crypto industry, there are four main types of airdrops:

- Standard airdrop

Standard airdrops are open to all interested participants and are the most affordable. In most cases, participation doesn’t require any additional tasks, although registration may be necessary. In a standard airdrop, a small amount of new cryptocurrency is transferred to the wallets of already registered users. It’s important to register quickly, as spots are usually limited. - Bounty airdrop

Bounty airdrops are often used as a marketing tool, where participants complete promotional tasks to receive cryptocurrency in their wallets. The conditions for receiving rewards may include subscribing to the project's newsletters or posting about the project on social media (most often on popular platforms like X (former Twitter), Facebook, or Instagram). - Holder airdrop

A holder airdrop rewards participants for holding a specific token or coin in their wallet. These airdrops are commonly conducted by projects implementing a hard fork or planning to launch a new blockchain. The reward size in such airdrops is typically determined by wallet balance snapshots taken on specific days. - Exclusive airdrops

Exclusive airdrops target a specific group of users who have demonstrated loyalty to the project in some way. The selection criteria can vary, including the time a user has spent on the project, their level of engagement, or investments not related to token trading. A prime example of an exclusive airdrop is Uniswap’s airdrop in September 2020, where the first 250,000 users of the exchange received UNI tokens.

What is retrodrop?

We’ve covered what a cryptocurrency airdrop is, but in addition to airdrops, there are also retrodrops. In a retrodrop, participants engage in various activities on the network and interact with certain wallets. The key difference is that information about the retrodrop and its conditions aren’t announced in advance. Participants only learn about the reward opportunity after the project has completed a snapshot of wallet activity, which is then used to assess eligibility for the drop.

This mechanism allows a project to reward active participants sometime after the mainnet launch. Since retrodrops aren’t announced beforehand, fewer participants artificially accumulate activities, making the rewards more meaningful.

To qualify for a retrodrop, a user needs to be an active member of the crypto community, closely follow the news, frequently perform cryptocurrency transactions on the project’s platform, and, importantly, test new networks.

The main goal of retrodrops is to attract as much attention as possible to the project and distribute cryptocurrencies among its community. When conducting such events, the project team must consider the close scrutiny from various regulatory bodies, such as the US Security and Exchange Commission.

Retrodrops are designed to reward early participants for their contribution to the project’s development and scaling, as well as for helping to identify and resolve issues.

Unlike airdrops, which aim to attract new users, retrodrops are intended to maintain the loyalty of the existing community and highlight those who actively contribute to the project's growth.

How to participate in airdrop

Now let’s explain how to properly participate in an airdrop. The conditions and token distribution process may differ from one project to another. Regardless, the most important thing that users must always have to receive rewards is a cryptocurrency wallet (such as the popular MetaMask wallet).

After setting up your wallet, make sure it can receive free tokens. If your wallet doesn’t have this option, you may need to interact with a website to claim the airdrop.

There is a lot of information online, and it might be difficult to filter through it on your own. It could be helpful to find a blogger or even a community that is familiar with the nuances of this field. You can search on Telegram (where there are plenty of themed groups) or visit Discord chats.

If you come across an advertisement for paid access to a private chat, remember that there is no need to pay for access to any community. There are plenty of accessible and completely free communities available. Usually, any paid access to a private group is simply a way to squeeze money out of naive users for information that is freely available on other resources.

We recommend starting by searching for relevant news on Twitter and watching bloggers on YouTube. They often not only talk about upcoming airdrops but also explain the steps you need to take to increase your chances of earning rewards.

It’s important to remember that there are many different conditions, requirements, and methods for boosting your wallet’s ranking and getting a higher multiplier (increasing your chances of receiving a token drop and the number of tokens).

Much depends on the project and the tasks you are required to complete. If token transactions occur on ERC20 or involve bridging to other networks, you may need to spend a significant amount of money on fees. In this case, you’ll have to decide how much you’re willing to invest to have a chance of receiving a reward from your chosen project.

Additionally, once you become part of a crypto community and start understanding projects, you’ll be able to rank them by tier—from the best (projects that have raised significant funds, have active Twitter communities, and partner with popular crypto exchanges) to the worst (which are unreliable and not worth attention).

It’s important to keep track of your actions by creating spreadsheets or lists, noting down all your activities, actual and potential expenses, and setting reminders to stay active in the networks.

When participating in such activities, always keep your crypto wallet secure. If you receive links to claim an airdrop, always check the source and verify who is behind the project. Remember, scammers often send out such links in public chats, aiming to trick inexperienced users into clicking and linking their crypto wallets, giving them direct access to your funds. The result is the theft of all your assets.

How to avoid fraudulent airdrops

Among the many airdrops available, there are both reliable and questionable ones. The problem is that distinguishing between a legitimate token distribution and a scam can sometimes be challenging.

It’s essential to thoroughly analyze any airdrop before deciding to participate, especially if it requires connecting your wallet to a website. Scammers often use methods that transfer tokens to your wallet, and then when you try to use or transfer them, your wallet gets drained.

Scammers often organize airdrops on phishing websites that are difficult to distinguish from official ones at first glance. Their schemes are designed to convince users to connect their wallets and sign a transaction, which results in all the funds being stolen. Fake accounts on Twitter and Telegram, which closely resemble official ones, are also common. In this case, your diligence, attentiveness, and curiosity are crucial.

Sometimes scammers request that you transfer cryptocurrency to an unknown address, promising free tokens in return. Always remember that legitimate airdrops never require participants to send funds or share their seed phrases. Be cautious with suspicious emails and private messages, and avoid opening them.

To protect yourself from scams, check the project’s official website and social media. Bookmark the official links and ensure the airdrop is genuinely being conducted. If there is little information about the project, or if it seems dubious, it’s best to avoid participating.

For additional protection, consider setting up a new wallet and email address to use exclusively for airdrops. This approach helps safeguard your main funds from phishing.

Many beginners see airdrops as an easy way to make money, but don’t forget that participating in airdrops requires significant effort, time, and is almost always associated with serious risks.

Here are a few tips on how to protect yourself and your funds from scammers:

|

| 2. Always thoroughly research each project before participating. Use trusted sources for information, such as ForkLog. Avoid joining airdrops for projects with very little information available. |

| 3. Be extremely cautious with airdrops that promise large and quick profits for participation. Most likely, these are scams. |

| 4. Never share your personal data or any information that could provide access to your account. |

| 5. If an airdrop asks you to send money in exchange for a promise of more in return, it’s almost certainly a scam. Legitimate airdrops always offer cryptocurrency for free and won’t ask for any purchases. |

Airdrop taxation

What is an airdrop in cryptocurrency? Beyond the above points, it also involves paying taxes on the income from the digital currency you receive. In the US, for example, cryptocurrency airdrop earnings are subject to mandatory taxation. This means that everyone who receives coins via an airdrop is required to pay taxes on the value of those coins.

The tax amount is calculated based on the market value of the token at the time of the airdrop. This is particularly important for those holding cryptocurrency in their wallet. Simply possessing these coins obligates you to pay taxes on the income generated from the airdrop.

You should check your IRS Form 1040, where such income is reported as "other income." Note that this is different from Form 8949, which is used to report capital gains from the sale of cryptocurrency.

Examples of notable airdrops

In 2018, a fund involved in creating the Stellar blockchain distributed XLM tokens worth around $125 million over a couple of months. All the tokens were given to users of Blockchain wallets.

In September 2020, the decentralized exchange Uniswap unexpectedly distributed 400 UNI tokens to everyone who had ever used its services. With an initial token price of $7, hundreds of thousands of users instantly received crypto assets worth several thousand dollars each.

In 2022, the team behind the leading NFT project Bored Ape Yacht Club conducted an airdrop of the ApeCoin (APE) token, which was distributed to owners of the Bored Ape and Mutant Ape NFT collections.

Back to articles

Back to articles