Friday's releases left more questions than answers. The pair is still trading within the range of 1.1260-1.1360, despite the release of the most important macroeconomic reports.

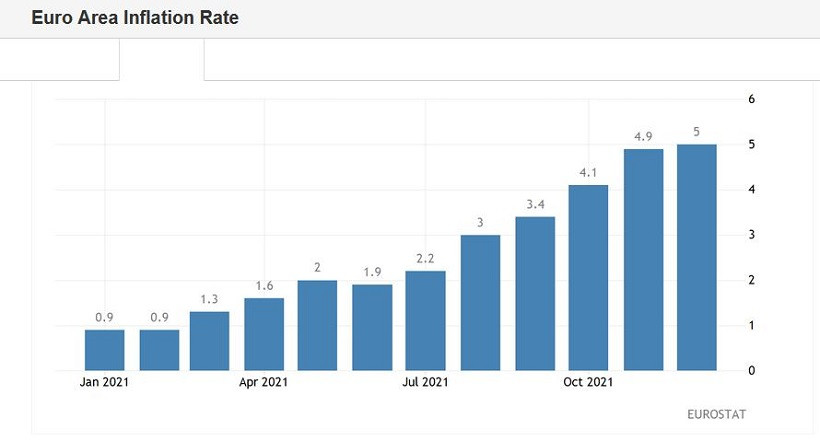

Buyers of EUR/USD were pleased with the European inflation. The consumer price index again found itself in the "green zone", and again distinguished itself with record growth. So, the overall CPI in December jerked up, reaching the level of 5.0%. This is a new historical record: the maximum value of the indicator in the entire history of observations (that is, since 1997).

The result turned out to be higher than the forecasts of most experts: analysts polled by Reuters had expected it to come out at 4.7%. The pivot CPI (excluding volatile energy and food prices) also performed well, rising to 2.6%. Analyzing the structure of the release, we can conclude that energy prices have increased most in the eurozone countries. Last month they increased by 26% (year on year). Prices for food, alcohol and tobacco products increased by 3.2%, for industrial goods - by 2.9%, services - by 2.4%.

In response to this publication, the EUR/USD pair updated the intraday high, but at the same time did not leave the above price range. Firstly, the market was ready for such results, especially after Thursday's data on the growth of German inflation. The consumer price index in Germany also showed a fairly strong growth - both in annual and monthly terms. Indicators also entered the green zone, signaling similar trends on a pan-European scale. The forecasts were justified.

Second, as mentioned above, the rise in the CPI was mainly due to the rise in energy prices. Whereas most of the ECB representatives expect the stabilization of prices for energy and electricity in the eurozone in 2022. This was particularly announced at the end of December by ECB President Christine Lagarde. And although the head of the ECB noted that "a certain level of uncertainty" around this forecast remains, she at the same time, expressed confidence that the energy crisis will end in the first half of this year.

Consequently, the indicators of European inflation will also turn down. A similar rhetoric was voiced the other day by Bank of France Governor Francois Villeroy de Galhau, as well as the chief economist of the ECB Philippe Lane. Lane said that the current surge in inflation is "part of a pandemic inflation cycle." At the same time, he once again repeated the "dovish" thesis. He said that in his opinion, the European Central Bank will not raise rates this year.

It is worth recalling that a month ago, the eurozone similarly surprised investors with a record rise in inflation (the previous record was at 4.9%), but the ECB members actually ignored this fact, demonstrating passive-wait-and-see behavior at the December meeting. Moreover, the regulator has "strengthened" the asset purchase program (APP), which will operate with an open end date.

For this reason, EUR/USD buyers are in no hurry to "uncork the champagne" today. The single currency has noticeably strengthened its positions, but paired with the dollar, it is still trading in the range of 1.1260-1.1360.

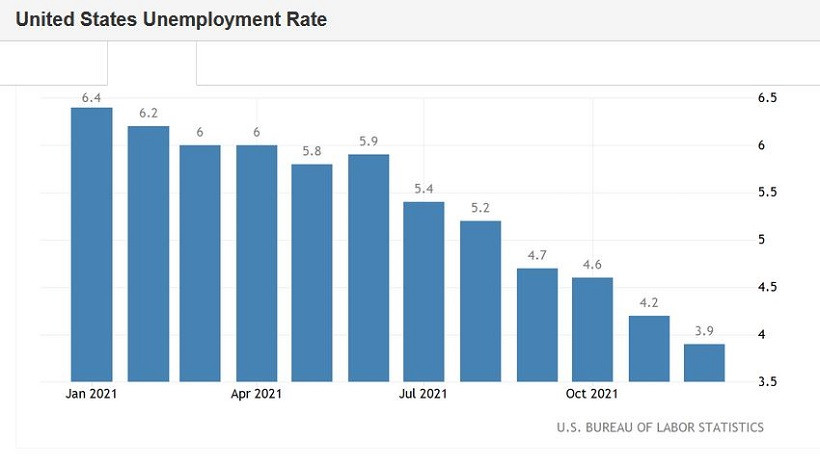

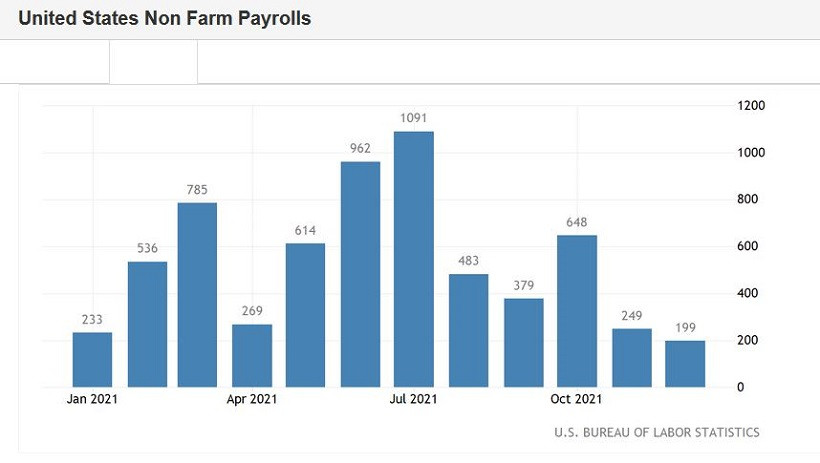

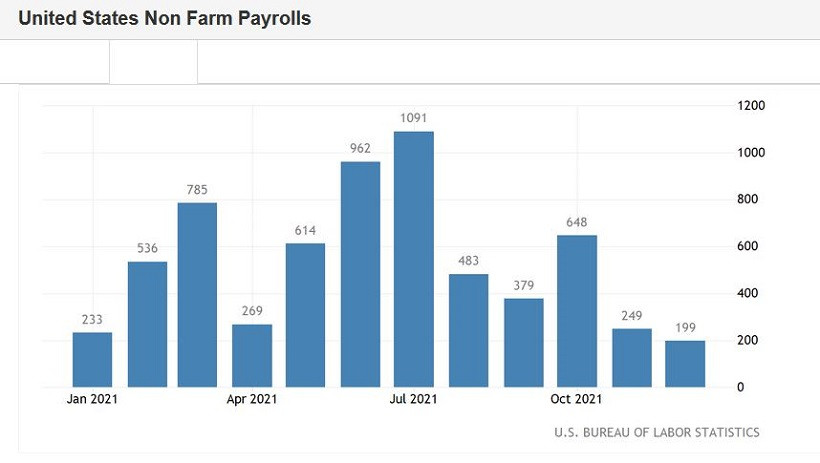

The data on the U.S. labor market did not help the EUR/USD bulls either, which left an extremely ambiguous impression. In general, the U.S. Nonfarm Payrolls report were able to surprise: as a rule, one of the components of a key release is knocked out of the general rut of forecast levels, demonstrating the ambiguity of the situation. But recent releases leave too many questions. On one side of the scale is a decrease in unemployment and an increase in the level of average wages. On the other side, there is a relatively weak increase in the number of people employed in the non-agricultural sector, in the manufacturing sector and in the private sector. This trend was observed a month ago, and the same trend was recorded Friday.

Thus, the unemployment rate in the United States fell to 3.9% in December. This is the best result since March 2020. In April, unemployment rose to 4.4%, in May - to 13.5%. Before the coronavirus crisis, the indicator for several years (to be more precise, from November 2017 to March 2020) fluctuated in the range of 3.5%-4.1%. In other words, the key indicator has now de facto returned to the area of pre-crisis values. It is also worth noting that the unemployment rate has been consistently decreasing for 15 months. Dollar bulls and salaries were also pleased. The average hourly wage increased to 4.7% (in annual terms) and to 0.6% (on a monthly basis). Both components came out in the "green zone", exceeding the forecast values.

On the other side of the "coin" is a weak increase in the number of people employed in the non-agricultural sector. This figure increased by only 199k, while the forecast growth is up to 410k. In the private sector of the economy, 211k jobs were created (forecast - 365k), in the manufacturing sector 26k (forecast - 35k). Job growth rates were roughly in line with November, when 246k nonfarm jobs were created. At the same time, both in November and December, the unemployment rate was consistently decreasing.

Against the background of such contradictory Nonfarm Payrolls data and record growth of European inflation, the EUR/USD pair naturally moves to the upper border of the range of 1.1260-1.1360. But here two questions arise: will the buyers of the pair overcome the resistance level of 1.1360, and most importantly, will they be able to consolidate above this target? Recall that on the last trading day of last year, against the background of the general weakening of the dollar, traders were able to "pull" the pair to the level of 1.1387.

However, this was the end of the upside campaign (barely starting). Buyers of EUR/USD did not dare to storm the 14th figure, and already on January 3, the bears seized the initiative. After all, if the representatives of the ECB, for the most part, retain their position, insisting on the temporary nature of the growth of inflation, and the Fed members focus their attention on unemployment (the level of which is steadily declining), buyers will again lose control over the EUR/USD pair.

Thus, at the moment it is most advisable to take a wait-and-see attitude on the pair. A rise in price may be false, especially if the upside impulse begins to fade around the 1.1360 resistance level. Long positions are risky, short positions are not yet justified by anything.