The pound/dollar continued to grow this week. It is very important that the growth of the British currency began around the same time when the Bank of England raised the key rate by 0.15%. Of course, it is now quite difficult to say when the next increase will happen, since even the December one was quite unexpected for many traders and at the same time, the quantitative stimulus program continues to operate in Britain. Nevertheless, it cannot be denied that the pound sterling received serious market support against the background of this BA decision. From our point of view, the pound may well be at the beginning of a new upward trend. We have already said earlier and once again draw attention to the fact that the price bounced from the important 38.2% Fibonacci level on the 24-hour TF. Consequently, after a slight downward correction, the upward movement may resume. The support for the "bullish" trend will be the Senkou Span B and Kijun-sen lines.

In the new week, the British currency will look for support from the fundamental background. According to tradition, there will be a little of it in the UK. In the UK, they like to publish all the most important statistics on one day, and on the rest - not to provide any important information. So it will be next week. Nothing interesting is planned from Monday to Thursday. But on Friday, important reports on GDP for different periods of time, a report on industrial production and the balance of visible trade will be published. Of course, the most important data will be on GDP. According to forecasts, GDP may increase by the end of November, and this may support demand for the pound. At the same time, we believe that this report can be considered local in terms of significance. That is, it is unlikely to affect the overall mood of the market, whatever it may be. As for other news from the UK, but with the beginning of the new year, negotiations with Paris and Brussels on the "Northern Ireland protocol" with the second and on the "fish issue" and the "migration issue" with the first should resume. As before, these topics do not have any impact on the pound yet. Nevertheless, given the looming, another political crisis and the fact that many Britons are not happy with the results of Brexit, Boris Johnson's policy, the solution or absence thereof of these issues may affect the political sphere of the country.

Of course, American statistics will be even more important. After all, the United States remains the country with the largest economy in the world, and the dollar has the status of a reserve currency. Hence the corresponding regalia and privileges. Two important reports and two not-so-important reports will be published in the US next week. First of all, you should pay attention to the inflation reports for December and retail trade volumes for the same month. It is expected that the consumer price index will continue to grow and will amount to 7.0-7.1%. If this forecast comes true, then the probability that the QE program in America will be completed ahead of schedule, and rates will start to rise faster, will increase. And this, in turn, is a bullish factor for the US currency. However, as we said earlier, all these factors can already be fully taken into account by the market, but the dollar can still receive local support. The retail trade report is likely to be as neutral as possible. On Friday, data on industrial production in December and the consumer sentiment index from the University of Michigan for January will also be published. We believe that the second indicator may affect the course of trading, but only if its value is very different from the previous one (70.6) or forecast (70.0). There will also be speeches by several Fed members over the next week, who are likely to be "hawkish", which may also support the US currency.

Recommendations for the GBP/USD pair:

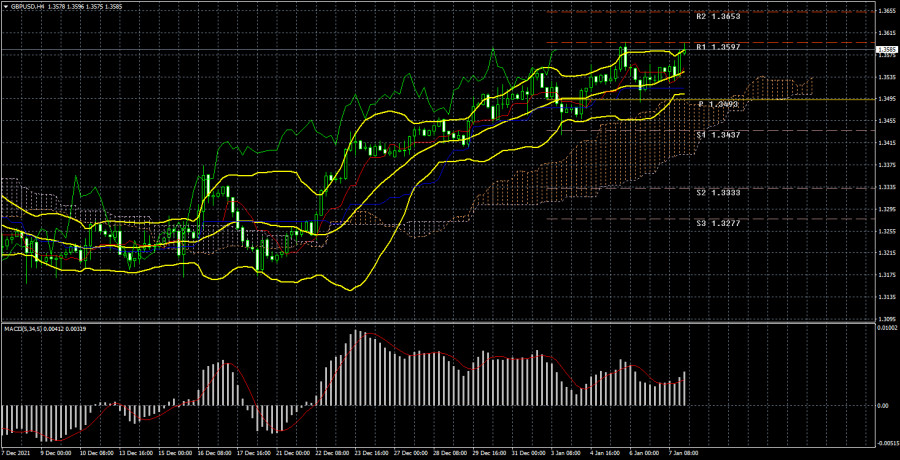

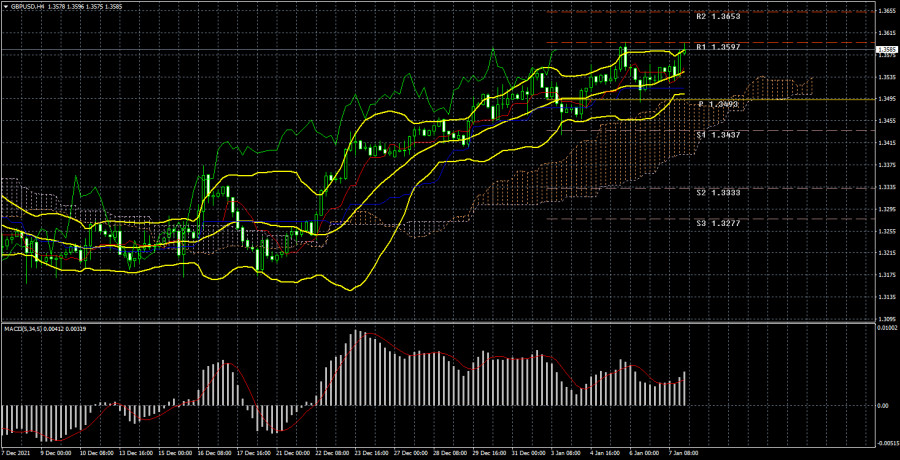

The pound/dollar pair continues its upward trend on the 4-hour timeframe, as evidenced by the Bollinger Bands and Ichimoku indicators. At the moment, the pair continues to be located above the critical line, so there is no reason to expect even a correction. Consequently, the growth of the British currency can continue with the goals of 1.3653 and 1.3757. Only if the price is fixed below Kijun-sen and/or Senkou Span B, we can expect a correction of 200 points, according to our conclusions made on the 24-hour TF. But in general, we expect the upward trend to continue globally in the next few months.

Explanations to the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target levels that are targets when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).