Conditions for opening long positions on GBP/USD

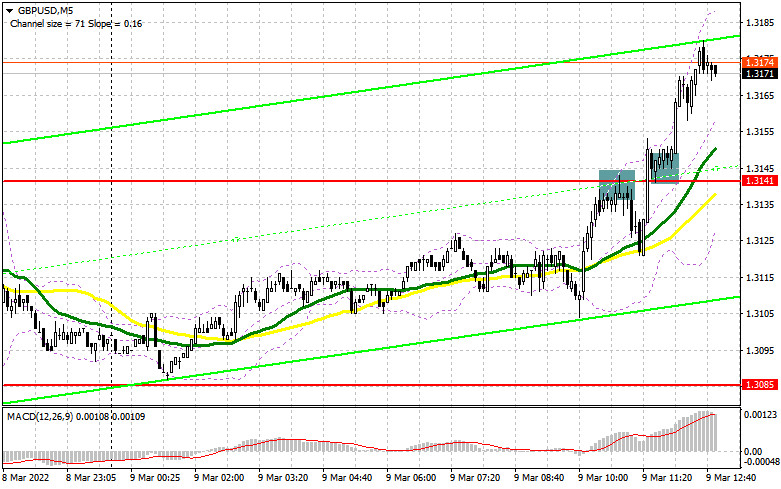

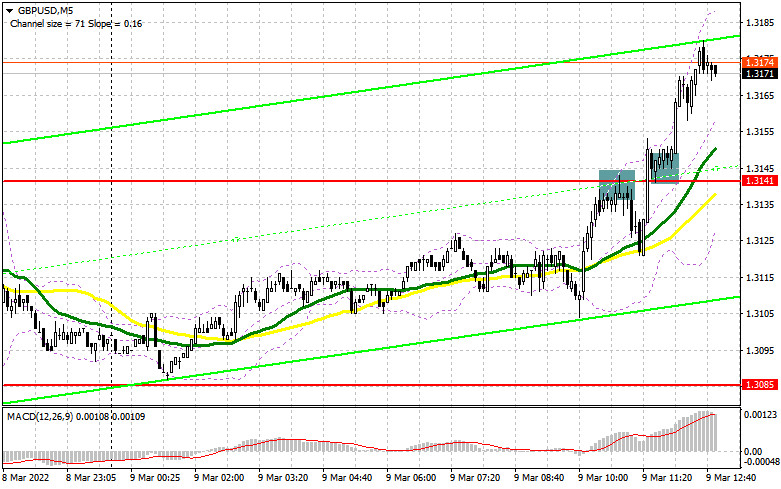

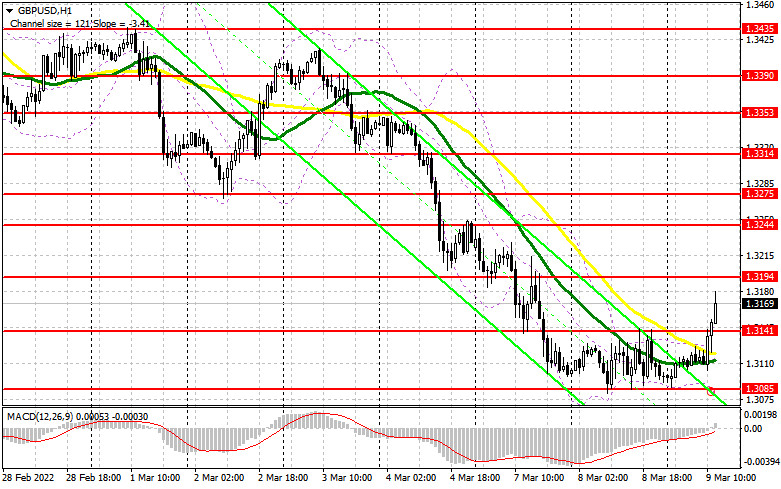

Earlier, I recommended focusing on the level of 1.3141 to take decisions to enter the market. Let us take a look at the 5-minute chart to analyze the market situation. A failure to consolidate above the resistance level of 1.3141 formed a sell signal. However, the pound sterling showed an insignificant decline. After a drop of 15 pips, bulls became active again, thus allowing the currency to break and consolidate above 1.3141. As a result, traders had to close sell positions with small losses and open buy orders, expecting the continuation of the upward correction. By the moment I wrote the article, the pair had gained more than 35 pips.

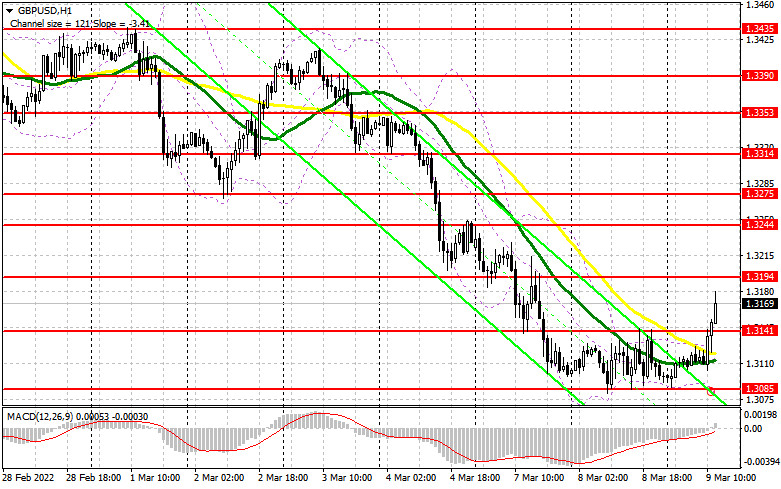

Since the macroeconomic calendar is not rich in events today, the pound sterling may receive support only from expectations of positive results of the Ukraine-Russia talks. Of course, this will hardly cause a trend reversal. The rise could be explained by the fact that traders lock-in profits ahead of important news, including the US consumer price report that is slated for release tomorrow. Until the pound/dollar pair trades above 1.3141, it will have every chance to hit new intraday highs. In the second part of the day, buyers should protect the support level of 1.3141. If the pair drops to this level after the publication of the data on the US job openings and oil inventories, traders should wait for a false break and buy the pair, expecting a rise to 1.3194. If the price downwardly breaks this level, some bullish stop orders could be executed, thus supporting buyers. In this case, the pair may climb to 1.3244 and 1.3275. The level of 1.3314 could act as a farther target. However, the pair will be able to reach it only tomorrow after the publication of the US inflation report. We should also remember that the Bank of England is considering a key interest rate hike, which is a strong bullish signal for the pound sterling. If the pair drops and bulls fail to protect 1.3141, a pessimistic scenario is likely to come true. A break of 1.3141 is likely to increase pressure on the pair. In this case, it is better to avoid long positions until we see a false break. It is possible to buy the pound/dollar pair from 1.3034 or from 1.3976, expecting an upward correction of 20-25 within a day.

Conditions for opening short positions on GBP/USD

Bears will hardly regain control over the market soon. If the pair closes the day below 1.3141, pressure on the pound sterling will rise. The British pound is significantly oversold especially amid the future key interest rate hike by the BoE. That is why traders should be very cautious about opening short positions. Only in case of a false break of 1.3194, it is possible to sell the pound/dollar pair. The support level of 1.3141 will act as the main target. A downward break of the level will provide traders with a short signal with the target at 1.3085. The area of 1.3034-1.2976 is a farther target, where it is recommended to lock-in profits. If the pair continues climbing amid weak data from the US, it is better to avoid sell positions. A break of 1.3194 may lead to a surge in the pair amid new stop orders initiated by sellers. In this case, sell orders could be opened after a false break of 1.3244. It is possible to sell the pound sterling from 1.3275, expecting a change of 20-25 pips.

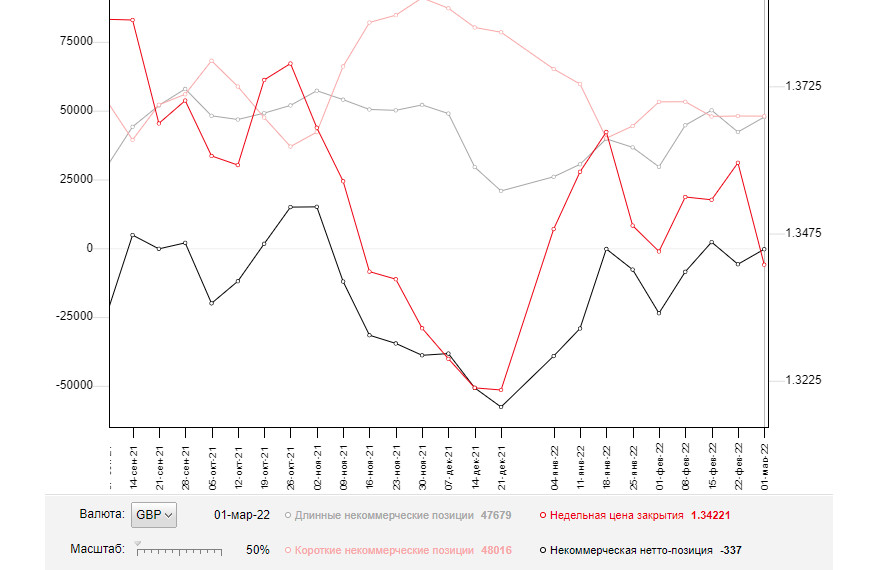

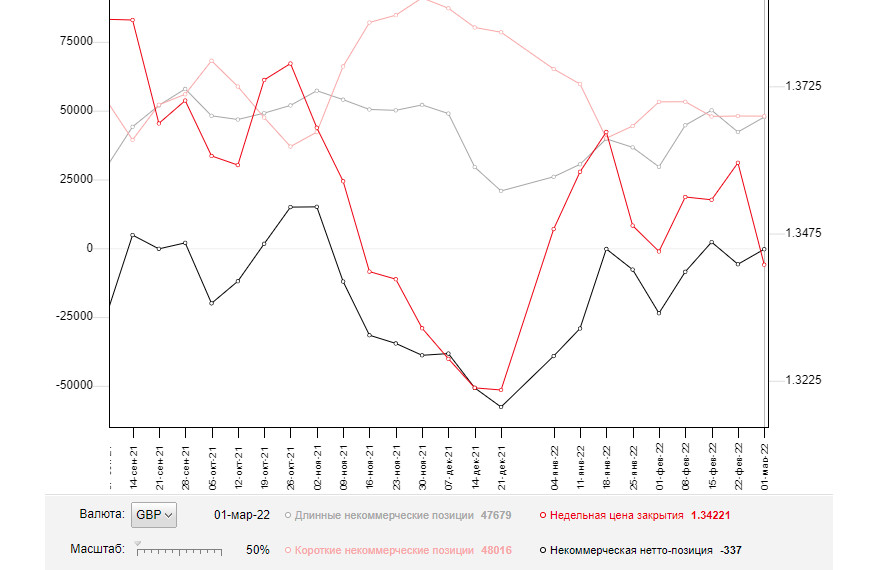

Commitment of Traders Report

According to the COT report from March 1, the number of long positions soared, whereas the number of short ones slumped. Notably, under the existing conditions, such reports are of minor importance. Currencies may change by 100-200 pips a day amid the present geopolitical situation. Next report is likely to unveil a jump in short positions. That is why it is better not to take into account the current figures. There is no use to predict a further policy of the BoE and the US Fed. If the situation in Ukraine becomes worse, monetary policies will be of minor importance. Russia and Ukraine are holding a new round of negotiations. A lot will depend on the meeting results. However, it is obvious that high inflation in the UK will make the BoE take more radical measures. Since the economic growth is slackening and Russia is planning to take response measures, the regulator will hardly raise the benchmark rate more than expected. However, it is necessary to do so. Otherwise, people's savings will vanish. The COT report unveiled that the number of long non-commercial positions increased from 42,249 to 47,679, while the number of short non-commercial positions decreased from 48,058 to 48,016. The weekly closing price dropped to 1.3422 against 1.3592.

Signals of indicators:

Moving Averages

Trading is conducted just below the 30- and 50-day moving averages, which indicates that bears are still controlling the market. .

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the price drops, the lower limit of the indicator located at 1.3085 will act as a support level.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands (Bollinger Bands). The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions is a total long position opened by non-commercial traders.

- Short non-commercial positions is a total short position opened by non-commercial traders.

- The total non-commercial net position is a difference between the short and long positions opened by non-commercial traders.