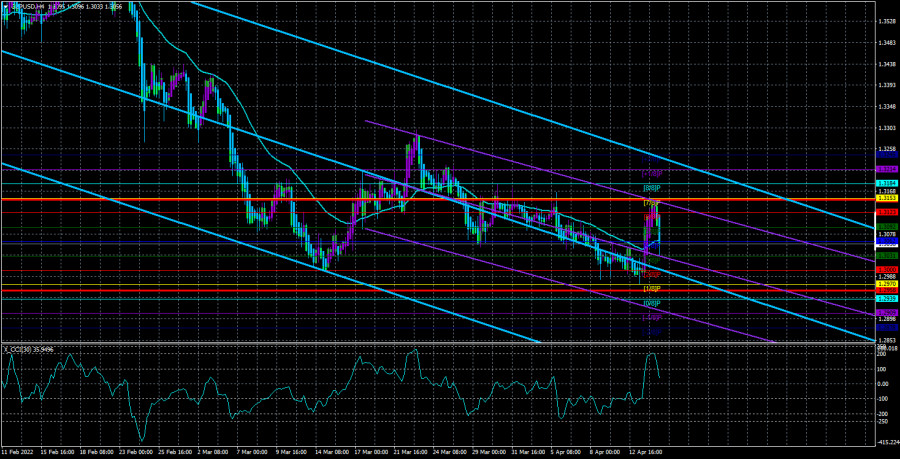

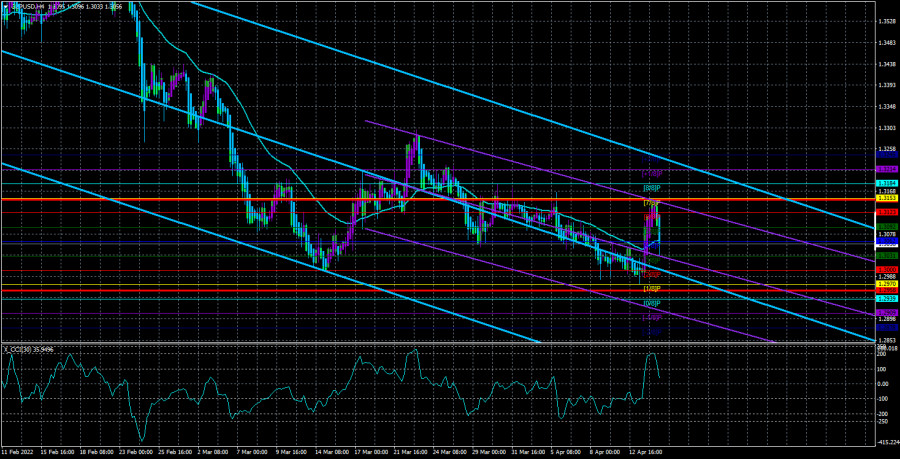

The GBP/USD currency pair on Wednesday managed to grow by 170 points at the end of the day. Part of this movement has already occurred on Thursday, but nevertheless. The point is that the pound sterling has absolutely out of the blue increased by almost 2 cents per day. For the same reasons, we can only single out a rebound from the level of 1.2981, which is a 15-month low for the pair. However, even for the strongest technical signal on the 4-hour TF, a movement of 170 points in less than a day is a lot. On Thursday, when, we emphasize, there were no statistics in the UK, there were no important statistics in the US, the British pound rushed down with no less speed. It began its fall when the results of the meeting of the European Central Bank were announced in the European Union, whose monetary policy has nothing to do with the UK or the British pound. At the same time, a report on retail sales for March was published in the States, which was only 0.1% different from the forecast values. And in a smaller direction. It could not provoke a sharp strengthening of the US currency in any way. The same goes for the report on applications for unemployment benefits and the consumer sentiment index from the University of Michigan. Thus, the pound collapsed on Thursday by more than 100 points for no reason. And the day before, it rose by more than 100 points for no reason. It's been such a crazy two days.

From a technical point of view, the pound/dollar pair may return and consolidate below the moving average line. As we have said in all our recent reviews without exception, there remains a high probability of a further fall in both the euro and the pound. Even despite the upward technical corrections that should happen from time to time. This week we saw such a correction, so now the pair can once again return to the level of 1.2981 and still overcome it on the third or fourth attempt. We believe that the downward trend continues, and the euro and the pound still have a strong enough potential to fall against the US currency.

Russia is not ready to conflict with Finland

Although the USSR attacked Finland in 1939, Helsinki maintained its non-bloc status and neutrality for the next 80 years. Only the events of recent months in Ukraine have forced the Finnish people (and at the same time the Swedish people) to change their minds about NATO and their security. The Kremlin has been actively warning the Baltic states over the past two months that Moscow will have to react to the possible deployment of NATO bases 200 km from St. Petersburg. Yesterday, Deputy Chairman of the Russian Security Council Dmitry Medvedev covered this issue in detail. The former head of the Russian Federation explained that if Sweden and Finland join NATO, the land border with the Russian Federation will double. Accordingly, it will have to be seriously strengthened, the grouping of ground forces and air defense will have to be strengthened, and naval forces will have to be deployed in the Gulf of Finland. According to Medvedev, the reasons for the desire of the two countries to join NATO do not lie in the special operation in Ukraine. "Even before Ukraine, attempts were made to drag these countries into NATO," Medvedev said. He also noted that Russia has no territorial disputes with Finland and Sweden, unlike Ukraine, so "the price of such membership in NATO is different." The clarification of the situation from Medvedev removes some of the tension from the markets. However, as we can see, the overall geopolitical background remains negative, so risky currencies continue to fall against the dollar.

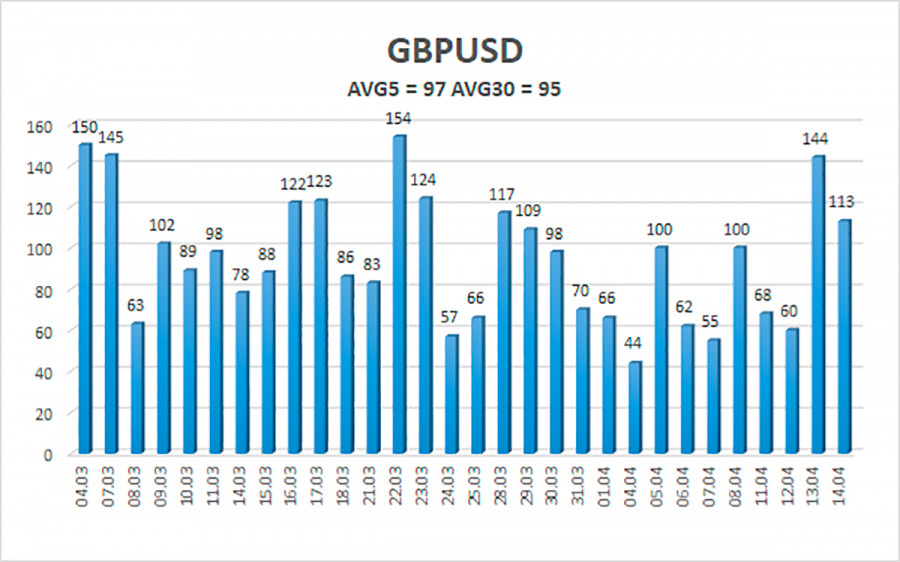

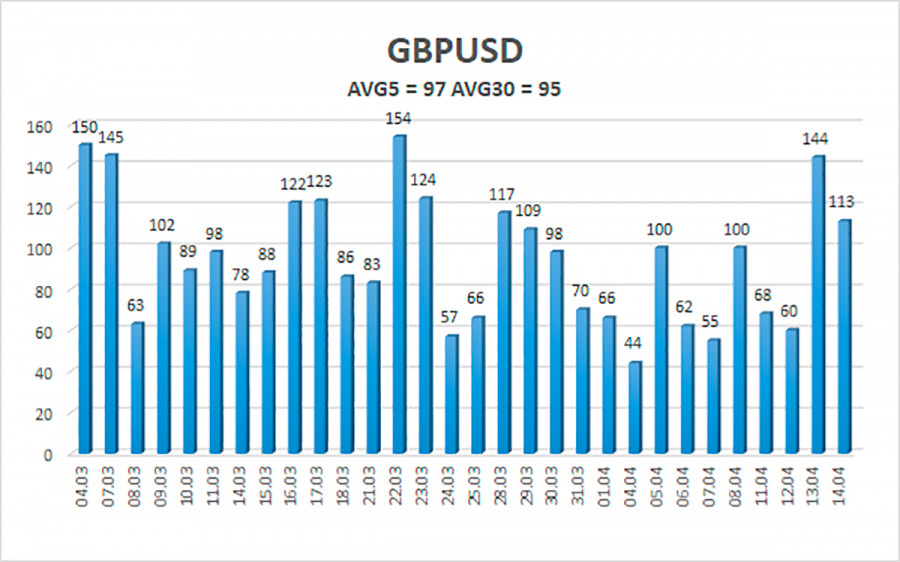

The average volatility of the GBP/USD pair is currently 97 points per day. For the pound/dollar pair, this value is the average. On Friday, April 15, thus, we expect movement inside the channel, limited by the levels of 1.2958 and 1.3152. A reversal of the Heiken Ashi indicator upwards will signal a possible continuation of the upward movement if the price remains above the moving average.

Nearest support levels:

S1 – 1.3062;

S2 – 1.3031;

S3 – 1.3000.

Nearest resistance levels:

R1 – 1.3092;

R2 – 1.3123;

R3 – 1.3153.

Trading recommendations:

The GBP/USD pair is trying to start an upward trend in a 4-hour timeframe. Thus, at this time, buy orders with targets of 1.3123 and 1.3153 should be considered if the price remains above the moving average. It will be possible to consider short positions if the price is fixed below the moving average line with targets of 1.3000 and 1.2970 (and below). The pair has problems with overcoming the 30th level.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, it means that the trend is now strong;

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now;

Murray levels - target levels for movements and corrections;

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators;

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.