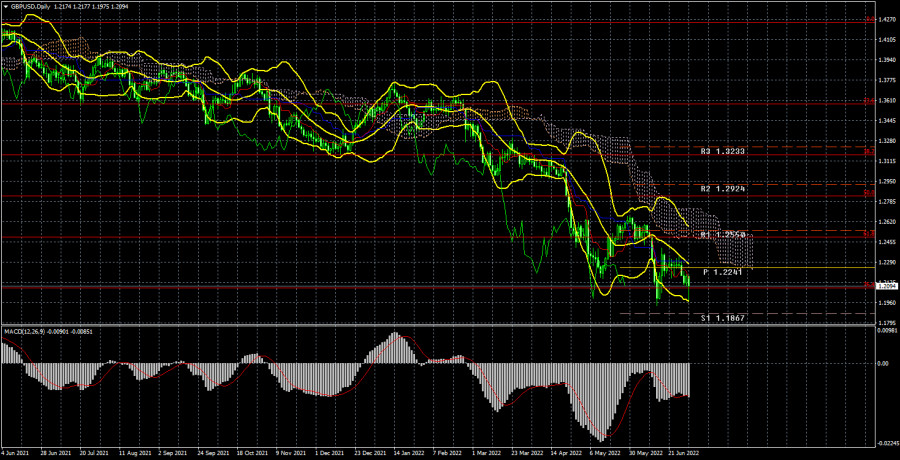

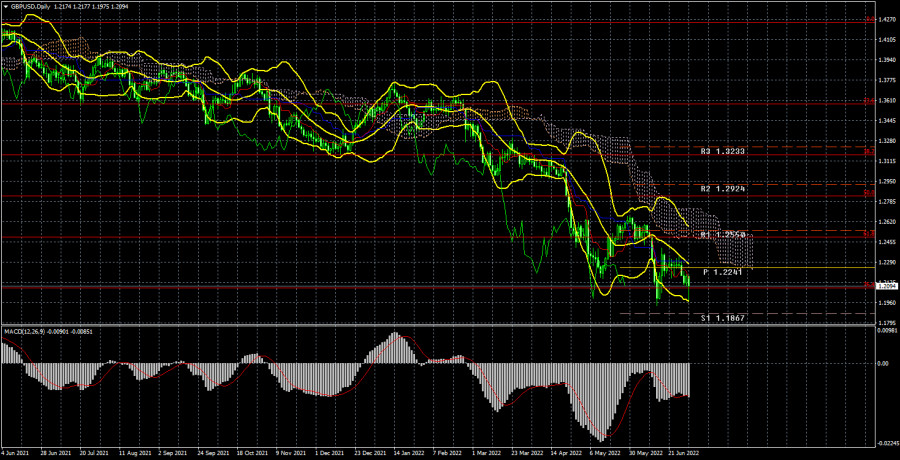

Long-term perspective.

This week has seen a 170-point decline in the GBP/USD currency pair. We cannot claim that the fundamental or macroeconomic basis supported such a decision. Although recent British figures have declined, the US and the EU are also experiencing difficulties. The possibility of a recession and excessive prices are universal issues. Therefore, it is incorrect to claim that the British pound's decline is a result of how much weaker the UK economy is than the US economy. Instead, the opposite. For instance, the GDP data for the first quarter in Britain is significantly greater than in the USA, where a decline of 1.6% q/q was noted. British GDP data just released this week indicated a rise of 0.8%. However, the UK didn't experience any more significant events. In June, the index dropped once further, reaching 52.8. But the US and the EU are currently experiencing a decline in corporate activity. As a result, we tend to think that the market environment has caused the pound to start falling again. The idea that Britain's conditions are not significantly worse than elsewhere is not even a thought among traders, who are already accustomed to dumping unstable currencies and assets. It would be best to sell the pound because the geopolitical situation is difficult, and the Fed rises interest rates more quickly and forcefully than the BA. That is the entire premise. The technical picture, however, poses even fewer issues. The pair is still trading below the crucial line and the Ichimoku cloud, continuing the long-term downturn. As a result, there is no indication that the pair may increase in size. The situation is very similar to the euro/dollar pair.

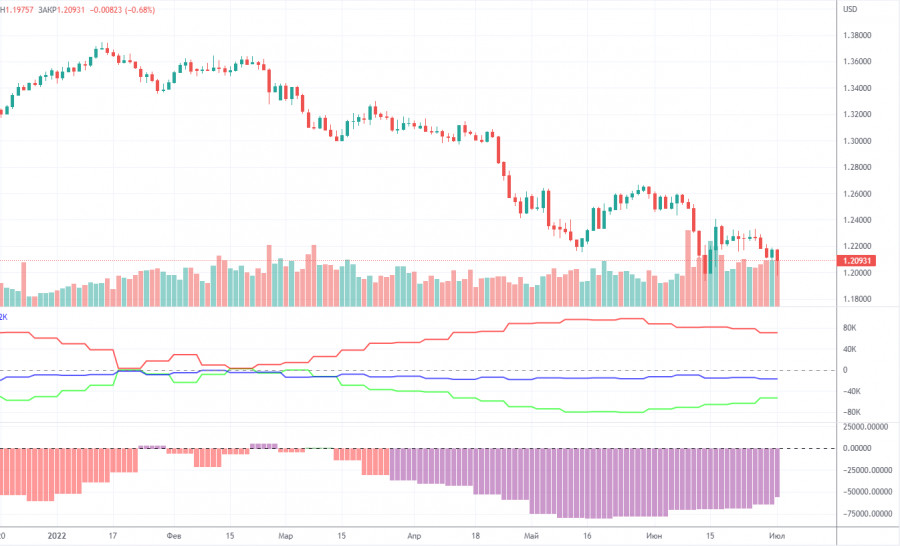

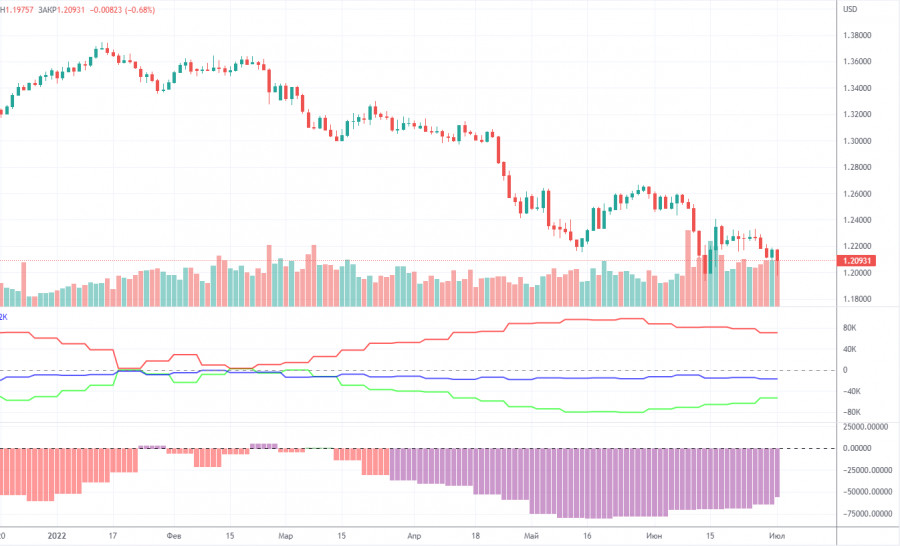

COT Analysis.

The British pound had minimal adjustments according to the most recent COT data. The Non-commercial group opened 6,700 buy contracts and closed 3,400 sell contracts throughout the week. As a result, non-commercial traders' net position climbed by 10,000. However, the second indicator in the accompanying image makes it quite evident that the key players' outlook is still "pronounced bearish." And despite the net position's improvement, the pound is still unable to exhibit even a slight upward correction. Even though the net position has increased after decreasing for three months, the British pound is still declining, so what does it matter? We've already mentioned that the demand for the dollar, which is presumably still highly high right now, is not considered by the COT reporting on the pound. Therefore, even for the British pound to strengthen, demand for it must increase more quickly and strongly than demand for the US dollar. In total, 88 thousand sales contracts and just 35 thousand purchase contracts have been opened by the non-commercial group to date. For a very long time, net positions must increase for these numbers to at least stabilize. Fundamental developments or macroeconomic facts do not support the UK currency. We can only expect corrective growth, but we anticipate that the pound will continue to decline over the next few months.

Analysis of fundamental events

There weren't many significant occurrences this week in the United States either. Speaking at the economic forum in Portugal was Jerome Powell, which the markets were not surprised by. A report on long-term goods orders released on Monday revealed that they exceeded expectations. The production business activity index, released on Friday, showed a further drop. It is therefore impossible to describe American statistics as being robust. But as we can see, the dollar's value has increased once more. As we have already stated, macroeconomics only influences currency movement locally; it cannot alter trader sentiment or cause a trend to change. Therefore, a shift in global fundamental and geopolitical circumstances is necessary for the pound and the euro to begin growing. Of course, there's also the chance that the market will get weary of buying hazardous currencies. It also cannot be disregarded. It is impossible to predict at what price values this will occur for obvious reasons.

1) The pound/dollar pair very quickly finished the bare minimum upward corrective, according to the trading plan for the week of July 4-8. It was unable to cross the crucial line this time. Therefore, purchases are still irrelevant at this time and should only be considered after the price has been fixed above the Ichimoku cloud. Although the pair still has the potential to rise, the market's bullish sentiment and buyers' desire are not at the level needed to predict a significant rise in the pound's value.

2) As the pound sterling stabilized below the crucial line, we may say that the downward trend has restarted. Technically speaking, there is no reason to anticipate a rise at this time. Therefore, if traders can push through the Fibonacci level of 76.4 % -1.2078 at this time, sales with a target of 1.1410 (100.0 percent Fibonacci) are relevant.Explanations of the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels – target levels when opening purchases or sales. Take Profit levels can be placed near them;

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5);

Indicator 1 on the COT charts - the net position size of each category of traders;

Indicator 2 on the COT charts - the net position size for the "Non-commercial" group.