The GBP/USD currency pair also traded very calmly on Tuesday, below the moving average line. We have already said that consolidation below the moving average can be considered a resumption of the global downward trend since all indicators are directed downwards. However, on the 24-hour TF, the price is still above the critical line, so the pound retains some chances of resuming growth. That's just why some good reasons are needed for this. And what could they be now? Geopolitics and the "foundation," as we have seen more than once, continue to pressure the pound. The internal political situation in the UK leaves much to be desired. The UK economy continues to be in a fever, and in the next few years, it may slip to the level of "crisis" Greece. Naturally, we exaggerate, but many problems are visible to the naked eye.

To begin with, everyone is criticizing Liz Truss now, even though she has just assumed the post of prime minister, and it would be nice to wait at least a year so that she can show at least some results. However, they can no longer imagine their lives without political crises in Britain, so signatures are collected to declare a vote of no confidence in her. Of course, it will not work to replace Liz just a month or two after the Conservatives themselves elected her as their leader. Most likely, this step is aimed at showing the seriousness of disagreement with her first steps at the head of the government. Nevertheless, the case itself is out of the ordinary.

Furthermore, Scotland will not calm down and insists that London give her official permission to decide her fate independently. In Scotland, they cannot accept that the British made the decision on Brexit for them. The majority of Scots voted against leaving the EU in the 2016 referendum. And in 2014, Scots voted to stay in the UK. Now they want to leave it and rejoin the European Union. It seems that the Scottish people themselves cannot decide what they need for a happy life. But this does not make it any easier in Westminster since, at some point, Edinburgh may go on an active offensive, hold a consultative referendum, and then appeal to the Supreme Court to prove the illegality of London's refusal to grant the right to a new referendum on independence.

Economists had plenty of time to study Kwarteng and Truss' tax initiatives closely. It turned out that the new tax reduction plan is not supported by alternative income, voters' approval, or parliamentarians' approval. Simply put, everyone is against tax cuts; at least, that's what economists and politicians themselves say. But we do not hear the opinions of the British. The same politicians speak for them, who often pursue their own goals. Sometimes, these goals are really "state-scale," and the foresight of the political elite, in this case, is a good plus for the people and the nation. But sometimes, the politicians themselves do not benefit from one or another plan that will ease the fate of the people.

Experts also note that, from an economic point of view, the plan is a complete failure since the budget deficit will amount to an additional 250 billion pounds. The markets also did not stay away. The Treasury bond debt market rose by almost 5%, and the pound collapsed to its absolute lows. Therefore, the central bank had to intervene urgently and print money to buy British bonds to stabilize the yield rate at least a little. And this, although just a couple of weeks ago, the Bank of England itself announced its readiness to start unloading its balance sheet, that is, to launch the QT program, which is aimed at reducing the money supply and fighting inflation. Investors immediately rushed to get rid of British assets. Thus, now the Truss government faces a very important task – to "give back" with minimal consequences for itself and for the entire Conservative Party, which at such a pace could lose its majority in Parliament at the next election.

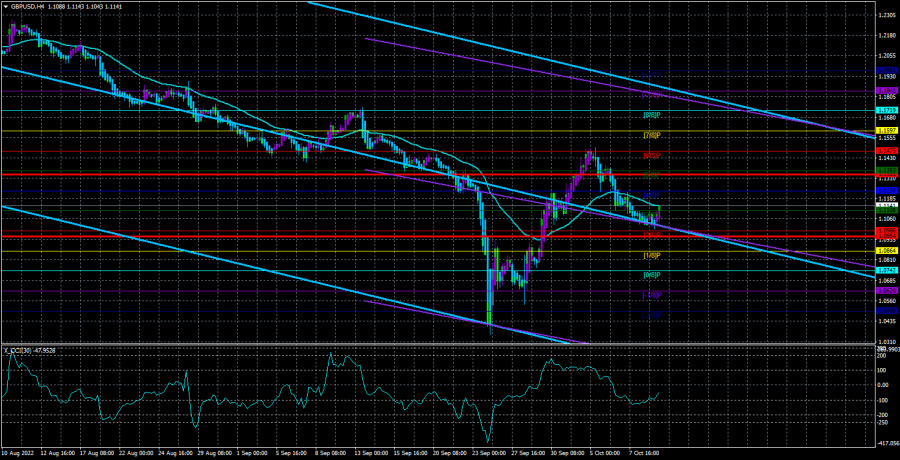

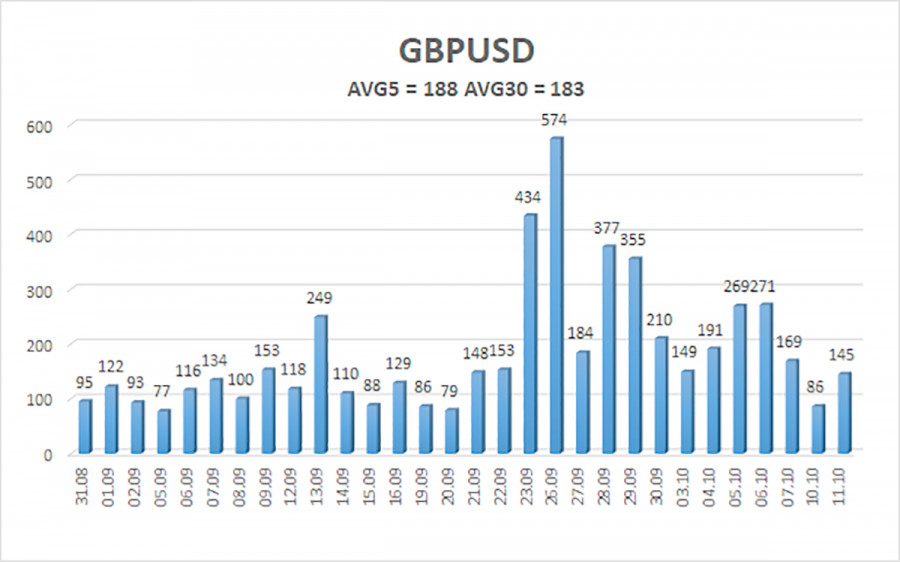

The average volatility of the GBP/USD pair over the last five trading days is 188 points. This value is "very high." On Wednesday, October 12, thus, we expect movement inside the channel, limited by the levels of 1.0954 and 1.1331. The reversal of the Heiken Ashi indicator downwards signals the completion of the upward correction.

Nearest support levels:

S1 – 1.1108

S2 – 1.0986

S3 – 1.0864

Nearest resistance levels:

R1 – 1.1230

R2 – 1.1353

R3 – 1.1475

Trading Recommendations:

The GBP/USD pair has started to adjust in the 4-hour timeframe but remains below the moving average. Therefore, at the moment, it is necessary to consider sell orders with targets of 1.0986 and 1.0954 in the case of a reversal of the Heiken Ashi indicator down. Buy orders should be opened when the price fixes above the moving average line with targets of 1.1230 and 1.1331.

Explanations of the illustrations:

Linear regression channels help to determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.