Australian consumers' confidence in the stability of the country's economy and their personal economy rose in January, despite rising inflation in the country. According to the Westpac index released Tuesday, consumer sentiment in January rose by 5.0% (to 84.3%) after rising by 3% a month earlier.

At the same time, the indicator from TD Securities, published at the beginning of the week, pointed to a slowdown in inflation in December (+0.2% after rising +1% in November).

The Australian dollar is also supported by data from China, which reflected a slowdown in GDP growth in Q4 2022 (from 3.9% to 2.9%) but turned out to be better than analysts' expectations at 1.8%, as well as an increase in commodity and gold prices: Australia, as you know, is a major exporter of such goods, in particular coal, liquefied gas, iron ore, and gold. China has also significantly relaxed anti-COVID restrictions, which should have a positive impact on the recovery of the Chinese economy, which actively uses Australian raw materials. Recently, new reports have come from China about easing anti-COVID restrictions, cancelling the mandatory PCR test for entry into the country, and citizens of the country will no longer be required to comply with centralized isolation.

Tomorrow, market participants following AUD quotes will receive a new batch of information and food for thought: at 00:30 (GMT), latest data from the Australian labor market will be published. Another increase in the employment rate is expected (by 22,500), and unemployment at the same level of 3.4% (previous values were 3.4% in November and October, 3.5% in September and August, 3.4% in July, 3.5% in June, 3.9% in May, April and March, 4.0% in February, 4.2% in January). An increase in the employment rate and a decrease (or low level) of unemployment is a positive factor for AUD.

If figures from this report turn out to be worse than the forecast, then the Australian dollar may decline sharply in the short term. Data better than the forecast will have a positive impact on AUD and the AUD/USD pair, respectively.

Today, market participants will study the report of the U.S. Census Bureau with data on retail sales. Consumer spending accounts for most of the overall economic activity of the population, while domestic trade accounts for the largest part of GDP growth. The relative decline in the indicator is expected to have a short-term negative impact on the dollar.

Also, statistics on U.S. producer prices in December will be presented.

The Producer Price Index (PPI) is one of the leading indicators of inflation in the United States, which evaluates the average change in wholesale producer prices. Previous values of the indicator: +0.3% (+7.4% YoY), +0.4% (+8.5% YoY), -0.1% (+8.7% YoY), -0.5% (+9.8% YoY), +1.1% (+11.3% YoY), +0.8% (+10.8% YoY), +0.4% (+10.9% YoY), +1.6% (+11.5% YoY), +0.9% (+10.3% YoY), +1 .2% (+10.0% YoY) in January 2022. Forecast for December: -0.1% (+6.8% YoY). The data testify to the continuing weakening of inflationary pressure, including on the Fed when it makes its next decision on monetary policy. If the data turns out to be better than the forecast (higher than the forecast values), the dollar is likely to strengthen in the short term; if worse than expected, it will continue its decline.

Also, for today (at 14:00, 14:30, 18:00, 20:00 GMT), speeches by Fed officials are scheduled. They are unlikely to cause a reversal of the general downward trend of the dollar, but cause an increase in volatility in its quotes—for sure, especially if Fed representatives make unexpected statements regarding the prospects for monetary policy. The hawkish rhetoric of their statements may have a positive impact on dollar quotes, but only in the short term.

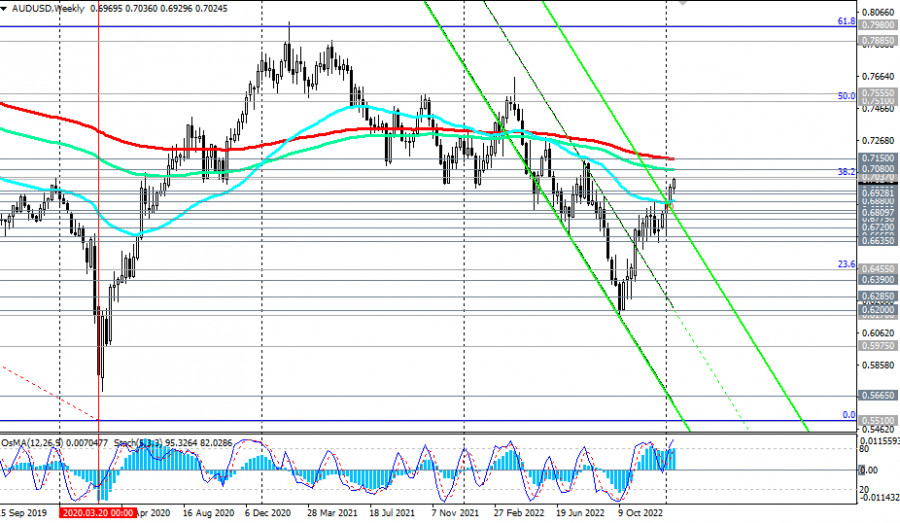

In general, the AUD/USD pair is dominated by a medium-term bullish trend in the form of a correction within a larger and global downward trend.

The pair is trading above key support levels 0.6880, 0.6830, while economists expect it to further strengthen and rise towards long-term resistance levels 0.7080, 0.7100, 0.7150.