After breaking below the moving average line the previous day, the GBP/USD currency pair recovered on Wednesday. Given the British pound's history of irrational rises, we advise traders to remain calm. The British pound started to increase again during the American trading day, completely out of the blue, and there is no explanation for this and there cannot be one. As a result, the pair is once again very close to its recent highs and is still very overbought. And a new, strong fall is still on the horizon.

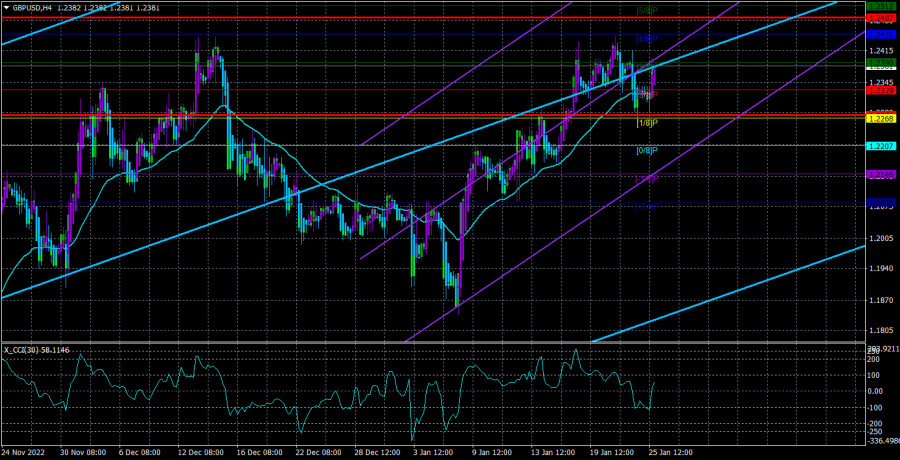

It should be noted that no technical sell signs have appeared yet. It just took a few hours for the pair to remain below the moving average, and now the rising trend is continuing. On a strong trend, the CCI indicator may return to the overbought level numerous times before the fall season starts. We would like to highlight the pound's inability to adjust once more, even at its greatest levels when its price has increased by 2,100 points in a short period. With no major macroeconomic events scheduled for yesterday, traders found justification to start long positions. Well, this is nothing new to us, and numerous economists and specialists continue to issue dire warnings about the impending devaluation of the pound.

The likelihood that the Bank of England's benchmark interest rate will increase by 0.5% the following week is decreasing. People's confidence in the British regulator's ability to take a tough stance toward rates is decreasing. Like many other regulators, BA is currently dealing with two fires, but its situation is significantly worse. First off, despite tax increases by the UK government, the budget deficit is still increasing rather than decreasing. Second, despite eight crucial rate rises, inflation in the UK is still out of control. Third, a recession was miraculously avoided in the fourth quarter, but most analysts predict that there won't be a similar "gift of fate" in 2023.

The state of the economy is getting worse.

As it turned out this week, business activity is still below the "waterline," British taxpayers' expenses are still high, and rates and taxes have gone up. All of this ought to cause a significant recession, as Rishi Sunak and Andrew Bailey have frequently predicted. It is important to realize that the current situation in an economy with little growth is just the beginning of the process. It is impossible to imagine that inflation will start to drop or slow down to the point where it will be at 2% in a year at the current level of the key rate, where it is still above 10%. As a result, the BA must keep tightening monetary policy, which will unavoidably cause the economy to "cool down" even more. Additionally, the British regulator is at a loss for alternatives. The earnings of British citizens will degrade very quickly if he chooses to "shut his eyes" to high inflation to sustain modest economic development because current pay growth is record-breaking but still below inflation. Given the current situation, the Conservatives will undoubtedly lose the upcoming election. So Rishi Sunak, a financier and economist, is faced with a difficult task: how to produce the least amount of recession (which can be justified to the British public) while increasing key interest rates the most. It is now exceedingly challenging to predict how this task can be completed. There is no need to have doubts about the UK if analysts are unsure whether there will be a recession in the US or the EU.

A record number of businesses and manufacturers are cutting production, according to the Confederation of British Industry, as they worry about losing government subsidies for paying their energy costs. According to the consulting firm Begbies Traynor, one-third more businesses are expected to declare bankruptcy by 2023. The British treasury's receipts rose by 11% over the previous year, but numerous initiatives to aid the populace and businesses negated any "oversupply," and the national debt is increasing. The government is assisting millions of people in surviving the cost of living issue, according to Finance Minister Jeremy Hunt, but we also need to remember that future generations will be responsible for paying it back, so the debt shouldn't be onerous for them. The outlook for the British pound is still bleak.

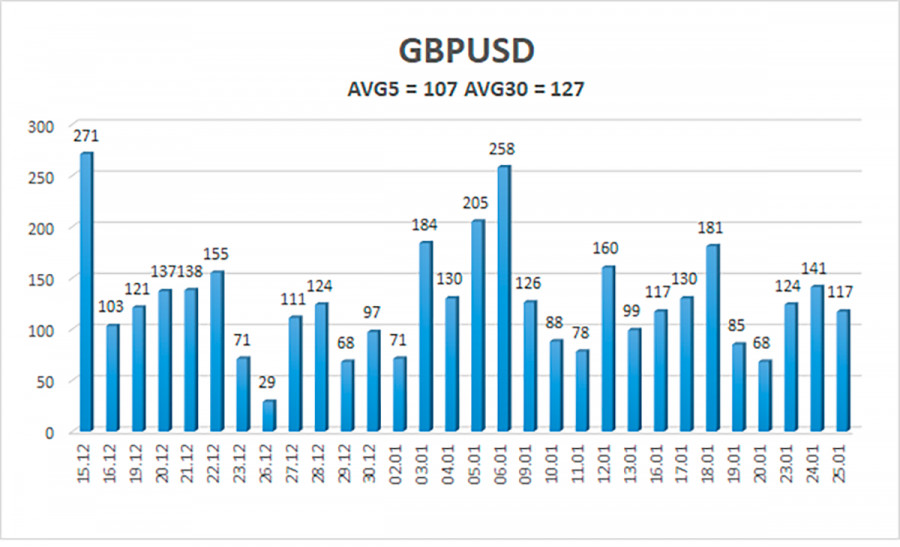

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 107 points. This number is the "average" for the dollar/pound exchange rate. Thus, we anticipate movement inside the channel on Thursday, January 26, with the levels of 1.2274 and 1.2487 acting as resistance. A new round of downward movement is indicated by the Heiken Ashi indicator turning downward.

Nearest levels of support

S1 – 1.2329

S2 – 1.2268

S3 – 1.2207

Nearest levels of resistance

R1 – 1.2390

R2 – 1.2451

R3 – 1.2512

Trading Suggestions:

In the 4-hour time frame, the GBP/USD pair returned to the region above the moving average. As a result, long positions with goals of 1.2451 and 1.2487 are currently possible until the Heiken Ashi turns down. If the price is locked below the moving average line, short trades can be opened with targets of 1.2268 and 1.2207.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.