The EUR/USD currency pair began a new downward reversal on Wednesday. This article has everything you need to know if you pay close attention to macroeconomic data and the fundamentals behind it. The fact is that despite not always having at least some justifications, let alone solid ones, the value of the euro has been rising rapidly in recent weeks. But yesterday, when a number of important reports came out at the same time that were bad for the US dollar, the dollar's value went up. In other words, when there are no reasons to buy a pair, traders buy, and when there are reasons to buy, they sell. Thus, there is currently no logic in the market's movements. Currently, the macroeconomic background is precisely the background to which absolutely nobody pays attention. Consequently, we can now anticipate almost any movement.

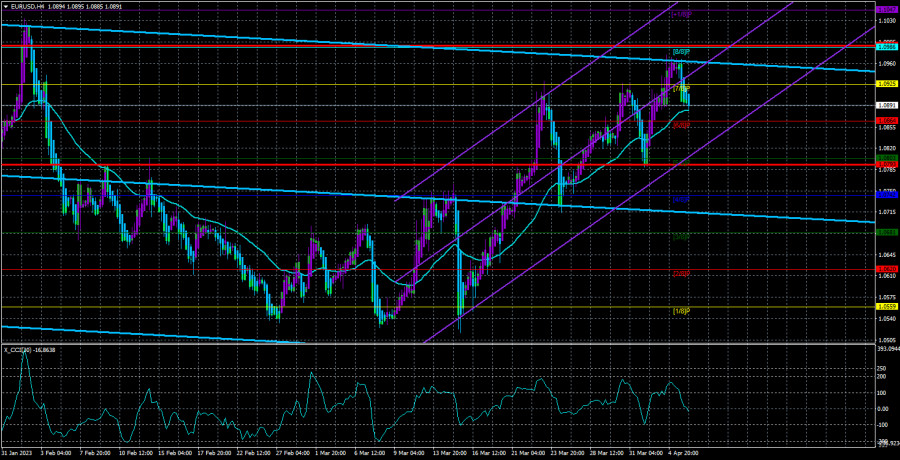

Currently, the technical picture could be clearer. The European currency rose to the Fibonacci level of 1.0938 (50.0%) on the 24-hour TF but could not surpass it. Therefore, the "swing" is still intact, and the pair from the current places may rush down once more. We are considering carefully if the recent upward trend of the euro and the pound was a trap for buyers. Both currencies have successfully attempted to exit the side channel on the daily time frame (TF). But past experience shows that the quotes may have risen a bit above the side channels. This doesn't change the main point, though. It is unclear why the euro has risen over the past few weeks. What further reasons does it have to grow following a 450-point increase? We continue to anticipate that a new wave of 500-600 point declines will begin, but we warn that these are merely our forecasts and understanding of the current situation. Even a fixation on the 4-hour TF below the moving average does not guarantee the start of downward movement.

Reports that failed to make a profit were disregarded.

The analysis of the macroeconomic events of the previous day should begin with the release of the JOLTs reports the day before. This data turned out to be worse than expected, which caused the dollar to drop again. On Wednesday, the business activity index in the European Union turned out to be only slightly below expectations but generally positive for the euro, the ADP report in the United States on the labor market fell short of expectations by as many as 55,000, and the ISM business activity index in the United States services sector dropped to 51.2, compared to a forecast of 54-54.5. Hence, the two most significant reports in the United States were significantly weaker than anticipated. Certainly, some market experts may argue that the ADP data has never been relevant, while the ISM index has remained above the "waterline" of 50.0. In this instance, though, why did the dollar fall precipitously in response to the JOLTs report a day earlier, which is not the same quality as nonfarm payrolls?

There is just one feasible reason. The market interprets all received data in a manner currently advantageous to it. Yesterday, most traders believed it necessary to take a break; today or tomorrow, the euro currency may again see a random increase. Consequently, we consider the following: It is prudent to anticipate a decline in quotes; you must be prepared. The euro's value will only increase with precise causes and grounds. Any sell indication, however, should be regarded with caution. There have been many such indications recently, but none have resulted in a significant price decline. On Friday, several significant statistics will be released in the United States, and the market will search again for a reason to sell the dollar. Even if the data does not fail, the pair can still grow.

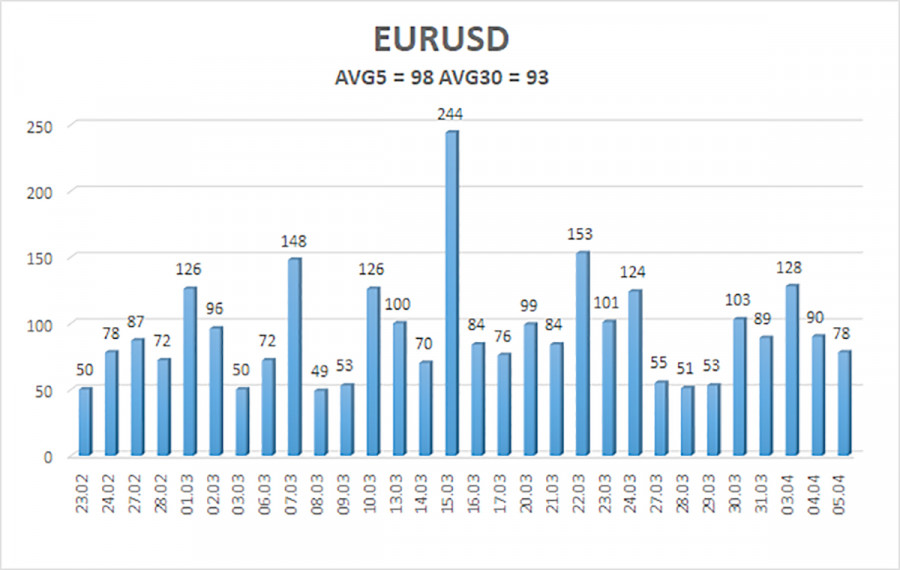

As of April 6, the average volatility of the euro/dollar currency pair for the previous five trading days was 98 points, considered typical. We, therefore, anticipate the pair to trade between 1.0793 and 1.0989 on Thursday. The reversal of the Heiken Ashi indicator to the top will signal the continuation of the rising trend.

Nearest support levels:

S1 – 1.0864;

S2 – 1.0803;

S3 – 1.0742.

Nearest resistance levels:

R1 – 1.0925;

R2 – 1.0986;

R3 – 1.1047.

Trading Recommendations:

The EUR/USD currency pair remains above the moving average line. Currently, we can consider additional long positions with targets of 1.0986 and 1.0989 in the event of a bullish reversal of the Heiken Ashi indicator or a price rebound from the moving average. Once the price falls below the moving average line, new short options can be opened with targets of 1.0803 and 1.0793.

Explanations for the illustrations:

Channels of linear regression – aid in determining the present trend. The current trend is strong if both are moving in the same direction.

Moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction;

Murray Levels - movement and correction target levels;

Volatility levels (red lines) represent the price channel in which the pair is anticipated to trade tomorrow based on current volatility indicators.

The CCI indicator — its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.