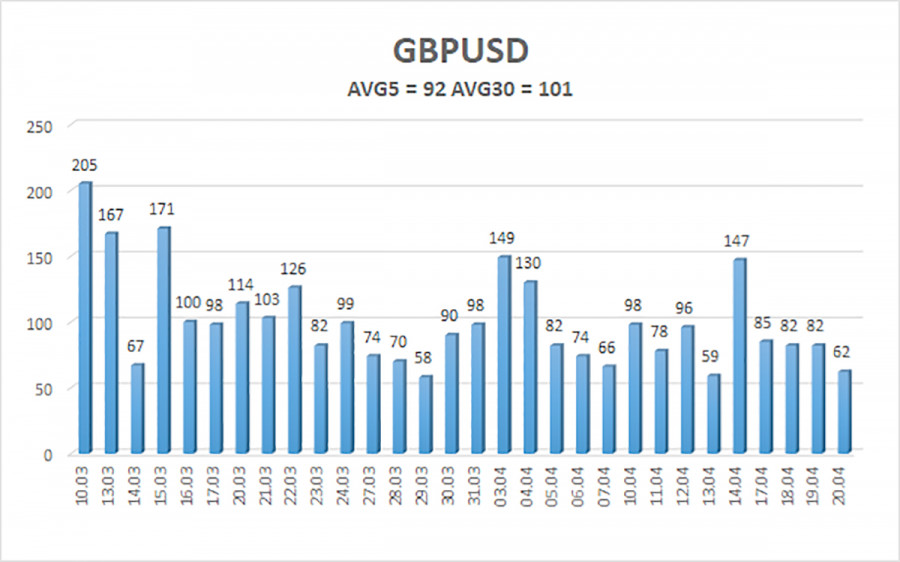

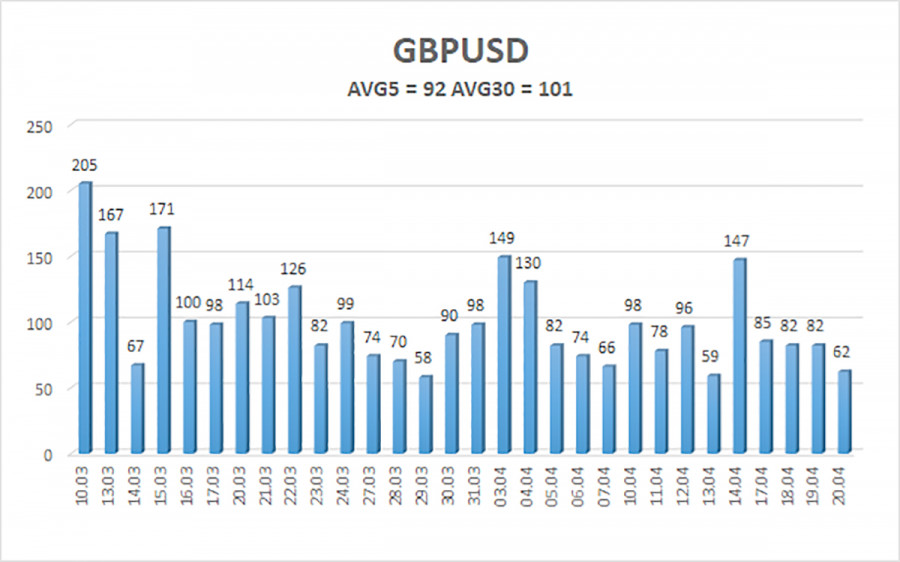

The currency pair GBP/USD showed the same "nonexistent" movements on Thursday as the EUR/USD pair. In the article on the euro, we already discussed that the fundamental and macroeconomic backgrounds were virtually absent yesterday. All events and publications marked on the calendar as important were different. Therefore, the pair was almost immobilized all day. Of course, this does not mean it was standing in one place. However, even from the illustration below, it can be seen that volatility has decreased significantly in recent weeks. We remind you that the volatility indicator should be read and understood correctly. If you trade intraday and volatility is equivalent to 90 points, this does not mean that traders could earn 90 points. Part of the movement falls on night trading; trading signals are impossible to work out immediately, and the movement begins much earlier than the formation of trading signals. Therefore, a movement of 90 points allows you to count on a profit of about 40–50 points at best. If you add the absence of a trending movement to this, we also add the formation of false signals, which "eat" part of the profit. As a result, 90 points of volatility look solid, but in practice, they give traders little chance to leave with a good profit.

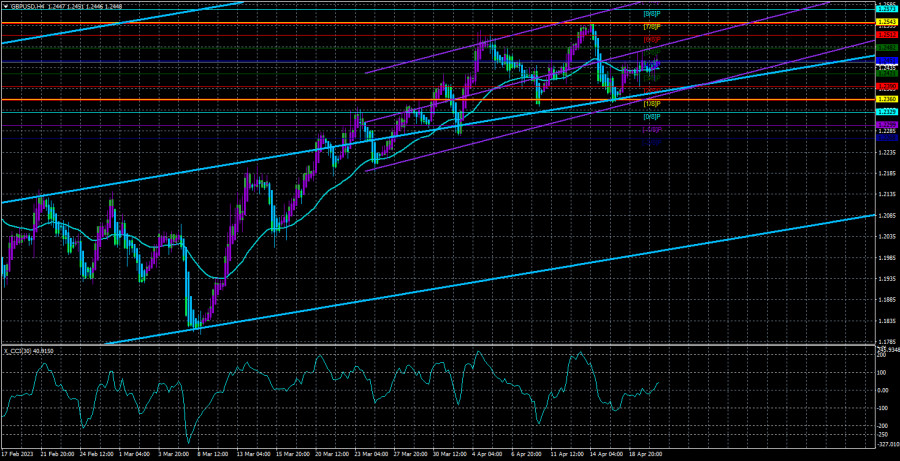

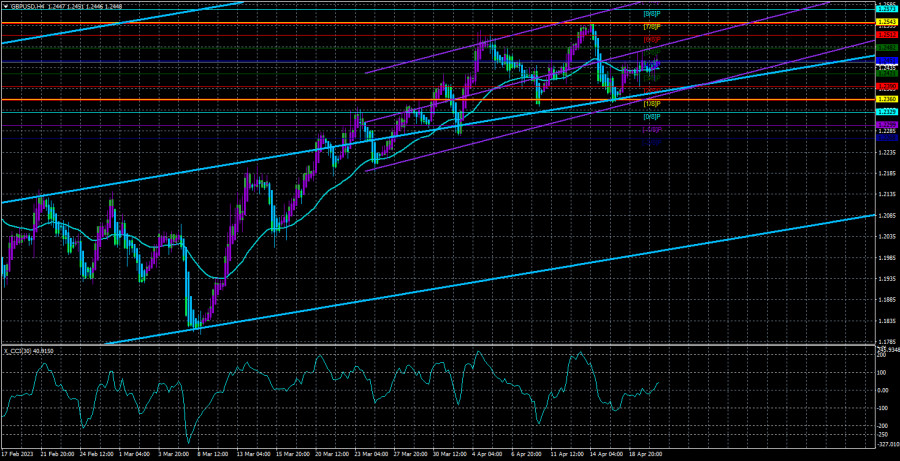

The picture on the 4-hour TF is approximately the same. Count how often the Heiken Ashi indicator has changed direction in the past few days. If, after each reversal, the pair passed 150–200 points, then you could earn very well. But it is now passing 30 to 60 points. Even entering a trade on time is quite problematic here. Therefore, the nature of the pair's movement now is such that it is better not to open trades at the current TF. It would be best if you traded either long-term or intraday.

Bostic adheres to a "moderately hawkish" position.

Meanwhile, the Federal Reserve's monetary committee representatives have become more active in the United States. A "quiet period" will begin in just two weeks, so they are making full use of the available time for interviews. Yesterday, Federal Reserve Bank of Atlanta President Raphael Bostic said he does not expect a recession in the American economy and supports another key rate hike. It should be noted that his opinion on recession expectations coincides with that of Bullard. However, they differ in rates. Mr. Bostic noted that inflation is decreasing too slowly, but he still hopes for a faster decline. He also noted that the rate should remain at its peak for a long time after the tightening cycle is completed. According to the head of the Atlanta Fed, the economy is still "accelerating," which stimulates inflation to grow rather than decrease. Of course, we see its rapid decline, but the economic acceleration slows down this process. Overall, Bostic confirmed market expectations for another rate hike of 0.25%.

It is difficult to say what traders expect from the Bank of England. We should expect a maximum of two more rate hikes, but there could be fewer. Inflation refuses to slow down, so it is time to pause and let the current rate level "unfold" fully. Andrew Bailey claimed that the full effect of tightening could last up to 18 months. Continuing to tighten in such conditions is unnecessary if it does not bring the desired result. It does not matter how long inflation remains high. It is not falling – that's the main thing. This means that a different approach is needed to avoid burying the economy, which has already been on the verge of contraction for the last few quarters. Given this fundamental background, it is a mystery how the pound manages to stay so high. We believe the pound is also heavily overbought and should fall, but the market seems to have a different opinion. We advise treating all sell signals cautiously, but remember that the pound may collapse anytime. Most likely, the fall of the euro and pound will be synchronized.

The average volatility of the GBP/USD pair over the last five trading days is 92 points. For the pound/dollar pair, this value is considered "average." On Friday, April 21, we expect movement within the channel, limited by levels 1.2360 and 1.2542. The Heiken Ashi indicator's downward reversal signals a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.2421

S2 – 1.2390

S3 – 1.2360

Nearest resistance levels:

R1 – 1.2421

R2 – 1.2451

R3 – 1.2482

Trade recommendations:

The GBP/USD pair on a 4-hour timeframe is trading near the moving average line. You can trade based on Heiken Ashi indicator reversals or smaller timeframes, as there is no clear trend – the price is too close to the moving average and ignores it.

Explanations for illustrations:

Linear regression channels – help determine the current trend. The trend is strong now if both are directed in the same direction.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.