The GBP/USD currency pair resumed its downward movement on Wednesday. The catalyst for the decline could only be Jerome Powell's speech at the economic forum in Sintra, as the head of the Federal Reserve stated that most Federal Reserve Monetary Committee members support two more interest rate hikes. It is worth noting that many experts and traders expected the Federal Reserve to end its cycle of monetary policy tightening in May. Still, after the June meeting, it became clear that it was not over. Thus, the interest rate in the United States may rise to 5.75% in 2023, reducing inflation rates to 3%. The consumer price index should continue to slow inertially, and in 2024, the regulator should begin to soften monetary policy.

From a technical point of view, the pair's decline remains the most logical development. It should be noted that the pound has risen by 2500 points in the last ten months and has only undergone formal corrections. In the past month, it has shown strong growth again, which cannot be completely illogical, but there were no substantial reasons. However, when the Bank of England raised the interest rate by another 0.5%, thus accelerating the pace of tightening, there was no further increase in the pound. This moment is very important, as it indicates that the market is saturated with purchases and will now start to take profit on long positions. If this is the case, the long-awaited decline of the British currency is beginning now, within which the pair may drop to 1.1800.

We set this target several months ago, but the market continued to buy the pound out of inertia. Now, with the Bank of England's rate reaching 5%, it is evident that the tightening process cannot continue for long. The pound remains overbought, and the US dollar and the US economy are not so weak that the pair cannot even correct itself.

The second half of the year could be favorable for the dollar. Jerome Powell, who typically makes modest statements, explicitly indicated that two more interest rate hikes should be expected. Interest rates remain a critical topic for the market, with the state of the economy being a secondary theme. Throughout the past months, while the pound continued its upward trend, a comparison was consistently drawn between interest rates in the UK and the US, as well as the economic conditions of both countries. Each time, the outcome was generally similar: the Bank of England's rate would not rise more strongly than the Federal Reserve's rate. If the market responded to tightening in the UK over the past 10 months, it is now time for this process to conclude. The UK's GDP has experienced zero growth for four consecutive quarters, while the US economy has been growing. While some macroeconomic indicators in the US are on a downward trajectory, the situation in the UK is still the same. Although a long-term upward trend lasting 2 or 3 years is not opposed, a downward correction is believed to be necessary before that occurs.

Furthermore, next year, the dollar could face further depreciation. Inflation in the US has already approached the target level, implying that the Federal Reserve may initiate rate cuts before the Bank of England. Consequently, the US currency may depreciate again towards the end of this year. This scenario is open, but until then, the pair should correct downwards by at least 600-700 points. However, sooner or later, the Bank of England will also commence rate reductions, which means the pound will not have a significant advantage in the long term. Currently, the focus is on a correction. Although a rebound upwards is possible, as indicated by the oversold zone of the CCI indicator on the 4-hour timeframe, even the Heiken Ashi indicator (fast indicator) has yet to turn upward. Therefore, the decline is expected to continue.

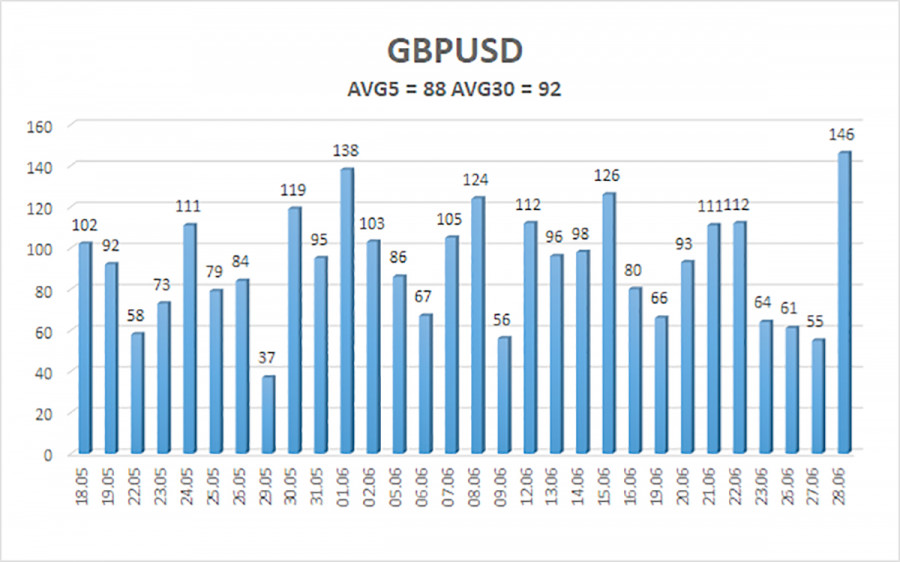

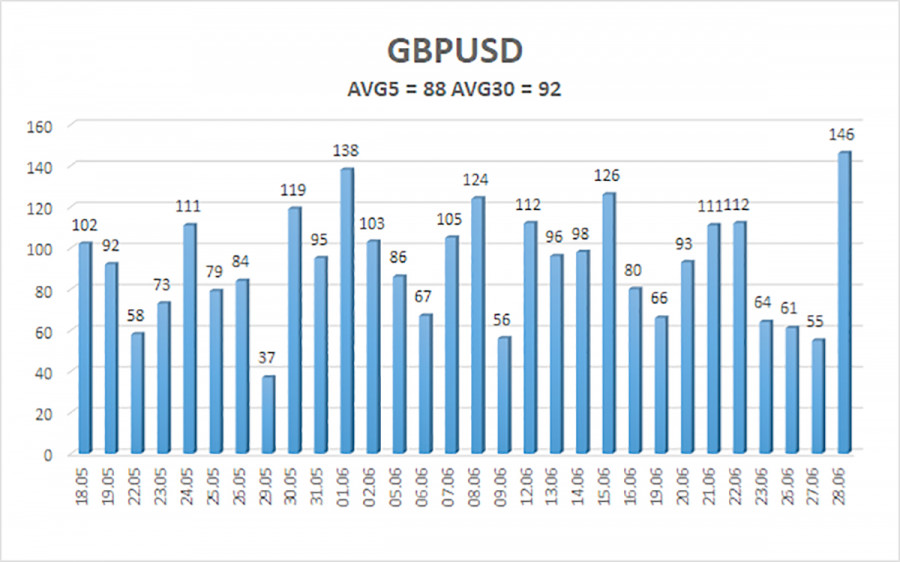

Over the past five trading days, the average volatility of the GBP/USD pair was 88 points, considered "average" for this currency pair. Consequently, movement on Thursday, June 29, is expected to occur within the range of 1.2536 and 1.2712. An upward reversal of the Heiken Ashi indicator will serve as a signal for a wave of upward correction.

The nearest support levels are:

S1 - 1.2604

S2 - 1.2573

S3 - 1.2543

Nearest resistance levels:

R1 - 1.2634

R2 - 1.2665

R3 - 1.2695

Trading recommendations:

On the 4-hour timeframe, the GBP/USD pair continues to correct. Currently, short positions are relevant, with targets at 1.2573 and 1.2536, which should be held until the Heiken Ashi indicator reverses upward. Long positions can be considered if the price consolidates above the moving average, with targets at 1.2756 and 1.2787.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels point in the same direction, it indicates a strong trend.

Moving average line (settings: 20,0, smoothed) - determines the short-term trend and direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel within which the pair is expected to trade the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates an upcoming trend reversal in the opposite direction.