The GBP/USD currency pair continued downward movement on Thursday and Friday. We cannot identify any fundamental or macroeconomic reasons for this decline yesterday and today. For instance, there were no significant events in the UK or the US yesterday. Today, a report on retail sales in the UK was published, and it turned out to be significantly higher than expected, which should have triggered a rise in the British currency instead of another fall. However, lately, we have grown accustomed to the market interpreting many reports as it wishes. Thus, we did not witness any pair growth today, and this is a positive sign as it is somewhat logical.

Remember that the pound has been rising for the past ten months and has gained almost 30 cents against the dollar. Before that, it experienced a significant decline, falling for a long time and deeply. However, clear reasons accounted for that decline, such as Brexit, followed by the coronavirus pandemic, which the British government managed much worse than the American or European governments. Furthermore, the exit from the EU led to a break in all economic ties and various other challenging events. Back then, the pound's decline didn't raise any questions. However, the reasons behind the pound's rise in the last five months remain uncertain.

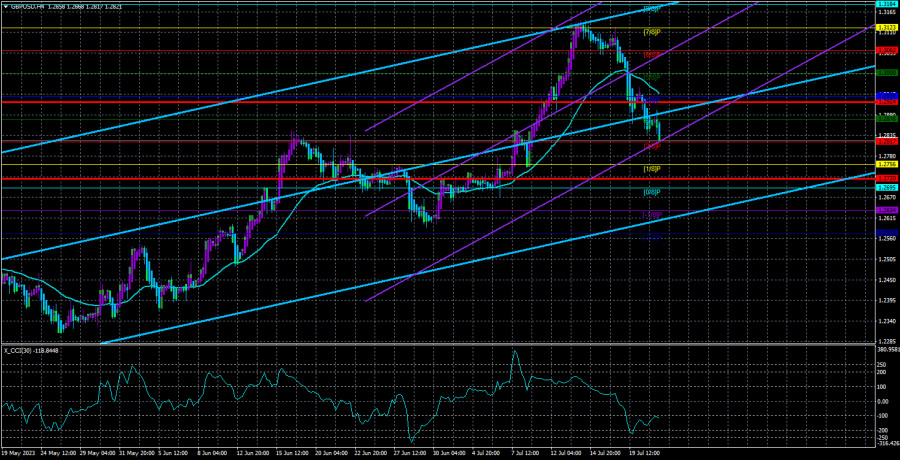

The recent decline is reasonable and expected to continue. Fortunately, the CCI indicator has yet to enter the oversold area again; otherwise, we would have received a new buy signal, which would be inconvenient. On the 24-hour timeframe, the pair has just reached the critical line today, and it still needs to surpass it to continue moving downward. Otherwise, we might experience another "under correction."

The market has begun to believe that the end of tightening is near.

One of the few reasons for the pound's rise in recent months could be the market's high expectations for the Bank of England's interest rate. We have previously explained why even this factor should not have led to such a powerful pound growth, and we adhere to our opinion. Nevertheless, the market may have been buying based on the assumption that the rate will increase no less than the Federal Reserve's rate, theoretically. In practice, it is unlikely to surpass the Federal Reserve's rate, and the dollar has been declining for ten months, reaching its peak value. Thus, this scenario also needs to have more logic. However, at least there is some reason for the pound's rise. But the Bank of England's rate has already risen to 5%, and no one doubts the next two hikes, which means the market may have already factored them in. Consequently, if the Bank of England is not planning to raise the rate to 7% or higher, there is no further basis for the pound to rise.

Therefore, we may now be witnessing the beginning of a new downward trend or a strong downward correction that we have been expecting for quite some time. We want to consider the macroeconomic context in this analysis, but the pound has been rising well even with weak macroeconomic data from the UK. Similarly, the dollar has been falling consistently, even with excellent labor market indicators and GDP indicators. Therefore, macroeconomics currently takes a back seat in terms of importance. Hence, we need to wait for the next Bank of England meeting, which will occur not next week but the week after, to understand the regulator's intentions.

Inflation in the UK is decreasing, but the decline is not rapid, and it has a much longer path to reach the target level compared to, for example, American inflation. Consequently, the Bank of England has grounds for more tightening of monetary policy. The main thing now is to receive a signal from them about their plans. Although Andrew Bailey rarely makes loud statements and announces his plans.

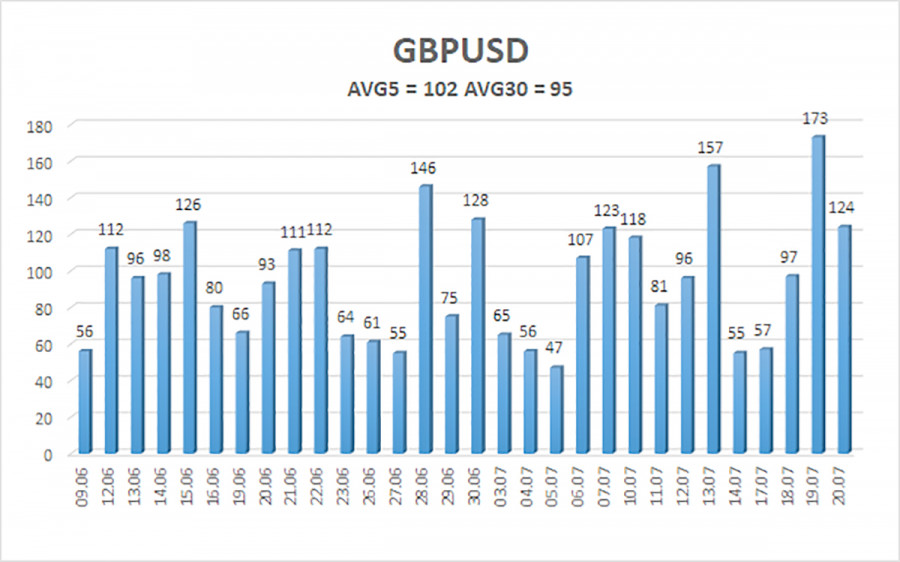

The average volatility of the GBP/USD pair over the last five trading days, as of July 21, is 102 pips, which is considered "average" for the pound/dollar pair. On Friday, July 21, we can anticipate movement between 1.2720 and 1.2924. An upward reversal of the Heiken Ashi indicator will indicate a possible upward correction.

Nearest support levels:

S1 – 1.2817

S2 – 1.2756

S3 – 1.2695

Nearest resistance levels:

R1 – 1.2878

R2 – 1.2939

R3 – 1.3000

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair stays below the moving average. Short positions with targets at 1.2756 and 1.2720 remain relevant, which should be closed in case of a reversal of the Heiken Ashi indicator upwards. Considering long positions will be possible if the price firmly establishes above the moving average, with targets at 1.3000 and 1.3062.

Explanations for the illustrations:

Linear regression channels – help determine the current trend. If both channels point in the same direction, it indicates a strong trend.

Moving average line (settings 20,0, smoothed) – identifies the short-term trend and the direction in which trading should be conducted.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the probable price channel in which the pair will move in the next 24 hours, based on current volatility indicators.

CCI indicator – its entry into the overbought zone (above +250) or the oversold zone (below -250) indicates an impending trend reversal in the opposite direction.