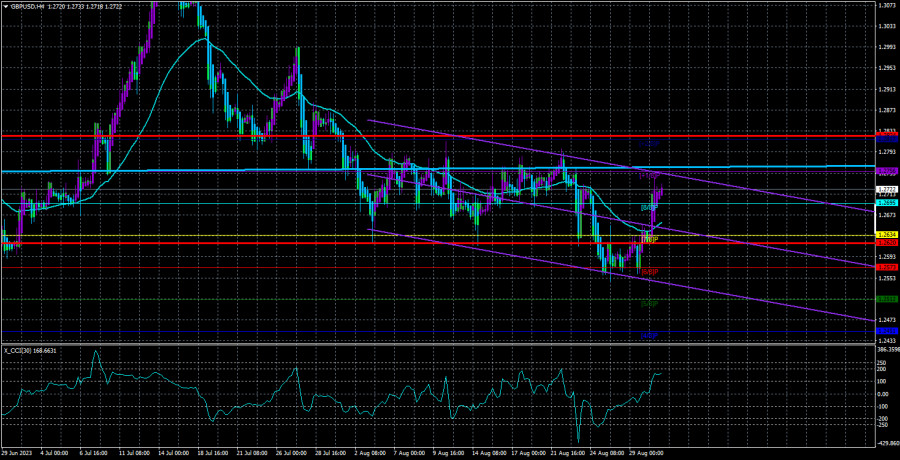

The GBP/USD currency pair also continued its upward movement on Wednesday, but it anchored above the moving average only yesterday. Thus, after the price broke out of the sideways channel, the decline did not continue. We warn that you can never be 100% sure of anything in the foreign exchange market. As it turns out, what seemed like a strong sell signal wasn't triggered. And all this was due to the macroeconomic statistics from across the ocean, which frankly disappointed this week. The GDP report for the second quarter fell through, the ADP report needed to be stronger, and the JOLTs report failed. Three of the three most important publications this week pressured the US currency. No wonder it has fallen for two days straight, as these are about more than mundane business activity indexes or retail sales.

However, we wouldn't conclude that the upward trend will now resume. It should be understood that the pound's growth on Tuesday and Wednesday is solely related to significant but weak US reports. Overall, the UK economy remains much weaker than the US one. Take, for instance, the same GDP reports. In the US, a growth slowdown to 2.1% is considered a dire result, while in the UK, a growth of 0.2-0.3% is already above the forecast. The worst value in the US is much better than the best value in the UK. Therefore, we are still looking for long-term growth prospects for the British currency.

It should also be remembered that the pound remains extremely overbought, has been rising for 11 months, rarely and slightly corrected, and the Bank of England can only keep raising the key rate for a while. Meanwhile, the Fed still needs to complete its tightening cycle. Almost all factors suggest that the dollar should continue to strengthen. We may also be seeing a correction of the CCI indicator's oversold condition that formed last week. As the trend has been downward for the last month and a half, this correction equals a retracement. Consequently, we expect the pair's decline to resume.

In the 24-hour timeframe, the pair failed to overcome the Senkou Span B line (its past value). However, like the EUR/USD pair, it has returned to the new value of Senkou Span B and to the critical line. Therefore, a bounce off these barriers with a resumption of the decline is highly likely. On Thursday and Friday, everything will depend on the nature of the macroeconomic statistics from across the ocean.

The ADP report was weak, but the NonFarm Payrolls might be pleasantly surprising.

The first thing to note is that the values of the NonFarm Payrolls and ADP reports rarely coincide. Neither in values nor in trend. In other words, the ADP report may show a significant drop in job creation, while NonFarm might show a substantial increase. In the case of NonFarm, it's crucial to carefully study the forecasted value, as it often serves as an "insurance." Meaning it indicates the lowest possible value that can be easily exceeded. For example, 170-180 thousand new jobs are expected in August, but this is a low forecast, and exceeding it will be a manageable challenge.

However, there's also the unemployment rate to consider. For instance, if the NonFarm Payrolls aligns with predictions or is slightly below them, and unemployment rises even by 0.1%, that might be enough for the dollar to fall again. If unemployment doesn't rise and the forecasted Non-farm value is surpassed, this will be a valid reason for the resurgence of the American currency's strength.

For both pairs, the price on the 24-hour timeframe has bumped into the important Senkou Span B and Kijun-sen lines. If the bears hold the market and reports from the States don't entirely collapse, we'd argue that a return to decline this week is likely. If these lines are overcome, both pairs could revert to a momentum-based upward trend or settle into a long-term sideways motion.

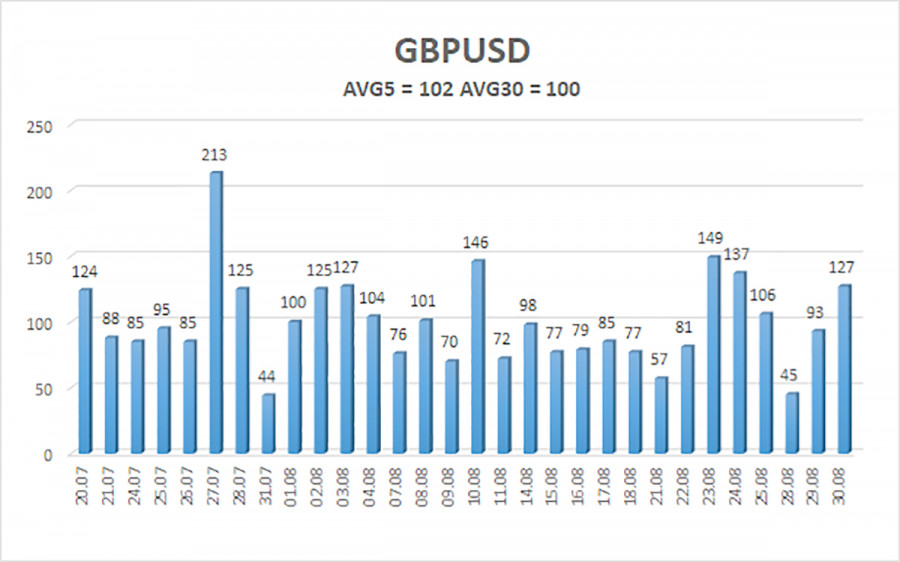

The average volatility of the GBP/USD pair for the last five trading days is 102 points. For the pound-dollar pair, this value is considered "average." Thus, on Thursday, August 31, we expect movement within the range bounded by the levels 1.2620 and 1.2834. A downward reversal of the Heiken Ashi indicator would signal a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.2695

S2 – 1.2634

S3 – 1.2573

Nearest resistance levels:

R1 – 1.2756

R2 – 1.2817

Trade recommendations:

The GBP/USD pair in a 4-hour timeframe has secured a position above the moving average. Therefore, at the moment, one should stay long with targets of 1.2756 and 1.2817 until the Heiken Ashi indicator turns downward. However, it's essential to note that the rise can continue if supported by the macroeconomic backdrop. Short positions will be viable only after the price is below the moving average, with targets at 1.2620 and 1.2573.

Explanations for illustrations:

Linear regression channels - help determine the current trend. If both are pointing in one direction, the trend is strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on the current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.