The GBP/USD currency pair remained below the moving average on Thursday, and this is the difference compared to the EUR/USD pair. While the euro is aiming for a correction, the pound is currently leaning towards resuming its downward trend. We believe that both European currencies will continue to gravitate towards a decline, but the differences in their movements are quite surprising, as these pairs usually move identically. However, this week, several reports from the United Kingdom did not provide support for the British currency. As a result, the pound has come under pressure and is falling instead of rising within the correction. Despite the price approaching its recent local minimum, we believe the correction is not over.

Yesterday, there were no significant events in the UK. The Chief Economist of the Bank of England, Huw Pill, spoke. He has been making more public appearances lately. However, as usual, nothing important was said during his speech. Like Jerome Powell, he indicated that the "door is not closed" and the central bank may raise the rate again. However, it was challenging to discern this hint from his speech. Central bank representatives are currently cautious about discussing their future actions (with the exception of ECB executives). Therefore, their speeches are filled with general phrases and hints. For example, Pill stated that the question of the need for a rate increase is "nuanced." In other words, the Bank of England's decisions regarding the rate will now depend on significant inflation values. In simpler terms, if inflation begins to rise again, the central bank may decide on another tightening. If not, the regulator will wait for the CPI to return to 2% without additional tightening.

This information is neither positive nor negative for the British pound. The essence of Pill and Powell's speeches yesterday can be summarized as follows: both central banks may raise the rate again, but only in an emergency. Therefore, the fundamental background for the pound and the dollar remains unchanged. Consequently, our forecast has not changed.

Jerome Powell disagrees with his colleagues on the rate issue. In reality, Powell's words, as usual, can be interpreted in any direction. The head of the Fed did not clearly state that a new rate increase would be necessary, but he also did not say that tightening has ended. In essence, his speech means the following: we are prepared to raise the rate again if there is a serious need. The market already knew and understood all of this. Besides that, Mr. Powell stated that the Fed has significantly tightened its monetary policy over the past 18 months and reduced its securities holdings by $1 trillion. "The Fed will proceed cautiously. The decision on the rate and the duration of its stay at the maximum level will depend on incoming data," the head of the Fed said.

All of his other statements are more like "filler." This "filler" is interesting but practically useless. For example, Powell stated that the Fed has succeeded in significantly reducing inflation without a substantial rise in unemployment, which is an "historically unusual event." According to him, inflation is still high and progress is unstable. The labor market is cooling down, the number of job vacancies is decreasing, and it currently only slightly exceeds pre-pandemic levels. However, the Fed will continue to work on slowing down the economy to provide a basis for further lowering inflation.

We do not consider Powell's rhetoric to be either "dovish" or "hawkish." Essentially, his words may seem "hawkish" compared to his colleagues' statements, but in reality, this is not the case. Federal Reserve members have never stated that the rate will not rise further under any circumstances, so another tightening was implicitly expected. The dollar is currently rising, not because of the Federal Reserve's future actions. The dollar continues to restore its fair value against the euro and the pound after almost a year-long decline, half of which was unfounded.

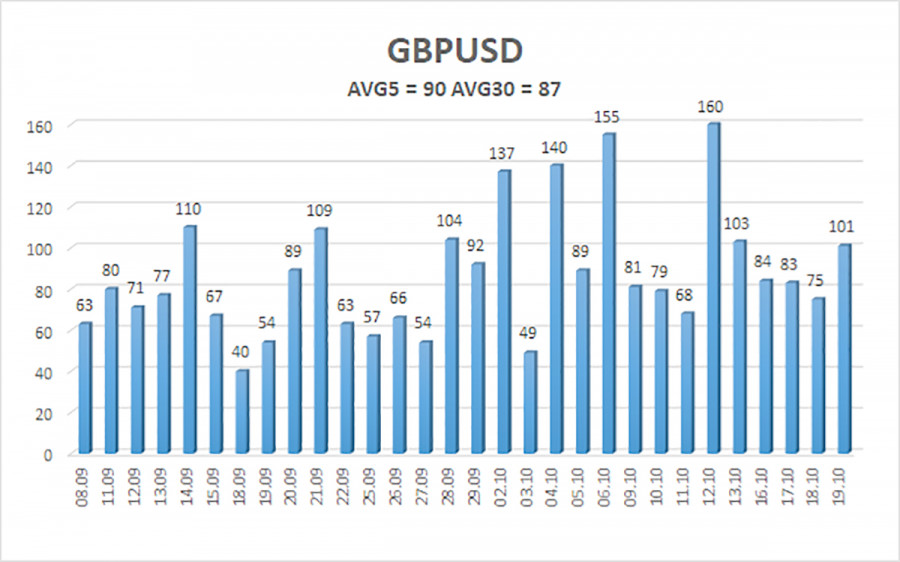

The average volatility of the GBP/USD pair over the last 5 trading days is 90 points. For the pound/dollar pair, this value is considered "average." Therefore, on Friday, October 20th, we expect movement within the range of 1.2043 and 1.2224. A reversal of the Heiken Ashi indicator upwards will signal a possible resumption of the upward correction.

Nearest support levels:

S1 - 1.2085

Nearest resistance levels:

R1 - 1.2146

R2 - 1.2207

R3 - 1.2268

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair continues to be positioned below the moving average. Therefore, it is currently advisable to maintain short positions with targets at 1.2085 and 1.2044 until the Heiken Ashi indicator reverses upwards. In the event that the price consolidates above the moving average, long positions with targets at 1.2224 and 1.2268 will become relevant again.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels are pointing in the same direction, it indicates a strong trend.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will trade over the next day based on current volatility indicators.

CCI indicator - its entry into the overbought zone (above +250) or oversold zone (below -250) indicates an impending trend reversal in the opposite direction.