The GBP/USD currency pair also corrected towards the moving average line on Wednesday but failed to surpass it, maintaining its upward trend. However, we still believe that the rise of the British currency is approaching its end. Several technical factors support this view. First, each successive upward wave is weaker than the previous one, and the peaks update less eagerly. Second, the CCI indicator entered the overbought zone three times. Third, the rise of the British currency within the current upward trend is slowing down. All indications suggest that the market needs a pause. Accordingly, the pair may correct downward by 200-250 points if there is no plan for resuming the downward trend.

In the longer term, we still expect a resumption of the downward trend, as we see no reason for further growth of the British pound. Like with the euro, the recent spike in growth was triggered solely by negative (for the dollar) inflation reports from the United States. However, things are not all well with the UK economy, and the Bank of England has set itself the task of confusing the market as much as possible and not answering its pressing questions.

In any case, the pound is currently significantly overbought. It has yet to fully correct after a year of growth, half of which was also unwarranted. Therefore, we expect the pair to fall in any case. Only macroeconomic statistics from across the ocean, which have recently tended to disappoint, can hinder this.

Andrew Bailey is against tightening, but his colleagues are for it.

This week in the UK, there was no macroeconomic publication. And based on what should traders make trading decisions if there is no news? No news means you need to try to trade technically. And in the short term, the technique shows an upward trend. That's what momentum growth is. Of interesting events, we can highlight the speeches of representatives of the Bank of England Haskell, Mann, Ramsden, and Bailey before the Treasury Committee. As we said yesterday, Mr. Bailey highly praised the recent progress in reducing inflation and stated that there are no plans for monetary policy tightening soon. At the same time, his colleagues drew attention to core inflation, which almost did not decrease by the end of October, and also noted that conclusions should be drawn only partially based on core inflation.

So, what does it all add up to? Andrew Bailey promised 5% by New Year's, and this goal has already been achieved. Mr. Bailey is more concerned about his ratings than the actual price decline in the UK. Core inflation in the UK is currently 5.7% and is not in a hurry to decline. In such a situation, the Bank of England should maintain a "hawkish" attitude. Still, in practice, only some monetary committee members are ready to support additional tightening.

However, this information is familiar, as at the last meeting of the British regulator, three voted in favor of a rate hike. So, the balance of power now is: inflation is falling, and the number of votes for/against tightening is 3 against 6. Given the fact that by the end of October, inflation slowed down by 2.1%, it is unlikely that the number of committee members supporting tightening will increase at the December meeting. Thus, the British pound has no advantage over the US dollar despite the "moderately hawkish" statements of Mann, Haskell, and Ramsden this week. It has already risen quite high over the past couple of weeks. According to the CCI indicator, there is not only a triple overbought but also a bearish divergence, as the last indicator's maximum is below the previous one.

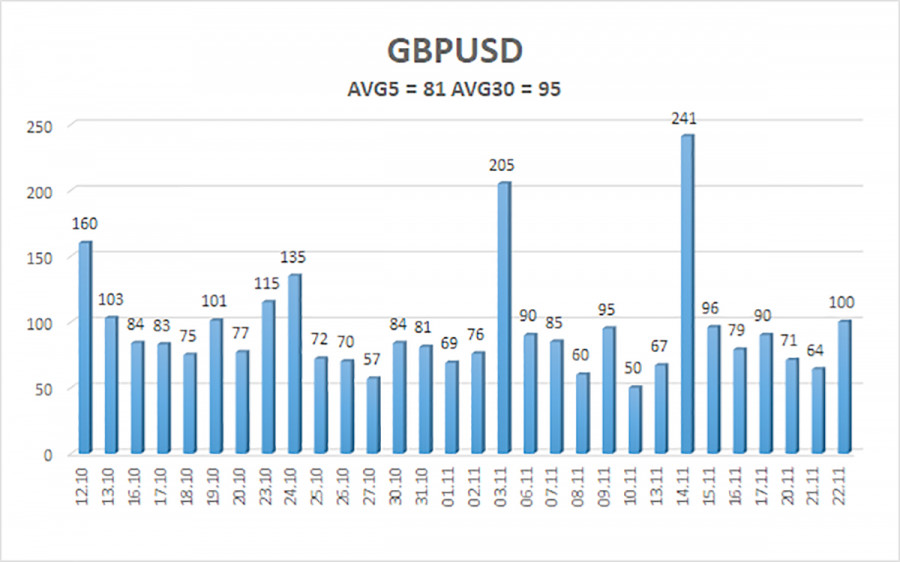

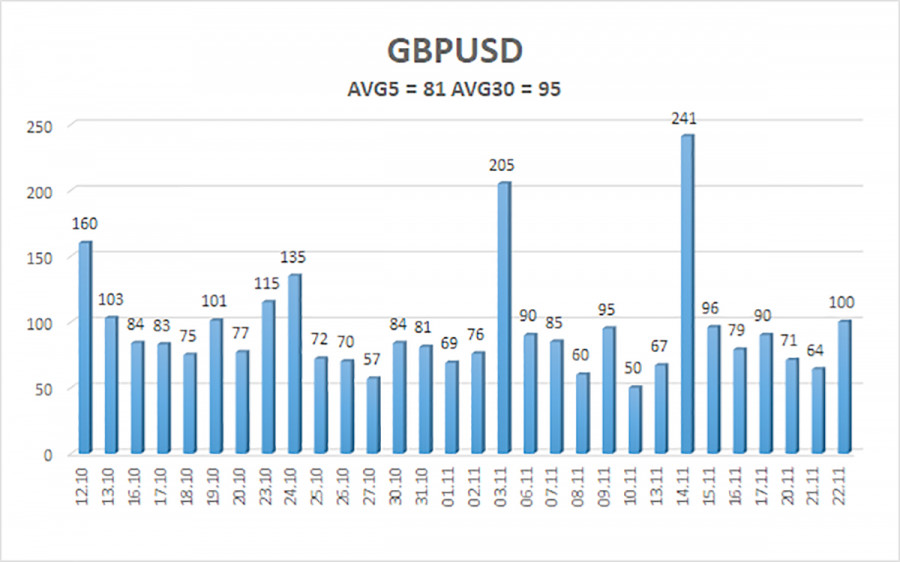

The average GBP/USD pair volatility for the last five trading days as of November 23 is 81 points. For the pound/dollar pair, this value is considered "average." Therefore, on Thursday, November 23, we expect movement within the range limited by the levels of 1.2419 and 1.2581. A reversal of the Heiken Ashi indicator back upwards will indicate a possible resumption of the upward trend.

Nearest support levels:

S1 – 1.2451

S2 – 1.2390

S3 – 1.2329

Nearest resistance levels:

R1 – 1.2512

R2 – 1.2573

R3 – 1.2634

Trading recommendations:

The GBP/USD pair continues a new upward movement phase above the moving average line. Short positions can be opened with targets at 1.2390 and 1.2329 if the price consolidates below the moving average. Long positions can be formally considered since the price is above the moving average, with targets at 1.2573 and 1.2581. Still, the triple overbought status of the CCI indicator indicates the danger of opening such deals.

Explanations for the illustrations:

Linear Regression Channels – help determine the current trend. The trend is strong now if both are directed in the same direction.

Moving Average Line (settings 20.0, smoothed) – determines the short-term trend and the direction in which it is currently advisable to trade.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator – its entry into the oversold zone (below -250) or overbought zone (above +250) means a trend reversal in the opposite direction is approaching.